USD/CAD Outlook

USD/CAD bounces back ahead of the April low (1.3301) after failing to extend the series lower highs and lows carried over from last week, and the exchange rate may attempt to retrace the decline from the monthly high (1.3640) as it trades within the April range.

USD/CAD recovery materializes amid failure to test April low

USD/CAD climbs above the 200-Day SMA (1.3457) as it trades to a fresh weekly high (1.3489), and data prints coming out of Canada may keep the exchange rate afloat as the Consumer Price Index (CPI) is anticipated to show slowing inflation.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

Canada’s CPI may do little to influence the monetary policy outlook as both the headline and core rate of inflation are expected to narrow in April, and a further slowdown in consumer prices may keep the Bank of Canada (BoC) on the sidelines as the central bank ‘expects CPI inflation to fall quickly to around 3% in the middle of this year and then decline more gradually to the 2% target by the end of 2024.’

In turn, the BoC may keep the hiking-cycle on pause as Governor Tiff Macklem and Co. pledge to ‘assess whether monetary policy is sufficiently restrictive to relieve price pressures,’ and the central bank may stick to the same script at its next meeting on July 12 as ‘GDP growth is projected to be weak through the remainder of this year before strengthening gradually next year.’

Until then, USD/CAD may continue to trade within the yearly range especially as the Federal Reserve adjusts the forward guidance for monetary policy, and the exchange rate may track sideways over the coming months amid

With that said, USD/CAD may stage a larger rebound ahead of the update to Canada’s CPI as it reverses ahead of the April low (1.3301), and the exchange rate may attempt to retrace the decline from the monthly high (1.3640) as it no longer reflects the bearish price action carried over from last week.

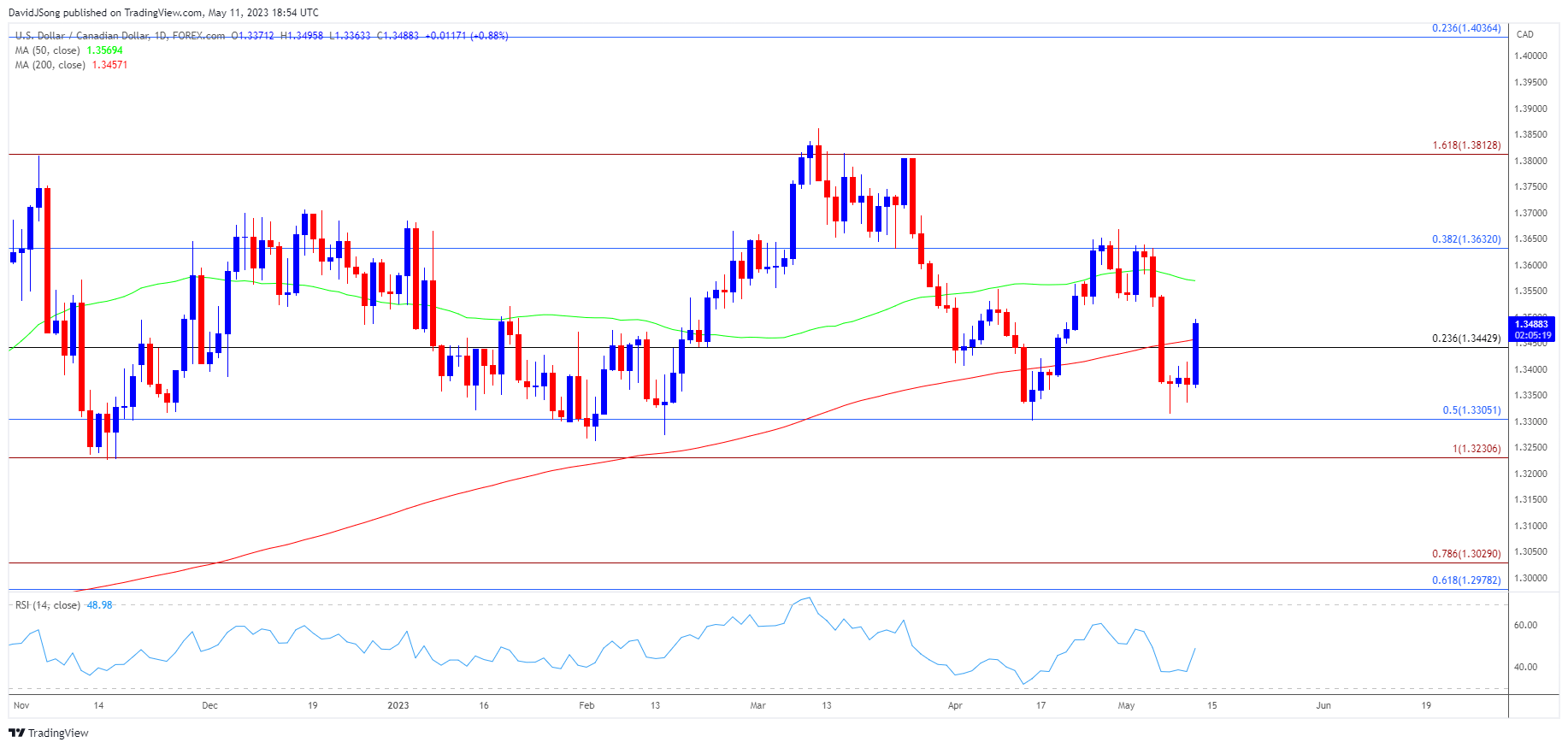

Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD appears to be trading within a broad range as it failed to test the April high (1.3668) at the start of the month, with recent developments raising the scope for a move towards the top of the price band as it reveres ahead of the April low (1.3301) to no longer reflect the series of lower highs and lows carried over from last week.

- A close above 1.3440 (23.6% Fibonacci retracement) raises the scope for a move towards the 50-Day SMA (1.3570), with the next area of interest coming in around 1.3630 (38.2% Fibonacci retracement).

- Need a break above the April high (1.3668) to open up the 1.3820 (161.8% Fibonacci extension) region, with the next area of interest coming in around the March high (1.3862).

- At the same time, failure to hold above the 200-Day SMA (1.3457) may push USD/CAD back below 1.3440 (23.6% Fibonacci retracement), with the next area of interest coming in around 1.3230 (100% Fibonacci extension) to 1.3310 (50% Fibonacci retracement).

Additional Resources:

EUR/USD outlook clouded by downward trend in RSI

AUD/USD rate rally stalls ahead of April high

--- Written by David Song, Strategist

Follow me on Twitter at @DavidJSong