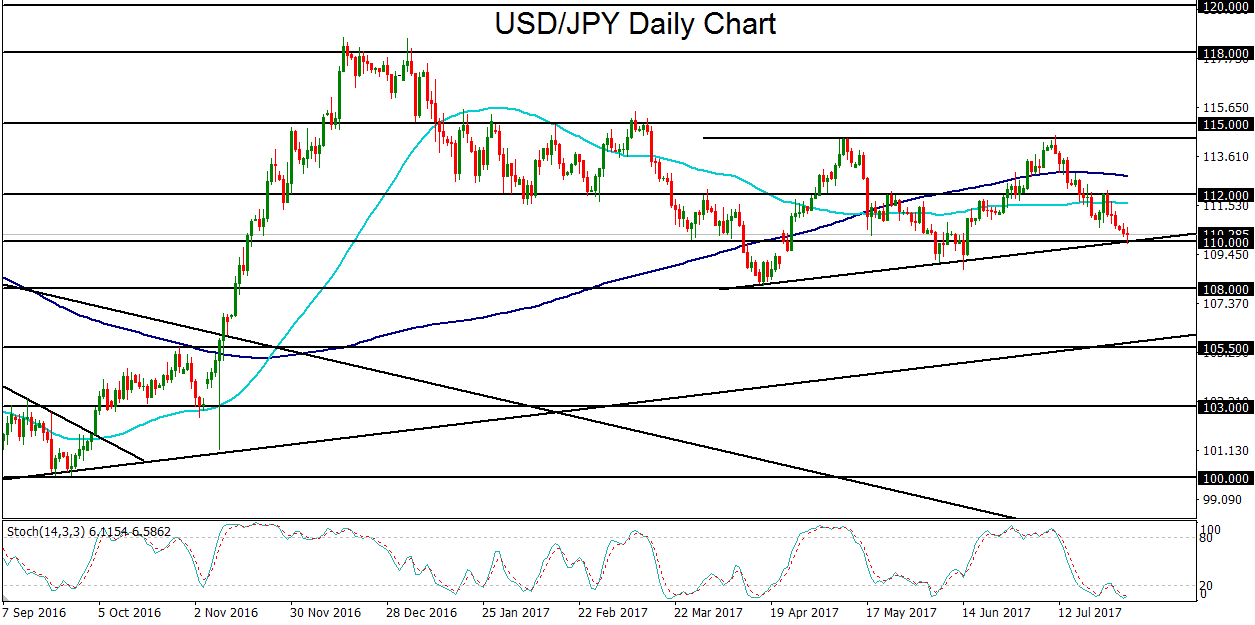

For the past three weeks, USD/JPY has followed a steep path to the downside as the US dollar has continued to be pressured by sustained dovishness from the Federal Reserve along with underwhelming US inflation and economic data. During the course of this three-week drop, the currency pair fell from major resistance around the 114.50 level and went on to breakdown below its 200-day and 50-day moving averages, as well as the critical 112.00 “line-in-the-sand.” The most recent culmination of this plunge occurred on Tuesday, when USD/JPY dropped further to dip slightly below the key 110.00 psychological support level before making a modest bounce.

The current week features critical economic data from the US that will impact USD/JPY price movement. The primary data event will be Friday’s jobs report for July, featuring the headline non-farm payrolls release. Currently, consensus expectations are around 180,000 jobs added in July, after the previous month’s better-than-expected 222,000. Even before the jobs report, other key US releases will include Wednesday’s ADP private employment report (187,000 forecast) and Thursday’s ISM non-manufacturing PMI (56.9 forecast). On Tuesday, the ISM manufacturing PMI for July was released, and the headline data was essentially in-line with expectations at 56.3, but represented slower growth than in June.

Ahead of this important series of major US economic data, USD/JPY has dropped down to a key support area that includes both the noted 110.00 psychological support level as well as the lower border of a large triangle consolidation pattern that has been in place for around the past four months. Whether USD/JPY continues to trade within the pattern and above 110.00, or breaks down below the lower border support, should depend largely on the outcome of this week’s key US data. With any downside surprise(s) that result in a USD/JPY breakdown, the next major bearish target is at the critical 108.00 support level. To the upside, with any pronounced bounce off 110.00 as a result of better-than-expected data, the noted 112.00 level (which bisects the current consolidation pattern) serves as a key short-term bullish target.