US Dollar Talking Points:

- The US Dollar has continued to fall following yesterday’s FOMC rate decision.

- There’s been a strong push lower in US yields, leading many to claim that rates have topped. It is still very early, however.

- Equities have caught a strong bid after showing oversold conditions last week. This begs the question as to whether we’re witnessing an oversold bounce or the start of a possible set up for a Santa Rally. I explore further below.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

It’s been just a little over 24 hours since the release of the FOMC statement at yesterday’s rate decision and already many markets have displayed tones of change.

Equities are certainly in that conversation as the S&P 500 and Nasdaq 100 are showing outsized bullish moves. This comes along with a dip in US Treasuries along with the US Dollar. Already many are declaring this as a drive from the Fed finishing rate hikes; but that doesn’t really fit with what Chair Powell had said yesterday as he directly proclaimed that ‘rate cuts are not something that we’ve discussed.’

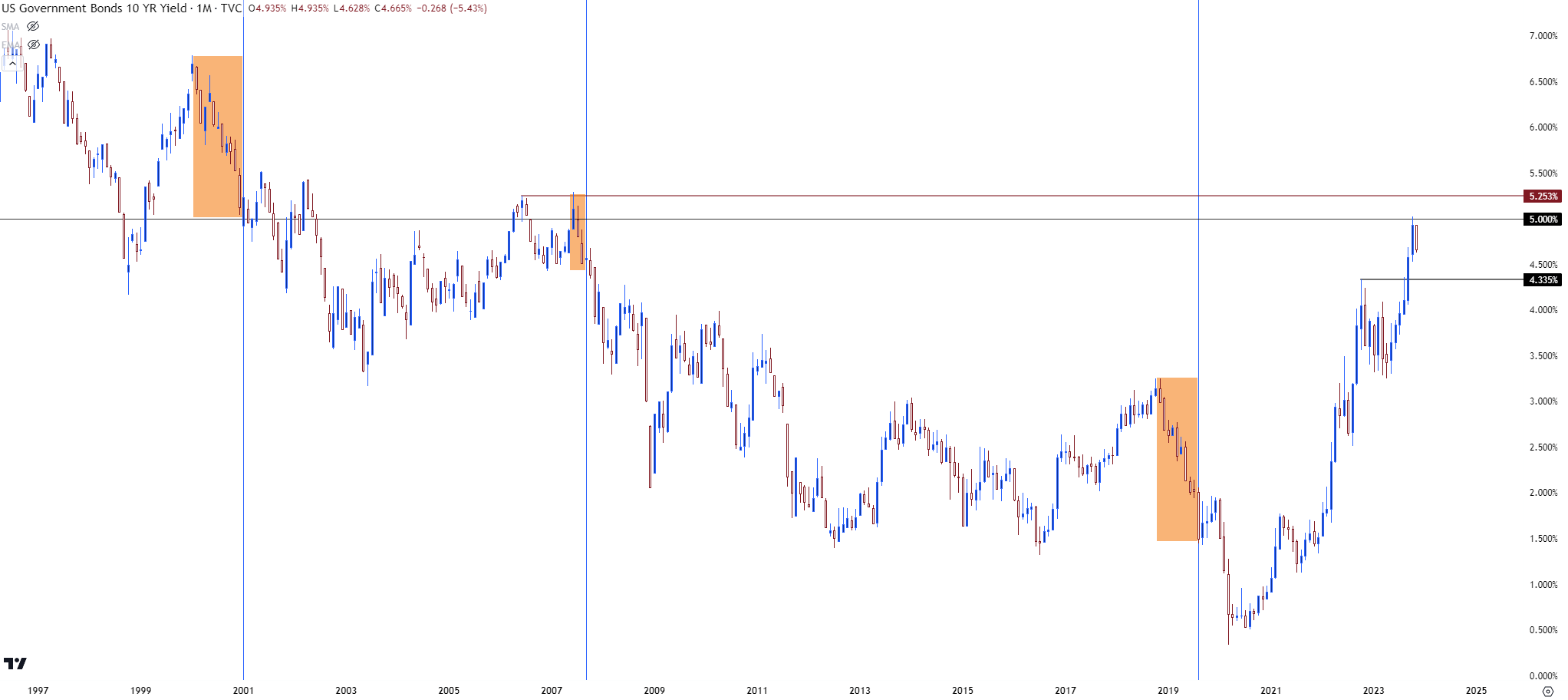

So, while we are seeing a dip in longer-term yields, one-month Treasury bills are practically unchanged on the week and that fits with the Fed’s pause at yesterday’s rate decision. Further out on the curve, however, there has been some demand and that means lower yields to go along with higher bond prices. But it’s important to note that longer term yields are at the drive of market participants – not the Federal Reserve. And, in many cases, yields will begin to fall far before the Fed begins to cut rates. On the below chart, I’m looking at 10-year yields going back to the year 2000. There’s been three primary cutting cycles since then: The dot com bust, the financial collapse and then the 2019 cuts that led into pandemic stimulus.

In each instance the 10-year yield had topped well in advance of the first cut for each cycle. In some cases, the lag was very long, like in 2000. The Fed actually hiked three times for 100 basis points in the year 2000 – even as the 10 year yield was swan diving. They eventually cut a full year after 10 year yields had topped, in January of 2001 and the 10 year note was already 175 bps off of its cycle high. And in 2019 – the 10-year yield set its cycle high in November of 2018 and the first cut from the Fed was in August of 2019.

Bond traders are not stupid – they aren’t going to wait around for rate cuts. They’ll anticipate that and price it in ahead of time, as we can see on the below chart. The first cut for each cutting cycle is defined below with a blue vertical line.

US 10 Year Yields – Monthly Chart (indicative only)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

With the move that we’re seeing today the natural question is: Have yields topped?

It’s a good question and if we look at it solely from the scepter of the Federal Reserve there may be some clear validity to that. But – again – the Fed does not control long-term rates, that’s up for the market to debate, and next year will see a massive amount of supply come online for long-dated Treasuries and if that supply is not met with adequate demand – like any other market – prices can go lower and rates higher. So, the jury will be out for a little bit there.

What is clear is that the 5% mark in the 10-year has produced some notable drive and that fall in yields has, so far, been a respite for equity prices.

This can keep the door open for a Santa Rally, as I had shared a few weeks ago. And this can also come along with a slew of question marks for next year.

In the S&P 500 we can see a massive rally developing this week which has retraced 38.2% of the bearish move that’s built over the past three months.

S&P 500 Daily Price Chart (indicative only)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

US Dollar

The week is not over yet, and there remains a massive data point for markets to digest with tomorrow’s Non-farm Payrolls report. Perhaps more important than a singular data point, however, is how markets incorporate that print. In the US Dollar, prices have pulled back today and found support at a familiar level of 105.88. But, this has, so far, been another failed attempt from bulls to continue the breakout that was so strong in early-October trade. As I’ve been highlighting in webinars and articles of late, my opinion is that the USD needs a deeper pullback before that dominant bullish trend is ready to take back over.

To date, we’ve only seen a 23.6% retracement of that bullish move that began in July. Each pullback thus far has been cut short as bears haven’t been able to break much fresh ground of late; and a reason for that may have something to do with currencies that aren’t the US Dollar. From the below weekly chart, we can see that stall in the bullish trend that’s held for going on six weeks.

US Dollar Weekly Price Chart (indicative only)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

The daily chart will look a bit more chaotic than the simple stall shown over the past six weeks on the above chart. But, the important thing to notice here is that extremes have so far been faded: Buyers jumped into bid the currency last week on a support test and then sellers hit the market yesterday as price inched closer to the 107.18 resistance level.

In my opinion, this is function of a still over-crowded trade after a long eleven week streak of strength. The question now is whether bulls will allow for a deeper pullback and tomorrow’s NFP report could be excuse for such.

For support, the same 105.39-105.55 zone lurks below current prices but it’s the 105 level below that which remains of interest. That support level was last in play around the September FOMC rate decision.

US Dollar Daily Price Chart (indicative only)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist