US Dollar Outlook: USD/CAD

USD/CAD seems to be unfazed by the Bank of Canada (BoC) interest rate decision as the central bank keeps the benchmark interest rate at 5.00%, but the US Non-Farm Payrolls (NFP) report may sway the exchange rate as the update is anticipated to show another rise in employment.

USD/CAD Unfazed by BoC Rate Decision with US NFP Report on Tap

USD/CAD holds within yesterday’s range as the BoC acknowledges that the ‘slowdown in the economy is reducing inflationary pressures in a broadening range of goods and services prices,’ and it seems as though the central bank will retain a wait-and-see approach at the next meeting on January 24, 2025, as Governor Tiff Macklem and Co. remain ‘prepared to raise the policy rate further if needed.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Until then, speculation surrounding US monetary policy may influence USD/CAD as the Federal Reserve is scheduled to update the Summary of Economic Projections (SEP), and it remains to be seen if the central bank will adjust the forward guidance as the economy shows little to no signs of a looming recession.

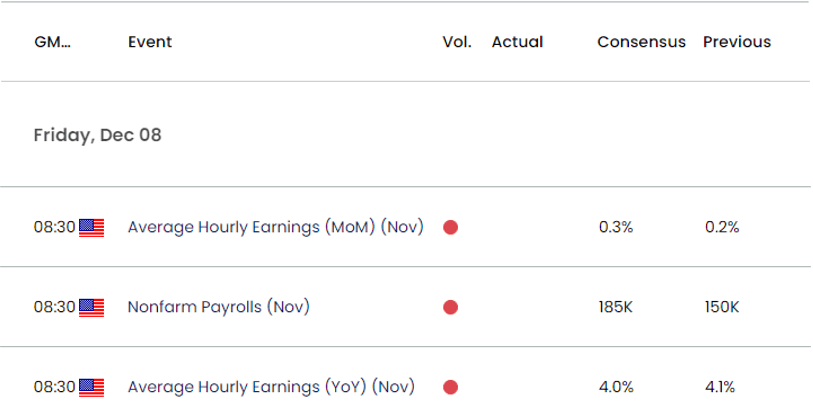

US Economic Calendar

As a result, the NFP report may push the Federal Open Market Committee (FOMC) to further combat inflation as the economy is projected to add 185K jobs in November, and a positive development may generate a bullish reaction in the US Dollar as it raises the scope for a Fed rate-hike.

However, a weaker-than-expected NFP print may drag on the Greenback as it fuels speculation of seeing US interest rates unchanged, and USD/CAD may give back the advance from the monthly low (1.3480) as it struggles to extend the recent series of higher highs and lows.

With that said, data prints coming out of the US may sway USD/CAD as attention turns to the Fed’s last rate decision for 2023, but the exchange rate may attempt to further retrace the decline from the November high (1.3899) as it bounces back ahead of the September low (1.3380).

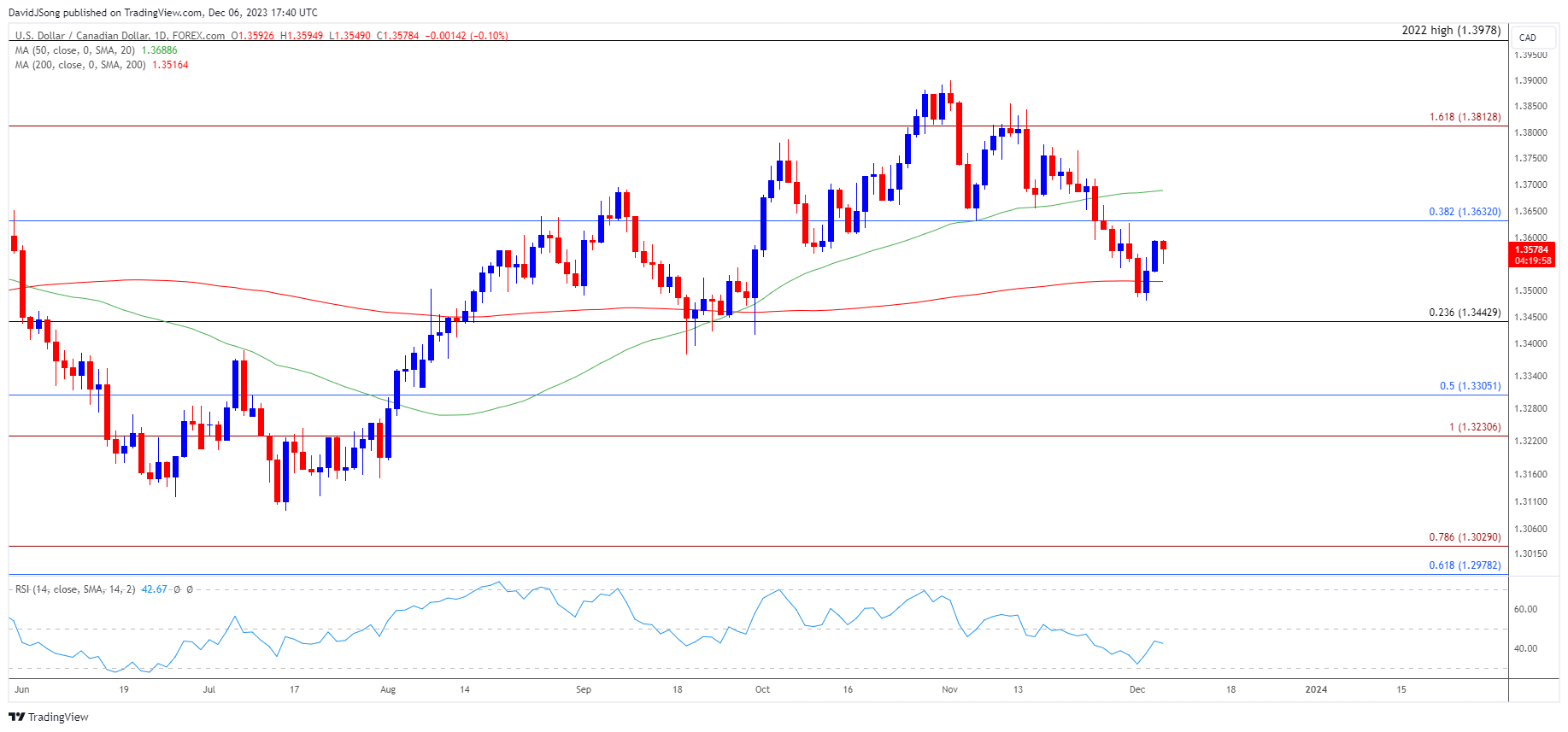

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD appeared to be on track to test the September low (1.3380) after closing below the 50-Day SMA (1.3689) for the first time since August, but the bearish momentum seems to be abating as the Relative Strength Index (RSI) rebounds ahead of oversold territory.

- Lack of momentum to test 1.3440 (23.6% Fibonacci retracement) may push USD/CAD back towards 1.3630 (38.2% Fibonacci retracement), with a break/close above 1.3810 (161.8% Fibonacci extension) bringing the November high (1.3899) on the radar.

- However, failure to push above 1.3630 (38.2% Fibonacci retracement) may curb the rebound from the monthly low (1.3480), with a break/close below 1.3440 (23.6% Fibonacci retracement) opening up the September low (1.3380).

Additional Market Outlooks

US Dollar Forecast: AUD/USD Post-RBA Decline in Focus Ahead of US NFP

US Dollar Forecast: USD/JPY Vulnerable Ahead of NFP Report

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong