- The Chinese yuan is trading at multi-year highs against the currencies of its major trading partners

- This strength has helped to counteract rampant US dollar strength, preventing larger losses for Asian FX names in 2024

- With the risk of an escalating trade war with the US, Chinese policymakers may be tempted to weaken the yuan to help with exporter competitiveness

- A revival of large-scale Fed rate cuts bets may provide respite for battered Asian FX names

If you trade Asian currencies like the Japanese yen, Australian or New Zealand dollar, you should always keep a close eye on what’s happening in the Chinese yuan. Especially this week. Because with trade wars between China and the United States set to erupt again, and with a raft of top tier US economic data scheduled, what happens in USD/CNH will be highly influential for other Asian currencies.

CNH performance influential on JPY, AUD & NZD

As the currency of the world’s second largest economy rising rapidly up the ranks of the most traded FX names worldwide, you’re doing yourself a disservice if the Chinese yuan is not on your radar. As seen in the chart below, for large periods of time, movements in USD/CNH have often been mirrored by USD/JPY, AUD/USD and NZD/USD.

Up until recently, USD/CNH and USD/JPY had a positive correlation in the high 0.8s on a rolling quarterly basis. For AUD/USD and NZD/USD, negative correlations above -0.9 were regularly observed over the same timeframe during the past year.

While the common denominator is the US dollar, with its movements influential across the entire FX market, what is not readily known right now is the Chinese yuan is not weak but strong when you look at its performance against a basket of currencies from its major trading partners, hitting levels not seen October 2022 in April. It’s only really been weakening against the greenback.

CNH an anchor for Asian FX names

Even though it’s not been enough to offset the impact of the strong US dollar entirely, measures from the People’s Bank of China (PBOC) to curb market forces seeking to weaken the yuan against the dollar have likely helped limit losses in other Asian FX names against the big dollar, making the yuan somewhat of an anchor for currencies in the region. Hence, if this anchor were to come loose, it’s very likely Asian FX names would be hammered.

One only needs to look back to the yuan devaluation episode in 2015 to what may happen. And that was when the yuan’s influence was considerably smaller than it is today.

Trend breakdown may explain weakening relationships

While the yuan has often had strong relationships with the likes of the JPY, AUD and NZD, that’s faded somewhat in recently. Rather than being less influential on currencies across the region, the breakdown of strong established trends in other asset classes may explain the waning relationship, resulting in choppy price action as traders and investors wait for definitive signals as to which direction markets will move next.

When new trends become established, it would be surprising if the relationship between the yuan and other Asia FX names does not strengthen again.

Trade war risk adds to devaluation threat

If you’re looking for a major catalyst that could spark a trend change, look no further than the threat of an escalating trade war between the United States and China.

If media reports are on the money, US President Joe Biden will quadruple tariffs on Chinese made electric vehicles and sharply increase levies for other green energy industries in an announcement later Tuesday, opening the door for other western governments to do the same given a concerted push to foster local green initiatives.

As mentioned above, Chinese policymakers have been pushing back against market forces seeking to weaken the yuan, setting the midpoint of the USD/CNY daily trading band far stronger than market forces would imply for months on end.

While not a certainty, the threat posed to China’s trade-exposed sectors from greater import barriers abroad, at a time when policymakers are fighting to prevent the yuan from weakening further, you don’t have to be Einstein to see why authorities may be temped to devalue the yuan to support its export sector.

If China were to go down that path, it would likely lead to a rapid appreciation in the US dollar, generating substantial volatility not only in Asian FX names but broader financial markets. As such, watching the daily USD/CNY fix may be advantageous near-term. If a devaluation episode were to occur, it would likely be initiated at the start of onshore yuan.

USD bull case also its biggest threat

Outside the threat posed by trade wars, the other potential catalyst than could spark a trend change comes from the US economic data calendar with CPI, PPI and retail sales figures for April released over the next 48 hours.

For the US dollar, uncomfortably sticky inflationary pressures have been a major factor behind its strength this year, combining with strong, above-trend economic growth to delay the start of the Federal Reserve’s rate cutting cycle.

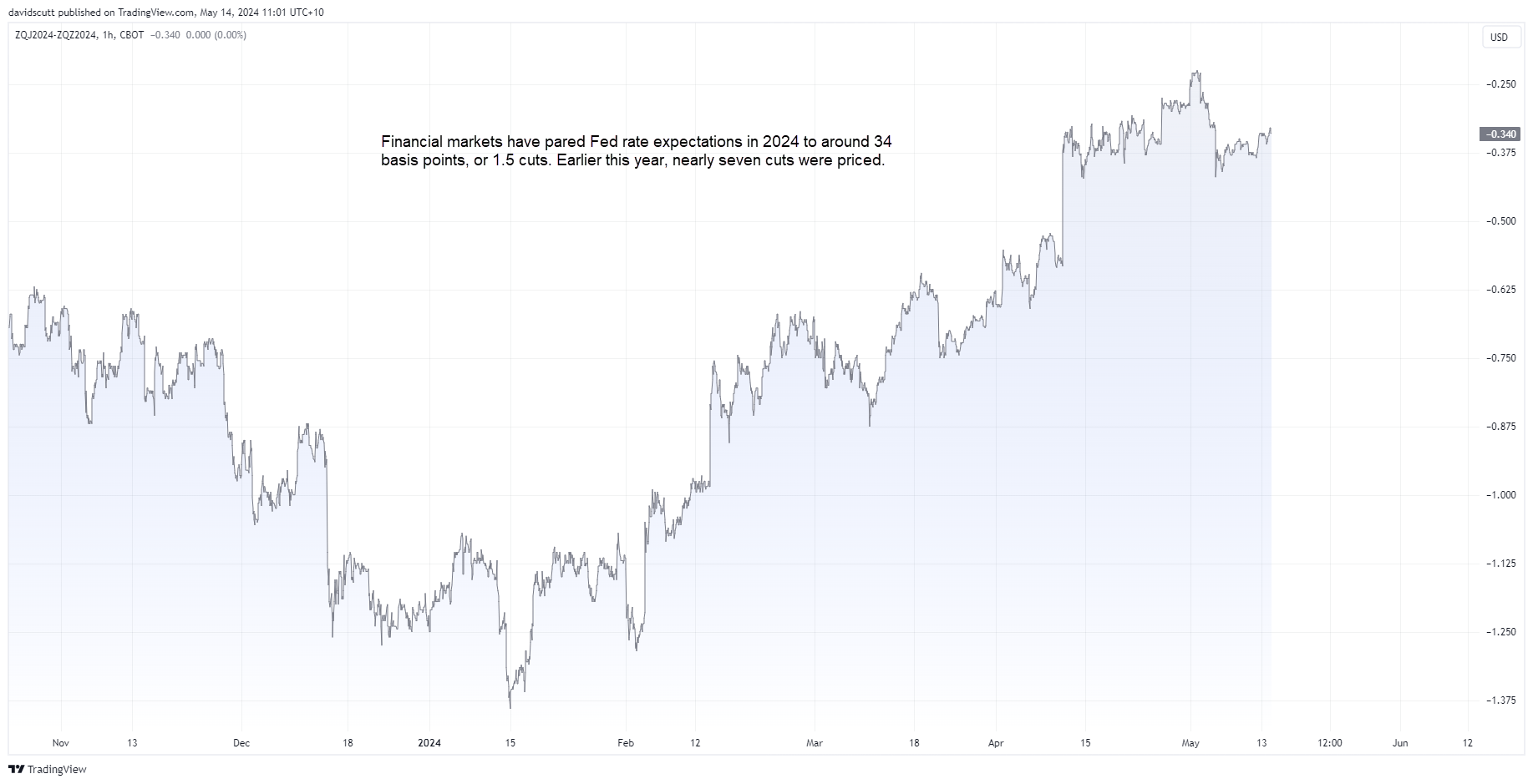

With these factors part of an established trend, markets now expect it, helping to prevent sustained periods of weakness from occurring. However, now that the number of rate cuts priced in 2024 has fallen from nearly seven to less than two, it’s now up to the data to keep feeding the prevailing narrative. If it doesn’t – as seen when nonfarm payrolls and ISM services data whiffed earlier this month – it can result in an abrupt weakness in the US dollar.

The more data that disappoints, the greater the risk it may encourage traders to unwind bullish bets and result in sustained dollar weakness. In other words, good news is arguably already priced in.

USD/CNH technical outlook

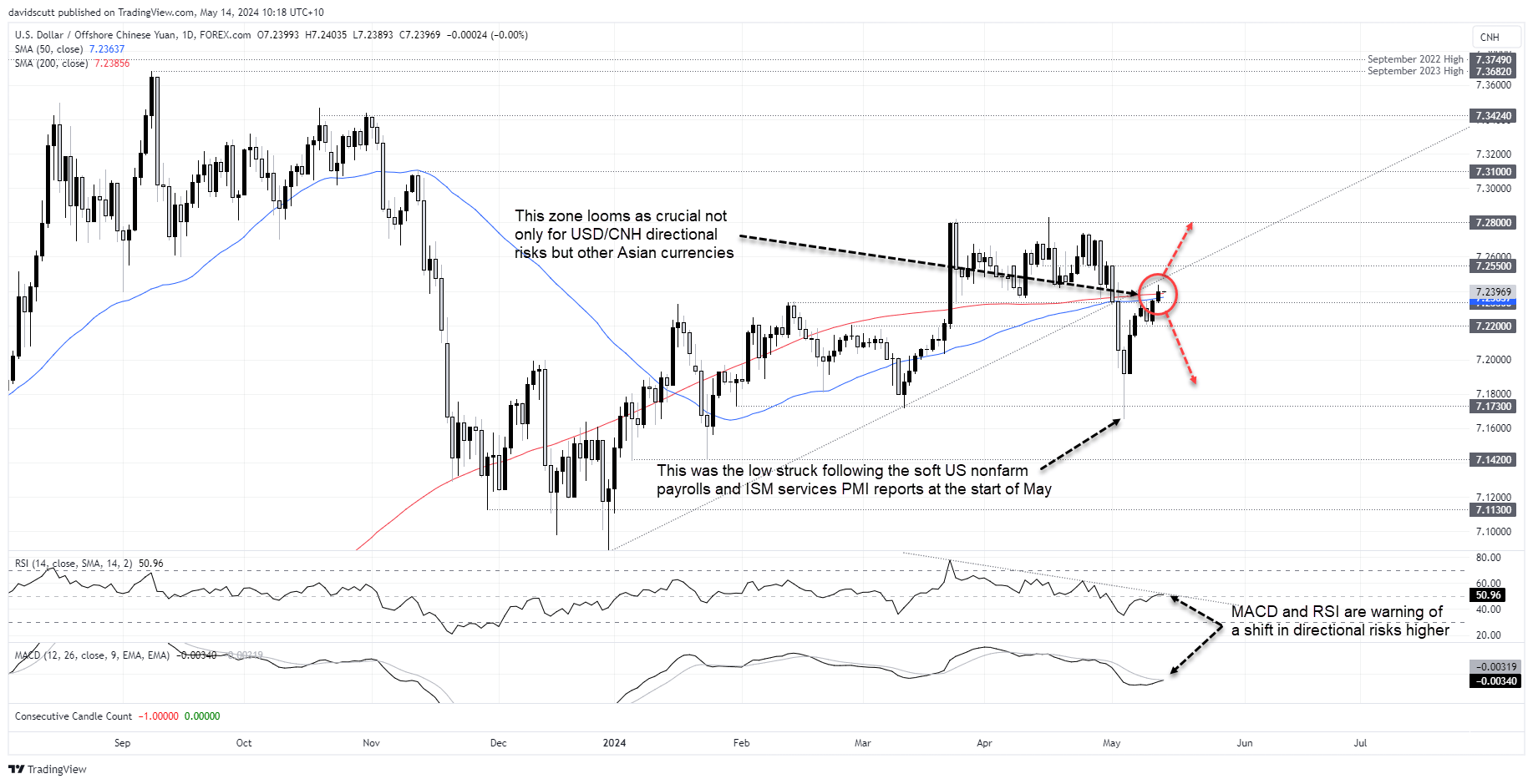

Adding to the sense that this week may be important for broader directional risks for Asian FX names, USD/CNH sits at an interesting juncture on the daily chart, threatening to surge straight back into the uptrend it was trading in for much of the year.

The bounce from the lows struck Friday two weeks ago has been powerful, seeing USD/CNH do away with two horizontal resistance levels at 7.2200 and 7.2335 before breaking through and closing above the 50 and 200-day moving averages on Monday.

With the downtrend in RSI threatening to break and MACD crossing over from below, directional risks look to be turning higher for USD/CNH. Aside from former uptrend support and horizontal resistance around 7.2550, there’s not a lot standing between USD/CNH and return to levels seen in late 2023.

While buying dips looks preferable to selling rallies near-term, it may pay to see how the price action evolves around these levels over the next 48 hours given ample event risk.

Another push and the pair will be back in its former uptrend, allowing for fresh longs to be established targeting a move towards the 2024 highs. A stop order placed below either the trendline or 50/200DMA zone would offer protection against reversal.

Alternatively, should the price fail to hold above the 50 and 200DMA, stops could be placed above this zone, allowing for fresh short positions to be established targeting a retracement towards 7.1730.

Either way, if we do see a meaningful directional shift in the yuan, it’s likely the Japanese yen, Aussie and New Zealand dollars will be following close behind.

-- Written by David Scutt

Follow David on Twitter @scutty