USD/JPY Talking Points:

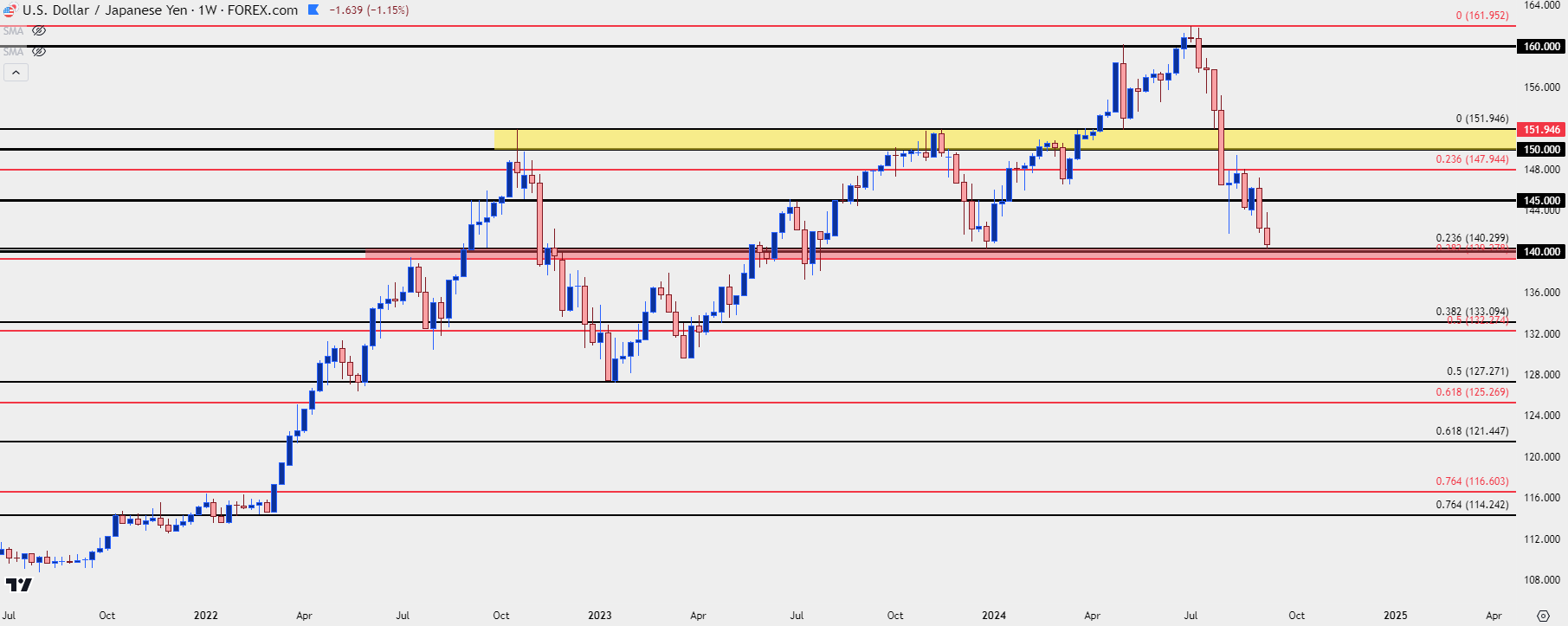

- Bears have continued to push this week and bounces have been getting more and more shallow. At this point price has started to re-test a long-term support zone, with a bounce currently showing at the 23.6% retracement of the 2021-2023 major move.

- As I’ve been saying for a while now, the fundamental case behind the long side of USD/JPY hasn’t been this dim since before the Fed began hiking rates in 2022. There appears to be remaining carry traders holding on but at the FOMC rate decision next week, the start of a cutting cycle could further diminish the carry, thereby compelling more unwind.

- I’ll be looking into these setups in the Tuesday webinar and you’re welcome to join, click here for registration information.

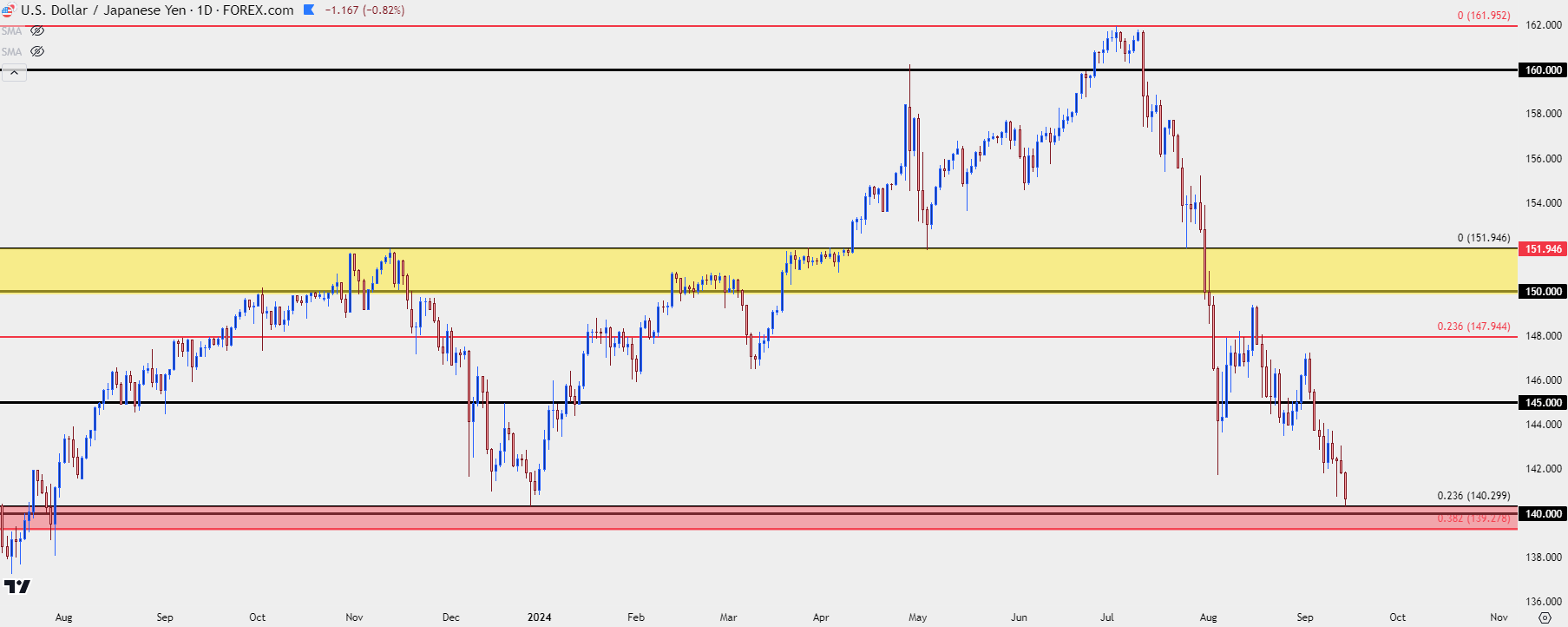

USD/JPY has continued to draw down and with the FOMC expected to shift into a cutting cycle next week, the enthusiasm for the long side of the pair gets less and less attractive. While rollover remains positive as of this writing, those rates can tighten further and given the fact that we haven’t yet seen 38.2% of the 2021-2024 major move taken-out, it’s logical to imagine that there’s some remaining carry traders that are and have been holding on.

Carry unwind can be an intense theme, such as we saw show up in July. We saw similar episodes in November of 2022 and 2023, but for each of those the fundamental case was lacking continuation potential as the Fed wasn’t yet in a position to cut. That’s not the case now with the FOMC expected to reduce rates at next week’s rate decision and as such, we’ve seen continued bearish movement in USD/JPY.

The pair has dropped to a fresh 2024 low at this point as longer-term carry has continued to unwind. USD/JPY has tagged the top-end of a longer-term zone with 140.30 coming into play, which is both the 23.6% retracement of the 2021-2023 major move – and the swing-low from December of last year.

USD/JPY Weekly Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

USD/JPY For Next Week

For next week I’m expecting USD/JPY to share relationship with broader US rates themes. The more-dovish that the Fed sounds, the less attractive the long side of the carry, which could compel further unwind from longer-term holders.

Timing with such scenarios can remain as a challenge and the past month-and-a-half is proof of that. But, notably, bounces have been growing more and more shallow and that can be symptom of longer-term bulls using those bounces to further reduce exposure to the pair.

For support – the 100 pips below current lows is a big spot, and if sellers can trade through that I would consider that a notable item. The 140.00 psychological level is of importance and below that, the 38.2% Fibonacci retracement of the 2021-2024 major move plots at 139.28.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist