US Dollar, EUR/USD, GBP/USD, USD/CAD, USD/JPY Talking Points:

- It was a big week for the US Dollar and hope has returned that inflation is settling and that we’ve seen the end of rate hikes from the FOMC. This led to a sizable sell-off in the USD on Tuesday and helped to prod a very strong move in equities and bonds.

- This follows a similar pattern as last year, and I had discussed this in the Monday article and so far, that pattern has remained close. This year presents a different backdrop, obviously, but the question remains as to whether more of that pattern will play out.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

It was a big week for the US Dollar and this may, possibly, be the opening that bears were looking for to take more control of the currency. I say that because, right now, the US Dollar is following a very similar pattern as 2022. Last year the US Dollar was driving throughout September trade to set a fresh 20-year high. But it was right around the Q4 open that the USD found resistance and began to stall, and that stalling, range-like action lasted for most of that month.

By the time November rolled around, the ECB had started hiking more aggressively and the USD was on its backfoot after having set a lower-low. It’s almost as if bears were waiting for confirmation before prodding a deeper reversal move, and that arrived on the morning of November the 10th in the form of a CPI report. Headline CPI printed at 7.7% that morning, which sounds bad, but when taken with the context at the time it was a relief. The expectation for that morning was at 8%, and only a few months earlier we’d seen that cycle peak at 9.1% in July.

We, of course, didn’t know that was the peak at the time but hope had begun to show when CPI came in at 8.5% in August, 8.3% in September and then 8.2% in October – showing a steady pattern of slower inflation that drove the thought that, perhaps the Fed was close to finished?

That 7.7% release on the morning of November 10th was a surprising miss to the 8% expectation but that seemed to be the point where bears finally had the motivation to push the Greenback down to a fresh low, and that led to a violent move that triggered a trend that lasted for the next few months.

For this year: The US Dollar put in a consistent streak of gains that held through September trade until, eventually, finding resistance in early-October. And then, like last year, the US Dollar ranged for most of last month with a slight bias towards weakness as presented by lower lows. And then on Tuesday headline CPI came out and helped to bring bears back into the mix, pushing the US Dollar down to a fresh two-month-low.

This raises the question as to whether the USD may fall into a deeper pullback scenario. And again, this is a single anecdote, and in both situations the matter was being pushed by falling expectations around the Fed as brought upon by CPI data.

US Dollar Daily Chart (indicative)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Has the US Dollar Topped?

Rene Descartes said, ‘doubt is the origin of wisdom.’ I find it best to investigate a thesis by trying to poke holes in it to see where the fragile points might appear.

The big difference in each scenario are rate expectations. When this shift began to show in Q4 of 2022, the European Central Bank had started to lift rates more aggressively and that had a tangible impact in the Euro. There was also the hope for many more rate hikes out of Europe, as the ECB only posed their first hike in July and there was a lot of ground to cover as the Fed had started earlier and had hiked by more. The Euro makes up 57.6% of the US Dollar quote via the DXY instrument; so if the US Dollar is going to push a deeper bearish move, it’s probably going to need some help from the Euro. And last year, that was very much the case.

This year, however, presents a very different scenario. Inflation remains elevated in Europe but many other leading economic indicators, like retail sales activity or consumer confidence, have taken a grim turn. So grim, in fact, that former ECB President Mario Draghi said that he was ‘almost sure’ that the Eurozone would fall into recession by the end of this year.

This, of course, could complicate matters for additional rate hikes out of the ECB. And it can also bring on the dreaded scenario of elevated inflation in a recessionary environment, at which point the Central Bank has to make some very difficult decisions.

This is, perhaps, one of the reasons for that stall in the US Dollar throughout October. I had highlighted this theme in late-September when an oversold EUR/USD was coming into a re-test with a major psychological level at 1.0500. That price helped to stem the sell-off but, all month, each bullish flare was seemingly met by sellers, which kept EUR/USD prices confined to a bullish channel. Until this week, that is.

In the USD, this showed as a mirror image, with slightly lower-lows printing through last month. November started off with the FOMC rate decision and price was perched near the highs as we came into that rate decision. But, the gains quickly left through the press conference and by the end of the day, that bar had built as a gravestone doji and the USD has been printing lower lows and lower highs ever since.

US Dollar Daily Price Chart (indicative)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

From the four-hour chart below, we can get a better view of that sequencing since the Fed.

The initial breakdown move found support at the 105 handle in DXY before bouncing. Lower-high resistance played in a week later, and that held last week’s high. We can then see that sizable move pricing in on Tuesday, propelling the USD down to the 104.03 level, which has held for the past few days.

As of this writing bears look to be going for another test of lows to further that them, and this highlights the next spot of support at the 103.50 level that I’ll look at after the next chart.

US Dollar Four-Hour Price Chart (indicative)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

USD Decision Point

The first trade of this day of this year saw DXY open and close at 103.50. And that price has been back in the picture for the USD on multiple occasions: As resistance in February, support in March. It was resistance-turned-support in May and June. And then it was the last spot of resistance before the breakdown attempt in July, which was a double top at the time.

This price became resistance again when the bullish trend had started back up, holding the highs in August and finally relenting in September.

But this is the next support level that I’m tracking on the weekly USD chart. It’s also the 50% mark of the recent bullish move so there’s some near-term context there as well.

If USD bears can push price down to that level – it becomes an interesting spot to investigate for reversal or pullback themes.

And for bears holding for a breakdown test at that level – the big question is whether they feel the Euro, British Pound and/or the Yen can take on enough strength to allow for a continued breakdown move.

US Dollar Daily Price Chart (indicative)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD

When the US Dollar broke down in Q4 of last year, the Euro was a massive help. As rate expectations were falling in the US they were rising in Europe and that helped to shift the trend in EUR/USD.

Before that – the pair was in a troubling sell-off that had seen the pair push below the parity level. It was November 10th when the breakout really took hold and that propelled price up to a near-term high of 1.0482. Interestingly – that was the first higher-low in October following the stall at 1.0448.

Below we can see the two themes compared between 2022 and 2023 trade. Strong selloffs that lasted through September, running into ranging countertrend moves in October, followed by November breakouts.

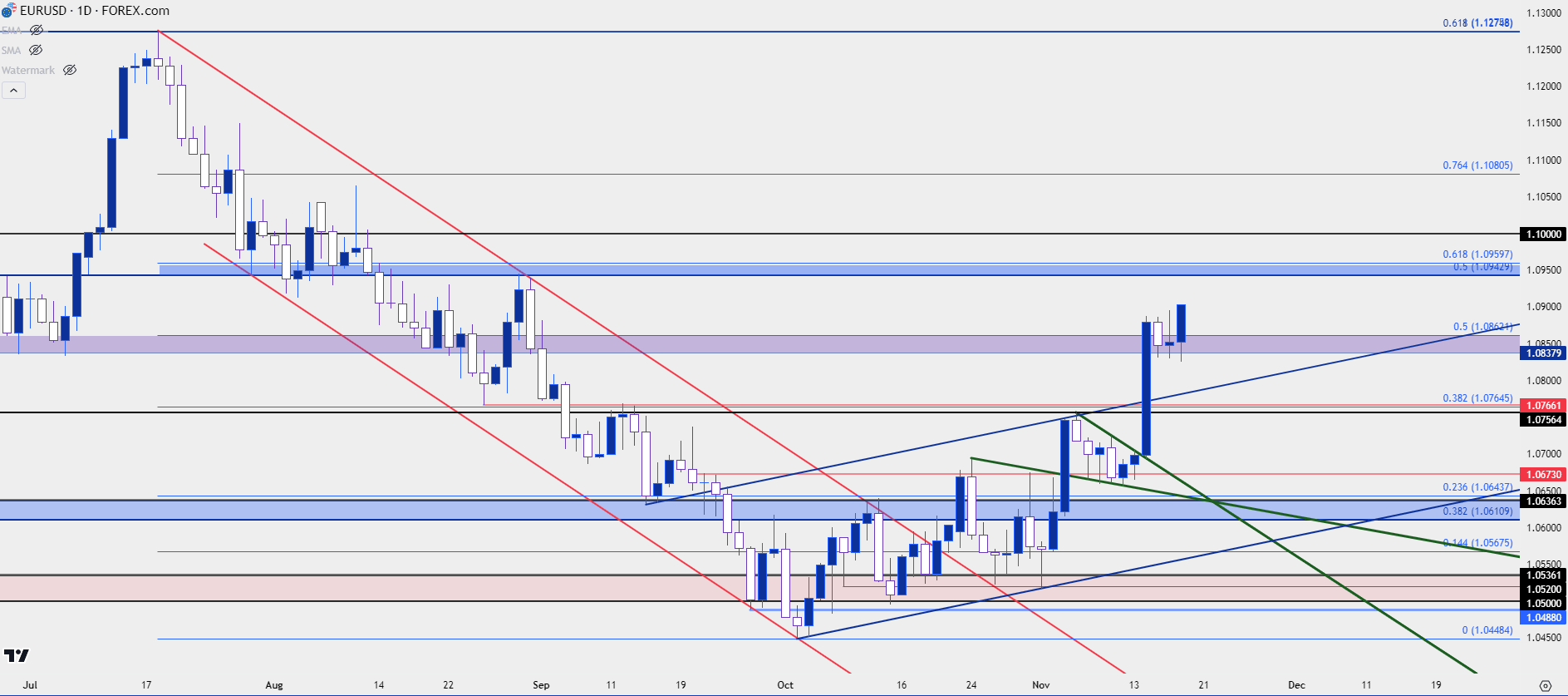

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

When I looked into this on Monday ahead of the CPI print, I highlighted a shorter-term setup in EUR/USD.

And there was a lot going on: First we had the bearish channel that held the trend for three months, which had led into the build of a bullish channel and that held for a month. But, while price was digesting within that channel, a falling wedge had formed. Falling wedges are often approached with aim of bullish continuation and when taken with the backdrop of higher-low support, that kept the door open for buyers as we moved into CPI.

That breakout hit aggressively and now price has pushed out of the channel. There hasn’t been much for pullback yet either as higher lows have held around the 1.0838 level and as of this writing, EUR/USD is perched at a fresh two-month high. The next zone of resistance that I’m tracking is a confluent pair of Fibonacci levels at 1.0943 and 1.0960.

For support – there’s a confluent spot with quite a bit going on around the 1.0750 level, and this would be the spot for bulls to hold to keep the trend intact.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

GBP/USD

Cable presents a similar, albeit less bullish picture at the moment.

While EUR/USD is working on fresh two-month highs, GBP/USD still has some resistance to deal with and this is a rather wide area. The 1.2500 level is obvious and that’s what helped to mark the highs this week. But just inside of that are Fibonacci levels at 1.2481 and 1.2459. There’s also a prior swing at 1.2428.

Support has so far held at 1.2391 and the daily chart is showing a possible morning star formation. This was the same backdrop that had built leading into CPI, as the doji from last Friday printed right at support around the 1.2200 handle and that was followed by strength on Monday to complete the formation.

For the current setup, whether the morning star completes or not appears to be an item that’ll go down to the wire. I’m generally looking for bar three of the formation to take out at least half of bar one, and in this case that would entail a close above the 1.2560 Fibonacci level which remains up in the air.

Either way, this will set up another test with the 1.2500 big figure next week. If bulls can make it beyond, the next item of resistance shows at 1.2590 and then there’s a massive zone of confluent around the 1.2750 psychological level.

GBP/USD Daily Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

USD/CAD: Wedge on Wedge

USD/CAD broke out of a very long-term formation a month ago.

This symmetrical wedge was defined by the range that came along with Covid stimulus and since the high was set in March of 2020 or the low was set in May a year later, prices have continued to coil into a tighter and tighter range.

That finally gave way in October.

But bulls couldn’t get very far as they got caught at the 1.3900 level, and while this did allow for a fresh yearly high, it also set an imposing slate for bulls with the 1.4000 psychological level looming above.

That brought a pullback, and support showed at a familiar Fibonacci level of 1.3652. That price has been in-play on the pair in numerous ways this year, as both support and resistance, and it’s been back in the picture of late as it’s led to a bounce and has, so far, helped to set the low after the breakout attempt.

USD/CAD Weekly Price Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

Chart prepared by James Stanley, USD/CAD on Tradingview

Since that breakout in October, another symmetrical wedge has appeared as price has been making both lower-highs and higher-lows.

This illustrates compression after the breakout and given the direction of the move that led into it, there could be some residual bias in that direction. The challenge, of course, is a wide set of resistance levels sitting overhead, not to mention the 1.4000 level that hasn’t been tested in this cycle. But – if the US Dollar is forcing a deeper turn lower, the Fibonacci level at 1.3652 could be vulnerable, and this opens the door for deeper support tests at 1.3575 or 1.3500.

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

Chart prepared by James Stanley, USD/CAD on Tradingview

USD/JPY

The Japanese Yen is 13.6% of the DXY quote.

This is notable because one of the items that really hastened the sell-off in the US Dollar last year was a fast reversion in USD/JPY. And again, there’s some sync between 2022 and 2023 themes.

In both cases, the carry remained decisively tilted to the long side of the pair. So market participants were very much incentivized on the long side of the trade and that carry factor has been a constant, to varying degrees, throughout these cycles.

But in November of last year when the US Dollar broke down after that CPI report on November 10th, 2022, USD/JPY went spiraling lower and that led into a bearish trend that lasted for about three months. Along the way, USD/JPY wiped out 50% of a move that had taken 21 months to build, with support eventually showing in mid-January at the 50% retracement of that same major move.

USD/JPY Weekly Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

Carry Trade Unwind Can be Powerful

Rate divergence can be a powerful factor in the FX market as daily rollover can be an incentivizing factor. As more traders go into a market to try to capture the carry, that can lead to an extension in the bullish move as more demand builds and that serves to incentivize others, as now there’s a bullish trend to go along with that positive carry.

This describes USD/JPY earlier this year, after finding support at that 50% mark. Carry traders returned and soon we had a bullish trend. As the USD started to go into hard trend mode in July, USD/JPY lifted and ran all the way back up to the 150.00 level and that was a point of contention throughout October.

But now that we have a similar USD break following a similar CPI report, the question remains if we’ll see a similar scenario play out in USD/JPY.

Because while the carry can remain as attractive – the risk of principal losses can fast outpace that, and this can lead to an unwind scenario that can present something similar to what we saw last year. The difference here is that bears attacked right after that report and at this stage, they appear to be a bit more tepid.

But – there is some context for sellers as price has pushed below 150 and broken below a falling wedge formation along the way. For next week, there’s key supports at 148.84 and 147.37, and these would be items that bears would likely want to see taken-out to further build the reversal theme in the pair.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist