US Dollar Outlook: USD/CAD

USD/CAD attempts to retrace the decline from the start of the month after responding to the positive slope in the 50-Day SMA (1.3655), and the exchange rate may test the 2022 high (1.3978) if it breaks above the opening range for November.

USD/CAD Forecast: November High in Focus Following Test of 50-Day SMA

USD/CAD may track the positive slope in the moving average as Federal Reserve Chairman Jerome Powell keeps the door open to further combat inflation, and data prints coming out of the US may sway the exchange rate as the Consumer Price Index (CPI) is anticipated to show sticky inflation.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

US Economic Calendar

Although the headline CPI is expected to narrow to 3.3% in October from 3.7% per annum the month prior, the core rate is anticipated to hold steady at 4.1% during the same period.

Evidence of persistent price growth may generate a bullish reaction in the Greenback as it puts pressure on the Federal Open Market Committee (FOMC) to implement a rate-hike in December, but a softer-than-expected CPI report may drag on USD/CAD as it fuels speculation of seeing US interest rates unchanged over the remainder of the year.

With that said, USD/CAD may face range bound conditions should it fail to clear the monthly high (1.3899), but a break above the November opening range may lead to a test of the 2022 high (1.3978) as the exchange rate seems to be tracking the positive slope in the 50-Day SMA (1.3655).

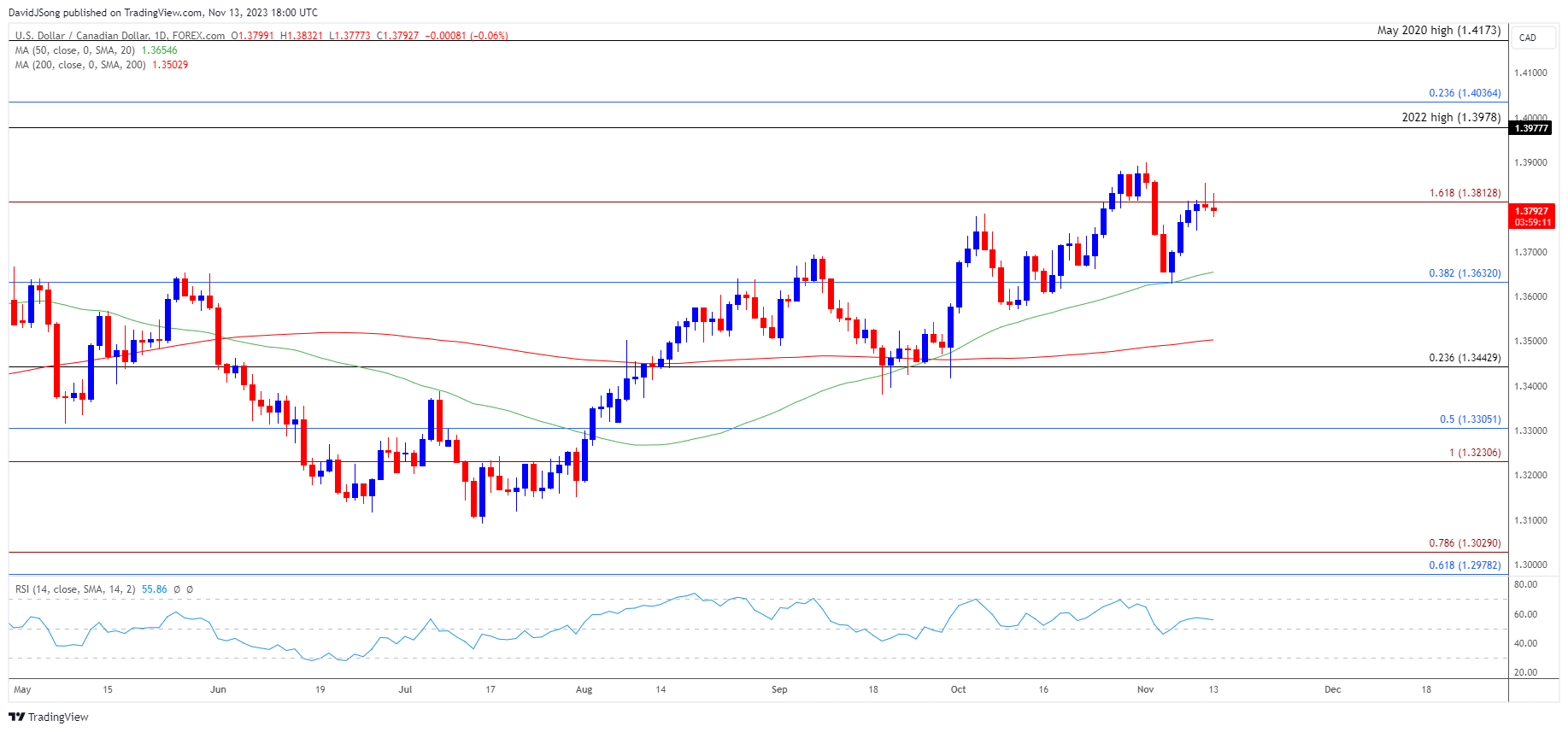

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD approaches the monthly high (1.3899) after testing the 50-Days SMA (1.3655), and the exchange rate may attempt to break above the opening range for November as it seems to be tracking the positive slope in the moving average.

- Next area of interest comes in around 2022 high (1.3978), with a break/close above 1.4040 (23.6% Fibonacci retracement) opening up the May 2020 high (1.4173).

- However, the string of failed attempts to close above 1.3810 (161.8% Fibonacci extension) may keep USD/CAD within the monthly range, with a breach below the moving average brining 1.3630 (38.2% Fibonacci retracement) back on the radar.

Additional Market Outlooks

Euro Forecast: EUR/USD Bounces Ahead of 50-Day SMA to Eye Monthly High

US Dollar Forecast: GBP/USD Vulnerable if Monthly Low Breaks

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong