It’s become gospel that technology is the most important sector of the US stock market; after all, tech stocks have the largest weighting in the S&P 500 (~26%), and the sector outperformed all others over the last year (+26%).

However, the technology sector, led by the so-called “FAANG” stocks (Facebook, Amazon, Apple, Netflix, and Google/Alphabet), has hit a serious speedbump over the last week or so. Last week, Facebook reported disappointing user growth in the second quarter, leading to the single worst day for any single stock in market history on Thursday, with FB dumping over $120 billion in market capitalization (-20%). Earlier this month, Netflix relayed that it had added fewer subscribers both domestically and internationally than expected, leading to a 20% drawdown of its own. Even Alphabet and Amazon, which each reported decent earnings, have been pulled lower over the past few sessions.

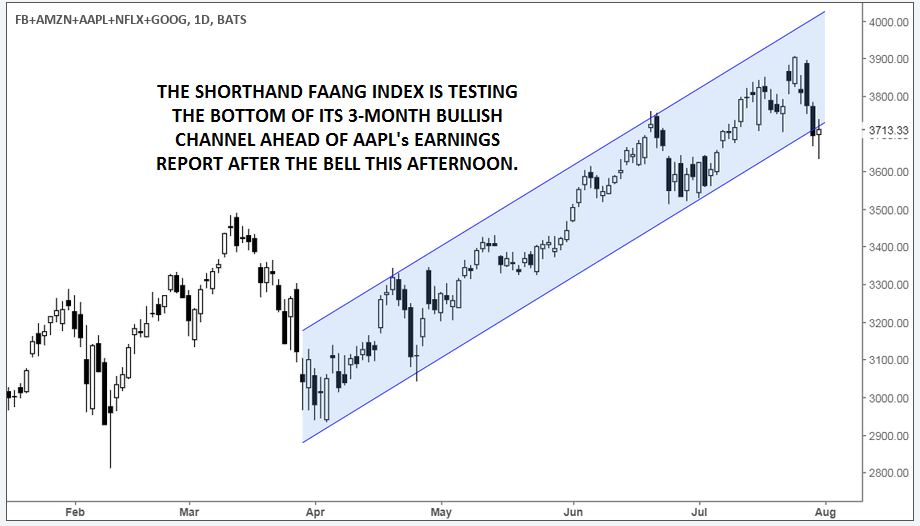

The chart below, which is simply the raw prices of FB, AMZN, AAPL, NFLX, and GOOG added together, shows that the recent downdraft has taken the stocks down to test their collective 3-month bullish channel:

Source: TradingView, FOREX.com

While this “FAANG Index” is far from scientific (it clearly underweights “lower priced” stocks like FB and AAPL at the expense of “higher priced” stocks like AMZN and GOOG), it still shows that these market leaders are collectively encountering more adversity than at any point since April.

While its certainly possible that US stocks could keep chugging higher with the FAANG stocks lagging, bulls would much rather see these tech giants participating. To that end, the world’s largest publicly-traded company, Apple, reports earnings after the bell today. Analysts are expecting EPS of $2.15 on revenue of $52.3 billion with 41.3 million iPhones sold at an average price of $699.

If the company can beat these estimates, investors could drive AAPL higher to become the first trillion dollar publicly-traded company from its current market cap of $964 billion. On the other hand, a weak quarter would represent another dose of bad news for beleaguered FAANG stocks and could take the broader S&P 500 back below its key previous-resistance-turned-support level at 2800.

One thing is clear: few serious stock market investors will be closing down their computers right at the closing bell!