After initially extending its post-NFP gains on Monday, the US dollar was on the back foot against most major currencies so far in on Tuesday’s session. The USD/CAD, however, was a touch firmer at the time of writing. Traders are largely sitting on their hands ahead of this week’s inflation data from the US, as well as several other data releases from around the world and a rate decision by the European Central Bank on Thursday. The dollar has found mild support and has stopped falling since the last week of August. The month of August itself was a bearish month for the greenback as investors bought foreign currencies on the back of softness in US data. It looks like the market has now mostly priced in Fed's expected rate cuts, totalling around 100 basis points for this year. Unless this week’s CPI comes in way below expectations, it looks like the Fed will start the rate cutting cycle with a standard 25 basis points on September 18, instead of 50 bps priced in a few weeks ago. This should still be negative for the US dollar. The greenback will require a run of stronger data to turn decisively higher; else the bearish USD/CAD outlook and trend that started in August will remain intact.

US dollar lacks momentum

After last week’s significant data releases, the macro calendar has been quite quiet so far this week. This has caused the dollar to trade side-ways. This comes after the Federal Reserve Chair Jerome Powell expressed concern at the Jackson Hole symposium about the job market and confirmed that interest rates would be reduced starting in September, sending the dollar lower across the board. Last week, though, the greenback found support even if we had more weakness observed in US employment data. While speculation about a possible 50-basis point rate cut at the Fed’s September 18 meeting have been watered down, expectations for more aggressive rate cuts later in the year are growing, especially after a Fed official suggested "front-loading" the cuts. As a result, we could see the dollar resume lower on the back of any short-term strength.

USD/CAD: US CPI in sharp focus

We are now just one day away from learning about the rate of inflation for August. With the US CPI steadily moving towards the Fed's target, the US central bank has already prepared the market for a rate cut at the upcoming September 18 FOMC meeting. The CPI report will be the final major data release before that meeting, and it will play a crucial role in shaping whether the Fed opts for a bolder 50-basis point cut or sticks with the more cautious 25 bps. All eyes will be on this report, especially if the figures deviate from expectations. Inflation has been cooling for four consecutive months, dropping to 2.9% year-over-year in July—the lowest since March 2021. For August, the forecast points to a further dip to 2.6%, while core CPI is expected to hold steady at 3.2% year-over-year. This will undoubtedly add fuel to the ongoing debate over the Fed’s next move.

A word or two on Canadian dollar

If you do not take into account the general US dollar strength observed against most major currencies in the last few sessions, one may be able to see that the Canadian dollar has been able to hold steady, suggesting that investors are not too alarmed by the jobless rate rising to a 7 year high of 6.6% as we found out on Friday. Last week, the Bank of Canada cut interest rates for the third consecutive meeting, which was fully priced in. Investors are anticipating a couple of more cuts by year’s end, especially if the job market continues to weaken. However, this doesn’t necessarily mean the USD/CAD will rise. The more significant influence on this pair will be the US dollar, as is the case with most major currencies.

USD/CAD outlook: technical analysis and trade ideas

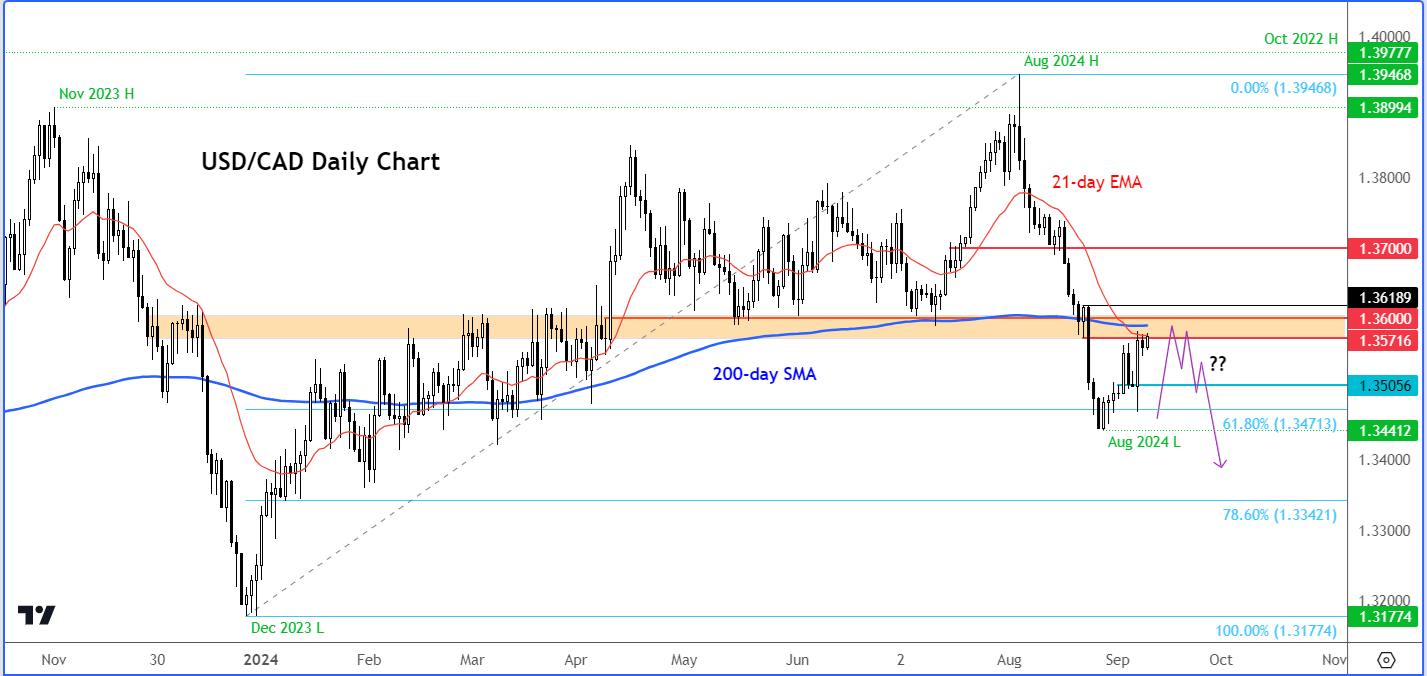

Source: TradingView.com

With the US dollar on shaky ground, the USD/CAD could be set to decline again as it tests a key area between 1.3570 and 1.3600. This zone, once a major support, broke down a few weeks ago. The question now is whether it will turn into firm resistance, potentially triggering another drop or whether rates will break back above this zone, leading to a short squeeze. I reckon it will be the former case and will thus maintain a bearish USD/CAD outlook from a technical point of view.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R