USD/CAD Outlook

The near-term advance in USD/CAD appears to be losing steam as the Relative Strength Index (RSI) holds below overbought territory, but the Bank of Canada (BoC) interest rate decision on March 8 may prop up the exchange rate as the central bank moves to the sidelines.

USD/CAD struggles to test January high ahead of BoC rate decision

Recent price action raises the scope for another run at the January high (1.3685) as USD/CAD bounces back ahead of the weekly low (1.3535), and the exchange rate may attempt to clear the opening range for 2023 as the BoC is expected to keep the benchmark interest rate at 4.50%.

Register Here for the Live Economic Coverage on the BoC meeting with David Song

It seems as though the BoC will endorse a wait-and-see approach over the coming months as the ‘Governing Council expects to hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases,’ and the potential change in regime may instill a bearish outlook for the Canadian Dollar should Governor Tiff Macklem and Co. talk down speculation for higher interest rates.

In turn, the US Dollar may outperform its Canadian counterpart in the months ahead as the Federal Reserve retains a hawkish forward guidance, and it seems as though the Federal Open Market Committee (FOMC) will implement a more restrictive policy as Governor Christopher Waller warns that ‘recent data indicate that we haven't made as much progress as we thought.’

Recent remarks from Governor Waller suggest the Fed will stick to its hiking-cycle as the permanent voting-member on the FOMC acknowledges that ‘inflation is not coming down as fast as I had thought,’ and it remains to be seen if Chairman Jerome Powell and Co. will project a steeper path for US interest rates at the March meeting as the central bank is slated to update the Summary of Economic Projections (SEP).

With that said, developments coming out of the BoC may sway USD/CAD ahead of the Fed rate decision on March 22 amid the diverging paths for monetary policy, and the exchange rate may stage further attempts to test the January high (1.3685) as it bounces back ahead of the weekly low (1.3535).

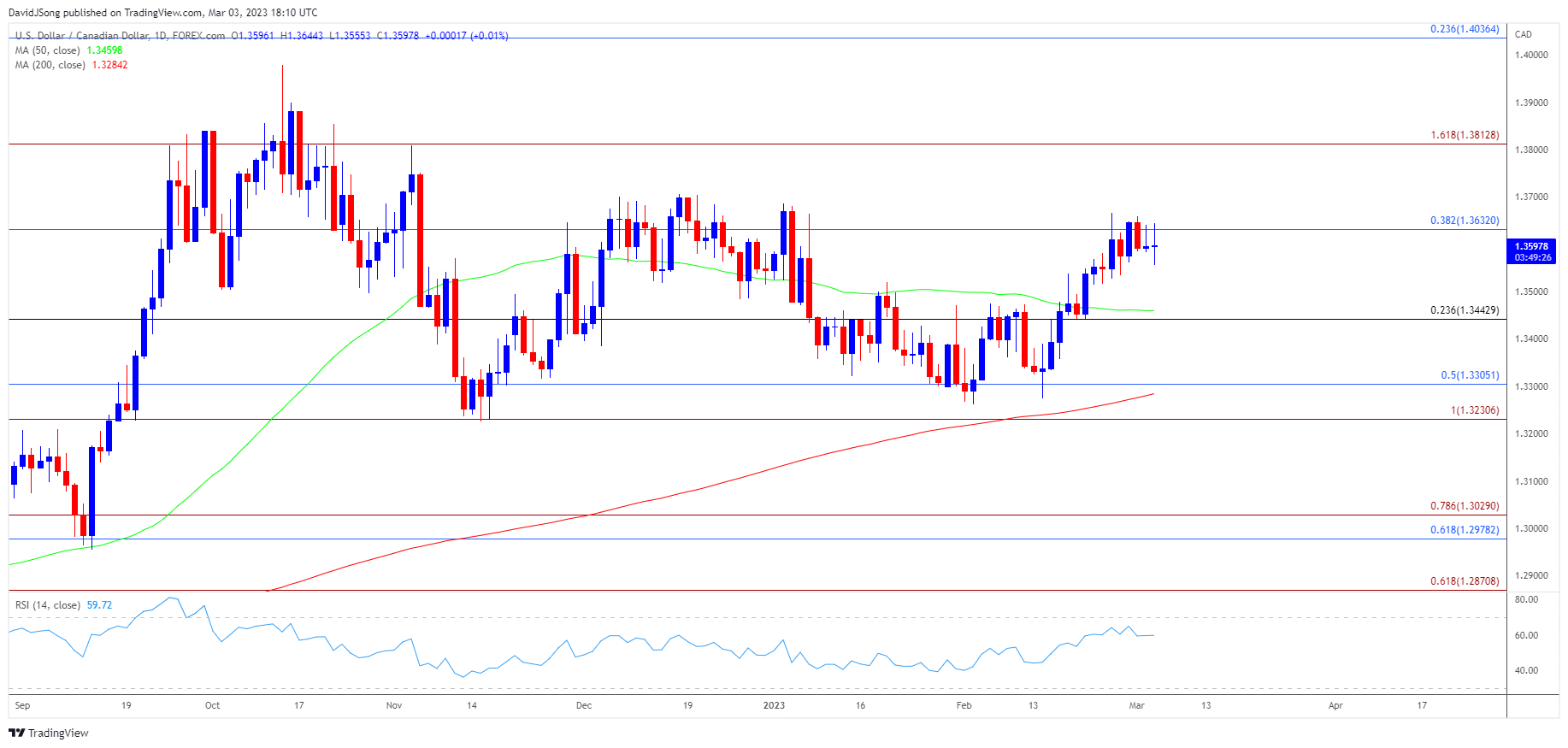

Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD seems to be stuck in a narrow range as it bounces back ahead of the weekly low (1.3535), and the exchange rate may continue to consolidate as it struggles to hold above the 1.3630 (38.2% Fibonacci retracement) region.

- Failure to clear the February high (1.3665) may push USD/CAD back towards the 50-Day SMA (1.3462) as the Relative Strength Index (RSI) holds below 70, with a break/close below 1.3440 (23.6% Fibonacci retracement) opening up the 1.3310 (50% Fibonacci retracement) area.

- At the same time, USD/CAD may stage further attempts to test the January high (1.3685) as it holds within the weekly range, with a move above the December 2022 high (1.3705) opening up 1.3810 (161.8% Fibonacci extension), which largely lines up with the November 2022 high (1.3808).

--- Written by David Song, Strategist

Follow me on Twitter at @DavidJSong