USD/JPY Talking Points:

- USD/JPY has retained a bearish posture after a hold of lower-high resistance yesterday.

- There’s a large batch of potential support surrounding the 140.00 level and the big question if sellers can muster the motivation to push through. The long side of the pair makes for a difficult argument given the expected rate cuts from FOMC. But, as I said in the webinar, fundamentals aren’t always a direct push-point for price as sentiment or investor behavior is what dominates supply and demand.

- I’ll be looking into these setups in the Tuesday webinar and you’re welcome to join, click here for registration information.

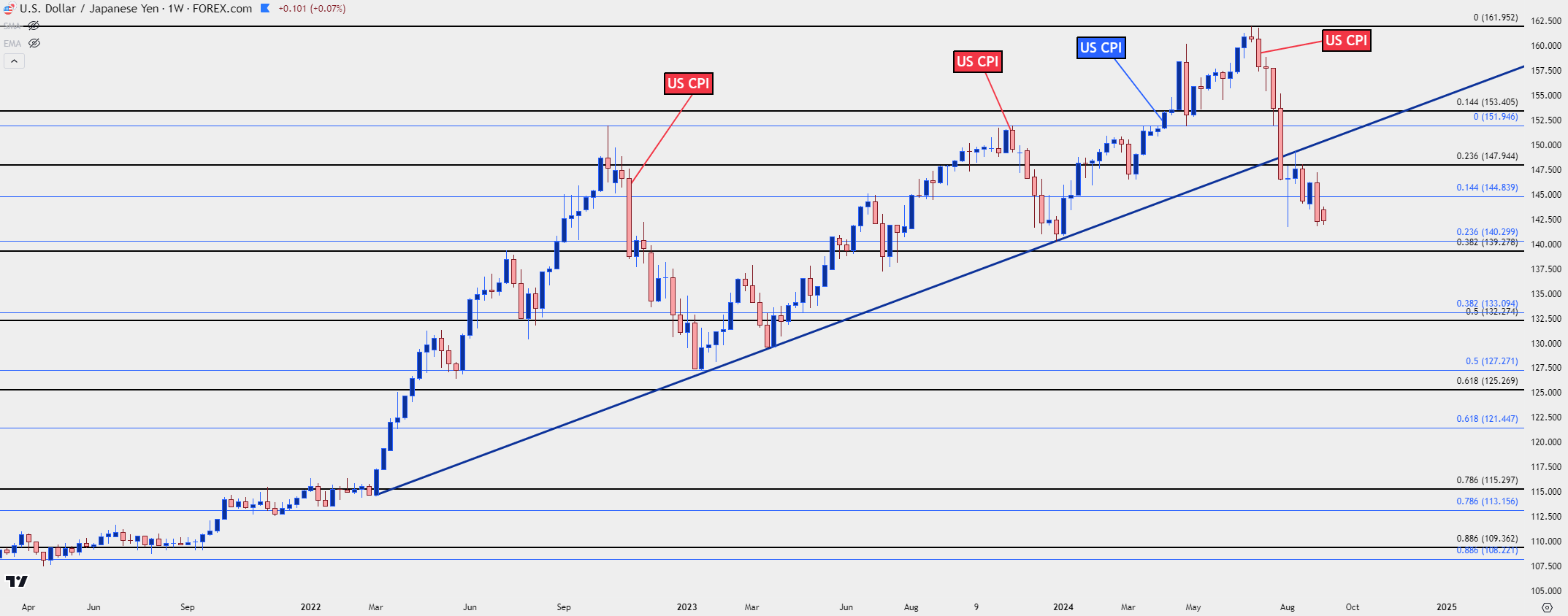

The carry trade was quite the run in USD/JPY. The pair started to perk up back in 2021 even as the Fed said that inflation was supply chain related and likely transitory, due to abate on its own. That, of course, did not happen but for bulls in USD/JPY, they were already pushing early in the year despite the Fed’s repeated dovish claims.

When the Fed did begin to actually hike rates in March of 2022, the pair went vertical and near-parabolic as bulls loaded up in anticipation of wider rate differentials. And after opening March of that year at 115.00, the pair soon found itself propelled up to the 150 marker in October.

An intervention from the BoJ was able to drive a pullback, with 50% of the move erased in three short months after having taken 21 months to build. But, in that episode, the Fed was continuing to hike as inflation remained elevated and in mid-January of last year, buyers started to regain control.

Another pullback developed in November of last year and similarly, this was driven by a below-expected CPI report in the US. This time the retracement ran for 23.6% of the prior trend before bulls came back in and re-took control. Another breakout ensued in April after a stronger-than-expected CPI report and this was the first test above 160.00 for the pair since 1990. The BoJ again intervened but this time the impact was limited as bulls loaded back up a week later.

The pair again pushed above 160.00 around the Q3 open after which the BoJ jumped back into the market and this time with a heavy hand. And what’s different about that episode is that it’s happened as US economic data has continued to cave and the Fed is now gearing up for rate cuts. In my estimation, the fundamental argument behind the USD/JPY carry trade is less attractive than at any point since before March of 2022, when the Fed started hiking rates.

With the Fed expected to continue leaning into rate cuts, the rate divergence between the two economies is set to narrow even more and this makes for a bearish fundamental backdrop for USD/JPY in the coming weeks and months.

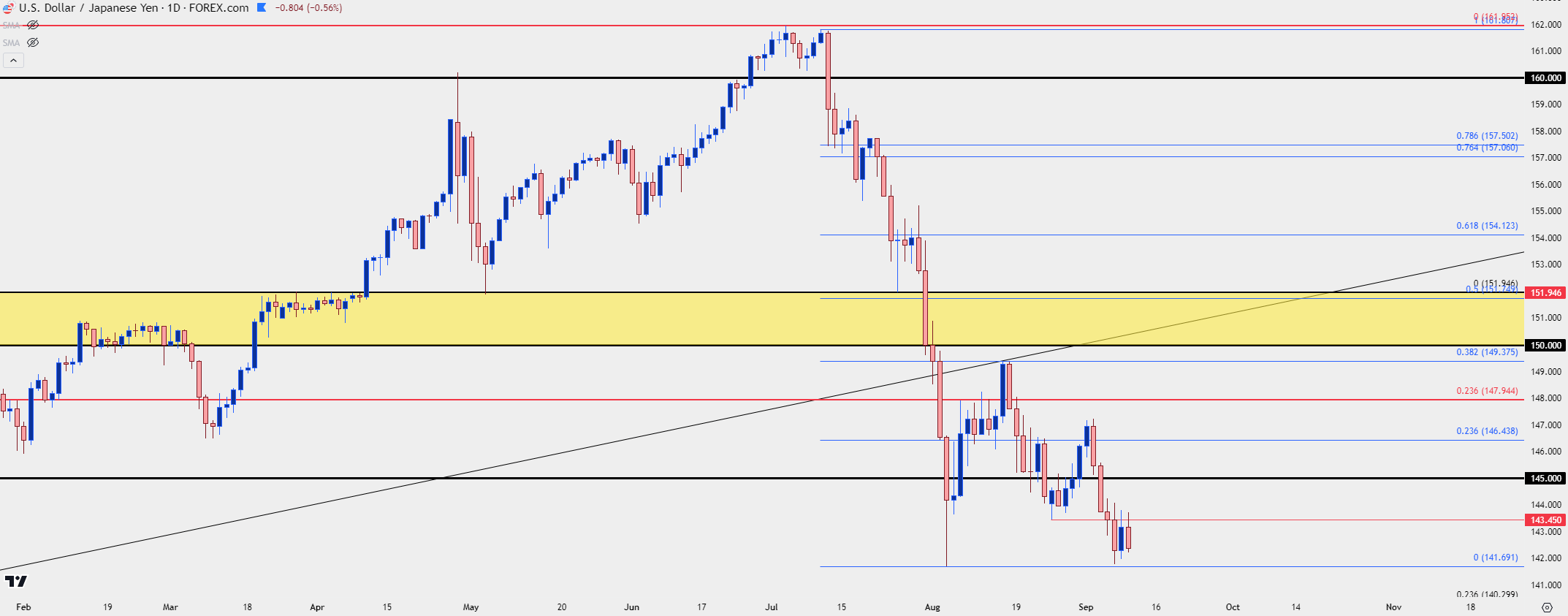

But – just because the fundamental backdrop is seemingly more bearish, that doesn’t mean that price has to pose a linear-move-lower, much as we’ve seen since the sell-off in early-August that was quickly followed by a rather clean 38.2% Fibonacci retracement of that move.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

Trends Inside of Trends

The bullish move in USD/JPY sparked in early-2021 and at this point less than 38.2% of that entire move has been erased. But on a shorter-term basis, since the sell-off in July, there’s been another trend in-force as sellers have taken out more than 2,000 pips from the pair. So, logically, there’s some short positions that have covered and this can help to explain that 38.2% bounce mentioned above.

The bigger question is when longer-term carry traders may grow more cautious of holding longs and items like a breach of the 140.00 handle could potential trigger stops while driving more supply into the market.

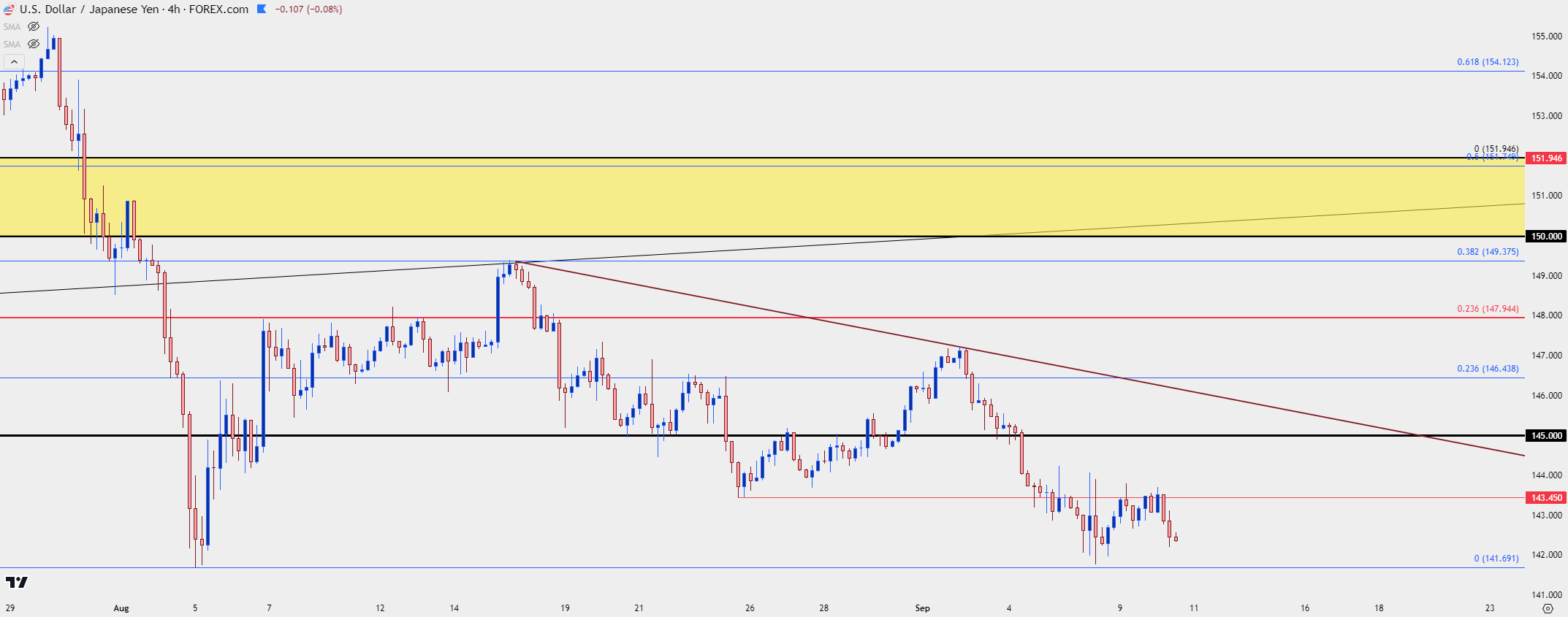

But, at this point, there’s no sign that sellers are yet willing to take that leap of faith. They have, however, been getting more and more aggressive on bounces as noted by the lower-highs since that 38.2% retracement – and that keeps the door open for breakdown potential as we move into another release of US CPI tomorrow.

USD/JPY Four-Hour Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

US CPI Impact on USD/JPY

US CPI prints have had a profound impact on the carry trade in USD/JPY and given the role between that data point and rate expectations, that makes sense.

The November 2022 and 2023 sell-offs both sparked after the release of below-expected CPI as crowded, one-sided trades began to unwind.

The breakout in April showed shortly after a better-than-expected CPI, propelling USD/JPY up to the 160.00 handle after which the BoJ stepped in to intervene.

And then in July, the BoJ intervened again after the release of CPI and given the below-expected print combined with the rising odds of more rate cuts, there was finally a fundamental drive that could elicit a larger sell-off, such as we’ve seen.

The big question now is whether tomorrow’s CPI print furthers that theme of expected rate cuts from the Fed. If Core CPI comes-in well below the 3.2% expectation that could firm the case for more rate cuts from the Fed, thereby making the fundamental case on the long side of the USD/JPY carry trade even less attractive. If it prints in-line or perhaps even above-expected, that could delay the theme a bit but it seems unlikely that it could re-fire the carry trade as the US seems to be headed for rate cuts, one way or the other. It’s only a question of timing and by how much, at this point.

USD/JPY Weekly Chart: US CPI Impact on Major Moves in USD/JPY

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

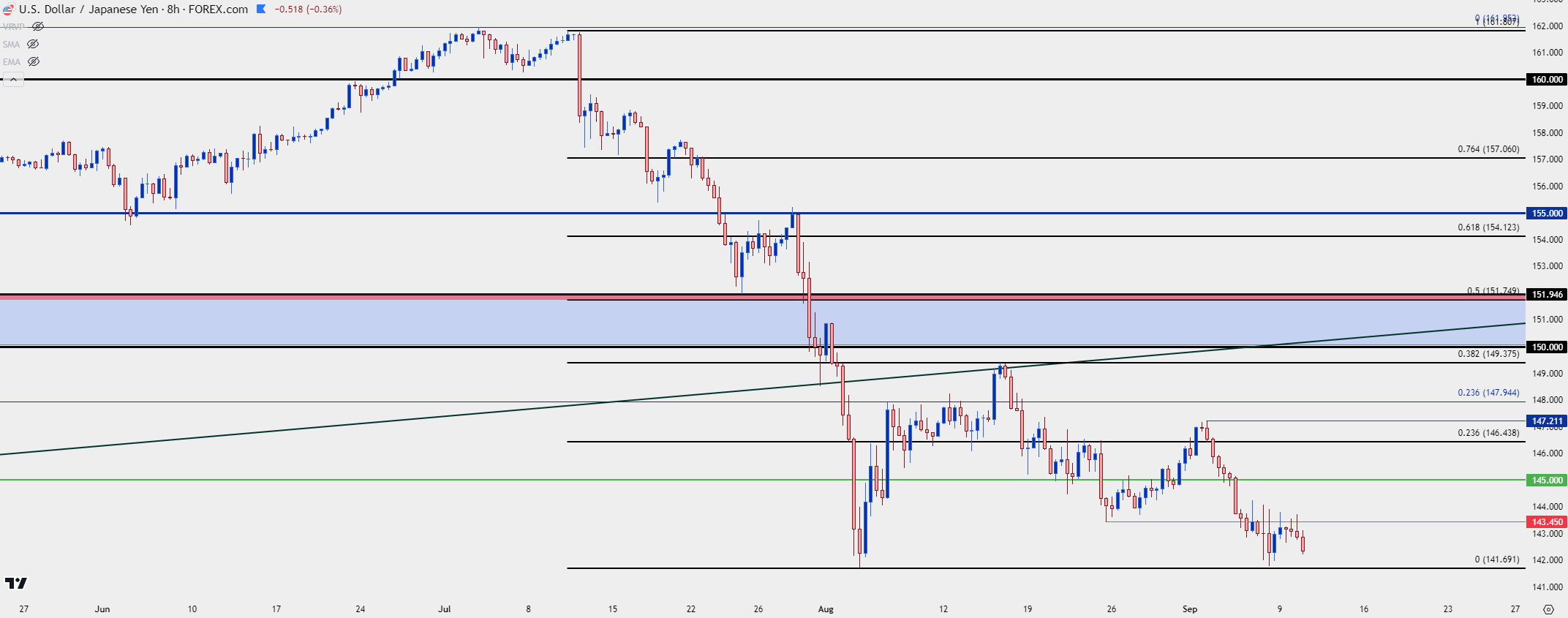

Seller Stall: Adverse Scenarios for Bigger Picture Bears

As I had written yesterday, sellers had an open door to fuel a breakdown last week and failed to do so. This suggests the possibility of short-term oversold scenarios but there’s also that longer-term theme in the backdrop, where price remains above the 38.2% retracement of the bigger picture trend.

This begs the question as to whether tomorrow’s CPI report can or will give sellers (both fresh shorts, and current longs) the motivation to take out those levels and drive through the 140.00 psychological level. If it doesn’t, and if they can’t, then that opens the door for lower-high resistance potential similar to what I had spoken of yesterday and again in today’s webinar.

From the below eight-hour chart we can see where bears made quite the effort to defend the 143.45 level that was in-play yesterday and another big spot is above that at the 145.00 handle. A show of sellers at the 145.00 level could be of interest and if that doesn’t hold, the 146.43 level could come back into the equation. Given last week’s resistance hold at 147.21, a resistance show at 146.43 could even be argued as a lower-high.

USD/JPY Eight-Hour Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist