November Retail Sales were 0.3% MoM for November vs an expectation of 0.9% MoM, much lower than October’s 1.8% MoM print. Retail Sales ex-autos were also 0.3% MoM vs an expectation of 0.7% MoM and a 1.8% MoM reading in October. Could it be that the highest inflation level in 40 years as finally caught up to the American consumer? Recall that the November headline inflation print was 6.8%! Although this print may give the pause to the FOMC when considering increasing the pace of tapering bond purchases, the number is still positive. The FOMC should have no reason to believe that November’s slowdown is the start of a trend. Therefore, there is no reason to expect that the FOMC will change its plans for this meeting based on the Retail Sales print.

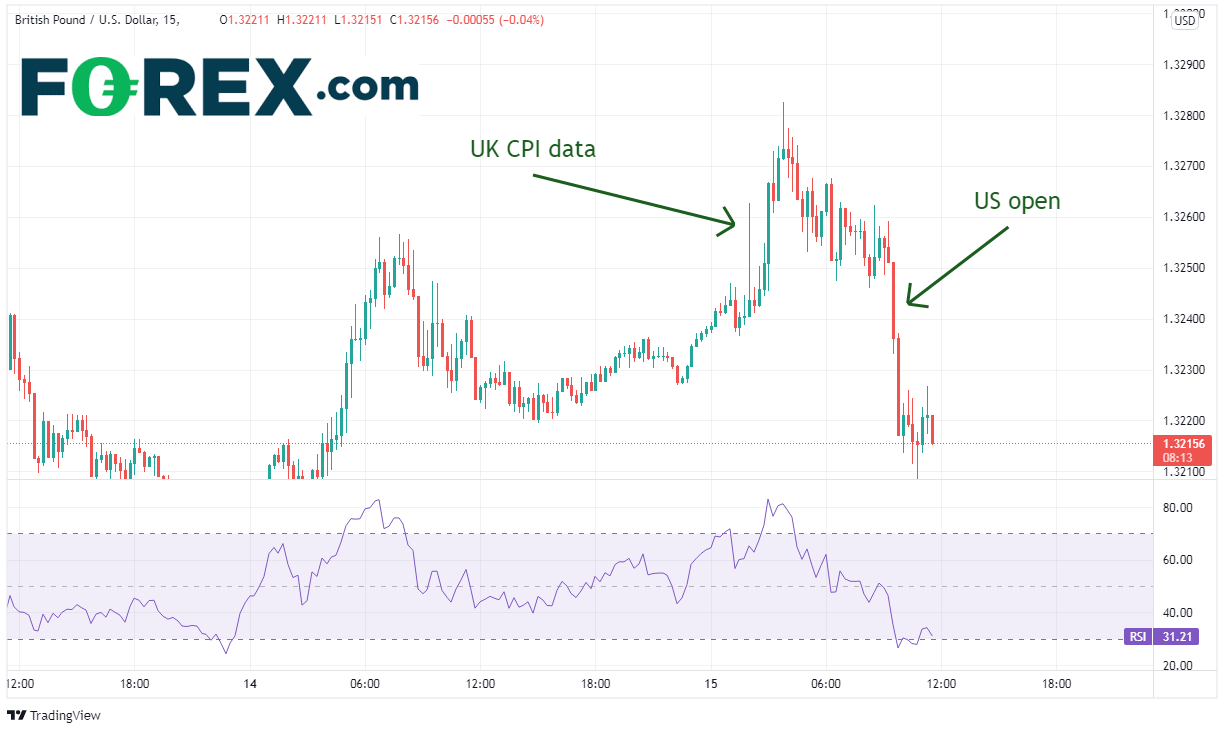

GBP/USD had initially gone bid on stronger than expected UK CPI data. As my colleague Fiona Cincotta pointed out earlier in her Two Trades to Watch, the headline print was 5.1% vs 4.7% expected and an October print of 4.2%. The core reading was 4.0% vs 3.7% expected and an October reading of 3.4%. However, as fears crept in that the Omicron variant of the coronavirus may be stronger than expected (shortly before publishing this article, the UK reported its highest one day increase in coronavirus cases ever, 78,610), the pair began moving lower. In addition, on the US open, stocks sold off in anticipation of a more hawkish FOMC, causing GBP/USD to move lower with them.

Source: Tradingview, Stone X

Trade GBP/USD now: Login or open a new account!

Levels to watch

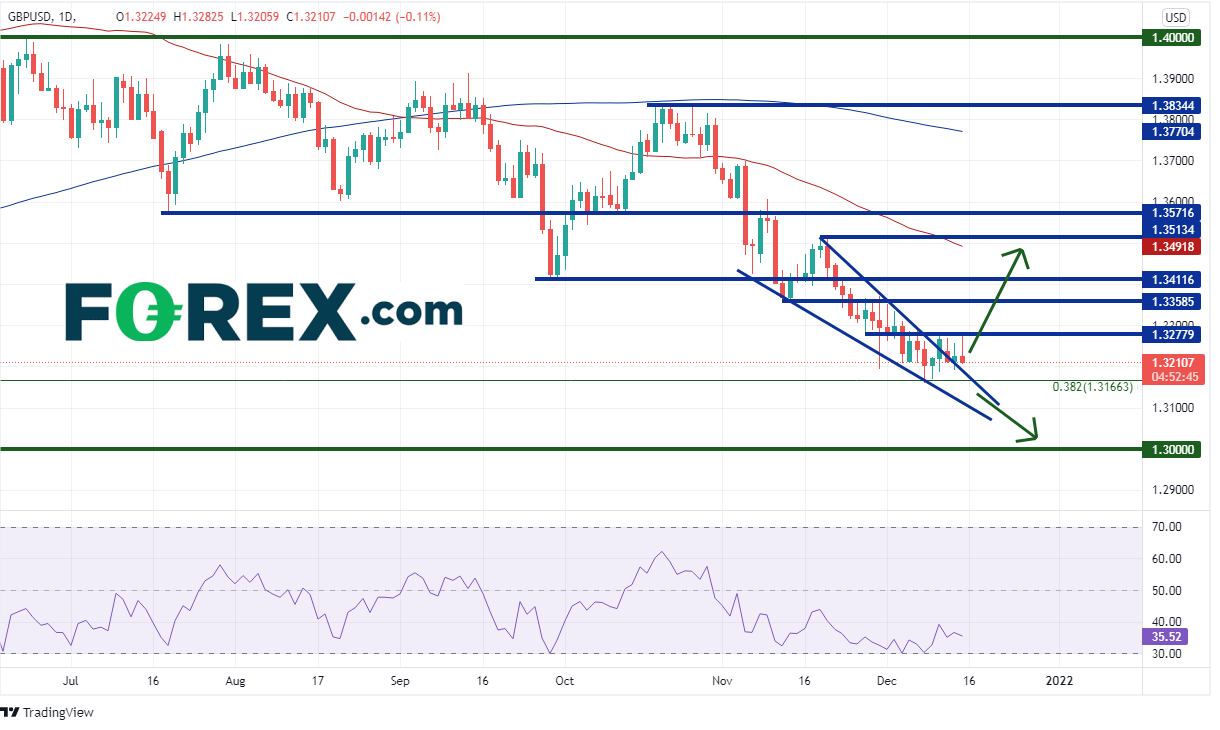

On a daily timeframe, GBP/USD has broken higher out of a descending wedge. However, it is threatening to break back below the upper trendline of the descending wedge at 1.3200. Support below is at the December 9th lows and the 38.2% Fibonacci retracement from the March 2020 lows to the May 2021 highs, near 1.3166. Below there is the bottom trendline of the wedge near 1.3105 and then the psychological round number support level of 1.3000. If the wedge holds and price moves higher, there are some well defined horizontal resistance levels before reaching the target (1.3513). They are at 1.3278, 1.3359, and 1.3412. The 200 Day Moving Average has also drifted below the target to 1.3492.

Source: Tradingview, Stone X

Heading into the FOMC meeting, stocks are lower, and the US Dollar is higher. Weak retail sales couldn’t push stocks higher (ie, thoughts of less tapering). Despite stronger CPI data from the UK, the high number of new coronavirus cases continues to rule GBP/USD. That may change after the FOMC meeting!

And don’t forget about the BOE meeting tomorrow!

Learn more about forex trading opportunities.