Monday US cash market close:

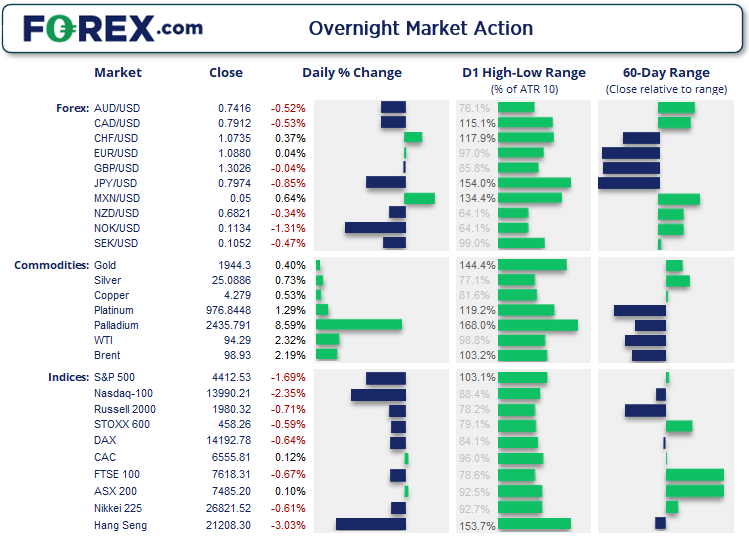

- The Dow Jones Industrial fell -413.04 points (-1.19%) to close at 34,308.08

- The S&P 500 index rose -75.75 points (2.51%) to close at 34,058.75

- The Nasdaq 100 index fell -337.051 points (-2.35%) to close at 13,990.21

Asian futures:

- Australia's ASX 200 futures are down 0 points (-0.15%), the cash market is currently estimated to open at 7,485.20

- Japan's Nikkei 225 futures are down -100 points (-0.37%), the cash market is currently estimated to open at 26,721.52

- Hong Kong's Hang Seng futures are up 298 points (1.41%), the cash market is currently estimated to open at 21,506.30

- China's A50 Index futures are down -4 points (-0.03%), the cash market is currently estimated to open at 13,565.10

Bond yields continued to rise overnight and dampen appetite for equities as traders increasingly expected a 50-bps hike at next month’s FOMC meeting. Fed fund futures are now pricing in an 82.1% chance of a 50-bps hike, which saw the Nasdaq lead the way lower with a -2.35% decline and the Philadelphia semiconductor index (SOX) fall -2.4%. All S&P 500 fell -1.7% and all of its sectors were in the red led by energy and technology stocks, the Dow fell -1.2%.

Dollar remains firm ahead of inflation data

The US dollar remains strong heading into today’s CPI data from the US. IN fact it is the strongest major month-to-date whilst the Japanese yen remains the weakest, helping USD/JPY rose to within a cast-whisker of the 2015 high overnight. USD/CAD rose to a 3-week high and tested its 200-day eMA from underneath, AUD/USD and NZD/USD hit a 14-day and 18—day low respectively.

The euro was also strong and extended its gains after Macron beat Le Pen in the first round of the French election. EUR/JPY rose almost 1% as it broke out of compression and approached the March high.

EUR/AUD is also on focus as its 4-day rally is now probing trend resistance. It remains in a clear downtrend in the daily chart yet now within a retracement phase, helped by strong sentiment towards the euro after round 1 of the presidential election. Yet the bearish trendline is capping the rally, the 61.8% Fibonacci retracement sits around 1.4710 and 20-day eMA at 1.4750. SO there is chance of a pullback from current levels or even a swing high to form, making the 1.4710/50 zone and important area to watch as it is clearly a pivotal level over the near-term.

Commodities performance was mixed

Gold initially touched a 4-week high and intraday break above 1950, yet its reversal and eventual close beneath that key resistance level shows of a hesitancy to properly breakout. Yet demand clearly resides around 1900 as each dip is gladly bought. Silver also saw a decent breakout of trend resistance and probed $25 to revitalise our bullish bias after a month of choppy retracement trading.

Up Next in Asia (Times in AEST)