- USD/JPY outlook remains supported by rising bond yields

- USD/JPY technical analysis: Gearing up for a breakout above 152.00?

- NFP among key data highlights coming later this week

Welcome to another edition of Technical Tuesday, a weekly report where we highlight some of the most interesting markets that will hopefully appease technical analysts and traders alike. In this week’s report, we will get technical on the USD/JPY.

The USD/JPY was coiling for a potential breakout, as investors awaited the release of key US data this week, and speeches by various Federal Reserve officials. Rising bond yields and crude oil prices are increasing the pressure for a bullish breakout on the USD/JPY which for now has been capped just below the 152.00 handle, where it has formed major highs in recent years. But will it now finally stage a breakout to increase the pressure on Japanese authorities to support the currency?

Before discussing the macro factors in greater details, let’s start by looking at the chart of the USD/JPY first…

USD/JPY technical analysis: Gearing up for a breakout?

Source: TradingView.com

The USD/JPY hasn’t one anywhere fast in the last week and a half. But the trend is clearly bullish after rates rose in each of the past three months. The USD/JPY briefly breached the highs that were made in the previous two years at around 151.91 to 151.95, making an incremental high at 181.97 in March. The quick rejection of that level raised some calls for a top, but we haven’t seen any further downside follow through to validate the bearish case. So, rates remain stuck inside a tight consolidation pattern in what appears to be a bullish ascending triangle pattern, just below the 152.00 handle.

Given how rates have consolidated here, a potential breakout above 152.00 looks to be on the cards even if the Japanese officials are trying to talk down the currency pair. That being said, a false breakout scenario or a triple top pattern cannot be ruled out at this point, although some further bearish price action is needed to signal a reversal in the trend.

If the USD/JPY were to break higher, as we anticipate, its next target could be 153.00. Following that, it might advance towards 154.00 and conceivably reach the psychologically-significant milestone of 155.00, coinciding with the 127.2% Fibonacci extension level traced from the November to December downturn.

On the downside support comes in at 150.80, which was resistance at various points in February, before being taken out in March. Below this level lies the 150.00 psychologically important level and then the 149 handle. If the USD/JPY were to break below 149.00, I think that would be a significant development from a bearish viewpoint.

USD/JPY outlook boosted by bond yields

The US dollar retreated somewhat after making a positive start to Q2 on Monday. But yields have broken further higher, with the 10-year reaching its best level since November. Economic data from the world’s largest economy have supported the upwards move in yields, which should keep the dollar supported on the dips. Today factor orders came in at +1.4% vs. +1.1% eyed, while JOLTS Job Openings in line at 8.76 million. The day before saw the ISM reports easily top expectations as purchasing managers in the manufacturing industry reported growth in activity, with prices sub index jumping notably, too, to 55.8 from 53.3. The prospects of aggressive rate cuts have fallen, especially with crude oil also remaining on the front-foot, with WTI surpassing the $85 level earlier, further fuelling inflation worries.

Last week saw, the USD/JPY hit its highest level since 1990, as investors dismissed the Bank of Japan’s first rate hike in decades, although heightened threat of Japanese intervention supported the yen and prevented USD/JPY from hitting 152.00 level for now. Dovish-leaving comments from the BoJ’s board member Naoki Tamura, who suggested that the central bank was in no rush to hike rates further, has been among the factors keeping the yen under pressure. If US data continues to show resilience then the USD/JPY

USD/JPY outlook: Key data coming later this week

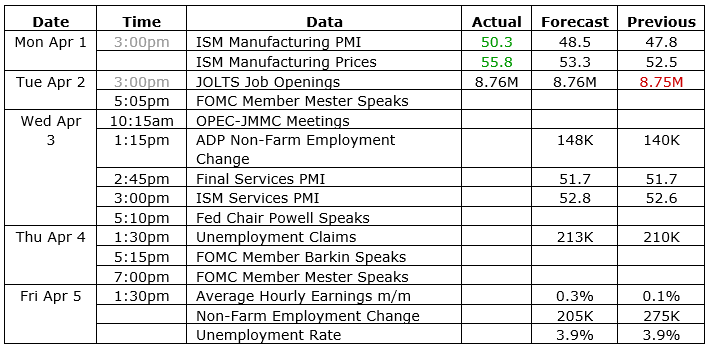

As we look towards the remainder of the week, firs thing to mentions is that there are over ten scheduled Federal Reserve speeches. Monday’s stronger manufacturing data might prompt caution among Fed officials regarding significant policy adjustments. Furthermore, various job reports are anticipated throughout the week, with particular attention on Friday's non-farm payrolls figures and unemployment rate. Consequently, trading activity could experience volatility in the upcoming week.

Here are the key US data highlights to watch this week:

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R