USD/JPY upside looks limited near-term, hindered by narrowing interest rate differentials and perceived increased risk of Bank of Japan intervention. The stronger yen may add to growing downside momentum in the Nikkei 225, putting two of the strongest market trends in 2024 under threat.

Don’t adjust your screens… USD/JPY declines

The Japanese yen received a rare reprieve on Wednesday, gaining against the US dollar on narrowing yield differentials and statement from US, Japanese and South Korean officials pledging to "consult closely" on foreign exchange movements, seemingly increasing the risk of potential Bank of Japan intervention to support the yen.

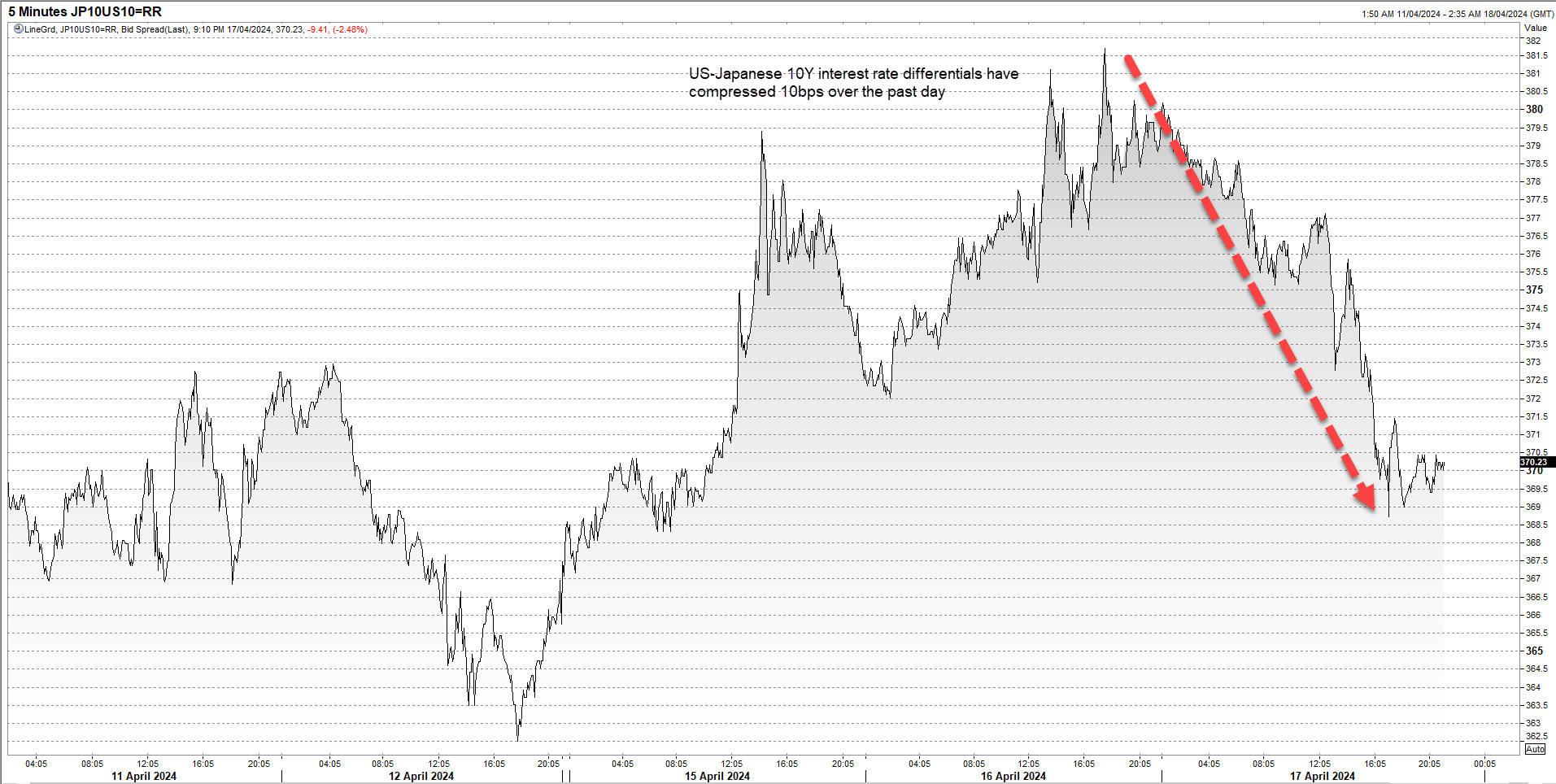

Source: Refinitiv

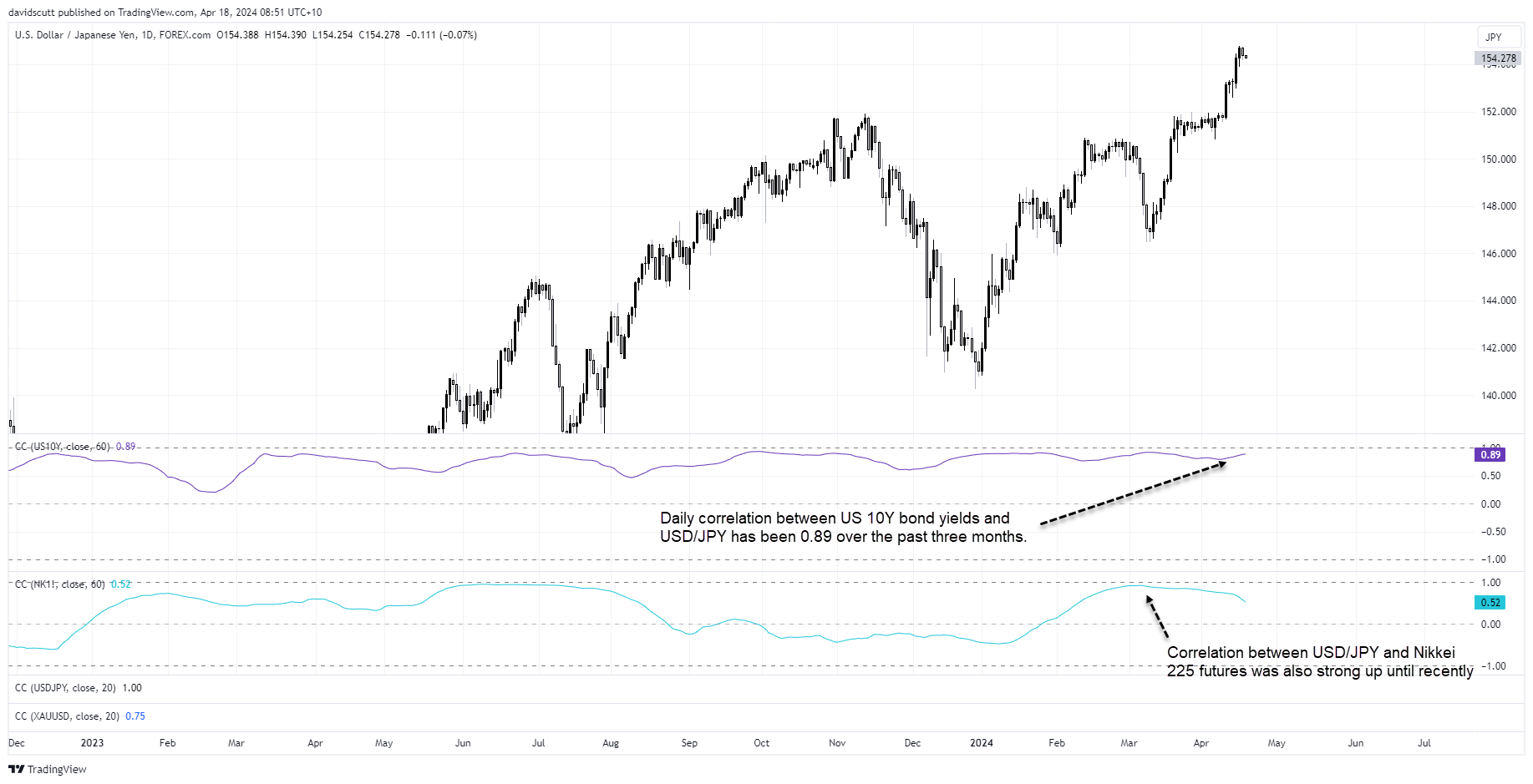

US-Japanese 10-year interest rate differentials have fallen more than 10 basis points from the highs struck earlier in the week. With a daily correlation of 0.89 with US 10-year yields over the past quarter, the compression in yield differentials partially explains the pullback in USD/JPY.

Adding to downside pressure on USD/JPY, finance ministers from the United States, Japan and South Korea released a joint statement which did nothing to lessen the perceived risk of coordinated action to counteract the stronger US dollar.

“We will also continue to consult closely on foreign exchange market developments in line with our existing G20 commitments, while acknowledging serious concerns of Japan and the Republic of Korea about the recent sharp depreciation of the Japanese yen and the Korean won,” the joint statement read.

In response, USD/JPY declined around 50 pips, moving it further away from the 155 level many traders are targeting.

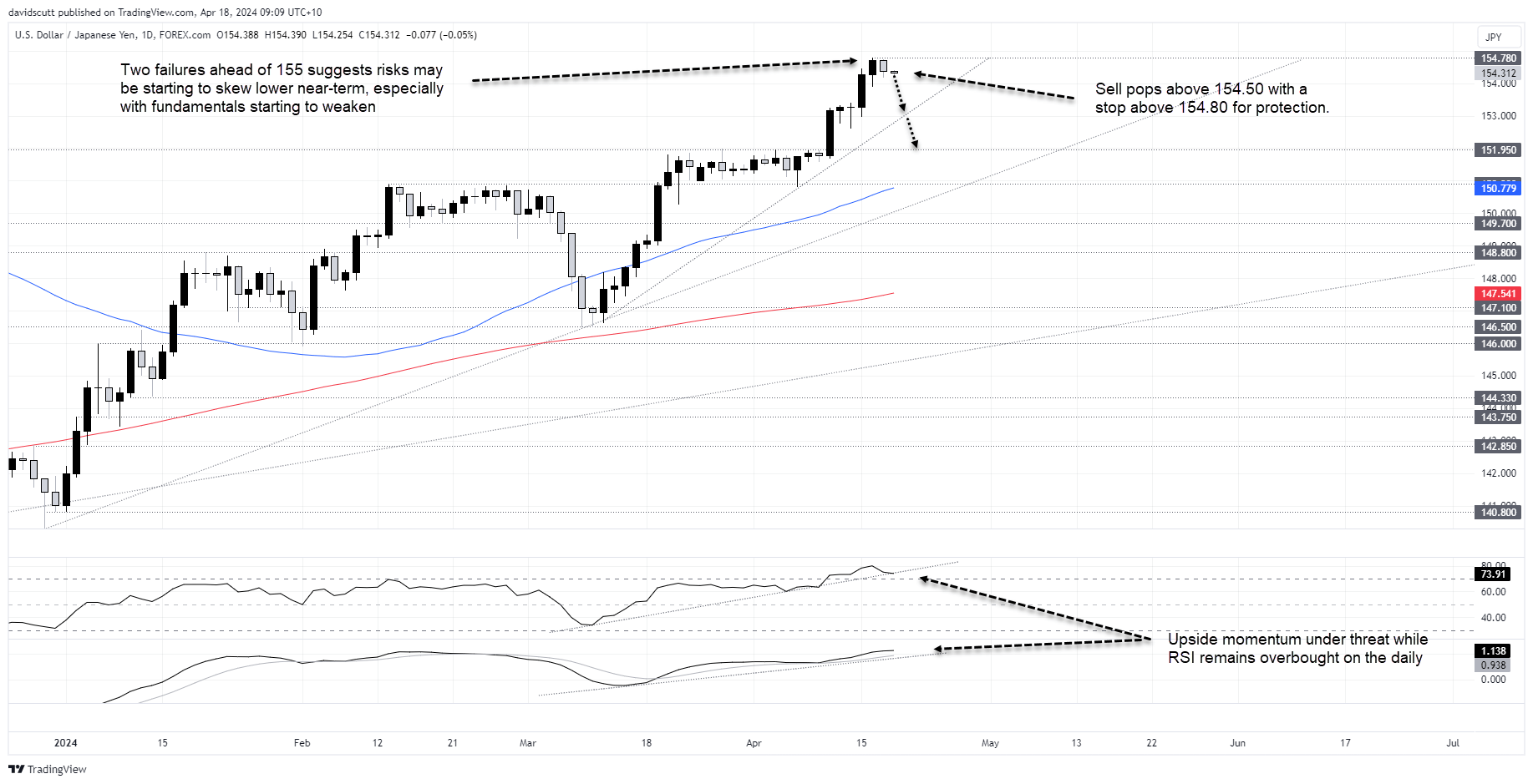

USD/JPY upside looks capped near-term

With risk sentiment souring, yield differentials narrowing and threat of BOJ intervention still apparent, upside in USD/JPY may be hard won near-term in the absence of a change in those market dynamics.

Having failed twice now on pushes towards 155, traders may want to consider selling pops in USD/JPY targeting a push below 154. Should the minor uptrend from early March give way, it opens the door to retracement to 151.95, a major level considering how long USD/JPY was capped below it prior to the recent break. Stops could be placed above 154.80 for protection. Should the trade work in your favour, you could lower the stop to entry level, providing a free hit at downside.

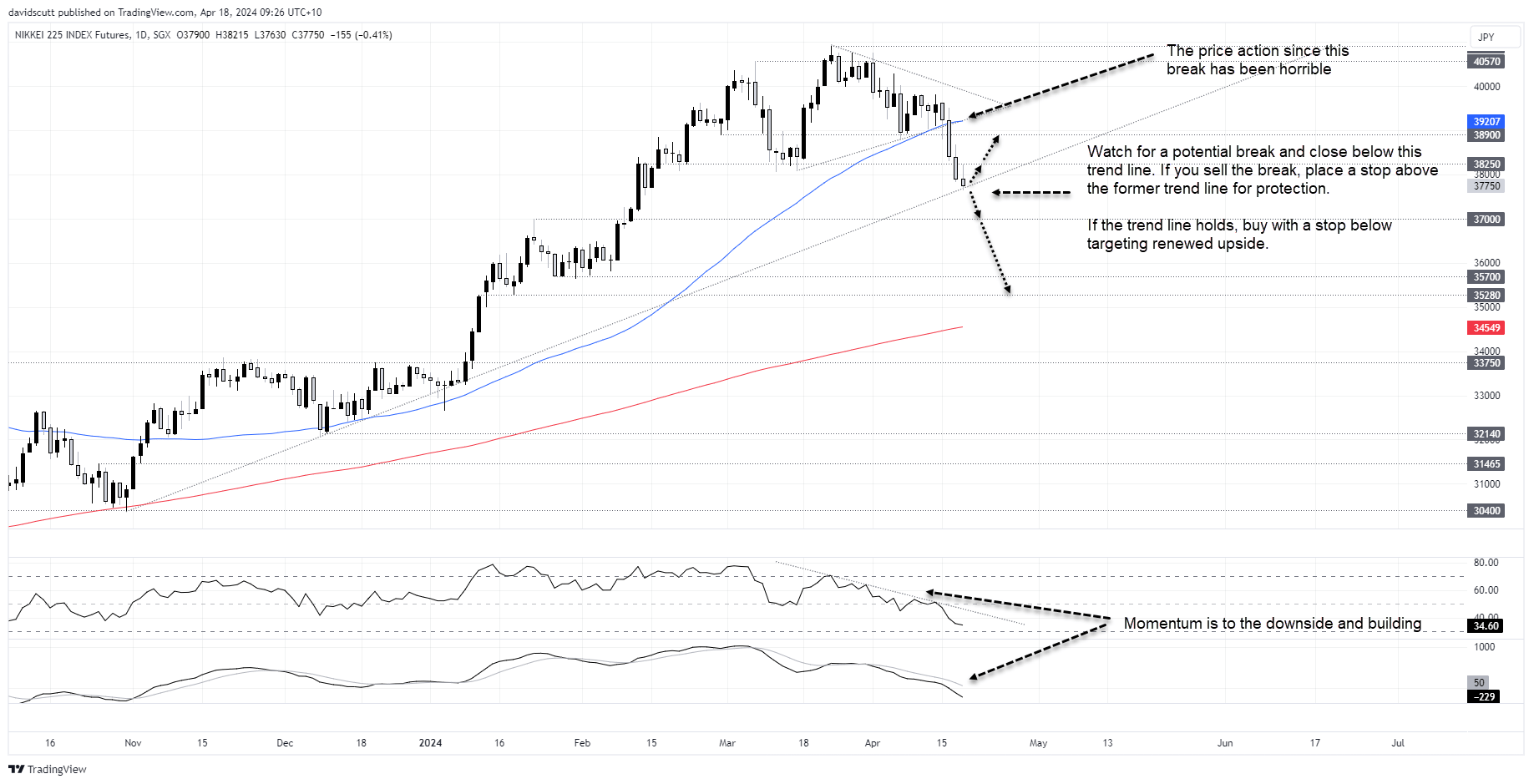

Nikkei 225 October 2023 uptrend under threat

For an index that’s been strongly correlated to movements in USD/JPY for much of 2024, the stronger yen could add to already growing pressure on the Nikkei 225, especially with weakness in the US tech sector spilling over to Japanese equities.

After hitting record highs in March, and despite the softer yen helping to juice Japanese exporter earnings estimates, the Nikkei has been entirely unconvincing ever since, breaking a series of minor supports before doing away with the 50-day moving average earlier this week.

It now finds itself teetering on uptrend support dating back to October, at risk of joining so many other leading stock indices that have broken down in recent weeks. Momentum continues to grow to the downside, fitting with the bearish price action seen this week.

Given the importance of this level, it makes for an ideal place to base trade setups around.

The bias is to the downside, so for those considering shorts, wait for a break and close below the trendline before establishing positions. There were plenty of false breaks intraday on the way up, so we could easily see something similar on this occasion.

If we get the break and close, 37000 is the first downside target with 35700 and 35280 the next after that. A stop could be placed above the former trendline for protection. If the trade were to work in your favour, it could be lowered to entry level.

Alternatively, should the Nikkei be unable to break lower, traders could buy ahead of the trendline, with a stop below for protection, targeting a bounce to 38250 or 38900.

-- Written by David Scutt

Follow David on Twitter @scutty