- US bond yields and dollar have rallied in 2024

- A significant repricing of Fed rate cut expectations has been a major factor

- Markets expect the Fed’s preferred underlying inflation measure will increase 0.4% in January, the fastest increase in a year

- Lofty expectations may make it difficult to deliver a hawkish surprise, creating downside risks for USD

The Japanese yen is strengthening before today’s US PCE inflation report, a somewhat unusual outcome considering its expected to show the largest monthly increase in a year. While it may reflect month-end flows or tweaks to positioning, the countertrend move, mirroring what US bond yields did Wednesday, suggests a hot inflation number is entirely baked in.

That means in the absence of a big upside surprise in the report it may be difficult for US bond yields to continue pushing higher, removing the catalyst that helped propel the US dollar higher over the past two months. Should the data only meet or even undershoot market expectations, it could easily lead to a more significant reversal in yield sensitive assets that have underperformed since the beginning of the year.

Hello, Japanese yen.

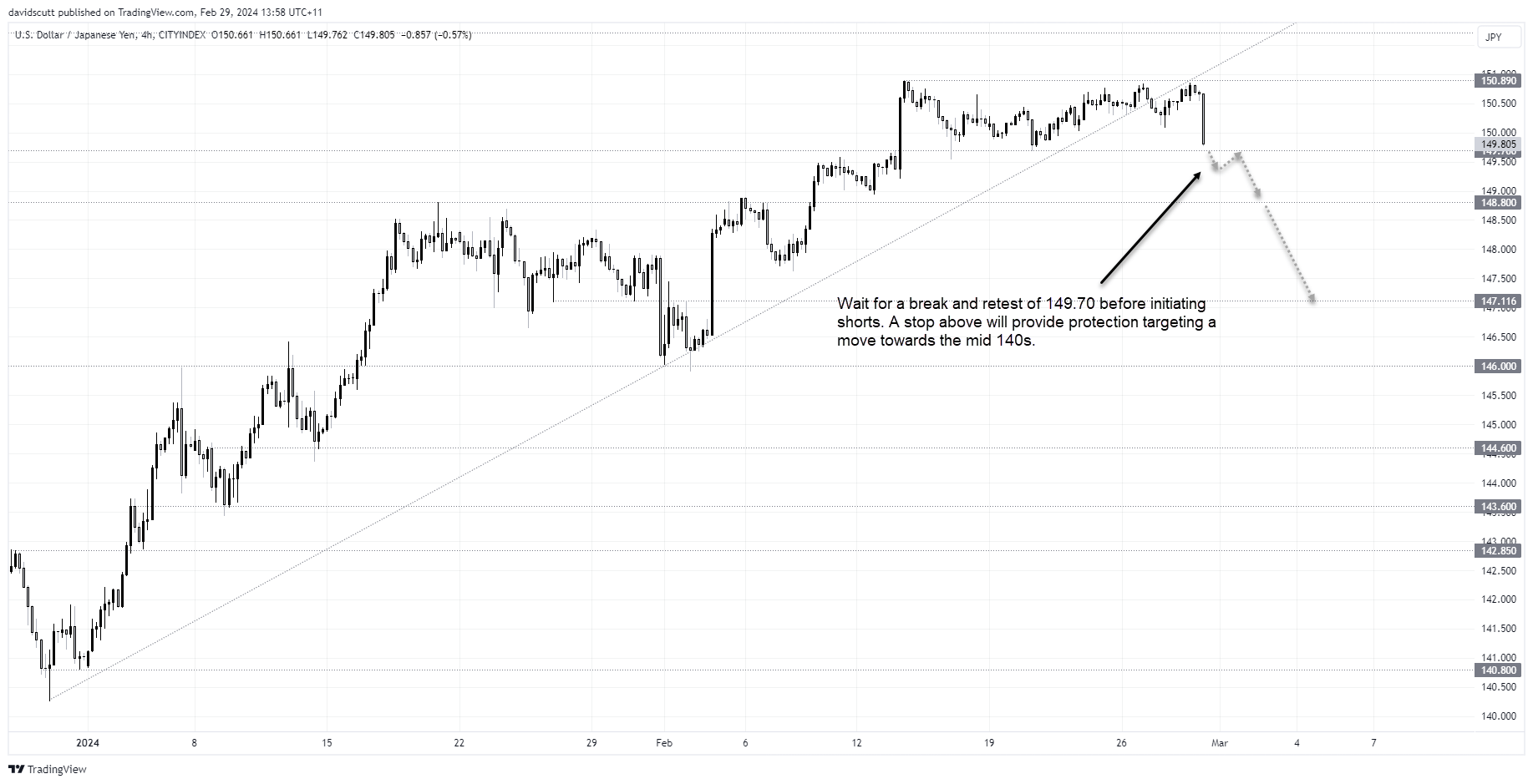

USD/JPY watching US bond yields like a hawk

As covered earlier this week, USD/JPY has been ultra-sensitive to shifts in US two-year bond yields over the past month with the correlation on the daily standing at 0.96. That’s near-enough moving in lockstep during February.

Given the extreme the relationship between the two, any reversal in US bond yields could be expected to spark a similar move in USD/JPY, assuming the relationship doesn’t weaken by a significant degree. Based on the price action today, that doesn’t seem to be the case with USD/JPY tumbling below 150, reacting belatedly to the move in US yields. Hawkish remarks from Bank of Japan policymaker Hajime Takata exacerbated the move, suggesting the bank needed to overhaul policy settings, including abandoning negative interest rates and yield curve control. Japanese two-year bond yields rose two basis points following the comments.

USD/JPY tumbles below 150

Having broken the uptrend dating back to late 2023, USD/JPY is now pushing towards horizontal support at 149.70. A break and hold there could open the door to a larger thrust towards 148.80, 147.10 or even 146.00. In the absence of a large and sustained decline in US yields, additional downside may be difficult to achieve near-term.

As a trade idea, a clean break of 149.70 provides a decent setup for shorts, allowing for a stop-loss to be placed above targeting a push towards one of the downside targets. Depending on which one you’re looking at, adjust your stop level accordingly to ensure an appropriate risk-reward.

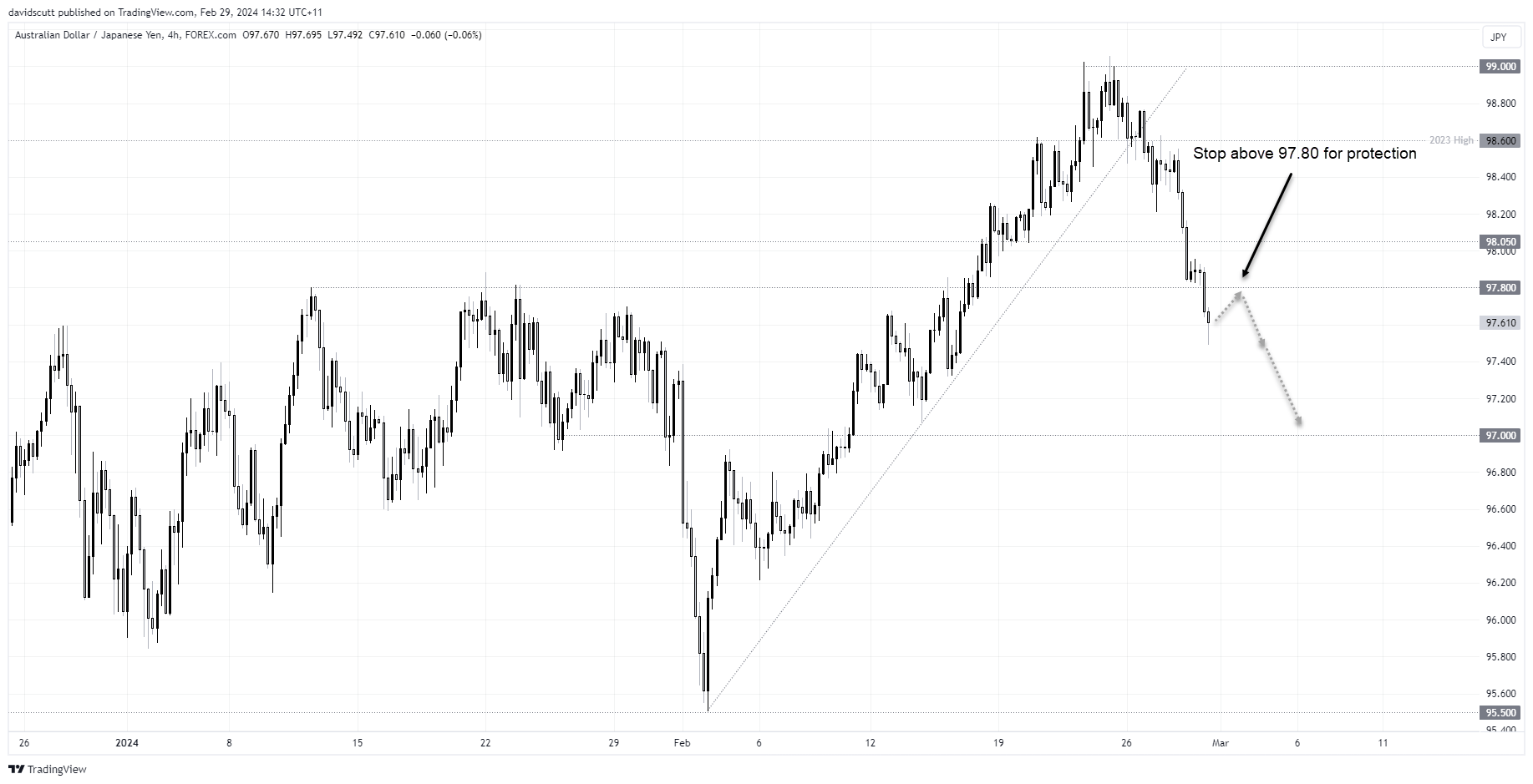

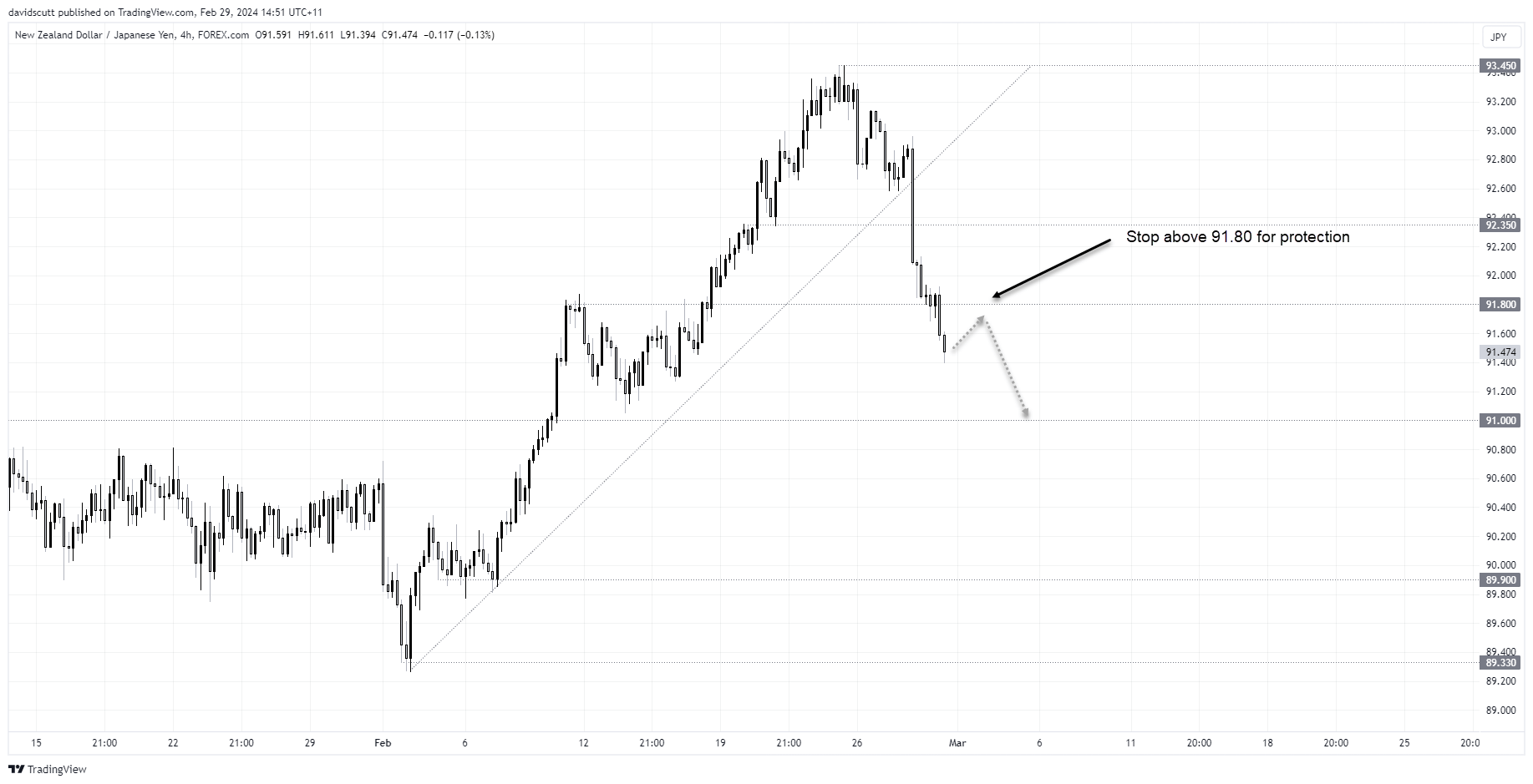

AUD/JPY and NZD/JPY shorts are other options for those looking for a reversal in US yields given the relationship with Aussie and Kiwi isn’t anywhere near as strong as the yen.

AUD/JPY looking heavy

AUD/JPY looks horrible on the four hourly, hit by an undershoot in Australia’s monthly inflation indicator and dovish surprise from the RBNZ on Wednesday before following that up with a soft retail sales report and reversal in USD/JPY today.

After looking heavy during European and US trade on Wednesday, support at 97.80 gave way as Japanese markets came online, seeing AUD/JPY slide below 97.50 before attempting to bounce. While some may be willing to sell the break, I’d prefer to wait for a potential bounce towards 97.80 before initiating shorts. That would improve the risk-reward, allowing for a stop to be placed above 97.80 looking for an unwind to 97.00

NZD/JPY reversal continues

The setup is not dissimilar for NZD/JPY with the pair breaking support at 91.80 earlier in the session before extending the move towards the European open. Sitting in the middle of the 91.00-91.80 range, I’d like to see a bonce before initiating shorts, allowing for a stop to be placed above 91.80 for protection. Below 91.00, the pair tagged 89.90 on six separate occasions earlier this month, making that a level worth targeting.

The key inflation figure for markets

As discussed earlier, these trade ideas are premised on the risk we see some form of pullback in US shorter-dated yields after the significant market repricing over the past two months. On that front, the US PCE inflation report will be the event to watch later in the session. Market consensus looks for a 0.4% lift in the Federal Reserve’s preferred core PCE measure, double the level of December.

-- Written by David Scutt

Follow David on Twitter @scutty