- Bullish break in USD/JPY on Thursday was preceded by a similar move in USD/CNH

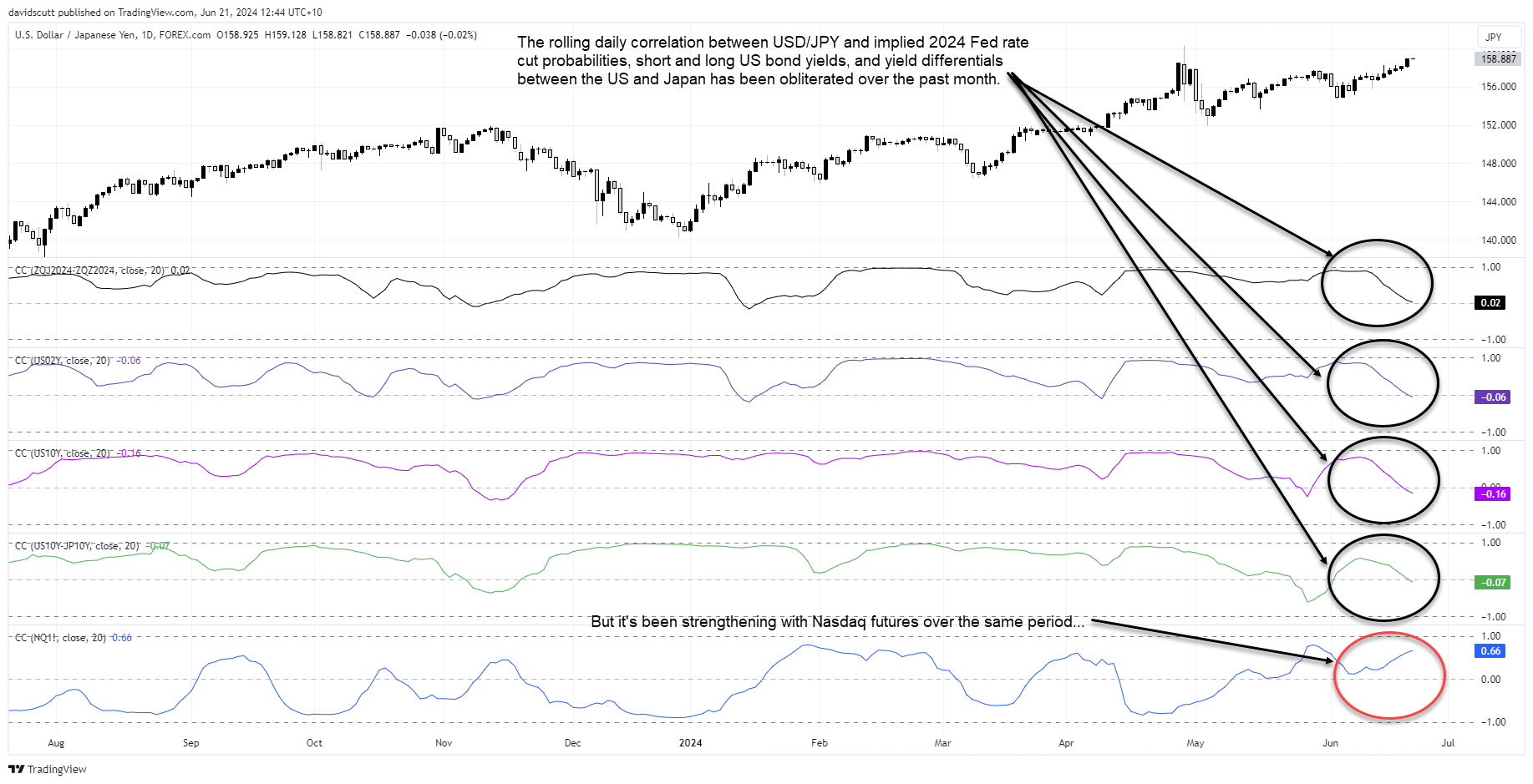

- USD/JPY correlation with traditional drivers has weakened, potentially adding to BOJ intervention risks

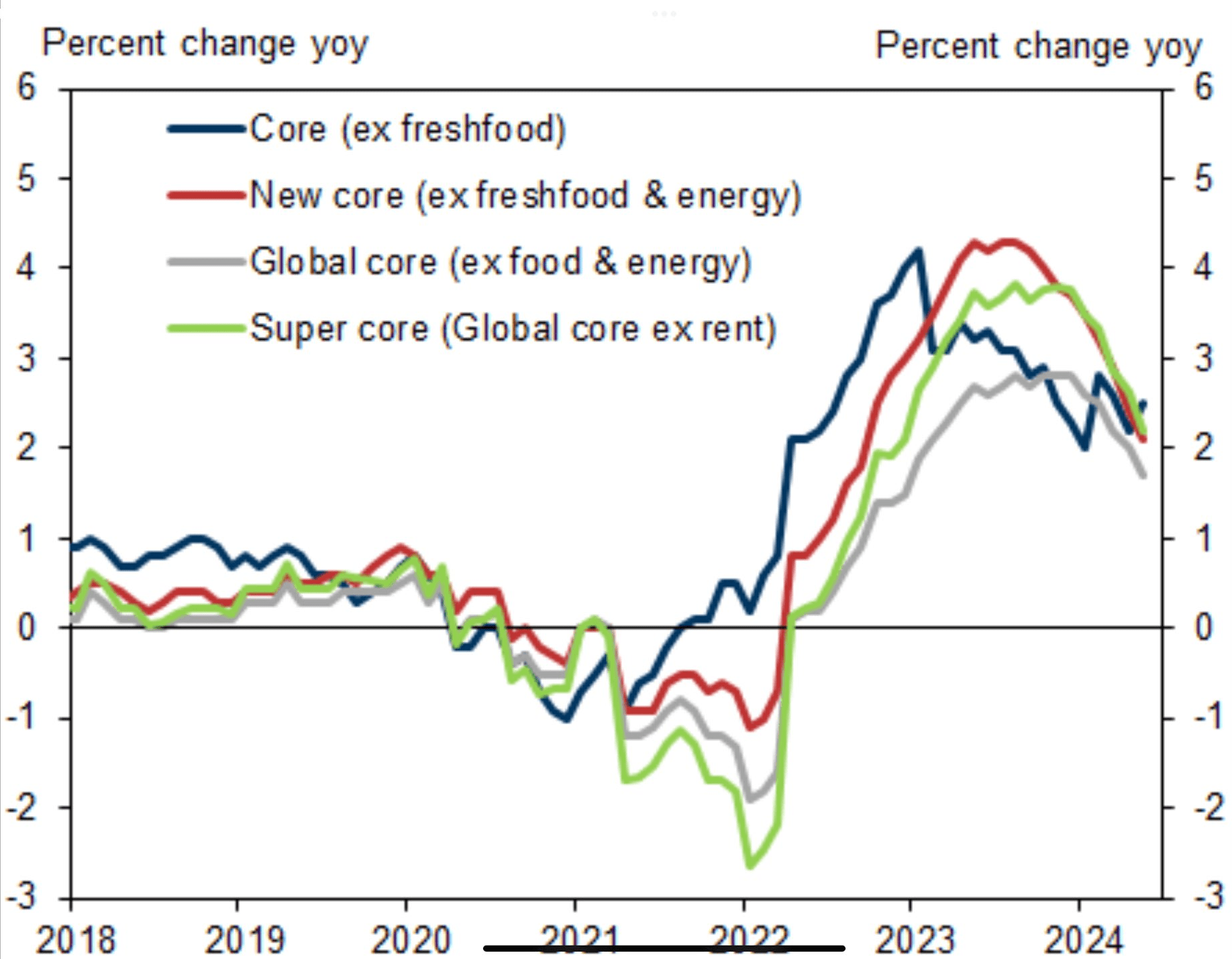

- Underlying inflation pressure in Japan continue to dissipate, limiting need for BOJ rate hikes

- Long-term USD/JPY moves likely to be heavily influenced by the path for US interest rates

Only intervention from the Bank of Japan (BOJ) or a dramatic increase in Fed rate cut bets look to be standing between USD/JPY and a test of the multi-decade highs struck in late April, unless the People’s Bank of China (PBOC) moves to curb weakness in the Chinese yuan against the US dollar.

Chinese yuan leading Japanese yen?

While much was made of the breakout in USD/JPY on Thursday which saw it close at 34-year highs, the move was actually preceded by a similar bullish break in USD/CNH 24 hours earlier. We discussed the factors behind the yuan weakness in another post, but it was driven by the PBOC allowing market forces play a greater role in determining the USD/CNH level.

There was no strong fix from the central bank, nor signs of other measures to curb dollar strength such as ordering state-backed banks to buy the yuan or initiating CNH bill sales in Hong Kong to mop up excess liquidity, deterring market participants to short the yuan by increasing funding costs.

With uncertainty over upcoming French elections weighing on the euro, the move from the PBOC added an additional tailwind behind US dollar strength, helping fuel the bullish breakout in USD/JPY. For anyone trading USD/JPY, it means you need to be keeping an eye on moves in USD/CNH as they may be quite influential over the near to medium-term.

Japanese inflationary pressures ease further

On the JPY side of the USD/JPY ledger, yen bulls are quickly becoming an extinct species with fundamentals and politics working against them.

Data released by the Japanese government on Friday revealed underlying price pressures continued to weaken in May with inflation excluding fresh food and energy growing at an annual pace of 2.1%, down from 2.4% in April and the softest outcome since September 2022. Private sector services inflation – which has a reasonable relationship with wage pressures in other western economies – also softened, lifting 2.2% over the year from 2.4% in April.

Source: Goldman Sachs

While both figures remain above the BOJ’s 2% inflation target, it’s the trend that raises question marks about the ability for the BOJ to continue tightening monetary policy while keeping inflationary pressures permeating across the economy.

Politics may hinder BOJ intervention threat

Adding to headaches for yen bulls, the United States Treasury added Japan to a monitoring list for its foreign-exchange practices, one step away from labelling it as a currency manipulator. The timing could not have been worse for Japanese officials, potentially deterring direct intervention in the yen despite attempting to strengthen it rather than weaken it.

s for whether the latest USD/JPY move is speculative in nature – a catalyst often cited by Japan’s Ministry of Finance to express displeasure at FX market fluctuations - officials may have a leg to stand on with traditional drivers such as interest rate differentials disintegrating over the past month, replaced by growing influence in speculative asset classes such as US tech stocks.

Regarding the intervention threat level, while there’s an argument USD/JPY moves have deviated away from fundamentals recently, prior BOJ moves have often been preceded by significant spikes in volatility. Put simply, speed looks to be a far more important factor than levels.

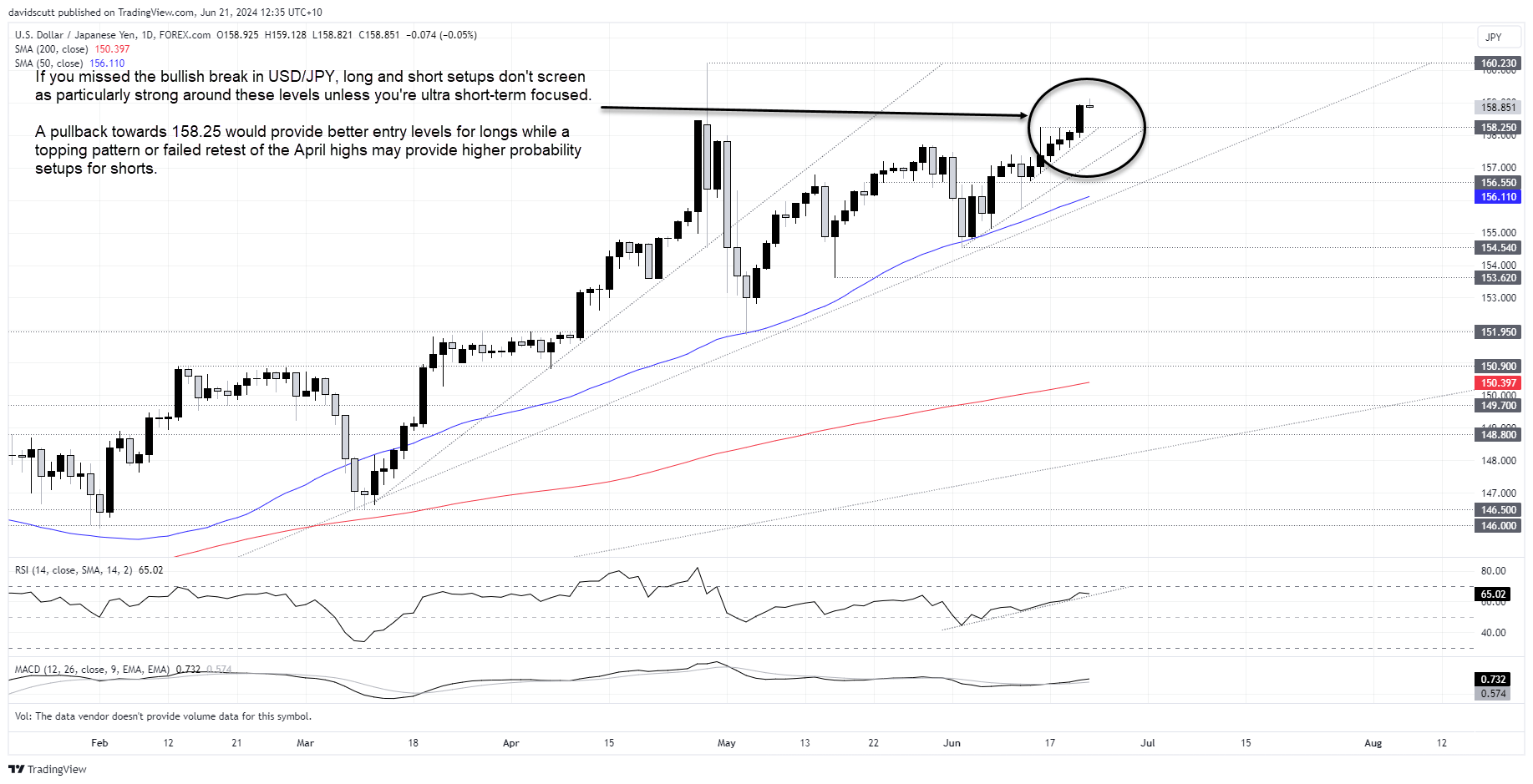

USD/JPY breaks higher – what next?

The technical picture is equally as dire for yen bulls with USD/JPY breaking above the highs set after the Bank of Japan meeting last week before going on with the move on Thursday.

While there are opportunities for short-term traders today, for those who like to operate on longer timeframes, buying the break has been missed. Nor does shorting screen as particularly smart given momentum, prevailing trend and distance to any form of major resistance. The setups look weak.

In the interim, on the short side of the equation, be on the lookout for a form of topping pattern, be it a bearish engulfing, evening star or bearish pin/hammer candle. For longs, you could look to buy dips towards 158.25 with a stop below targeting the April 29 high above 160.

-- Written by David Scutt

Follow David on Twitter @scutty