US Dollar Outlook: USD/CAD

USD/CAD cleared the July high (1.3387) as Canada’s Employment report showed an unexpected 6.4K contraction in July, and data prints coming out of the US may sway the exchange rate this week as the Consumer Price Index (CPI) is anticipated to show sticky inflation.

USD/CAD Rate Forecast: All Eyes on US CPI Report

USD/CAD extends the advance from last week to register a fresh monthly high (1.3400), and it seems as though the exchange rate will no longer respond to the negative slope in the 50-Day SMA (1.3274) as it trades above the moving average for the first time since June.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Nevertheless, fresh remarks from New York Fed President John Williams appear to be dragging on the Greenback as the permanent voting-member on the Federal Open Market Committee (FOMC) emphasizes that ‘we’re pretty close to what a peak rate would be.’

Williams went onto say that the Fed may ‘need to adjust interest rates down to keep real interest rates at least constant’ during an interview with the New York Times, while Governor Michelle Bowman argues that ‘additional increases will likely be needed to lower inflation to the FOMC's goal’ while speaking at an event held by the Atlanta Fed.

US Economic Calendar

Signs of dissent within the FOMC may bring increased attention to the US CPI as the headline reading is projected to increase to 3.3% in July from 3.0% per annum the month prior while the core rate of inflation is expected to narrow to 4.7% from 4.8% during the same period.

A further deviation from the Fed’s 2% target may generate a bullish reaction in the US Dollar as it puts pressure on the FOMC to pursue a more restrictive policy, but a softer-than-expected CPI print may undermine the recent advance in USD/CAD as it fuels speculation for a looming change in regime.

With that said, expectations surrounding Fed policy may sway USD/CAD as the central bank seems to be nearing the end of its hiking-cycle, but the exchange rate may attempt to extend the advance from the monthly low (1.3184) as it no longer responds to the negative slope in the 50-Day SMA (1.3275).

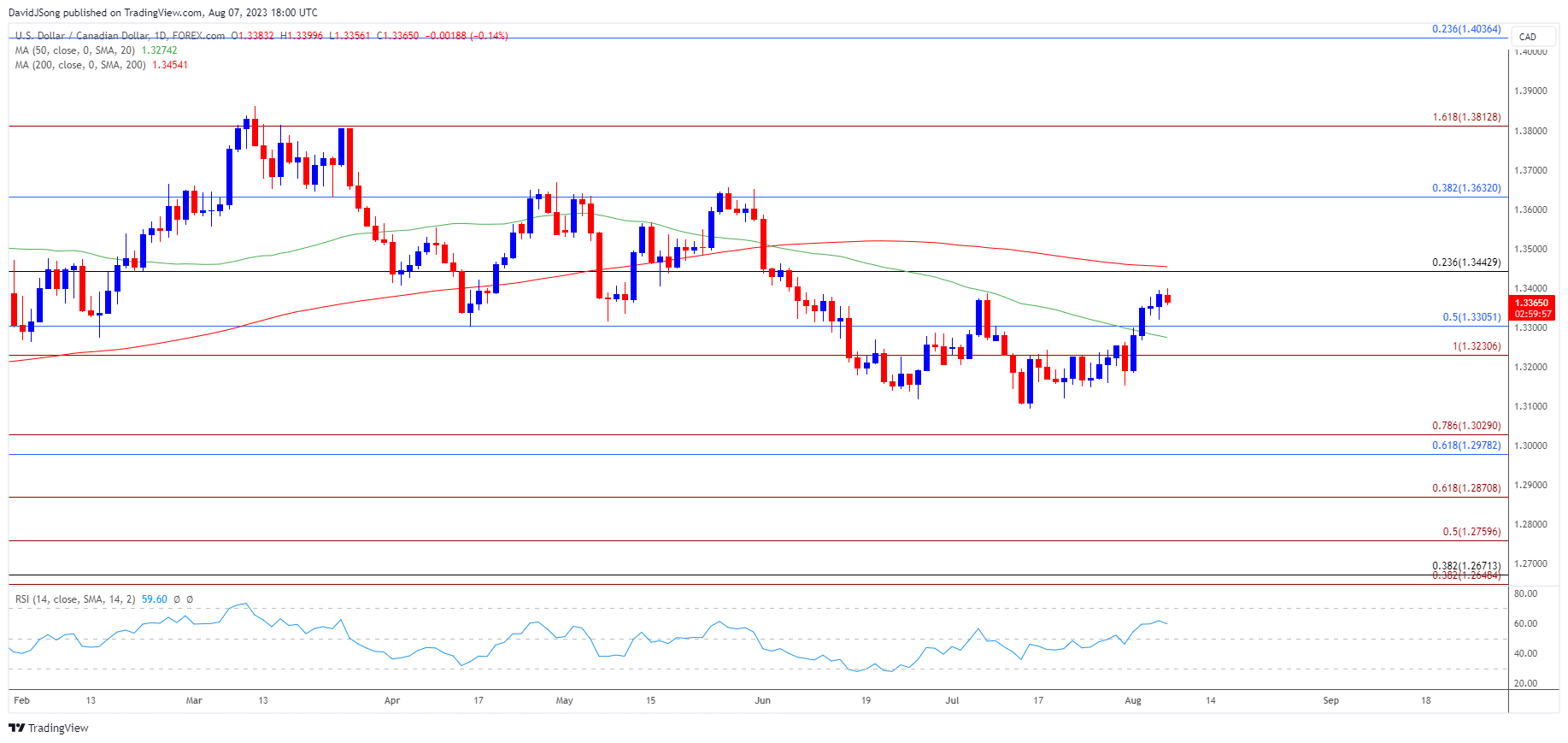

US Dollar Price Chart – USD/CAD Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD extends the advance from the start of August to register a fresh monthly high (1.3400), with the exchange rate no longer responding to the negative slope in the 50-Day SMA (1.3274) as it trades above the moving average for the first time since June.

- The breach above the July high (1.3387) may push USD/CAD towards 1.3440 (23.6% Fibonacci retracement), with a move above the 200-Day SMA (1.3454) bringing the June high (1.3585) on the radar.

- Next region of interest comes in around 1.3630 (38.2% Fibonacci retracement), but failure to push above 1.3440 (23.6% Fibonacci retracement) may curb the recent advance in USD/CAD, with a move below the 1.3230 (100% Fibonacci extension) to 1.3310 (50% Fibonacci retracement) area raising the scope for a test of the monthly low (1.3184).

Additional Markt Outlooks

USD/JPY Outlook Mired by Failure to Test June High

GBP/USD Post-BoE Weakness Undermines Rebound from June Low

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong