US Dollar Talking Points:

- The next week and a day are big for both FX markets and the macro risk trade. Stocks are on edge and fears of recession have produced a ‘bad is bad’ backdrop for equities, where bad news has been driving strength into US Treasuries and away from US equities.

- The big question is whether the Fed pushes a 25 or 50 bp cut at next week’s meeting and tomorrow’s CPI data will play a role in that decision.

- This is an archived webinar and you’re welcome to join the next one: Click here for registration information.

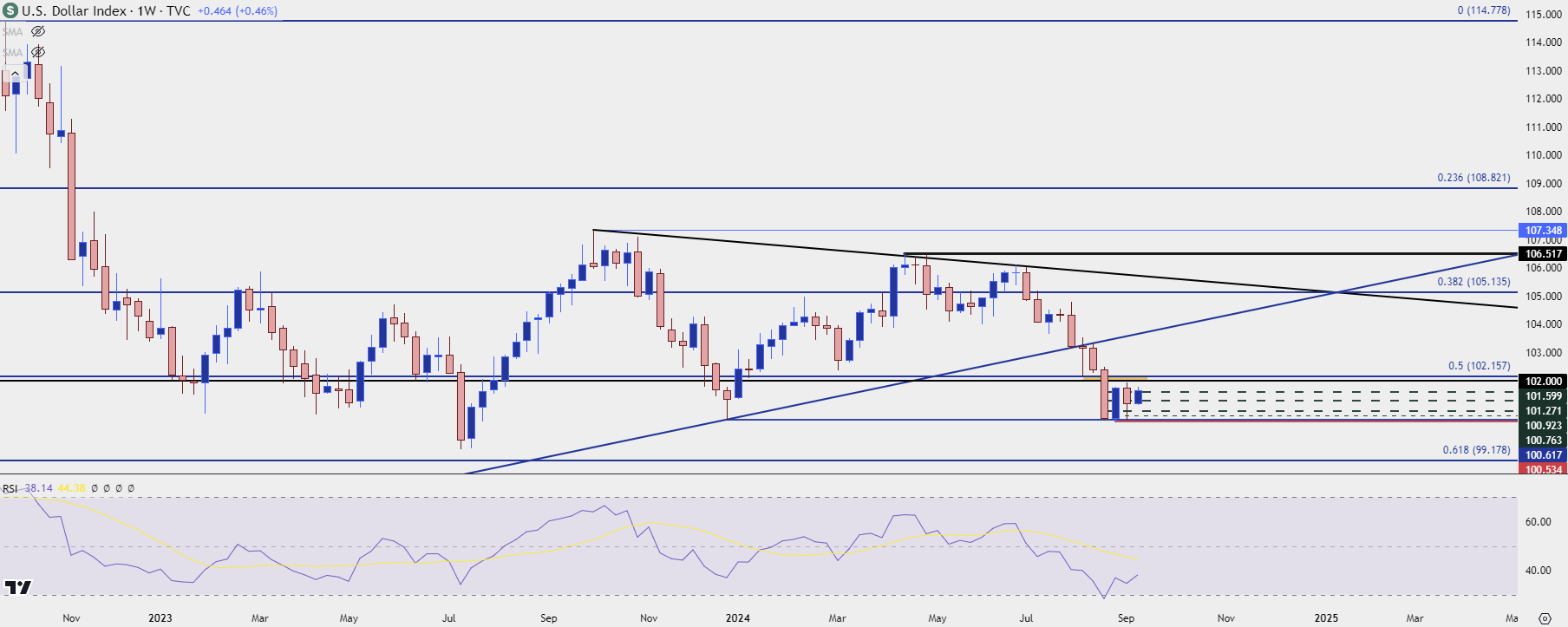

The US Dollar has continued the bounce from the oversold conditions that showed on the weekly chart in August. In the webinar, I looked at the last such episode while highlighting technical dynamics that remain in-play.

For the USD the next week and a day are key as tomorrow’s CPI release is followed by the European Central Bank on Thursday and the FOMC next Wednesday. The 102-102.36 area in DXY is of interest, as a test there would be an opportunity for sellers to show up in anticipation of lower-high resistance from the longer-term chart. But, a failure to break to a fresh low and continue the trend-down opens the door for a higher-low and a strong bullish move as the European Central Bank rate decision on Thursday could have sway on the matter. And, notably, EUR/USD hasn’t yet put in a support test of the 1.1000 handle after last month’s breakout.

Also of interest is USD/JPY, where the fundamental case for the carry trade is perhaps weaker than it’s been since the Fed started hiking rates in March of 2022. When USD was in the hard sell-off during the first two months of Q2 it was weakness in USD/JPY that was helping to drive the currency-lower.

I looked at equities in the latter portion of the webinar and for that I referenced a forecast that I had written the week before last, before sellers made a significant push last week. And I had updated levels and the backdrop for the S&P 500 this morning.

US Dollar Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist