USD/CAD Outlook

USD/CAD carves a series of higher highs and lows after trading to a fresh yearly low (1.3117) earlier this week, but the rebound may end up short-lived if the exchange rate struggles to push back above the former support zone around the April low (1.3301).

USD/CAD Forecast: Test of Former Support in Focus

USD/CAD appears to have reversed ahead of the September 2022 low (1.2954) as the Relative Strength Index (RSI) recovers from oversold territory, and the oscillator may continue to show the bearish momentum abating as it returns to the levels seen earlier this month.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

At the same time, the update to the US Personal Consumption Expenditure (PCE) Price Index may keep USD/CAD afloat as the core rate, the Federal Reserve’s preferred gauge for inflation, is expected to hold steady at 4.7% in May while the headline reading is projected to increase to 4.6% from 4.4% per annum the month prior.

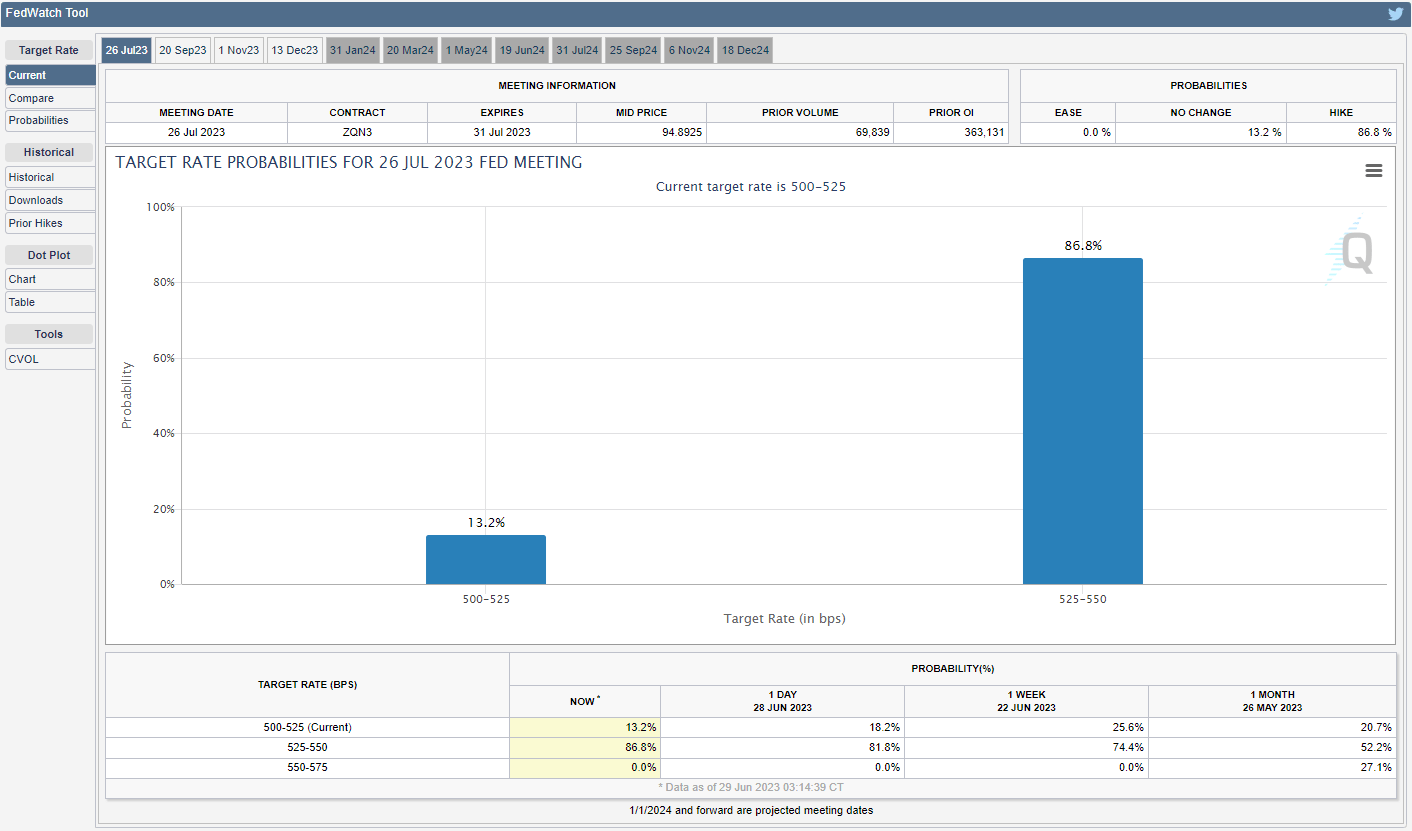

Stickiness in the PCE index may fuel speculation for higher US interest rates as Chairman Jerome Powell and Co. show a greater willingness to pursue a more restrictive policy, and the Federal Open Market Committee (FOMC) may restore its hiking-cycle at the next interest rate decision on July 26 as inflation remains above the central bank’s 2% target.

Source: CME

Until then, speculation surrounding Fed policy may sway the US Dollar as the CME FedWatch Tool reflects a greater than 80% probability for a 25bp rate hike next month, and USD/CAD may stage a larger rebound going into July as it carves a series of higher highs and lows.

With that said, evidence of persistent US inflation may generate a bullish reaction in USD/CAD amid growing expectations for a Fed rate hike in July, but the recent rebound in the exchange rate may end up short-lived if it struggles to push back above the former support zone around the April low (1.3301).

Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD appears to have reversed ahead of the September 2022 low (1.2954) as the Relative Strength Index (RSI) recovers from oversold territory, with the exchange rate carving a bullish price series after registering a fresh yearly low (1.3117).

- Need a break/close above the 1.3230 (100% Fibonacci extension) to 1.3310 (50% Fibonacci retracement) region to bring the 50-Day SMA (1.3513) on the radar, with a move above 1.3440 (23.6% Fibonacci retracement) opening up the 200-Day SMA (1.3515).

- However, failure to push back above the former support zone around the April low (1.3301) may curb the recent rebound in USD/CAD, with a move below the 1.2980 (61.8% Fibonacci retracement) to 1.3030 (78.6% Fibonacci extension) area raising the scope for a run at the September 2022 low (1.2954).

Additional Market Outlooks

GBP/USD Susceptible to Test of 50-Day SMA

AUD/USD Rate Outlook Hinges on RBA Rate Decision

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong