This time tomorrow we will finally know where the Fed stands regarding a 20 or 50 bp cut. Money markets have priced in roughly a two in three chance they’ll cut by 50bp yet the consensus around economists is around one third. In fact money markets are now implying two 50bp cuts and a 25bp cut by December, which would see 125bp of easing and rates fall from 5.25% - 5.50 to 4% - 4.25%. Personally, I think such an aggressive level of easing could do more damage than good, as it signals a hard landing.

Aggressive cuts should really be kept for times of turmoil, and we’re not yet in those times. CPI and PPI data ticked higher, unemployment was lower and recent ISM reports outperformed expectations. Still, it could also be argued that this is an opportunity to close the gap which many say the Fed have fallen behind, ahead of the US election next month.

25 or 50bp debate aside, the Fed’s message for futures easing will be key to how markets ultimately respond, once the initial knee-jerk reactions are out of the way. But if they do go for 50, they will need to convince markets that all is fine, assuming they want to avoid some sort of market meltdown.

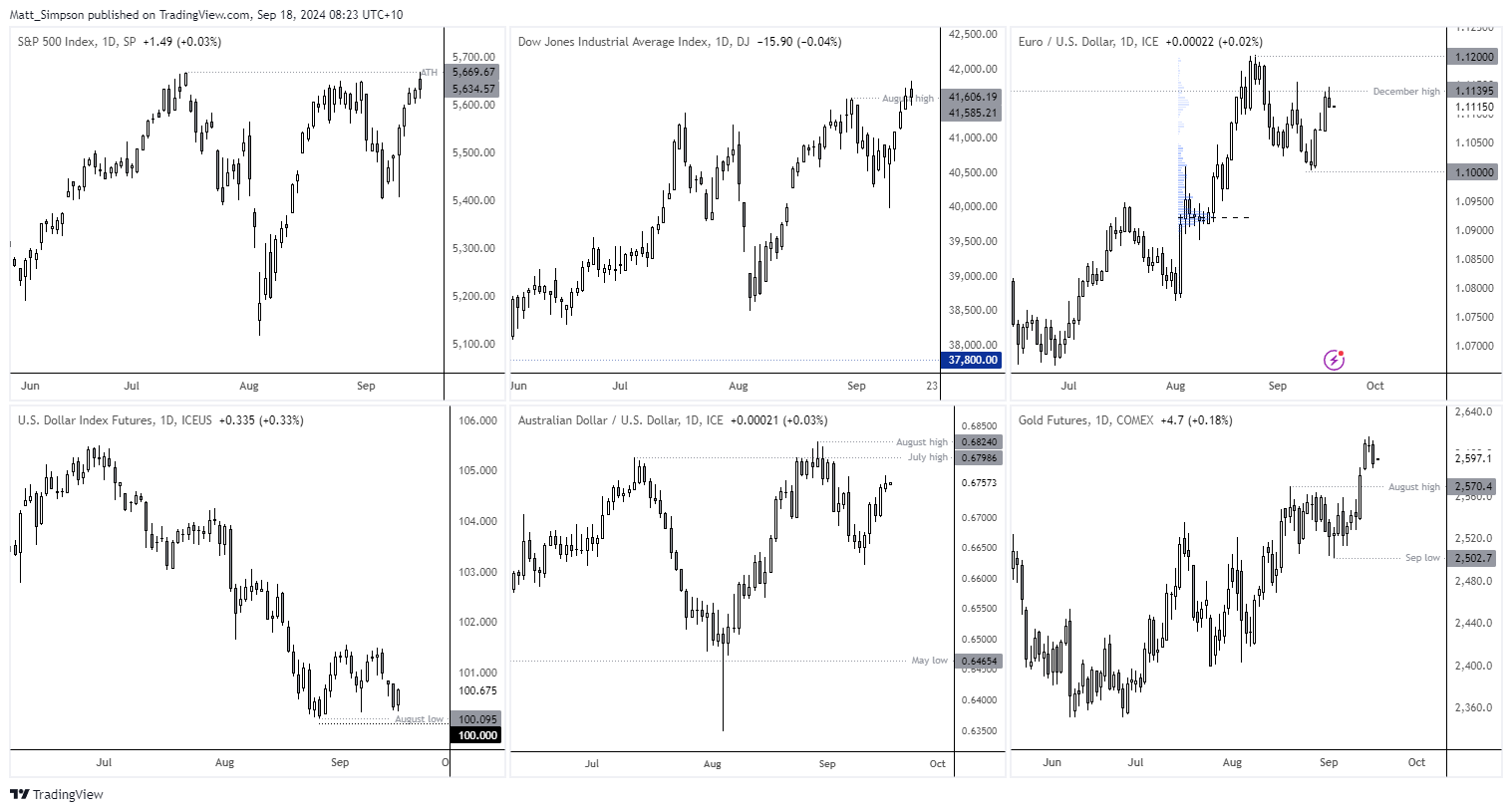

- The USD index was higher overnight alongside bond yields, despite dovish market pricing for the Fed

- The USD index rose for the first day in four, as the arguably oversold market tries to form a base above the August low and 100 handle. I warned that being short the USD may be a stale trade on Monday, but it looks like de-risking ahead of the Fed meeting may be behind dollar strength on Tuesday

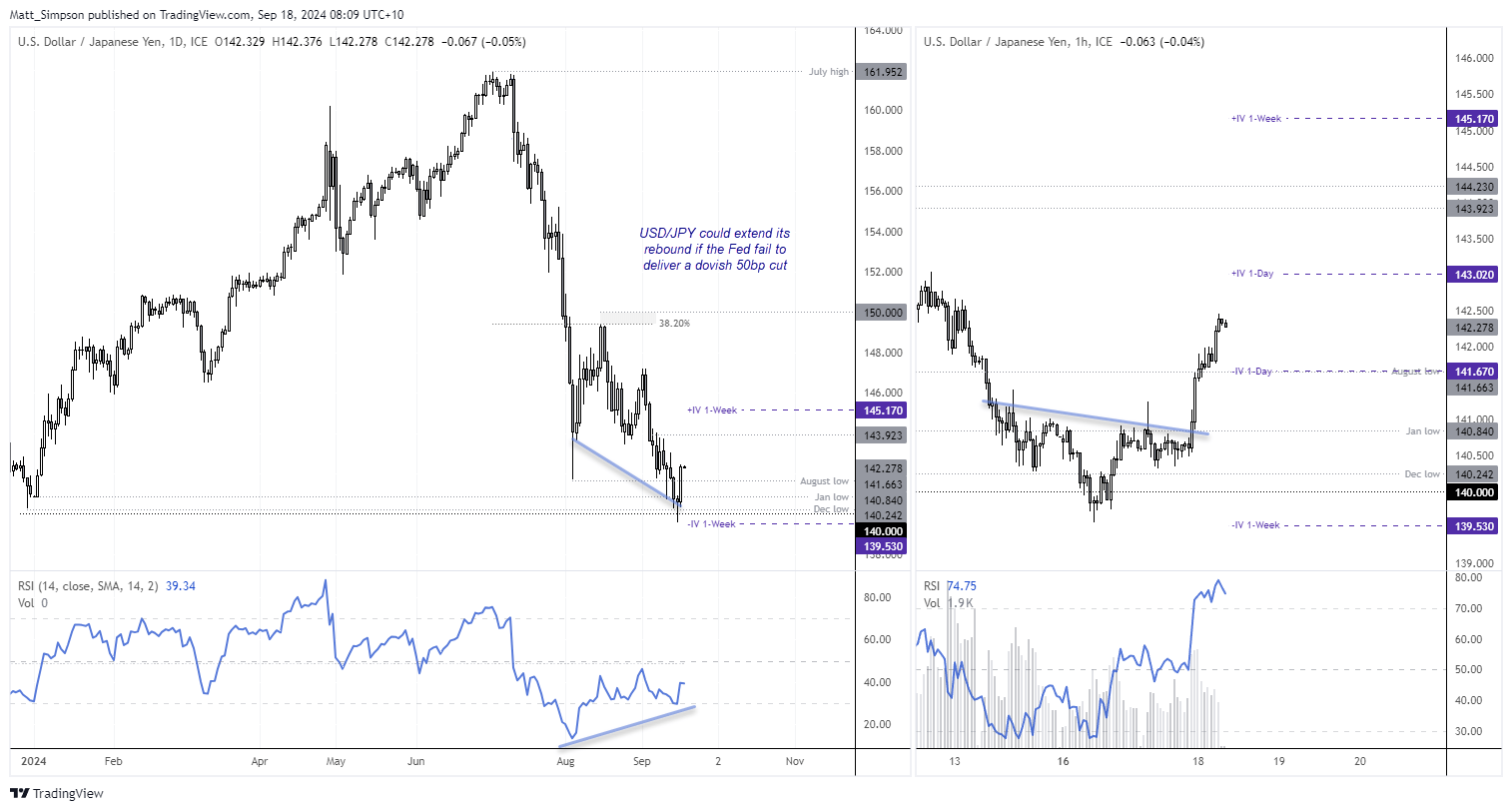

- USD/JPY snapped a 5-day losing streak and enjoyed its best day since in 23, rising 1.2% and forming a 3-day bullish reversal (morning star pattern)

- EUR/USD faltered around the December high and 1.15 handle and retraced -0.15% lower

- De-risking was also apparent on the S&P 500 and Dow Jones which pulled back from record highs

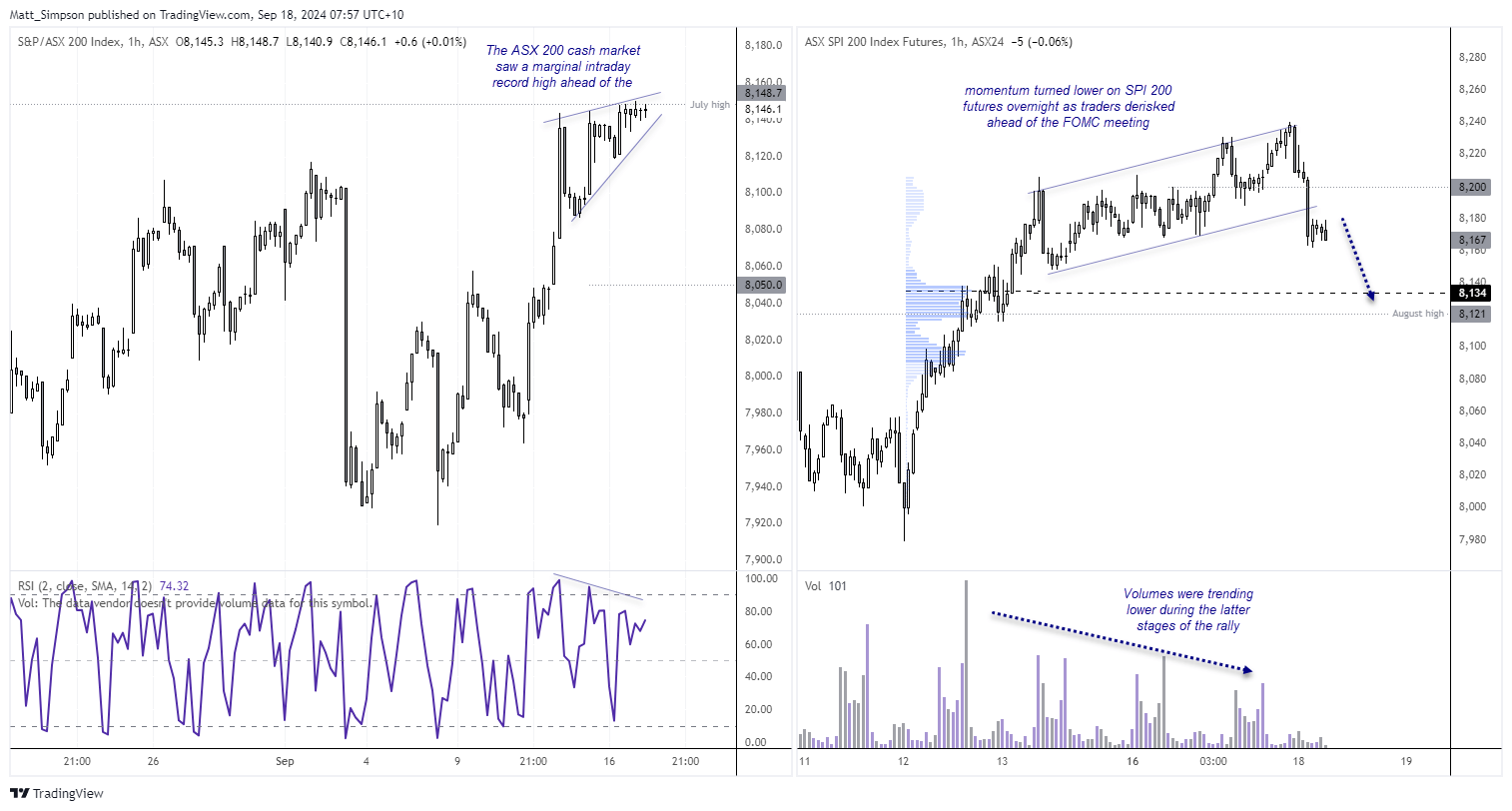

- The ASX 200 sneaked in a marginal record high on Tuesday, yet SPI 200 futures reverted lower overnight in line with yesterday’s analysis

- Gold prices also pulled back and dipped below 2600 on apparent derisking, although the trend remains firmly bullish even if a deeper pullback could be on the cards first

Events in focus (AEDT):

- 08:45 – NZ current account

- 09:20 – RBA assistant governor jones speaks

- 09:50 – JP adjusted trade balance

- 16:00 – UK CPI, PPI

- 19:00 – EU CPI

- 04:00 – FOMC interest rate decision, economic projections, statement

- 04:30 – FOMC press conference

ASX 200 futures (SPI 200) technical analysis:

Yesterday I warned that while the ASX 200 cash market appeared set to gap higher and reach for a record high, there was a risk it could then mean revert. We saw a marginal record high on the ASX 200 cash market ahead of the close, and SPI 200 futures turned lower overnight – which means the cash market will gap lower today.

Futures volumes were trending lower during the latter stages of its rally to its own record high, and price action on the 1-hour chart suggest a move towards the highest high (8121) or high-volume node (HVN at 8134) could be on the cards, while prices remain beneath 8200.

USD/JPY technical analysis:

What if the Fed do not deliver a dovish 50bp cut? Then the US dollar could be looking for a broad-based rebound to weigh on EUR/USD, GBP/USD, AUD/USD and so on. It could also see USD/JPY extend its rally which began yesterday.

USD/JPY fell nearly -14% from its July high, with only one sizeable pullback along the way. Prices saw a false break of 140 earlier this week, which marked a bullish pinbar. And yesterday’s bullish range expansion is the third candle of the three-day bullish reversal called a morning star formation.

The 1-week implied volatility band sits at 139.50 to 145.17, although I remain doubtful that the 1-day band of 141.67 – 143.02 is accurate (as it seems too narrow for the potential level of volatility that could follow the FOMC meeting). Either way, the Fed really do need to come out swinging with a dovish narrative and oversized cut to drive this pair lower. Which means risks could be skewed to the upside.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge