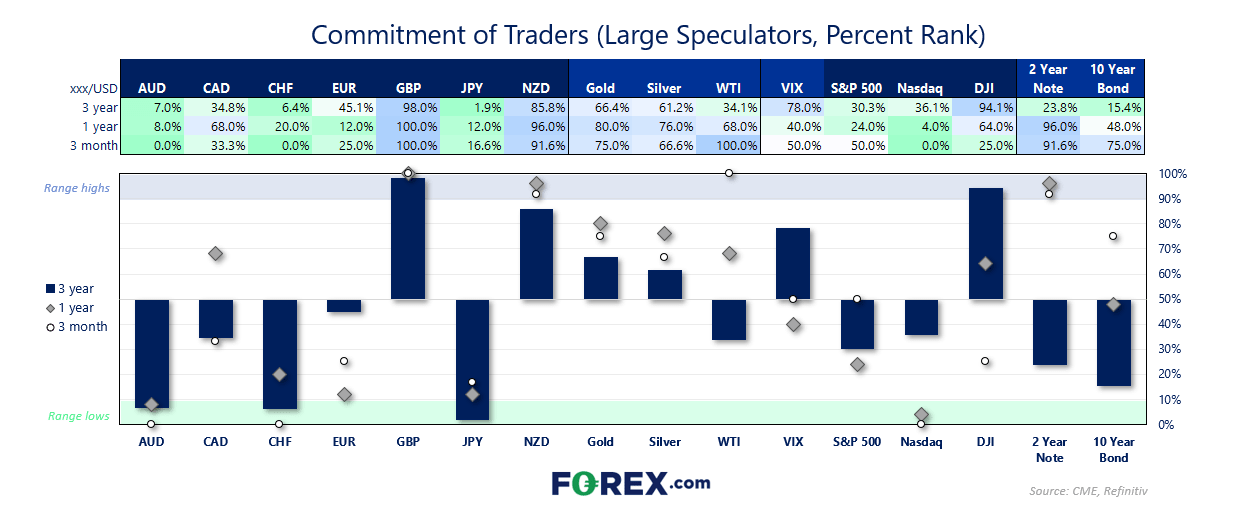

Market positioning from the COT report - as of Tuesday March 5, 2024:

- Gross-short exposure to CAD futures rose by 46.8% (+19.8k contracts)

- Large speculators also increased their gross-short exposure to CHF futures by 23.9% (+6.6k contracts)

- Net-long exposure to GBP/USD futures rose to a 28-week high (gross longs up 11.2%, to 10.3k contracts)

- Short bets against JPY futures fell for the first week in nine, which saw net-short exposure pull back from its 10-week high

- Large speculators increased their net-long exposure to the 2 and 10-year bond futures for the fist week in five

- Large speculators increased their net-long exposure to gold futures at their fastest pace in three and a half years

- Net-long exposure to silver futures rose at its most aggressive pace in 27 weeks

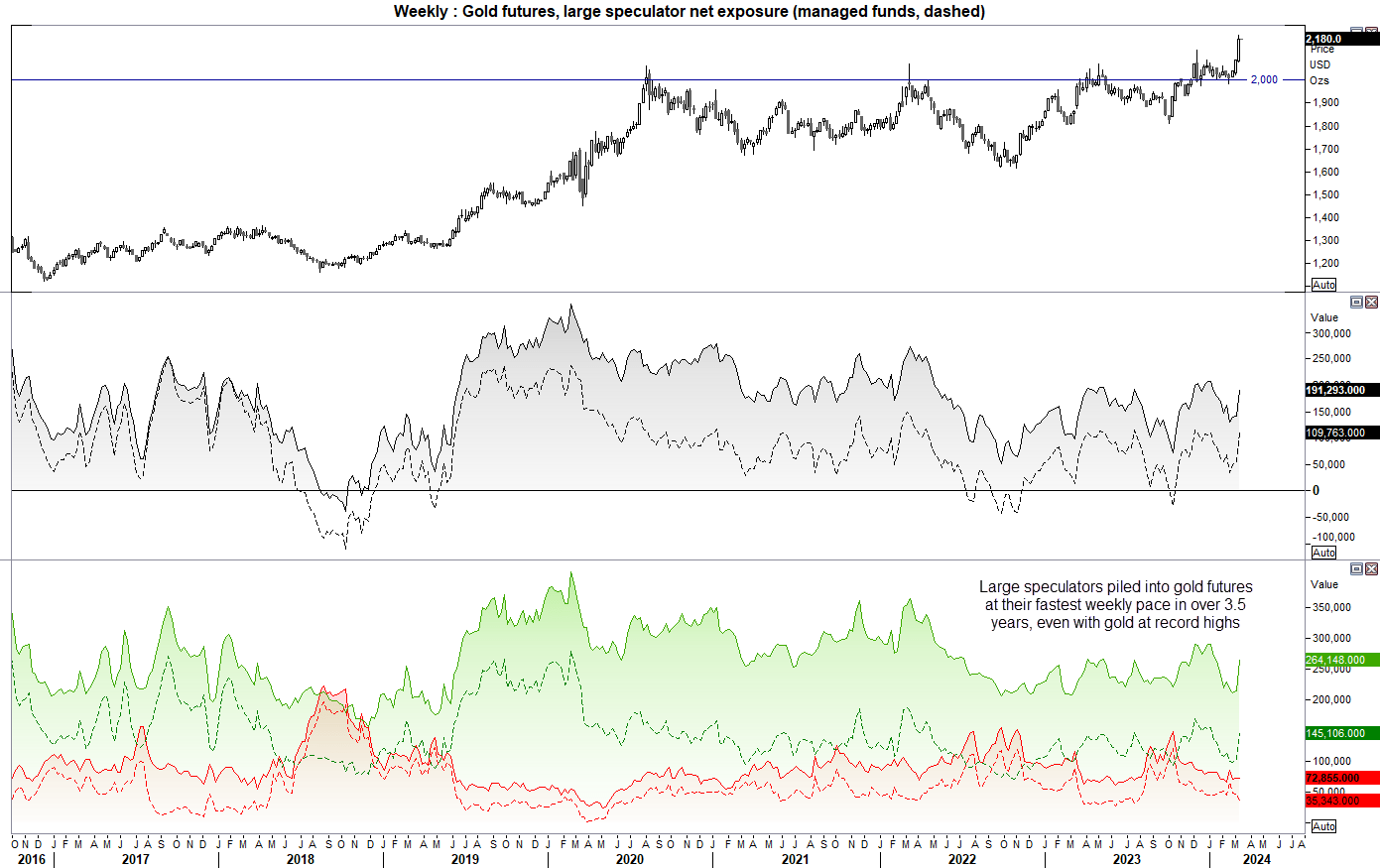

Gold futures (GC) positioning – COT report:

I mentioned in last week’s COT report that “We can only image large bets increased considerably”, and traders did not disappoint. Large speculators increased their net-long exposure to gold futures at their fastest weekly pace in over three and a half years, despite gold being at record highs. And perhaps more intriguingly, net-long exposure is nowhere near a historical extreme which suggests there is still upside potential for gold.

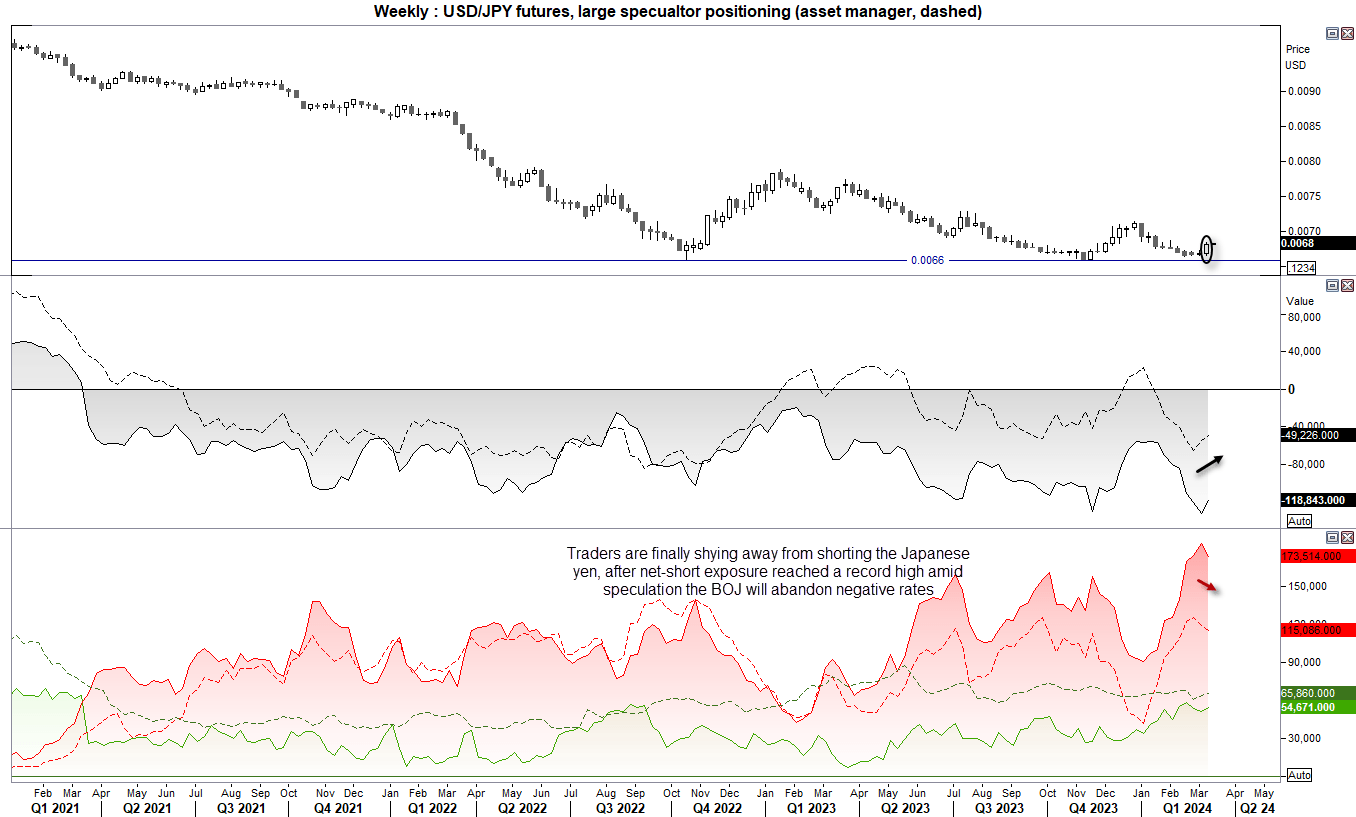

JPY/USD (Japanese yen futures) positioning – COT report:

The reversal of the Japanese yen seems to finally be upon us. I’ve raised the potential several times in recent weeks, with gross short and net-short exposure among large speculators finally reaching a record high. They have also been quietly increasing their gross-long exposure since Q4, and I now suspect asset managers and large speculators will continue to do so in the coming weeks given the clues form the BOJ that they will indeed abandon negative rates. And should US data continue to soften, it builds the case for a lower USD/JPY sooner.

As for USD/JPY itself, bearish momentum is waning after four notably bearish days. And with prices holding above the February low, I suspect some mean reversion higher is due. But if USD/JPY failed to hit 151 despite the Fed’s pushback on cuts, I very much doubt it will have the juice to head for 152. So perhaps we have seen a meaningful top on USD/JPY.

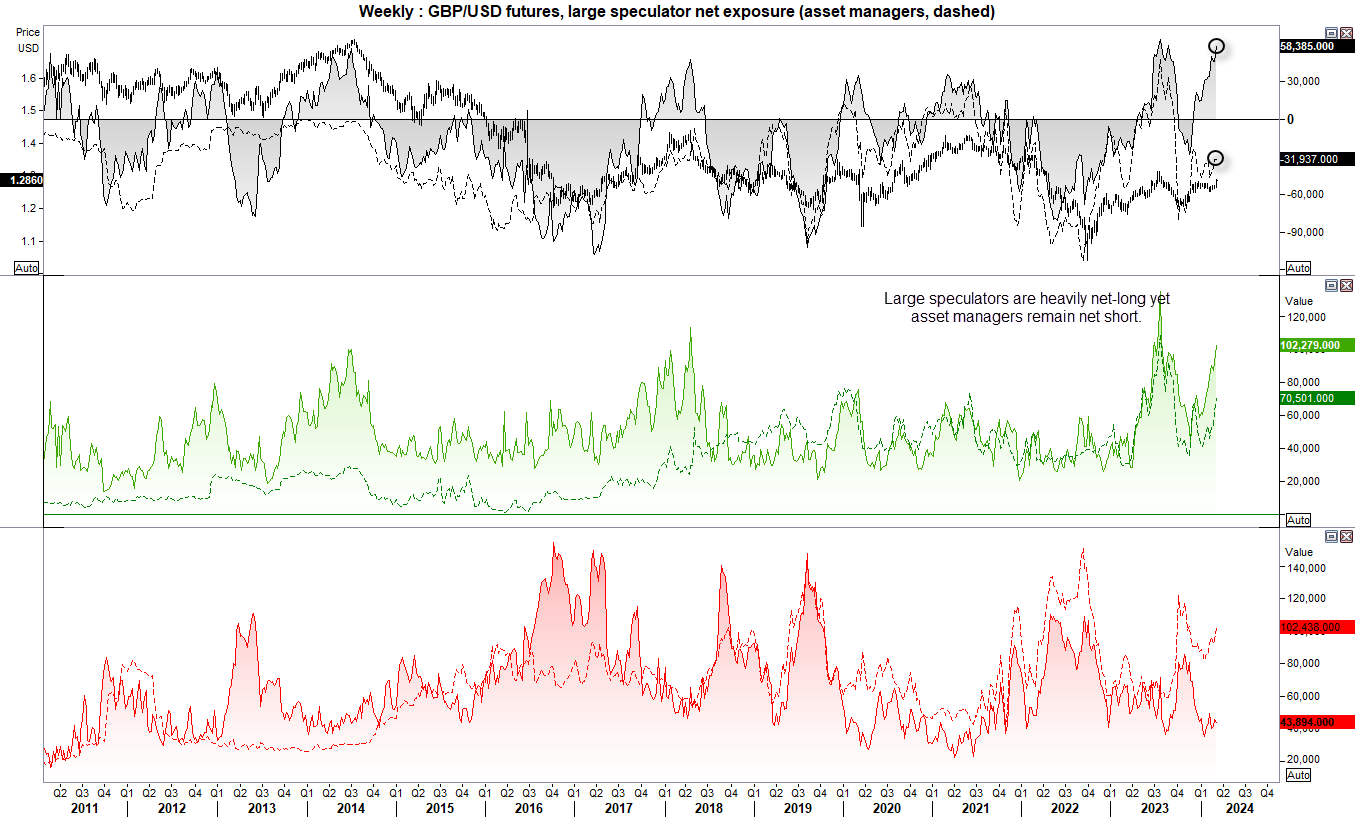

GBP/USD (British pound futures) positioning – COT report:

Large speculators seem to be in a disagreement to asset managers, as they remain by far the more bullish set of traders to GBP/USD futures. Their net-long exposure to GBP/USD futures is fast approaching its July 2023 peak, which itself was the most bullish they were since August 2007. Meanwhile. Asset managers remain net-short, and are actually increasing their gross-short exposure alongside net-long exposure, whilst large speculators are simply increasing their bullish bets. Ultimately, I now strongly suspect that ne-long exposure to GBP/USD futures is approaching a sentiment extreme

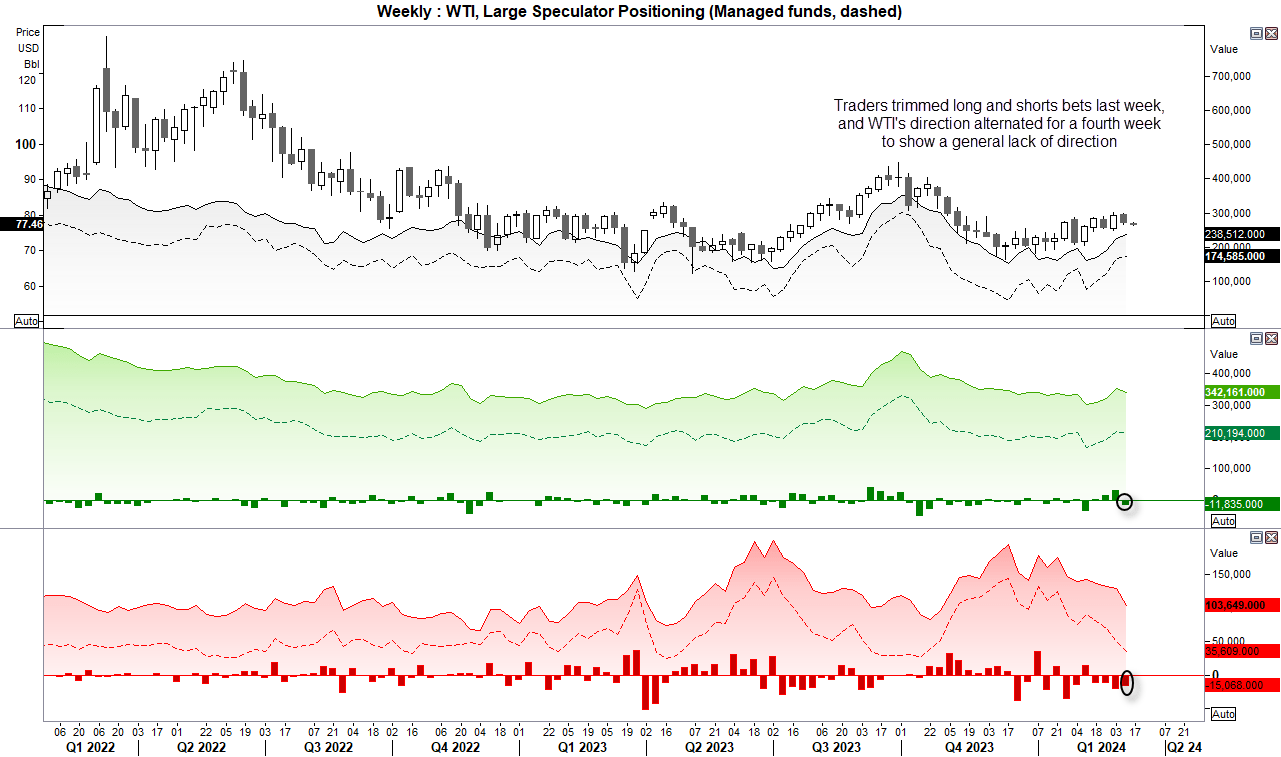

WTI crude oil (CL) positioning – COT report:

It seems I spoke too soon when I said that a “bullish case for TWI crude oil continues to build”, as we failed to see a follow through of increased net-long exposure. Instead, both large speculators and managed funds trimmed long and short bets, which suggests a general lack of confidence in its direction on the weekly timeframe. And given WTI crude oil has switched its direction each of the past four weeks, traders may be best to stick to the intraday timeframes and not expect home runs.

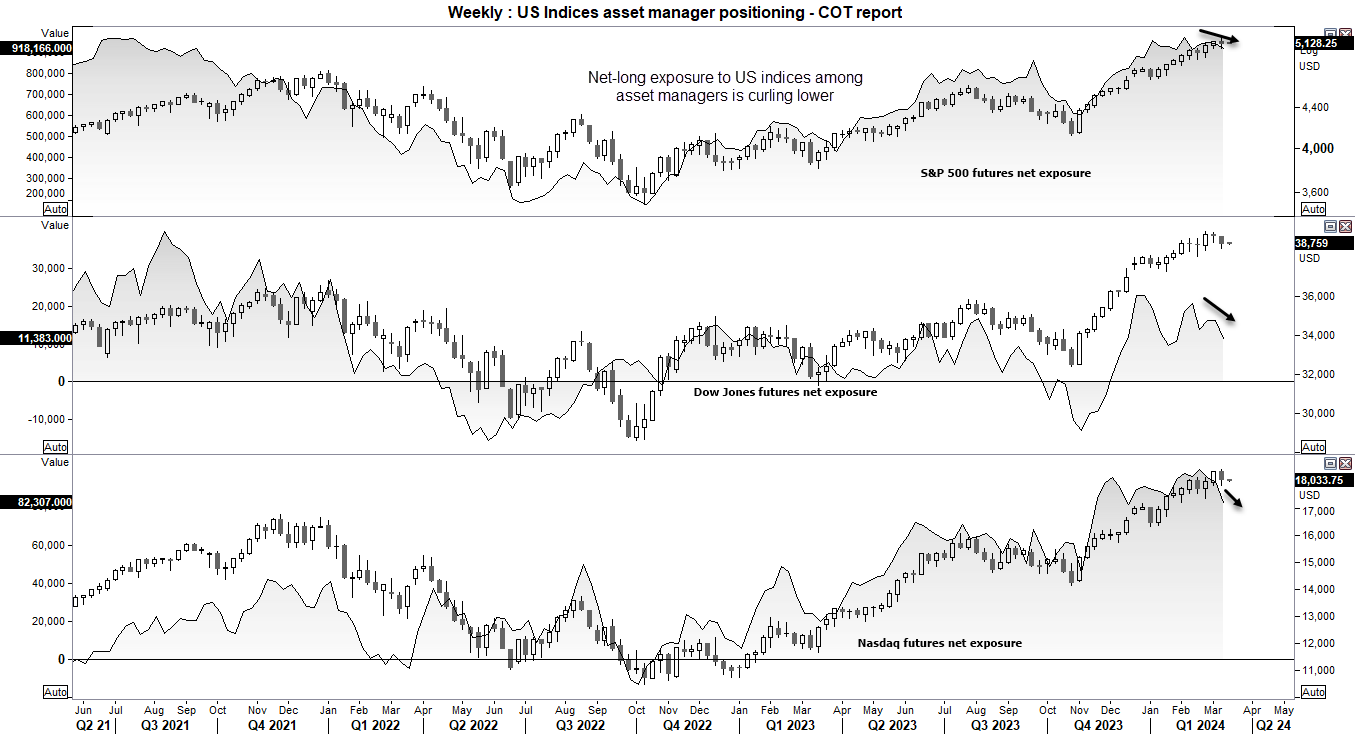

S&P 500, Nasdaq 100, Dow Jones futures positioning – COT report:

Clearly, bears have been burned all the way up on US indices. But it should be noted that asset managers are trimming their gross-long exposure to the S&P 500, Nasdaq 100 and Dow Jones futures around their record highs. This may not necessarily spell impending doom for these key US indices, but with net-long exposure for the S&P 500 near a historical high, perhaps bulls may want to be cautious around these highs and not get carried away with extrapolated estimates from analysts.