- A weak US dollar was further pressured last week after key inflation data came out lower than expected, giving rise to concerns that the Federal Reserve may become more hesitant in its current monetary tightening cycle after having hiked interest rates in March.

- On Thursday of last week, the US Producer Price Index (PPI) for March came out at -0.1% – the first negative reading since July 2016 – which fell below expectations that producer prices would remain unchanged. Additionally, the core PPI (excluding food and energy) also failed to meet expectations at 0.0% against forecasts for a 0.2% rise.

- The PPI data was followed on Friday by even more disappointing Consumer Price Index (CPI) data for March, which showed a -0.3% drop versus expectations for no change in prices. This was the first negative monthly reading for headline consumer inflation in over a year. The core CPI (excluding food and energy) came out at -0.1%, the first negative reading in seven years, against forecasts for a 0.2% rise.

- Along with the consumer and producer inflation data last week, US retail sales also disappointed expectations, leading to further pressure on the US dollar.

- Meanwhile, geopolitical concerns have continued to take center stage as the Trump Administration nears the end of its first 100 days in office and struggles to deal with increasing global tensions. Most recently, late last week saw the US military drop the largest non-nuclear bomb that it has ever used in combat on targets in Afghanistan. And over the weekend, North Korea again conducted a failed missile test, prompting increasing worries that the renegade regime is becoming ever more aggressive in its aims to further extend its nuclear firepower.

- These and other geopolitical risks and concerns have recently contributed to boosting safe haven assets like gold and the Japanese yen.

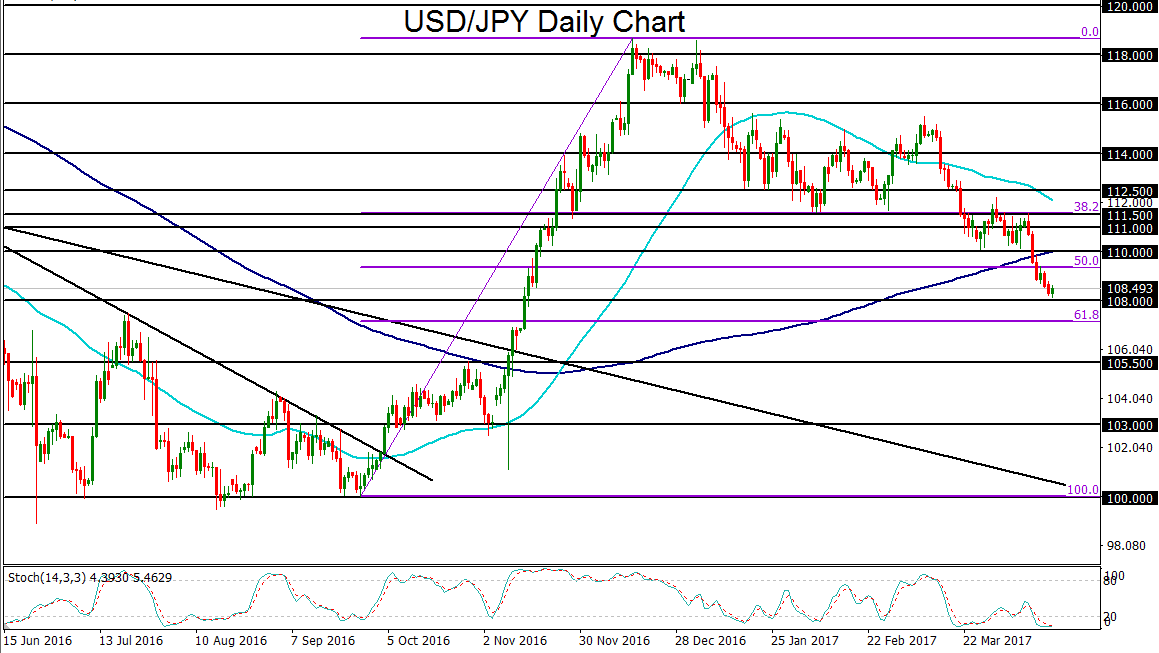

- In the case of USD/JPY, the combination of a falling dollar and surging yen has pushed the currency pair down to approach major support around the key 108.00 level, extending the general downtrend that has been in place since the beginning of the year. This drop prompted USD/JPY to trade below its 200-day moving average last week for the first time since November of last year. With any further breakdown below 108.00 support, the next major downside target is around the key 105.50 support area.

Latest market news

Yesterday 11:57 PM

Yesterday 08:25 PM

Yesterday 07:48 PM

Yesterday 06:25 PM

Yesterday 05:30 PM