Canadian Dollar Outlook: USD/CAD

USD/CAD holds within a narrow range after registering a fresh monthly high (1.3640) last week, and data prints coming out of the US may keep the exchange rate afloat as Federal Reserve Chairman Jerome Powell and Co. are ‘prepared to raise rates further if appropriate.’

USD/CAD Forecast: RSI Continues to Reflect Overbought Reading

USD/CAD appeared to be on track to test the May high (1.3655) as the Relative Strength Index (RSI) pushed into overbought territory for the second time in 2023, and the bullish momentum may persist as long as the oscillator holds above 70.

At the same time, the prepared remarks for the Kansas City Fed Economic Symposium in Jackson Hole, Wyoming suggest the Federal Reserve is in no rush to switch gears as the central bank intends to ‘hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

US Economic Calendar

It remains to be seen if the Federal Open Market Committee (FOMC) will take further steps to combat inflation as Chairman Powell warns that ‘the process still has a long way to go,’ and the update to the US Personal Consumption Expenditure (PCE) Price Index, the Fed’s preferred gauge for inflation, may sway foreign exchange market as the core rate is expected to widen to 4.2% in July from 4.1% per annum the month prior.

Evidence of persistent price growth may generate a bullish reaction in the US Dollar as it puts pressure on the FOMC to pursue a more restrictive policy, but a softer-than-expected PCE print may drag USD/CAD as it fuels speculation for a looming change in regime.

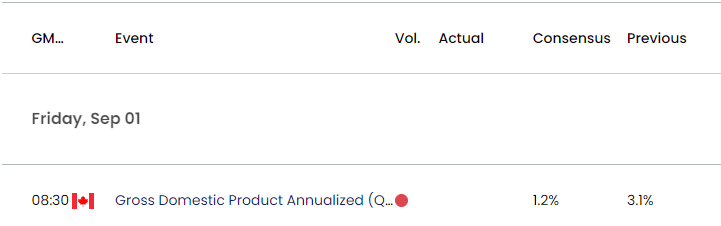

Canada Economic Calendar

In turn, USD/CAD may stage further attempts to test the May high (1.3655) as the FOMC continues to strike a hawkish forward guidance, and Canada’s Gross Domestic Product (GDP) report may do little to curb the recent advance in the exchange rate as the economy is expected to grow 1.2% in the second quarter after expanding 3.1% during the first three-months of 2023.

With that said, USD/CAD may face increased volatility going into September as the US PCE is anticipated to show sticky inflation, but a move below 70 in the Relative Strength Index (RSI) is likely to be accompanied by a larger pullback in the exchange rate like the price action from earlier this year.

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD appears to be stuck in a narrow range after registering a fresh monthly high (1.3640) last week, and the exchange rate may stage further attempts to test the May high (1.3655) as long as the Relative Strength Index (RSI) holds in overbought territory.

- Need a close above 1.3630 (38.2% Fibonacci retracement) to raise the scope for a move towards 1.3810 (161.8% Fibonacci extension), with the next area of interest coming in around the March high (1.3862).

- However, failure to test the May high (1.3655) may push the RSI back below 70, with a break/close below 1.3440 (23.6% Fibonacci retracement) bringing the 1.3230 (100% Fibonacci extension) to 1.3310 (50% Fibonacci retracement) area back on the radar.

Additional Market Outlooks

USD/JPY Pullback Keeps RSI Out of Overbought Territory

US Dollar Forecast: EUR/USD on Cusp of Testing July Low

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong