This time tomorrow we will have the conclusion of the highly anticipated BOJ and FOMC meetings, with a clearer idea of whether the RBA will be forced into action after today’s quarterly inflation report.

We have a jam-packed calendar today, with two of the big-three central bank meetings taking place. We also have Australia’s quarterly inflation report which could ignite bets of an RBA hike should it not behave.

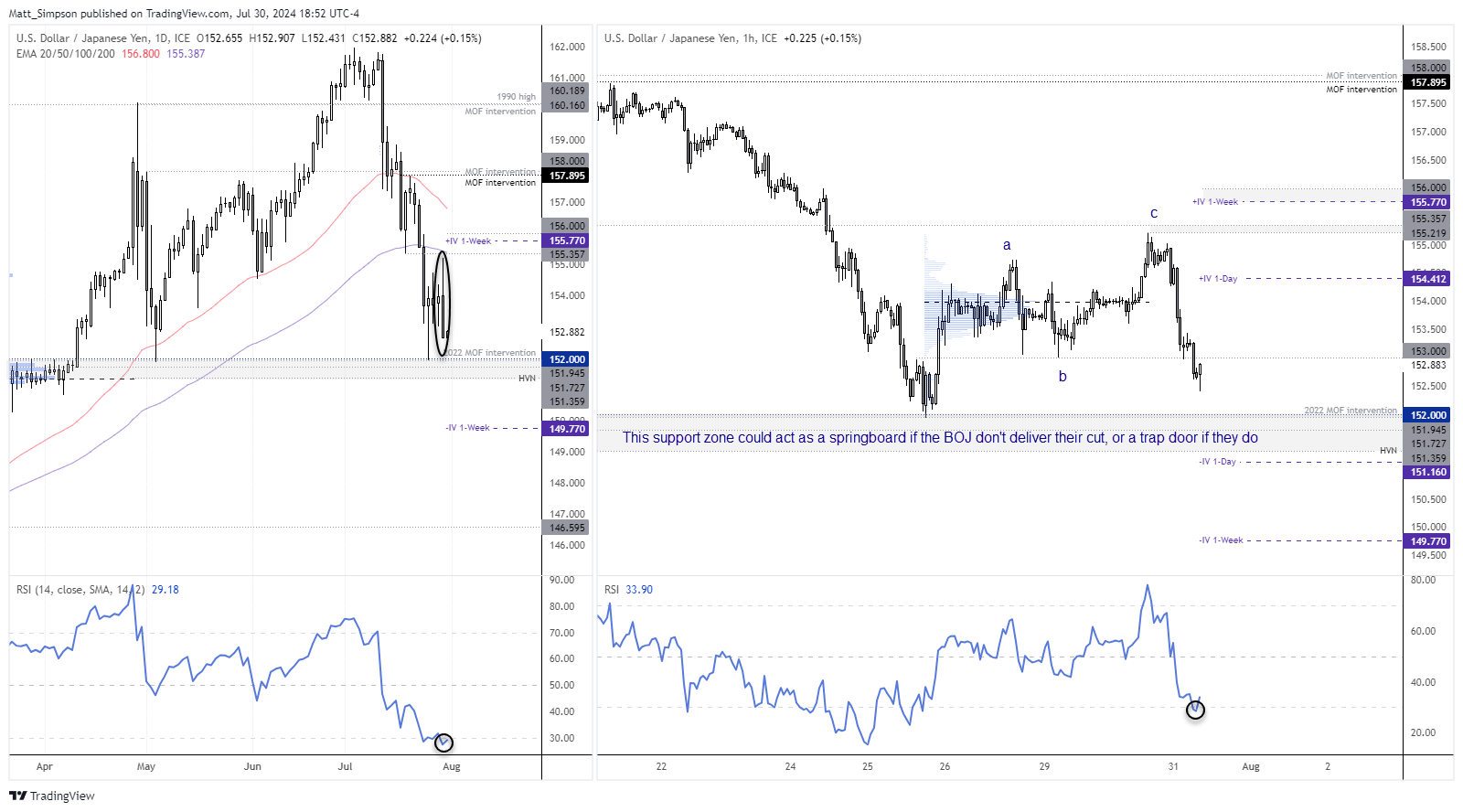

There has been plenty of excitement that the Bank of Japan (BOJ) could hike rates by a measly 10bp to a whopping 20bp. Although given they have already warned of plans to unveil a ‘detail plan’ to reduce ETF purchases and then yen has already sold off in anticipation of said hike, the move could already be priced in and the yen is in risk of weakening (to send USD/JPYW higher) should then BOJ not deliver said hike. Note that times may vary with any BOJ announcement. In fact they rarely, if ever, arrive on time.

We also get to find out of the Federal Reserve will signal the September hike markets have had priced in for several weeks already at the FOMC meeting. Again, the risk is one of disappointment if the Fed do not deliver. Only this time it could result in a higher US dollar and yields as it suggests the Fed are not as dovish as hoped.

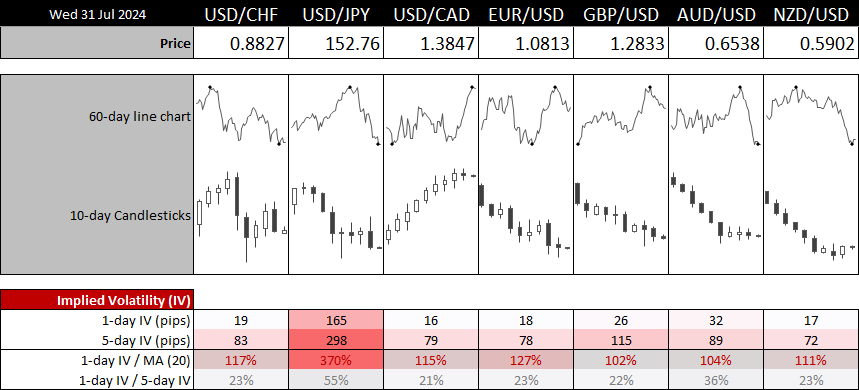

Needless to say, the 1-day implied volatility band for USD/JPY has blown out to nearly four times is 20-day average in anticipation of the BOJ and FOMC meetings.

But first, Australia’s Q2 GDP report is released at 11:30. The RBA’s preferred trimmed mean measure is expected to remain at 1% q/q and 4% y/y, which is more than enough for the RBA to retain their hawkish bias and likely rekindle bets of a hike if they tick higher. Weighted mean is expected to soften to the still-elevated level of 4.3% q/q from 4.4%, and soften to 3.8% from 4%. Broad CPI is forecast to remain at1% q/q and rise to 3.8% y/y from 3.6% previously.

Wall Street indices tend to be buoyant ahead of an expected dovish Fed meeting. But not on Tuesday. Weak tech earnings and economic data have been too much for the pattern to hold this time around. Job openings were lower and consumers were less upbeat on the labour market, while Microsoft’s Azure cloud business earnings disappointed. The VIX rose for the first day in three, the Nasdaq closed to a 7-week low and the S&P 500 formed a bearish outside day.

China concerns continued to weigh on WTI crude oil, which fell for a third day to a 7-weekn low. Gold closed above 2440 for the first day in four on safe-haven flows ahead of headline events. The Japanese yen was higher against all majors except the Swiss franc on bets of a BOJ hike, with CHF also taking in safe-haven flows.

Events in focus (AEDT):

- 08:45 – NZ building consents

- 09:00 – SK industrial production, service sector output, retail sales

- 09:50 – JP industrial production, retail sales

- 11:00 – NZ business confidence

- 11:00 – AU inflation (Melbourne Institute)

- 11:30 – AU Q2 CPI (Australian Bureau of Statistics)

- 11:30 – CN PMIs (NBS)

- 12:30 – BOJ monetary policy statement

- 13:00 – BOJ interest rate decision

- 14:00 – BOJ outlook report

- 15:00 – JP construction orders, household confidence, housing starts

- 15:00 – SG business expectations

- 19:00 – EU CPI

- 22:15 – US employment change (ADP)

- 04:00 – Fed interest rate decision, FOMC statement

- 04:30 – FOMC press conference

USD/JPY technical analysis:

Prices played nicely with yesterday’s analysis, rising to my lower 155 target in line with an ABC correction higher on the 1-hour chart. Yet gains were short lived. A bearish outside (and engulfing) day formed around the 155 handle and 100-day EMA and closed the day beneath the 153 handle. The 152 handle near a prior MOF intervention level is the next obvious support level, which could act as a springboard should the BOJ disappoint, or a trap door should they deliver.

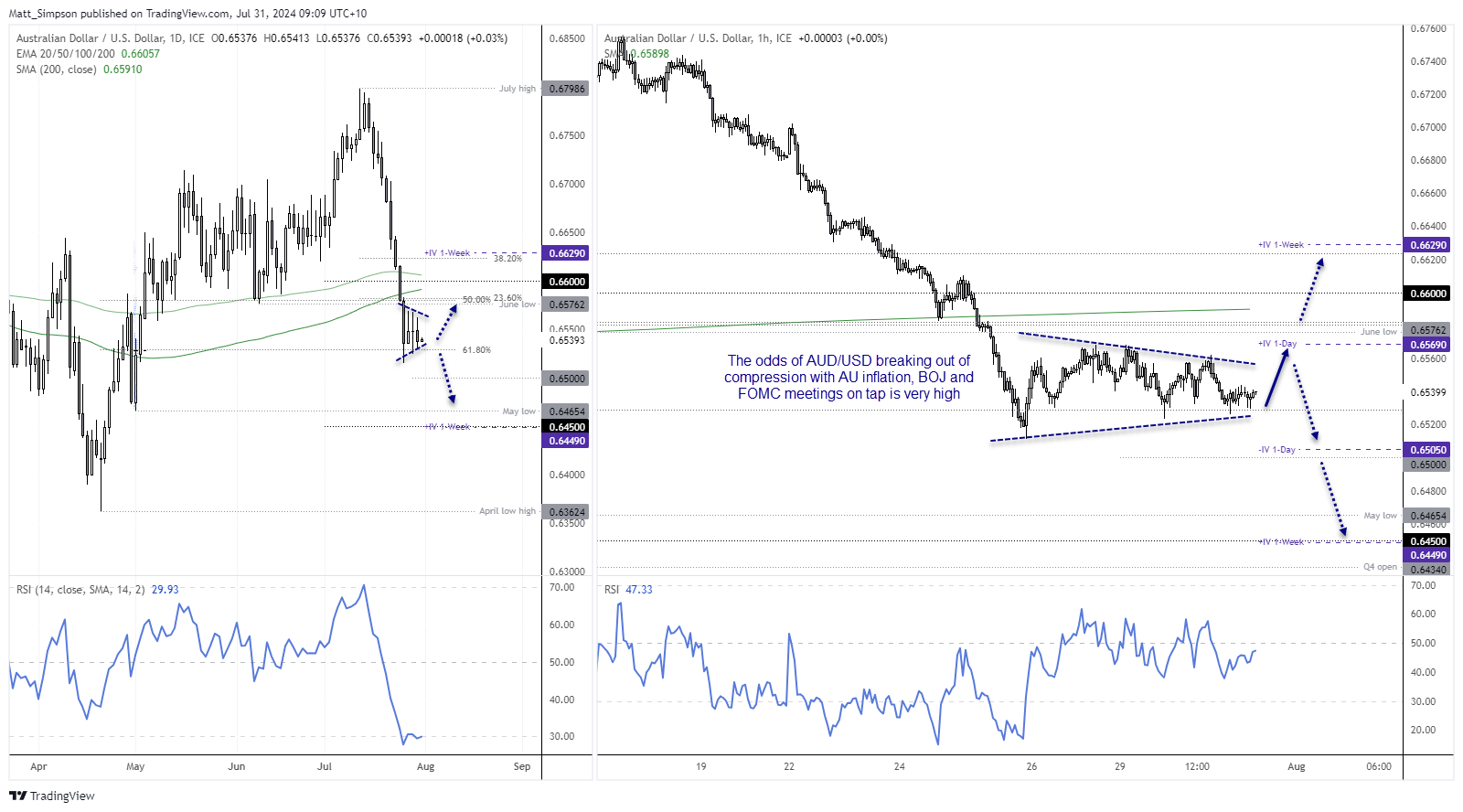

AUD/USD technical analysis:

There is a striking resemblance between the daily USD/JPY and AUD/USD charts: Both have fallen sharply from their month-to-date highs and momentum points lower ahead of these key events. And both have the potential to extend of reverse their losses.

AUD/USD CPI is an important event for Australia and RBA watchers, but secondary in regards to the BOJ and FOMC meetings. But the Aussie will get caught up in all three, which means this could be a difficult market to trade unless all three events points towards Aussie strength or weakness.

AUD/USD sits on a 61.8% Fibonacci level, where a break of current cycle lows opens up a run for 0.6550. Should prices rise, take note of the plethora of resistance levels around the June low (0.6576) and 200-day MA (0.6951) which could act as resistance and tempt bearish swing traders back to the table.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge