- PBOC cuts seven-day reverse repo, loan prime rates by 10bps

- USD/CNH pushes to multi-week highs

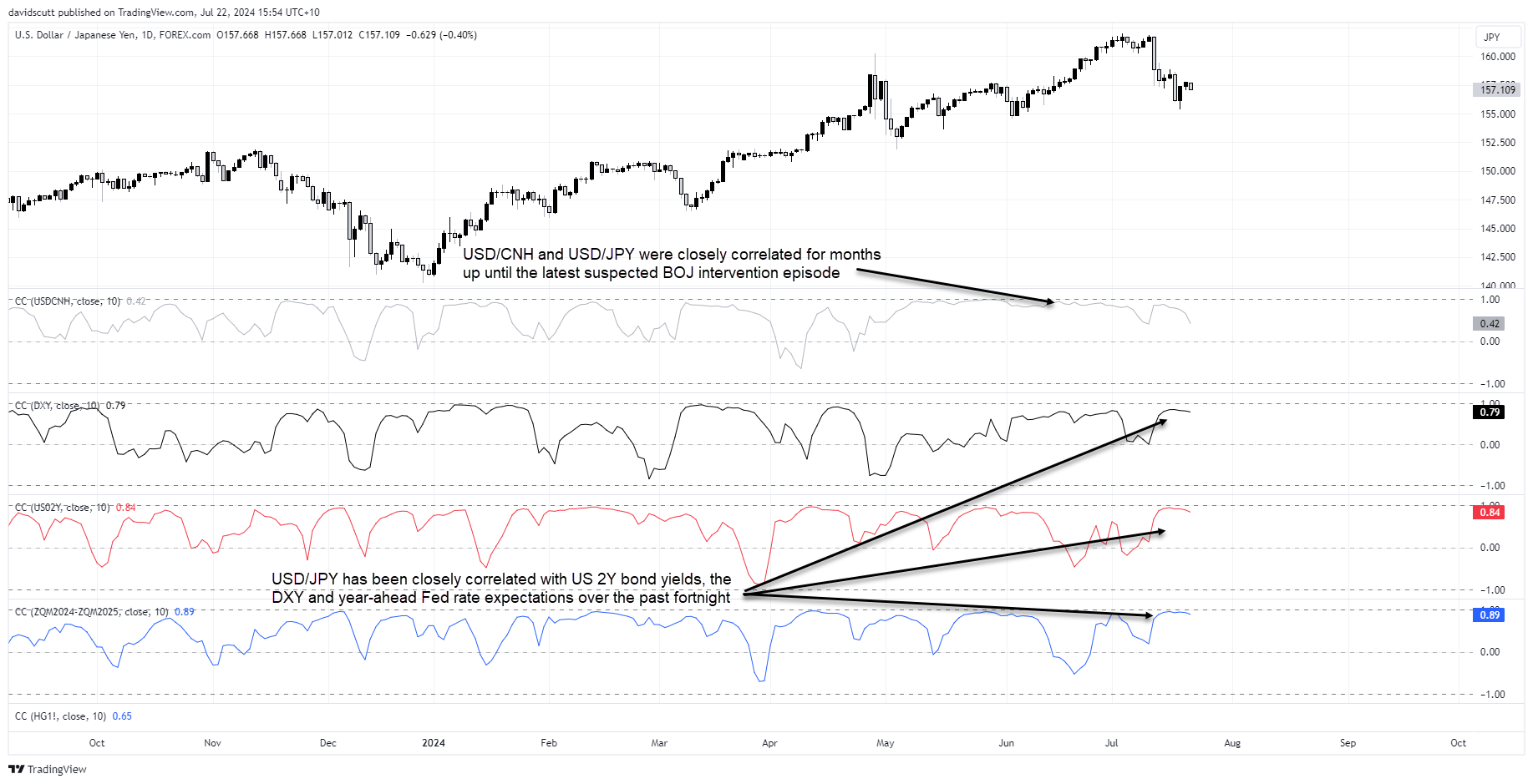

- USD/CNH and USD/JPY have traditionally been strongly correlated

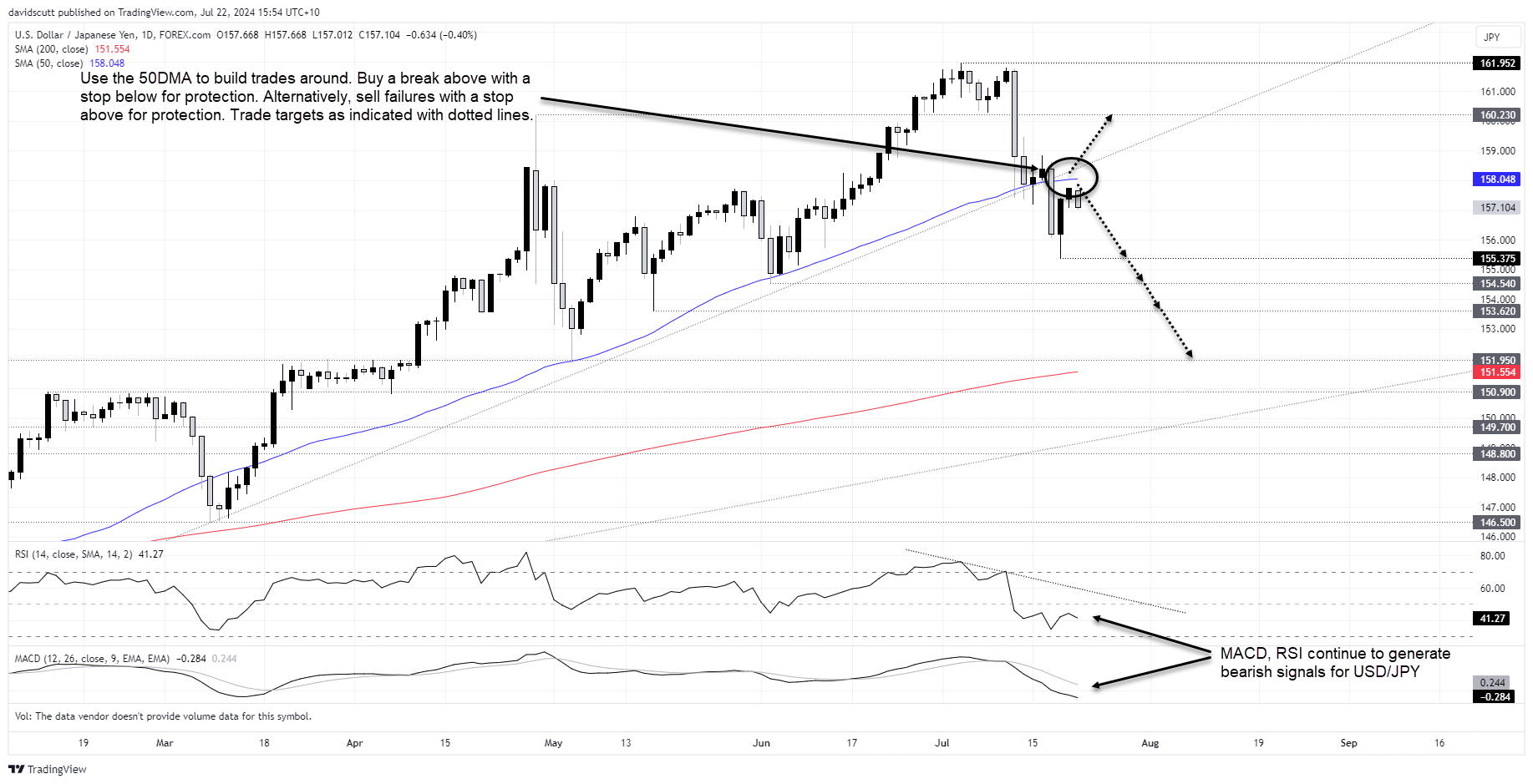

- USD/JPY sits just below key 50DMA, providing level to build setups around

Yuan influential on Asian FX names

It’s no secret that I feel the offshore-traded Chinese yuan is unappreciated as an influence over Asian FX names, especially the Japanese yen given the tight correlation that usually exists between the two against the US dollar. It’s akin to an anchor for currencies across the region and emerging markets. When it holds firm, so too do most other names against the buck. But when it starts to drag, moves elsewhere can be sizeable in nature.

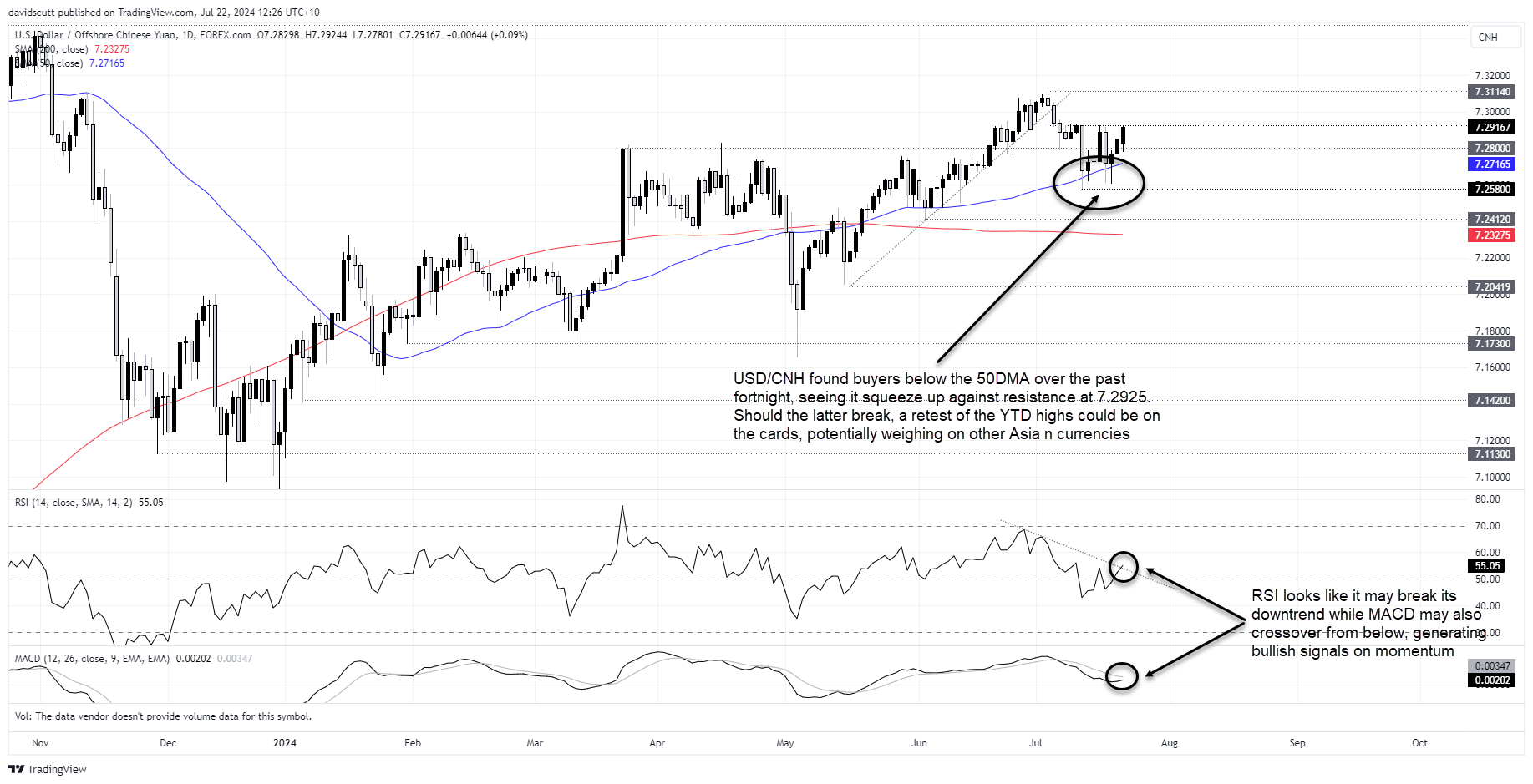

USD/CNH eying 2024 highs after PBOC rate cuts

Looking at USD/CNH on the daily chart, you can see it’s been grinding higher over the past fortnight, attracting bids consistently on dips below the 50-day moving average. That’s seen it squeeze up against resistance at 7.29250, a level that has capped gains dating back to July 5. Should it give way, it points to a potential retest of the 2024 highs at 7.3114.

With relative interest rate differentials back in focus after the People’s Bank of China (PBoC) cut its loan prime and seven-day reverse repo rates by 10 basis points on Monday, traders were provided a timely reminder that while the Federal Reserve may be on the cusp of pivoting, the PBoC is not. It continues to ease monetary policy, likely selecting this moment given the rapid repricing in Fed rate cut expectations, limiting selling pressure on the yuan.

But what happens if markets are wrong about the magnitude of rate cuts the Fed delivers? They were earlier this year, so why not now? It means dollar weakness may not be the slam dunk many traders were looking for, pointing to the possibility of the USD re-strengthening against the yuan and other Asian currencies.

USD/JPY break reverses to key level

As an interest rate sensitive pair with a historically strong correlation with USD/CNH, the downside break in USD/JPY last week could be at risk of reversing should the yuan anchor begin to drag other currencies lower. What happens in the near-term may could important when it comes to the longer-term trajectory for the yen.

You can see the break of the 2024 uptrend last week on the chart, taking out the important 50-day moving average in the process. You can also see the large rebound over the past few days, coinciding with a rapid reversal in markets that had run very hard beforehand. The net result is USD/JPY sits at an important level just below the 50DMA and former uptrend, providing an excellent location for setups depending on how the near-term price action evolves.

Should we see USD/JPY follow USD/CNH higher and break above the 50DMA, you could consider buying the break with a stop-loss order just below for protection. The initial trade target would be 160.23. Alternatively, should USD/JPY remain below the 50DMA, consider selling with a stop above the level for protection. Potential targets include 155.37, 154.54, 153.62 before more meaningful downside support is found at 151.95.

Managing risk events

While the Fed’s preferred underlying inflation measure, the core PCE deflator, arrives on Friday, unless we see a big deviation from the 0.2% median forecast, it may not be the major market mover it once was. CPI and PPI data released earlier this month suggest an upside surprise is unlikely. Focus is now equally on economic activity, making the advance US Q2 GDP report arguably even more important. So too initial jobless claims data released alongside it on Thursday.

More broadly, you cannot discount the importance of earnings results from tech titans Alphabet and Tesla on Tuesday, providing an early glimpse on whether expected revenue windfalls from AI are coming to fruition. Given the implications for carry trades involving the yen, any disappointment could spark capital repatriation, strengthen the yen.

-- Written by David Scutt

Follow David on Twitter @scutty