With the odds of a Fed cut arriving this year now in jeopardy, it is now over to the BOE, ECB or BOC to take the title as ‘first to begin easing’. And that brings Canadian CPI data into focus today for CAD traders.

Last week the Bank of Canada (BOC) held interest rates at 5% for a seventh consecutive meeting. Although the statement and press conference provided clues that the central bank is moving closer towards easing.

The statement noted slower growth, weaker labour market conditions alongside signs that “wage pressures are moderating”. Comments on inflation were also encouraging for the dove camp, with “easing in price pressures becoming more broad-based across goods and services”, even if CPI remains “too high” and upside risks remain. But what really stole the show was Governor Macklem’s comment that “yes, June rate cut is within the realms of possibilities” as “inflation has come down”.

The BOC hold their next monetary policy decision on June 5th, which leaves room for two more inflation reports. And one of them is later today.

Canada’s inflation rate is falling towards the BOC’s target zone

Canada’s inflation story is one of the more convincing as far as doves are concerned. Core CPI is just 0.1 points above their 2.1% median target, having fallen from a peak of 6.2% in July 2022. In isolation this could have the BOC with their finger on the cut button, but I suspect they’ll at least want to see trimmed mean and median CPI dip within the 1-3% target band, which are sitting at 3.2% y/y and 3.2% y/y respectively. And that is not impossible with the annual rate slowing by -0.2 and -0.3 increments over the past couple of months.

Ultimately, the further below the upper band of 3%, the greater the odds of a BOC cut. But with time on the BOC’s hands to view another inflation report ahead of June’s decision, it would likely require some particularly weaker figures today for a June cut to be effectively confirmed.

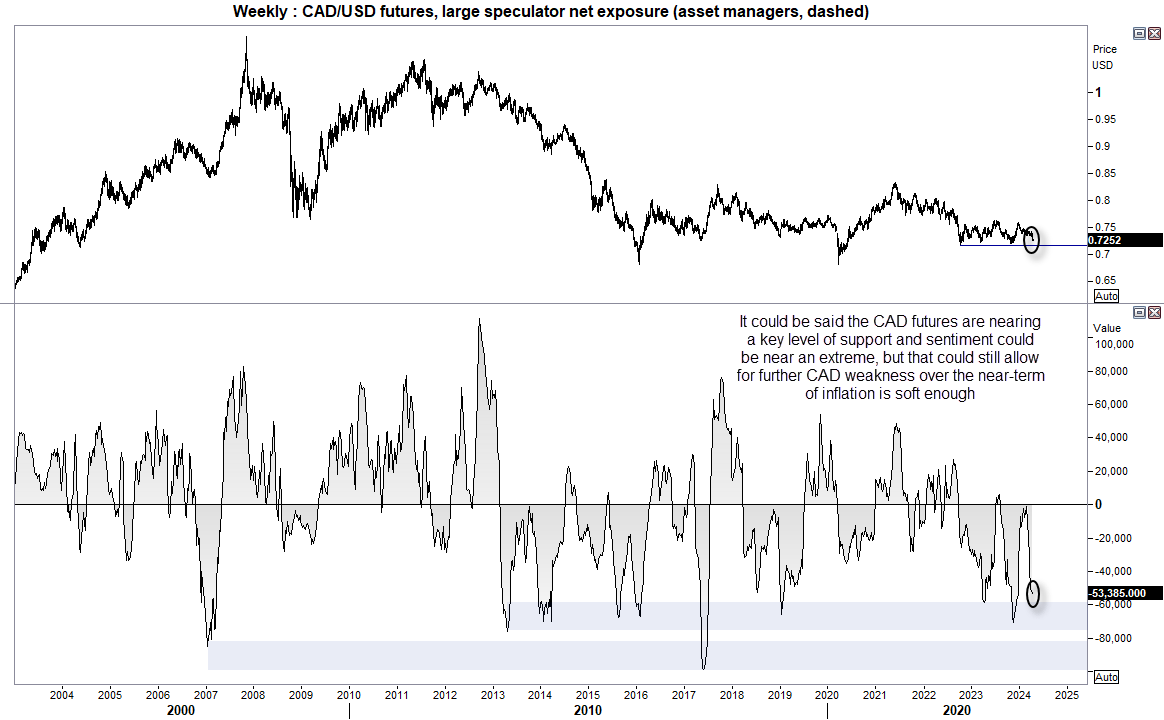

Canadian dollar market positioning from the COT report

Shorting CAD futures is certainly not a new idea, with large speculators net-short by -53.4k contracts. I wouldn’t say it is at a sentiment extreme just yet as we have seen net-short exposure rise in excess of 70k to 100k over the year. But it is more likely near a sentiment extreme than not. Besides, CAD futures are also nearing a key level of support – and a surprisingly hot inflation report could trigger some short covering and stall the rally.

Of course, we also need to factor in the US dollar which is being supported by strong economic data, a further reduction of dovish-Fed bets and safe-haven flows from a rise in geopolitical tensions.

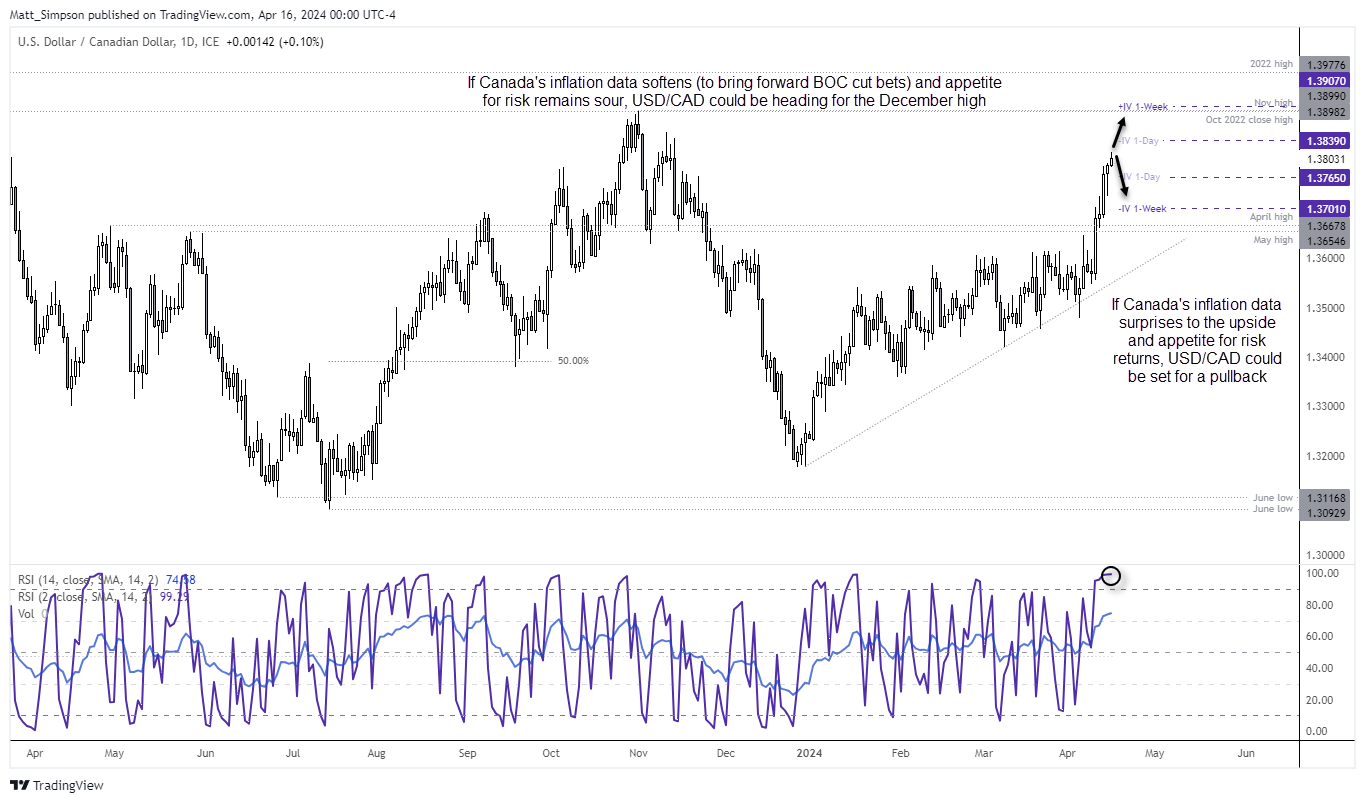

USD/CAD technical analysis:

The US dollar index is currently trading higher for a fifth day, with the futures contract touching a fresh YTD high in the Asian session. USD/CAD has effectively followed the US dollar in lockstep amid its fifth day higher and sitting a touch above 1.3800. But perhaps it is becoming over extended.

RSI (2) has been overbought on the daily timeframe for four days, and the bullish daily ranges are becoming smaller. Obviously, Canada’s CPI figures and headline risks from the Middle East could sway this market either way over the near term. But I do suspect we could be nearing an inflection point.

If Canada’s inflation figures disappoint to the upside, it could spark a round of short covering to at least cap gains on USD/CAD. And if sentiment is to improve (expressed by higher indices and lower gold) then that could help USD/CAD retrace lower.

But for USD/CAD to simply extend its rally, soft CPI data form Canada and continued risk-off sentiment could be key. But even then, I doubt it will simply break above the December high – at least upon its first attempt.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge