US futures

Dow futures -0.62% at 33513

S&P futures -0.76% at 3985

Nasdaq futures -1.27% at 11695

In Europe

FTSE -0.37% at 7747

Dax -0.47% at 15029

Microsoft disappoints; Tesla is up next

US stocks are set to open lower, with the tech-heavy Nasdaq leading the charge lower after Microsoft earnings disappoint.

The Nasdaq futures have tumbled over 1%, snapping a two-day rally after Microsoft warned of slowing growth and as earnings reports from other big names such as 3M and chipmaker Texas Instruments fueled concerns over the health of corporate America, and over the outlook for the economy across the coming year.

Worries over weak earnings outlook, combined with recession fears after PMI data yesterday showed business activity slowed for a 7th straight month are weighing on risk sentiment.

Geopolitical concerns are also adding to the downbeat mood after Germany approved the export of German-made tanks, a move that could mark an escalation in the Russian war.

Corporate news

Microsoft is falling pre-market after mixed earnings. The tech giant posted revenue growth of just 2%, its slowest growth in 6 years. Revenue was $52.7 billion, missing forecasts of $53.17 as sales of Windows and Xbox related services slumped. Meanwhile, EPS fell 12% to $2.32 but beating consensus of $2.30.

Next up is Tesla which reports Q4 earnings after the close. The EV maker is expected to report adjusted EPS of $1.13 on sales of $24.7 billion. This is compared to $0.85c on sales of $17.7 billion in Q4 2021. However, the outlook will be very much in focus as competition heats up and Tesla has cut its prices.

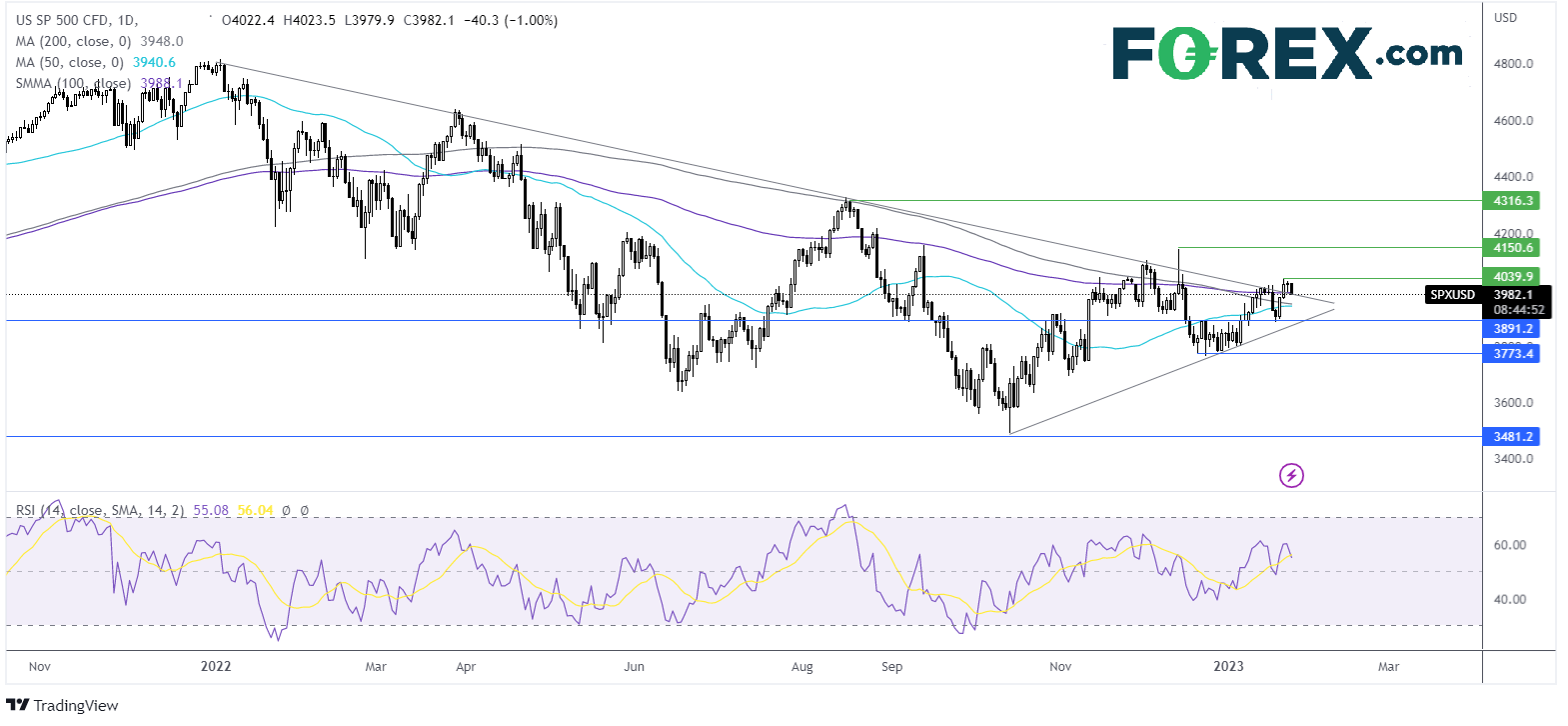

Where next for the S&P500?

After pushing above the 200 sma, the lack of conviction in the move raises questions over the markets’ ability to push the price meaningfully above the multi-month falling trendline and break above 4040, the 2023 high. A move above 4040 is needed in order to attack 4145 the December high. Bears are testing the 100 sma at 3985, a decisive break below here could open the door to the 200 sma at 3945 and 3885, last week’s low.

FX markets – USD rises, AUD rises

The USD is rising, paring some losses in the previous session. While the greenback is ticking higher, it remains close to its 9-month low as the Fed is expected to slow the pace of rate hikes in the February FOMC meeting next week.

AUD/USD is rising, outperforming major pairs after Australian inflation jumped to a 30-year high in December, raising the prospect of further RBA rate hikes. Inflation jumped to 7.8% in Q4 up from 7.3%. The Aussie briefly pushed above 0.71 to a 5-month high.

EUR/USD is slipping on USD strength and despite encouraging eurozone data and hawkish ECB comments. German Ifo business sentiment hit a seven-month high in January as business morale brightens. The index rose to 90.2, up from 88.6 in December and adds to mounting evidence not a recession in the eurozone's largest economy could be milder than initially feared.

AUS/USD +0.63% at 0.7088

EUR/USD -0.2% at 1.0868

Oil slips ahead of inventory data

Oil prices are inching lower, extending gains from the previous session following a rise in US crude oil inventories and as recession fears overshadow optimism surrounding China’s reopening.

Hopes of a strong rebound in China's demand have helped oil prices rally across recent weeks. However, a continuation of this rally really depends on how quickly China's demand bounces back this quarter. Separately, PMI data showing that US business activity contracted for a 7th straight month is raising concerns over a recession in the US, the world’s largest consumer of oil.

In the meantime, the focus has been on inventory data from the API, which showed that US oil stockpiles raised by 3.4 million barrels in the week ending January 20th; this was well up from the 1 million forecast. EIA stockpile data is due later this afternoon.

WTI crude trades -0.3% at $80.00

Brent trades at -0.25% at $85.95

Looking ahead

15:00 BoC rate decision

15:30 EIA crude oil inventories

How to trade with FOREX.com

You can trade with FOREX.com by following these four easy steps:

- Open an account, or log in if you’re already a customer

- Search for the instrument you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade