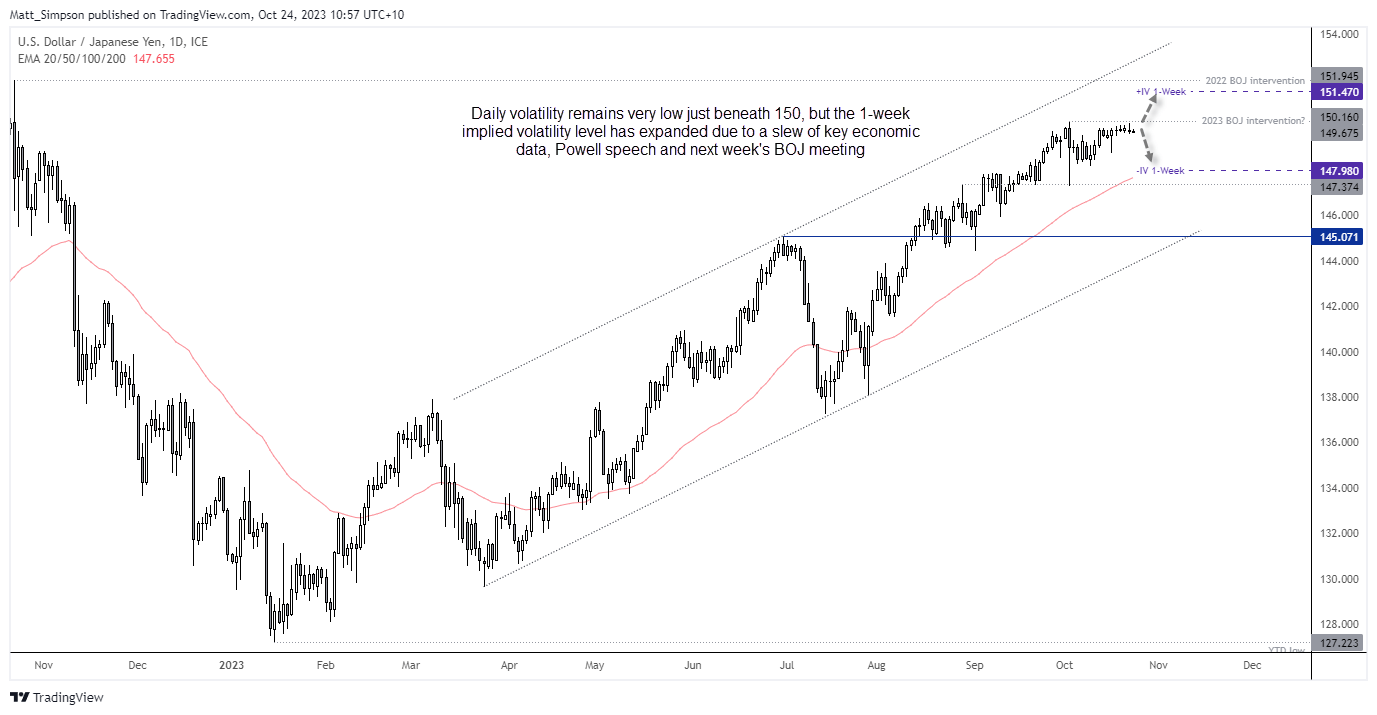

USD/JPY has been a particularly tricky pair to trade with its small daily ranges, just beneath a big resistance level. But with key data from the US and Japan scheduled over the coming days ahead of next week's BOJ meeting, it can't stay trapped for ever. Besides, forex trading can be like a fine wine, as a currency needs to be paired wisely to heighten its trading potential. And that also places EUR/JPY and GBP/JPY into focus for potential setups.

The importance of 150 on USD/JPY cannot be understated, given it triggered a BOJ intervention when USD/JPY broke above it in October 2022 (and a suspected intervention earlier this month). The -286 pip drop on October 3 has since seen volatile dwindle as prices grind away well within that daily range. Yields differentials continue to support the pair yet the threat of intervention is keeping a breakout in check. For now, at least.

Implied volatility for USD/JPY has blown out to +/- 175 pips over the next week. And that is not surprising, given the events stacked up. US flash PMIs are scheduled for today ahead of a Powel speech and GDP report on Wednesday and PCE inflation on Friday. Tokyo CPI could also set the tone for next week’s BOJ meeting, which has seen a rise in speculation that the BOJ could tweak or abandon their yield curve control policy.

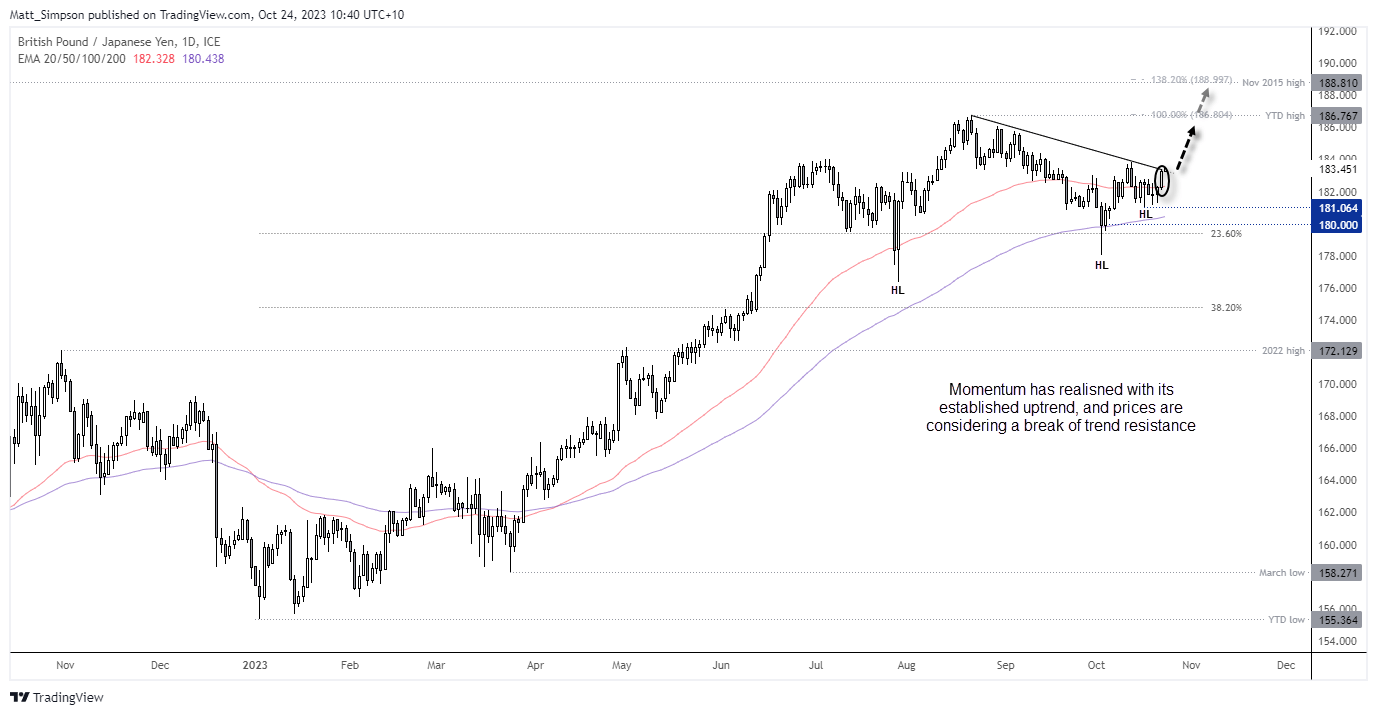

Whilst we await for volatility to return to USD/JPY, we take a look at a potential setup on GBP/JPY and EUR/JPY/

GBP/JPY technical analysis (daily chart)

GBP/JPY has formed a strong uptrend on the daily chart, although it recently underwent a multi-week retracement. The correction failed to hold beneath 180 and found support at the 100-day EMA, ad also formed a higher low.

Momentum has since reverted in line with the dominant trend, produced a small pullback, and prices are now considering a break of trend resistance.

- The bias remains bullish above 181, although if prices break higher then tighter risk management could be considered (such at 181.80)

- A break above 183.90 confirms a trend reversal, although a more aggressive entry could use a break of trend resistance

- The initial target is 186, just beneath the YTD high an 100% Fibonacci projection, a break above which brings 188.80 into focus, near the 2015 high and 138.2% Fibonacci ratio

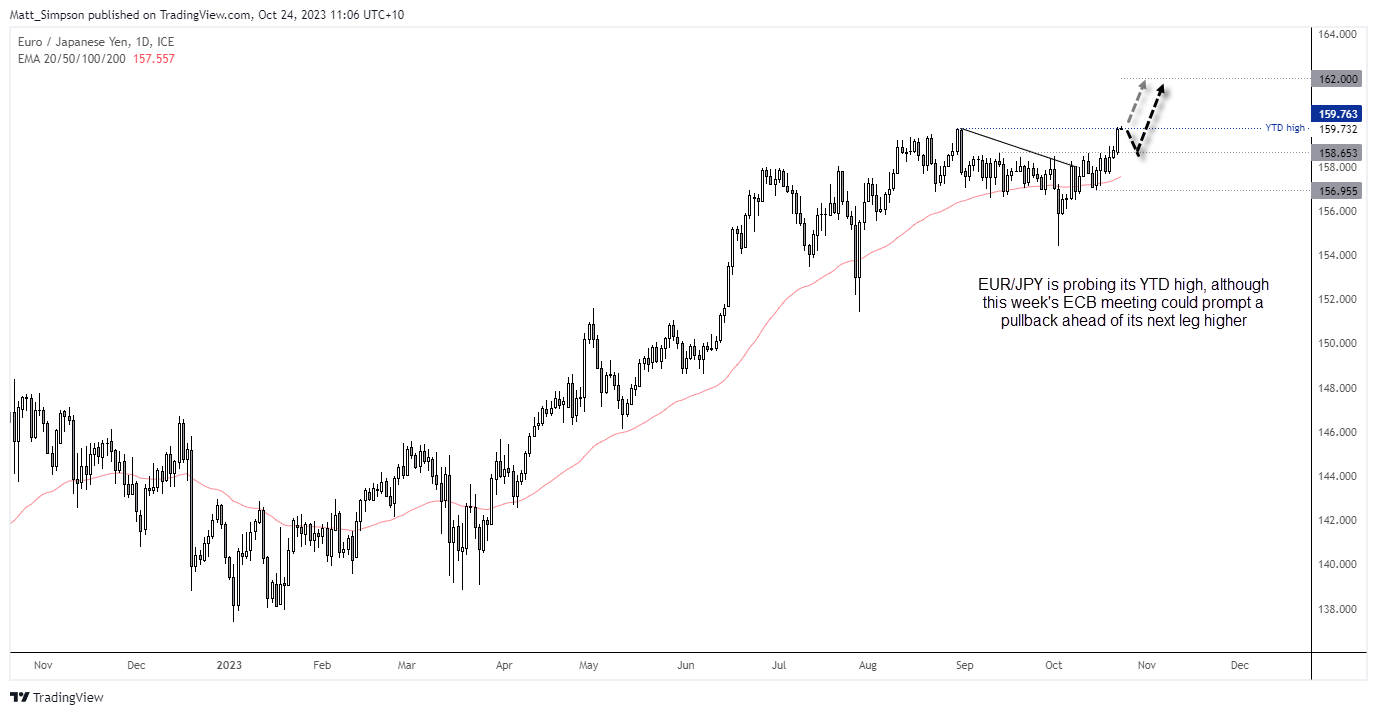

EUR/JPY technical analysis (daily chart)

EUR/JPY has also produced a strong uptrend on the daily chart, although prices are probing their YTD highs at the time of writing. This tells me that EUR/JPY is the stronger pair on this timeframe, although trader may want to warrant caution being long EUR/JPY ahead of this week’s ECB meeting.

Given the potential for a dovish tone form the ECB, I would prefer to wait for a pullback and seek bullish setups at support levels (in anticipation of an eventual breakout).

- The bias remains bullish above the 156.95 low

- I’d prefer to see a retracement towards 158.65 before considering bullish setups to increase the potential reward to risk ratio (and avoid being long at what could be a cycle high)

- If prices initially break higher, bulls could then seek dips towards the 159.75 breakout area

- 162 is a viable bullish target on the daily chart, assuming the reward to risk ratio is adequate

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge