Canadian Dollar Outlook: USD/CAD

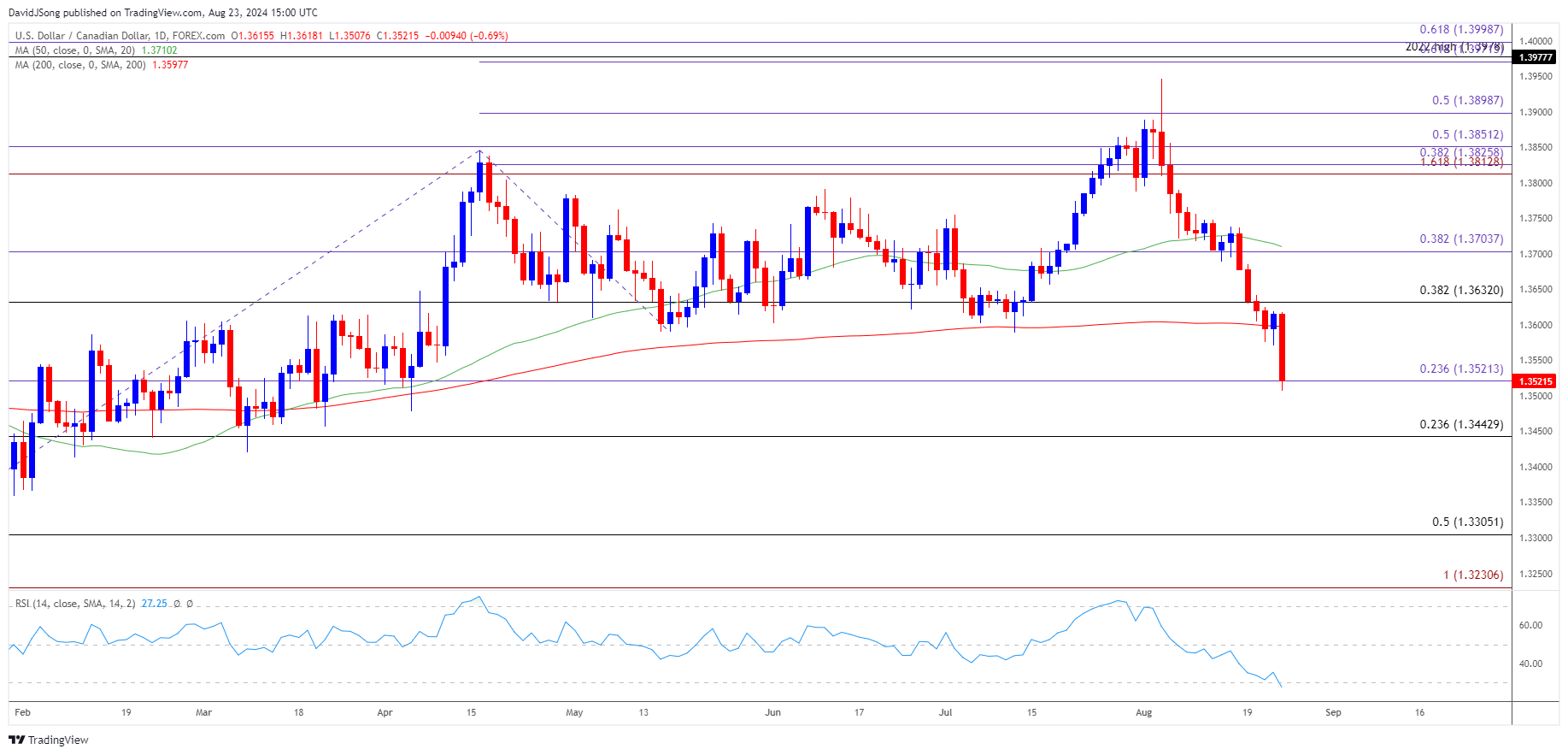

USD/CAD tumbles to a fresh monthly low (1.3508) as Federal Reserve Chairman Jerome Powell states that ‘the time has come for policy to adjust,’ and the exchange rate may continue to give back the advance from the April low (1.3478) as the Relative Strength Index (RSI) pushes into oversold territory for the first time this year.

USD/CAD Falls Towards April Low as Fed Signals Policy Adjustment

The move below 30 in the RSI is likely to be accompanied by a further decline in USD/CAD like the price action from last year, and the exchange rate may search for support over the remainder of the month as it failed to defend the July low (1.3589).

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD may continue to depreciate as it extends the series of lower highs and lows from last week, with a breach below the April low (1.3478) bringing 1.3440 (23.6% Fibonacci retracement) on the radar.

- Next area of interest comes in around the March low (1.3420) and the weakness in USD/CAD may persist as long as the RSI holds below 30.

- Nevertheless, lack of momentum to close below 1.3520 (23.6% Fibonacci extension) may pull the RSI back from oversold territory but need a move back above 1.3630 (38.2% Fibonacci retracement) for USD/CAD to negate the bearish price series.

Additional Market Outlooks

British Pound Forecast: GBP/USD Rally Eyes 2023 High

Gold Price Forecast: XAU/USD Pullback Keeps RSI Below 70

AUD/USD Rally Pushes RSI Towards Overbought Territory

US Dollar Forecast: USD/JPY Rebound Unravels Ahead of Fed Symposium

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong