Australia’s economic data was skewed to the downside on Monday, with manufacturing PMI, job adverts and company profits all missing the mark. The headline PMI at 48.5 marks the 18th month of contraction, although it was the slowest contraction in three months. New orders fell and vendor performance deteriorated at the fastest pace in two years. Job adverts fell -2.1% in August to mark the seventh consecutive contraction. And at -5.3% q/q, company profits shrunk at their fastest pace in four quarters ahead of a key GDP report on Wednesday. Such figures will make it difficult for the RBA to hike rates, even though they’ll probably retain their hawkish bias going forward.

A weak manufacturing PMI weighed on China’s stock markets on Monday. Official data from the National Bureau of statistics shows manufacturing PMP slipped to 49.1 from 49.4, to mark its fastest contraction since February. The Hang Seng slipped -1.7% and formed a bearish engulfing day, bring its 4-week rally into question.

ECB members remain divided over the eurozone’s growth outlook. While another cut in September is practically a given, there’s disagreement over whether the economy could be headed for a recession or if inflationary pressures are to persist, which makes forecasting future cuts after September tricky.

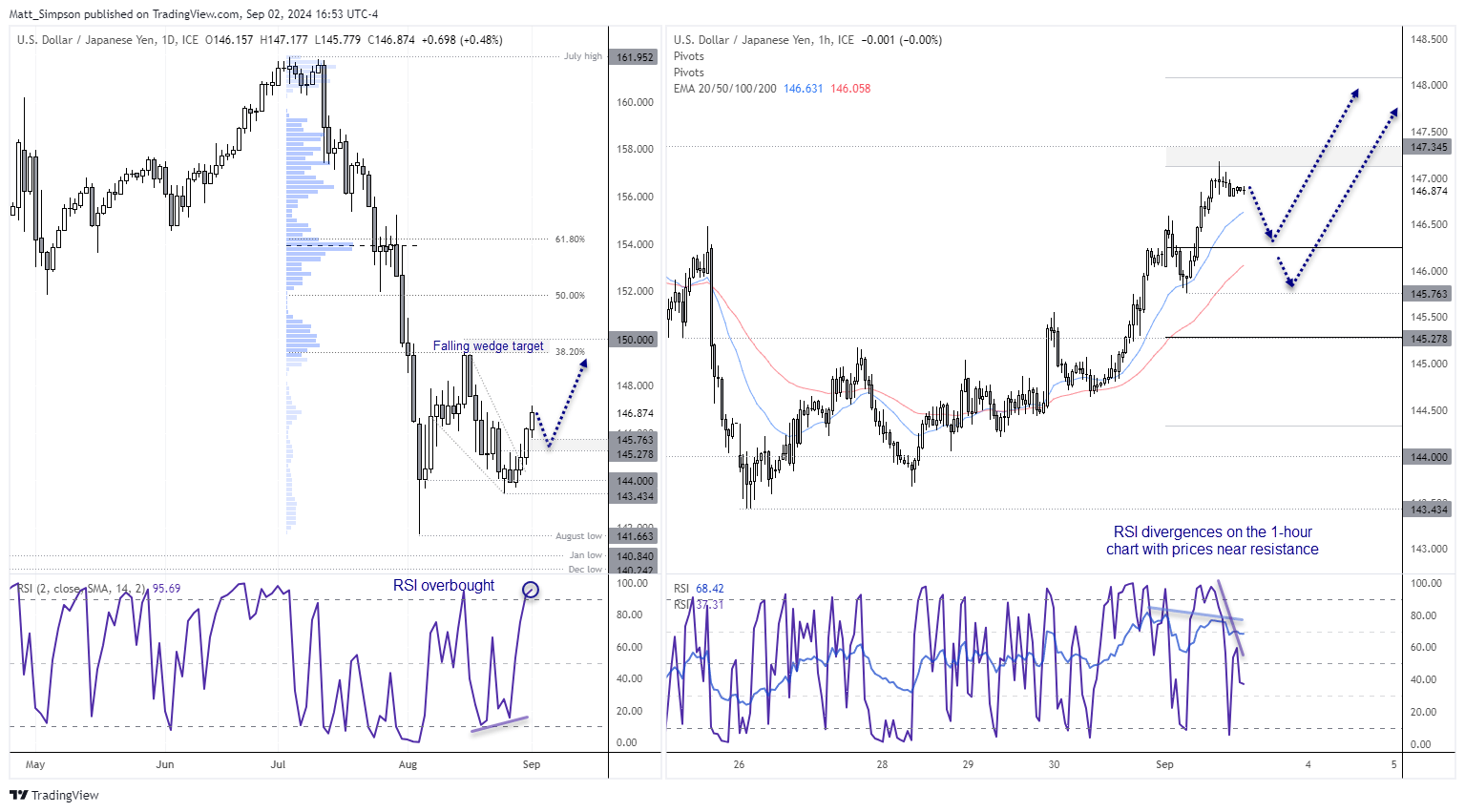

USD/JPY technical analysis:

Last week I outlined a few times that I felt he US dollar was due some bullish mean reversion. The US dollar index rose for the last three days of the week (thanks month-end-flows), and a weaker yen allowed USD/JPY to rise for a fourth consecutive day on Monday.

USD/JPY has now surpassed my initial 146 upside target, and we could now be looking at a move towards the base of the falling wedge ~149. However, the daily RSI (2) is overbought, and with EUR/USD forming a bullish inside day and the US dollar index rally stalling, perhaps the US dollar is in need of a minor pullback before USD/JPY takes its next leg higher. Besides, US data begins to flow in tonight, and any weakness could be renew bets of a dovish Fed.

The 1-hour chart is on a strong uptrend, although bearish divergences is also present on this timeframe. Resistance was also met at the weekly R1 pivot point. The 1-hour trend remains bullish above the 145.76 low, and the monthly pivot point sits at 146.25. I am therefore seeking dips towards such levels for the next potential swing trade long opportunity.

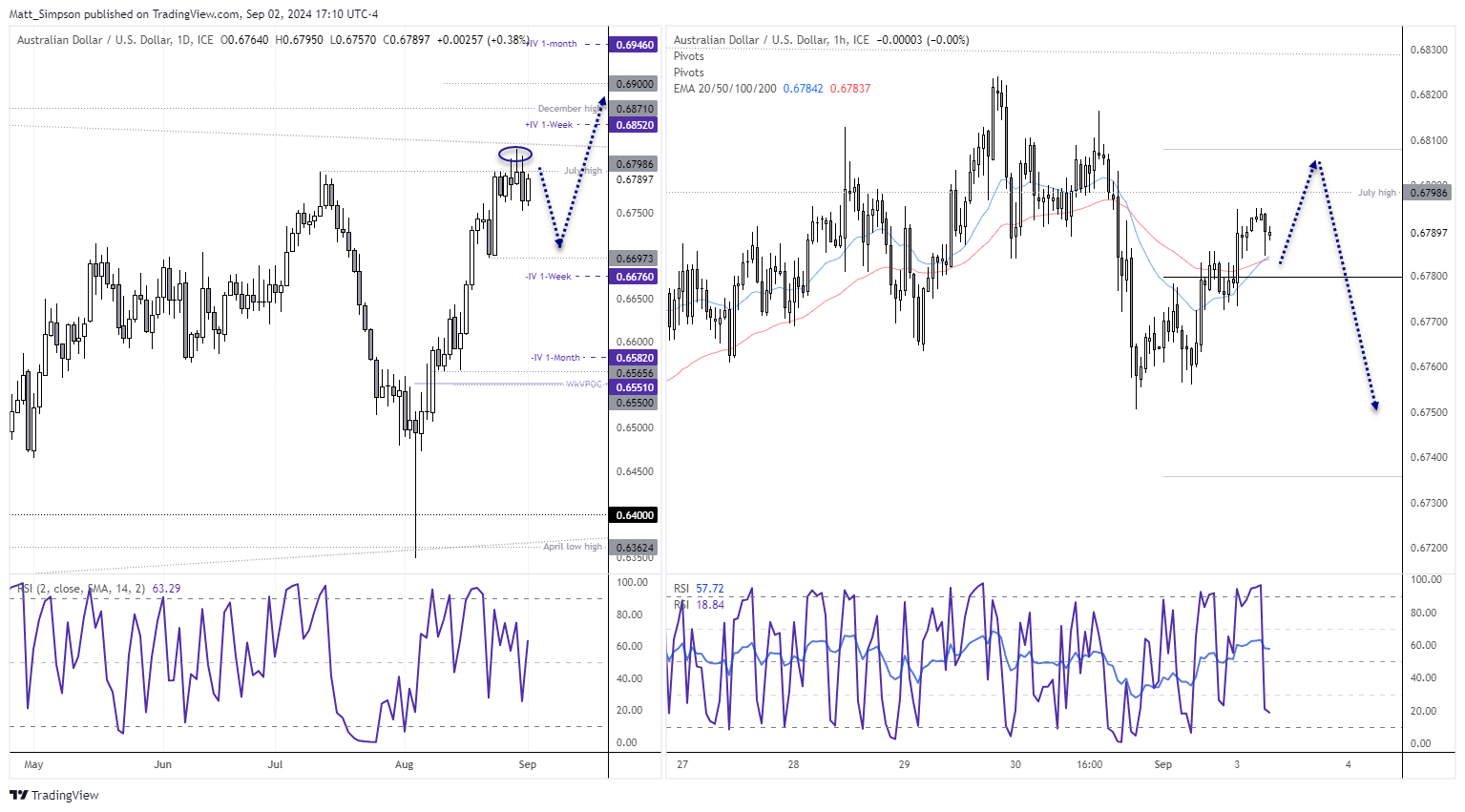

AUD/USD technical analysis:

This is really just a minor update to my weekly AUD/USD outlook report. A small bullish inside day formed on Monday which closed just beneath the July high and 68c handle. We’re yet to see a daily close above them, although three daily wicks have provided false breaks higher.

The bias remains for a leg lower before the next move to 69c. Yet the 1-hour chart is grinding an uptrend together, so perhaps it has another leg or two higher of its own to contend with before my assumed leg lower. Bulls could seek dips down to the weekly pivot point near 0.6870 for a move back to the July high or weekly R1 (0.6808). Alternatively, bears could seek to fade into such levels, or wait for the RSI (2) to reach overbought before considering shorts.

Events in focus (AEDT):

Volatility is expected to pick up overnight as US traders return to their desks after Labour Day weekend. ISM manufacturing data is the first big release of the week from the US. Sure, the services report on Thursday carries more weight, but any surprises here can shape expectations for incoming employment figures ahead of Friday’s NFP, while also providing a glimpse at underlying inflationary and growth trends.

Australia’s net exports contribution could see banks revise their GDP forecasts for Wednesday if they deviate from the script too far. With traders looking for vindication of their dovish RBA pricing, AUD/USD bears will want to see a decent negative print to anticipated lower growth figures this week.

- 08:45 – NZ terms of trade

- 11:30 – AU Net exports contribution, current account

- 16:30 – CH CPI

- 23:45 – US manufacturing PMI (final)

- 00:00 – US ISM manufacturing PMI

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge