US Non-Farm Payrolls (NFP)

The US Non-Farm Payrolls (NFP) report showed the US economy adding 206K jobs in June following the 218K expansion the month prior, while Average Hourly Earnings narrowed to 3.9% from 4.1% during the same period to mark the lowest reading since June 2021.

US Economic Calendar – July 5, 2024

A deeper look at the report showed the US Unemployment Rate unexpectedly increasing to 4.1% from 4.0% in May amid an expansion in the Labor Force Participation Rate, with the rise in the participation rate suggesting that discouraged workers are returning to the labor force.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

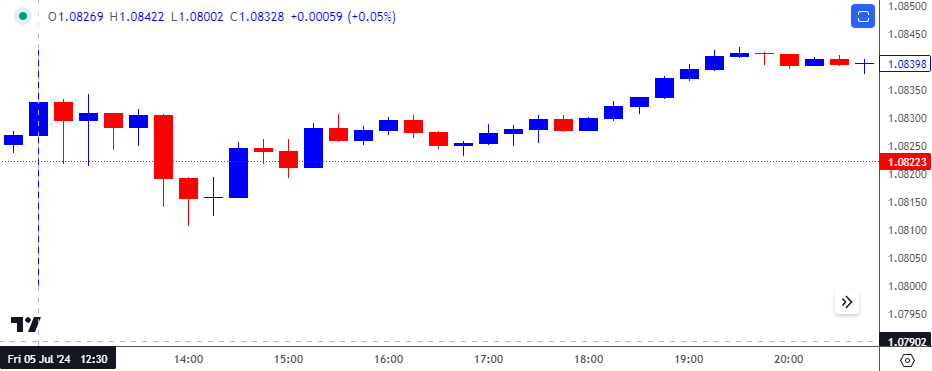

EUR/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

Despite the better-than-expected NFP print, EUR/USD whipsawed following the release as it dipped to a session low of 1.0800. Nevertheless, the initial reaction was short-lived as EUR/USD closed the day at 1.0840.

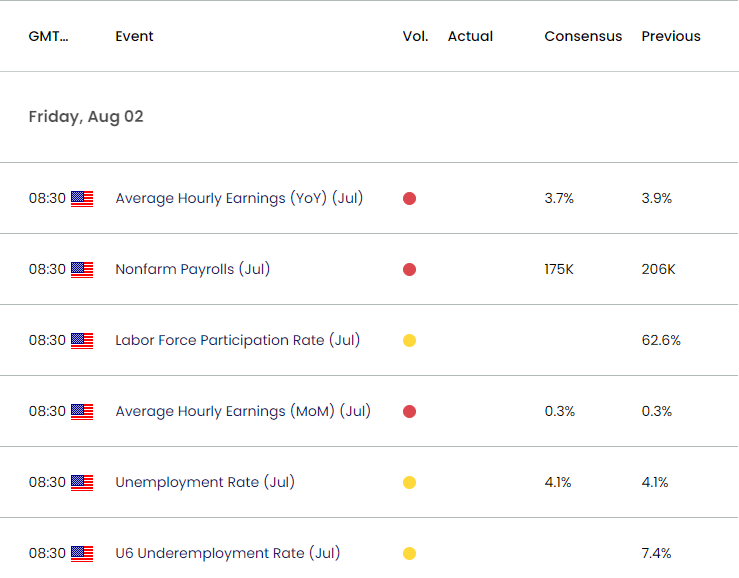

Looking ahead, the US economy is anticipated to add 175K jobs in July while the Unemployment Rate is expected to hold steady at 4.1%, and evidence of a strong labor market may spark a bullish reaction in the Greenback as it raises the Federal Reserve’s scope to keep US interest rates higher for longer.

However, a weaker-than-expected NFP print may push the Federal Open Market Committee (FOMC) to switch gears at its next meeting in September, and signs of a slowing economy may drag on the Greenback as it fuels speculation for an imminent Fed rate-cut.

Additional Market Outlooks

British Pound Forecast: GBP/USD Pending Breakout

US Dollar Forecast: USD/JPY Holds Above Former Resistance

AUD/USD Forecast: RSI Recovers from Oversold Zone

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong