Canadian Dollar Outlook: USD/CAD

USD/CAD appears to be negating the ascending channel from earlier this year as Canada’s Consumer Price Index (CPI) shows an unexpected rise in inflation, but the exchange rate may face range bound conditions if it defends the monthly low (1.3603).

USD/CAD Negates Ascending Channel amid Uptick in Canada Inflation

USD/CAD extends the series of lower highs and lows from last week as the update to Canada’s CPI shows the headline reading climbing to 2.9% in May from 2.7% per annum the month prior, with the core reading rising to 1.8% from 1.6% during the same period.

Signs of persistent price growth may push the Bank of Canada (BoC) to the sidelines following the 25bp rate cut at the June meeting, but it seems as though the central bank will move to a more accommodative stance as Governor Tiff Macklem points out that ‘there is some slack in the labour market’ while speaking at the Winnipeg Chamber of Commerce.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Governor Macklem goes onto say that the ‘the economy has room to grow and add more jobs without creating new inflationary pressures,’ and the comments suggest the BoC will continue to shift gears as ‘inflation is much closer to the 2% target.’

Looking ahead, the Federal Reserve may also alter the path for monetary policy as the Summary of Economic Projections (SEP) show that ‘the appropriate level of the federal funds rate will be 5.1 percent at the end of this year,’ and Fed officials may start to prepare US households and businesses for a change in regime as the US Personal Consumption Expenditure (PCE) Price Index is anticipated to show slowing inflation.

US Economic Calendar

The core PCE, the Fed’s preferred gauge for inflation, is seen narrowing to 2.6% in May from 2.8% per annum the month prior, and evidence of easing price growth may produce headwinds for the US Dollar as it fuels speculation for a FOMC rate-cut in 2024.

At the same time, a higher-than-expected core PCE print may force Chairman Jerome Powell and Co. to further combat inflation, and signs of sticky price growth may spark a bullish reaction in the Greenback as it raises the Fed’s scope to keep US interest rates higher for longer.

With that said, USD/CAD may face range bound conditions if it struggles to test the monthly low (1.3603), but the exchange rate may continue to carve a series of lower highs and lows as it no longer trades within the ascending channel from earlier this year.

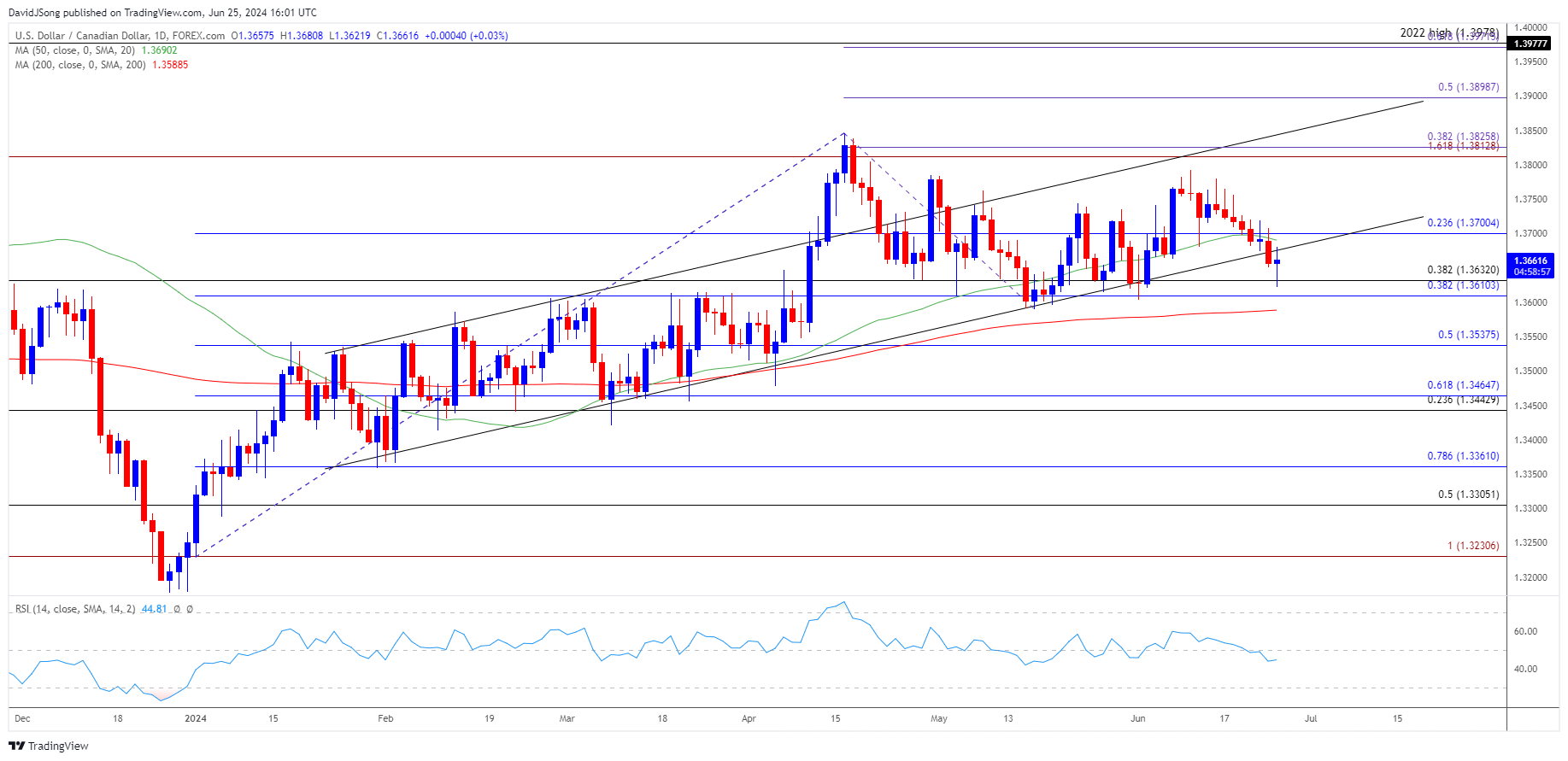

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD approaches the monthly low (1.3603) as it extends the series of lower highs and lows from last week, with a breach below the May low (1.3590) raising the scope for a move towards 1.3540 (50% Fibonacci retracement) as it no longer trades within the ascending channel from earlier this year.

- Next area of interest comes in around the April low (1.3478) but USD/CAD may face range bound conditions if it struggles to break/close below the 1.3610 (38.2% Fibonacci retracement) to 1.3630 (38.2% Fibonacci retracement) region.

- Need a move above 1.3700 (23.6% Fibonacci retracement) for USD/CAD to trade back within the channel, with a breach above the monthly high (1.3792) bringing the 1.3810 (161.8% Fibonacci extension) to 1.3830 (38.2% Fibonacci extension) area back on the radar.

Additional Market Outlooks

US Dollar Forecast: EUR/USD Bounces Back Ahead of Monthly Low

US Dollar Forecast: USD/JPY Rally Pushes RSI Towards Overbought Zone

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong