US Retail Sales

The US Retail Sales report showed a larger-than-expected rebound in household consumption, with sales increasing 1.0% in July versus forecasts for a 0.3% print.

US Economic Calendar – August 15, 2024

A deeper look at the report showed Retail Sales ex Autos increasing 0.4% following the 0.5% expansion in June, with the update from the Census Bureau highlighting that ‘nonstore retailers were up 6.7 percent (±1.4 percent) from last year, while food services and drinking places were up 3.4 percent (±2.1 percent) from July 2023.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

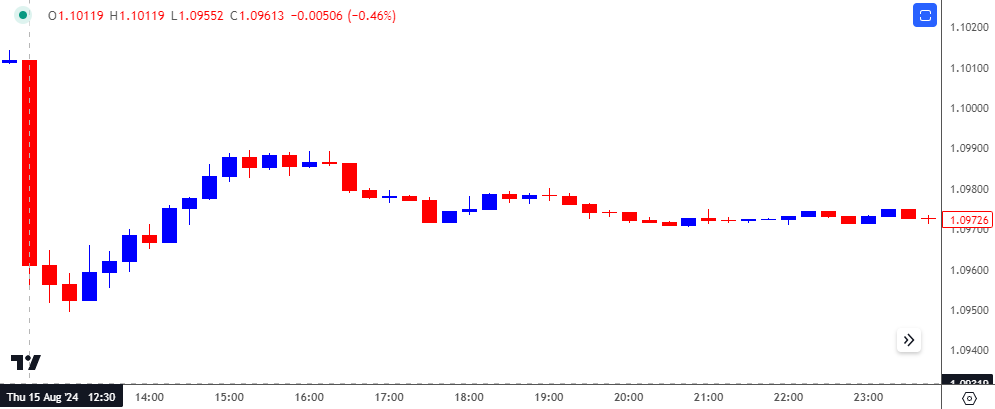

EUR/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

EUR/USD came under pressure following the stronger-than-expected US Retail Sales report, with the exchange rate dipping to a fresh session low of 1.0950. Nevertheless, the reaction was short-lived as EUR/USD closed the week at 1.1029.

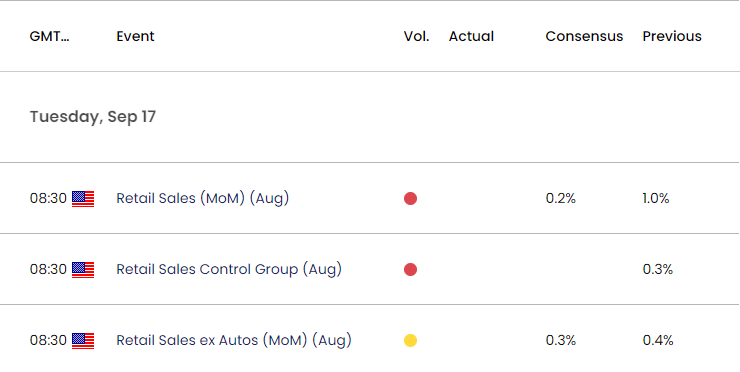

Looking ahead, US household spending is projected to increase 0.2% in August, with Retail Sales ex Autos expected to rise 0.3% during the same period.

With that said, a positive development may generate a bullish reaction in the US Dollar as it encourages the Federal Reserve to further combat inflation, but a weaker-than-expected Retail Sales report may produce headwinds for the Greenback as it raises the central bank’s scope to pursue a rate-cutting cycle.

Additional Market Outlooks

Gold Price Breakout Pushes RSI Toward Overbought Zone

US Dollar Forecast: USD/JPY Rebounds Ahead of December Low

US Dollar Forecast: USD/CAD Pushes Above September Opening Range

EUR/USD Fails to Hold in September Opening Range Ahead of ECB

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong