ISM Services Purchasing Manager index (PMI)

The Institute for Supply Management (ISM) Non-Manufacturing survey unexpectedly slipped below 50 for the second time in 2024, with the index falling to 48.8 in June from 53.8 the month prior to indicate a contraction for the sector.

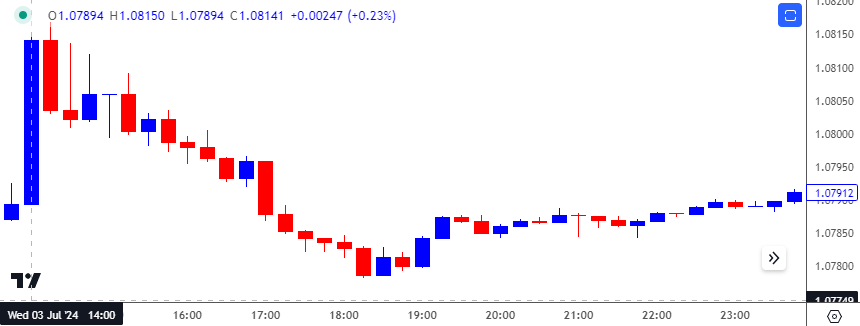

US Economic Calendar – July 3, 2024

A deeper look at the survey showed the employment component narrowing to 46.1 from 47.1 during the same period, with the index for Prices Paid also falling to 56.3 from 58.1 in May. They update also revealed that ‘the Business Activity Index registered 49.6 percent in June, which is 11.6 percentage points lower than the 61.2 percent recorded in May and the first month of contraction since May 2020.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

EUR/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

The weaker-than-expected ISM Services survey dragged on the Greenback with EUR/USD climbing to a session high of 1.0817. However, EUR/USD gave back the initial reaction as it closed the day at 1.0788.

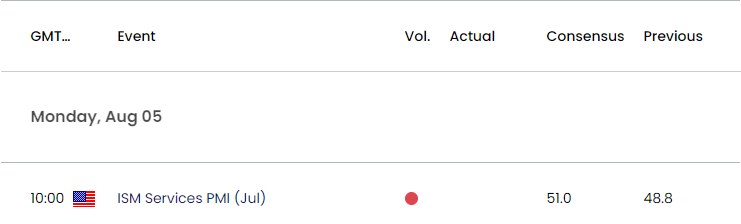

Looking ahead, the ISM Services PMI is expected to reflect an expansion for the sector as the index is projected to increase to 51.0 in July from 48.8 the previous month and signs of a resilient economy may encourage the Federal Reserve to retain a restrictive policy as Chairman Jerome Powell and Co. ‘do not expect it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2 percent.’

In turn, a positive development may generate a bullish reaction in the US Dollar, but a weaker-than-expected ISM survey may drag on the Greenback as it raises the Federal Open Market Committee’s (FOMC) scope to implement a rate-cut later this year.

Additional Market Outlooks

US Dollar Forecast: EUR/USD Opening Range for August in Focus

British Pound Forecast: GBP/USD Pending Breakout

US Dollar Forecast: USD/JPY Holds Above Former Resistance

AUD/USD Forecast: RSI Recovers from Oversold Zone

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong