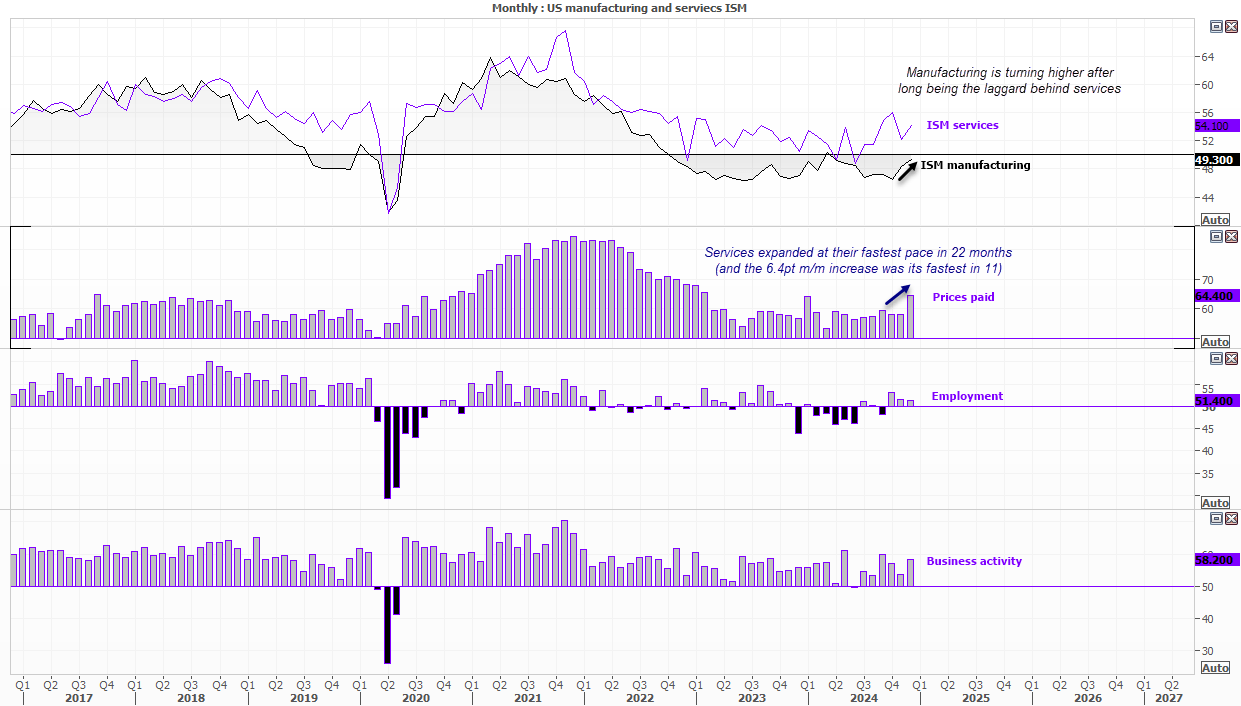

With traders slowly returning to their desks following the extended break over Christmas, December’s ISM and PMI figures may not have receive their usual levels of attention. But with inflationary pressures now quite apparent, perhaps they will.

ISM services increased 2 points in December to 54.1, but more importantly the ‘prices paid’ index expanded at its fastest pace in nearly two years at 64.4. Its 6.2 month-over-month increase was also its fastest in 11 months. Business activity was also up 4.5 points to 58.2 and new orders up marginally by 0.5 points to 54.2.

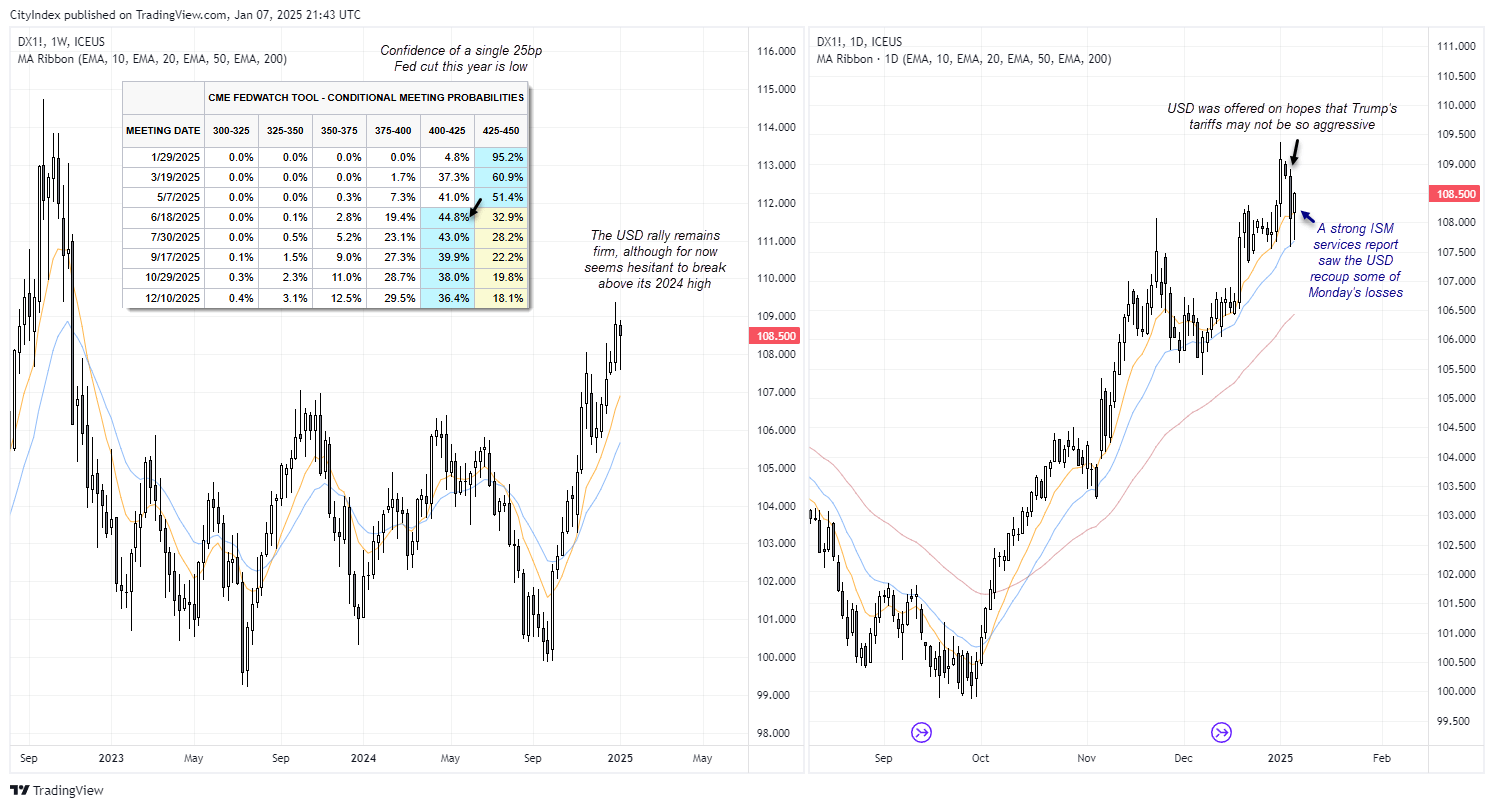

One survey respondent noted that “inflation levels seem to be increasing, thus dimming hopes of interest rate cuts”. And I would say that respondent is right on the money, given the robustness of the US economy. While there was some excitement on Monday that Trump’s tariffs may not be as aggressive as originally feared (and therefore his policies less inflationary), this does nothing to stifle the inflationary pressures already building in the latest ISM services figures.

Furthermore, ISM manufacturing beat expectations by 0.9 points and contracted at its slowest pace since March. Prices paid and new orders also expanded at 52.5. The S&P Global manufacturing figures also had manufacturing’s contraction slowing and beating expectations by 1.1 points.

And this has kept traders open to the prospects that the Fed may not be in a position to cut rates at all this year. Fed fund futures currently imply just a 44.8% chance of a 25bp cut in June, and this has helped the USD index recoup some of Monday’s losses.

The weekly chart remains firmly bullish although there is a hesitancy for it to simply break above its 2024 high. The daily chart has found support at its 20-day EMA and seems to be an area bulls favour for dips at present. But with liquidity still on the thin side, we may be on for smaller ranges.

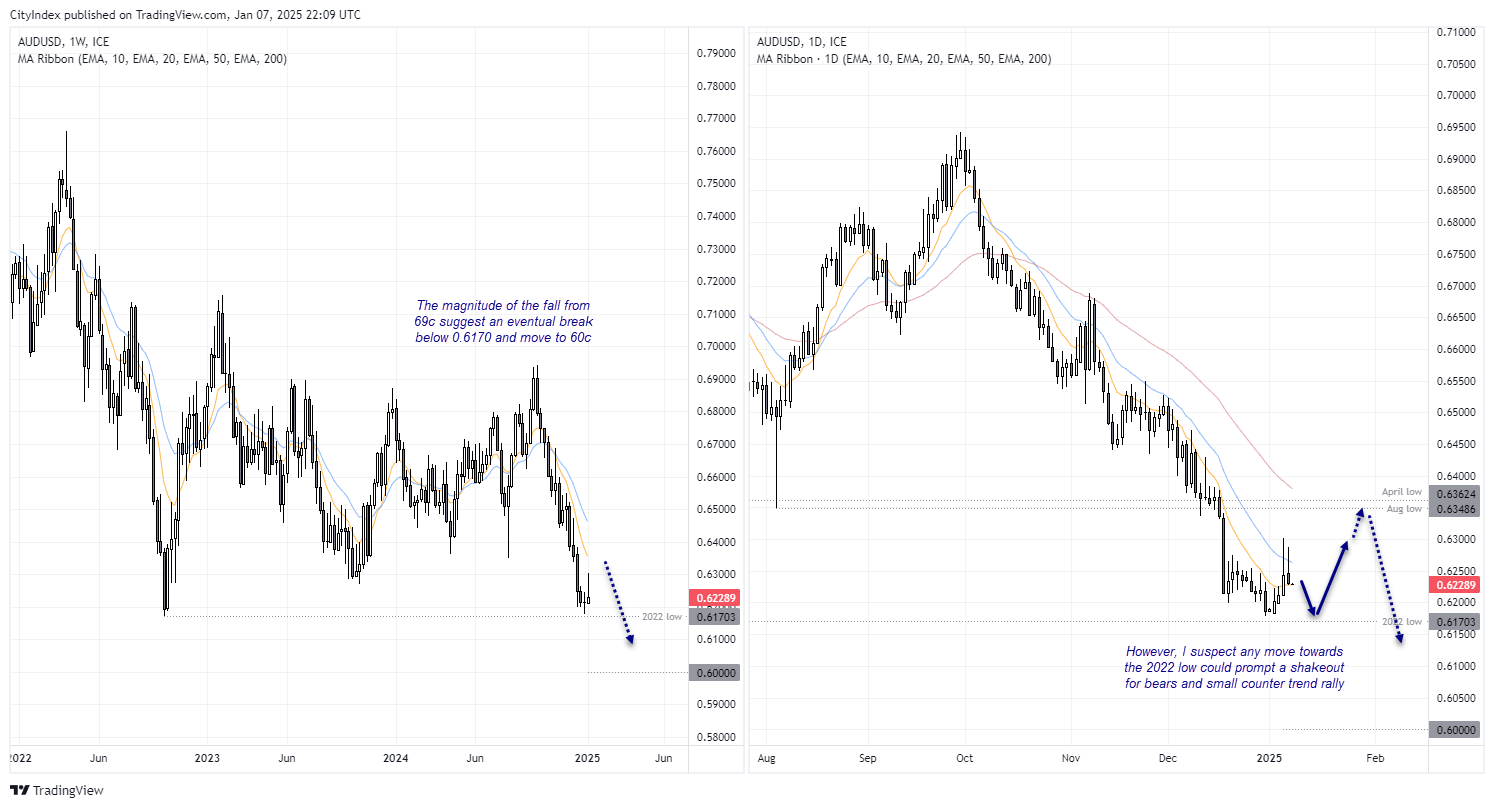

AUD/USD technical analysis

The Australian dollar is staring down a bearish gun with the potential for a break beneath its 2022 low on the cards. However, if I am correct in assuming that the USD will refrain from an immediate break of its 2024 high for now, we could find that AUD/USD bears may be lulled into a bear trap with any move below 0.6170 for AUD/USD over the near term.

Therefore, bulls could consider dips towards the 2022 low area in anticipation for a shakeout and bounce towards 63c, before its next leg lower. Unless of course Trump plays very nicely and prompts a bounce for risk from arguably oversold levels. But given the magnitude of the fall from 69c, an eventual break beneath the 2022 low and move to 60c appears to be on the cards.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge