US Non-Farm Payrolls (NFP)

The US Non-Farm Payrolls (NFP) report showed a 114K expansion in July versus forecasts for a 175K rise, while Average Hourly Earnings narrowing more-than-expected during the same period as the gauge slipped to 3.6% from 3.8% the month prior.

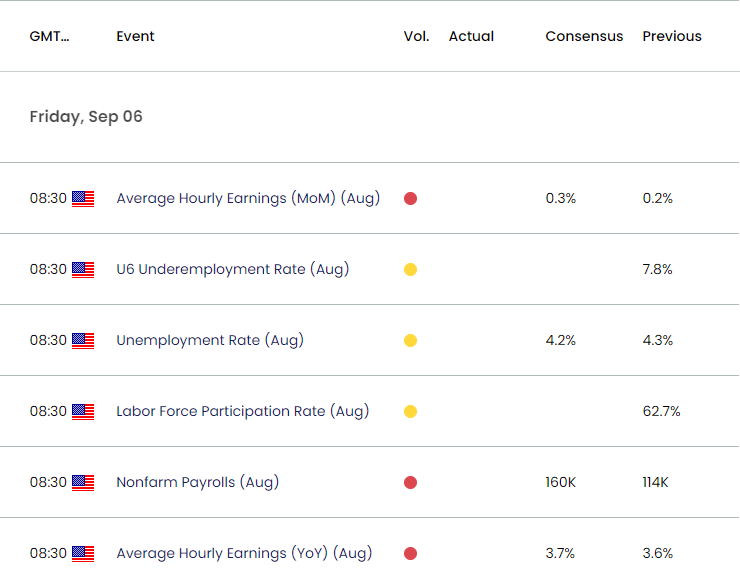

US Economic Calendar – August 2, 2024

The update from the Bureau of Labor Statistics (BLS) showed the Unemployment Rate climbing to 4.3% from 4.1% during the same period as the Labor Force Participation Rate widened to 62.7% from 62.6%, with the report going onto say that ‘employment continued to trend up in health care, in construction, and in transportation and warehousing, while information lost jobs.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

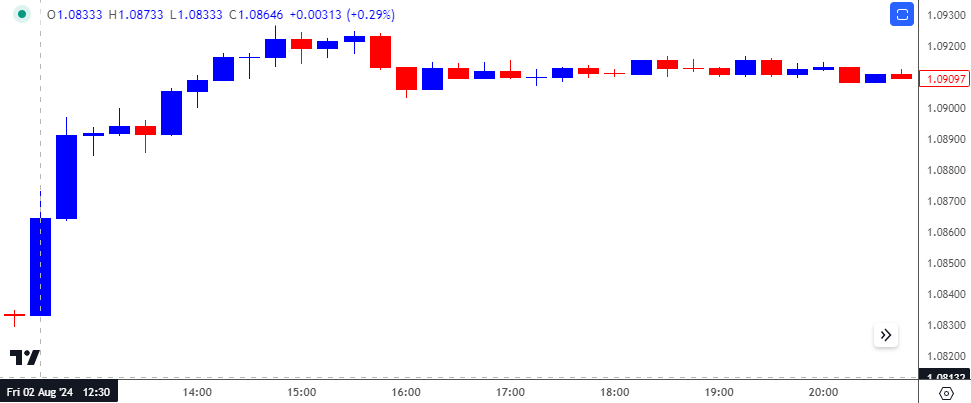

EUR/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

The softer-than-expected NFP print dragged on the Greenback, with EUR/USD rallying to a fresh weekly high of 1.0927 following the release. EUR/USD largely preserved the reaction to the US employment report as the exchange rate closed the following week at 1.0931.

Looking ahead, the US economy is projected to add 160K jobs in August following the 114K expansion the month prior, while the Unemployment Rate is seen narrowing 4.2% from 4.3% during the same period. At the same time, Average Hourly Earnings is expected to widen to 3.7% from 3.6% during the same period.

With that said, a positive development may generate a bullish reaction in the US Dollar as it raises the Federal Reserve’s scope to further combat inflation, but another weaker-than-expected NFP print may produce headwinds for the Greenback as it puts pressure on the central bank to unwind its restrictive policy.

Additional Market Outlooks

Euro Forecast: EUR/USD Opening Range for September in Focus

AUD/USD Under Pressure Ahead of Australia GDP Report

US Dollar Forecast: USD/JPY Rally Persists After Defending Weekly Low

Canadian Dollar Forecast: USD/CAD Rebound Emerges Ahead of March Low

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong