US Dollar, USD/JPY, EUR/USD, US CPI Summary

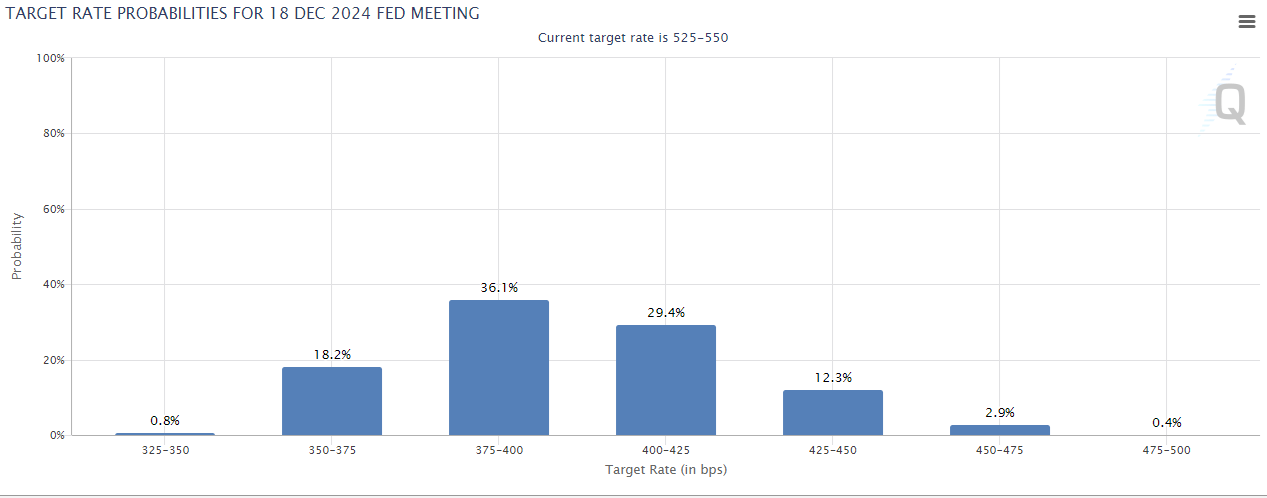

The big item for this week is the CPI release on Thursday. As we saw in November this data point had a large bearing for rate expectations and that continued in December as Powell took a dovish tone to the FOMC rate decision. Markets are now expecting as many as six 25 bp cuts this year but CPI data is expected to come in at 3.8% for Core on Thursday, which would complicate the argument for cuts beginning in March, which is currently expected to a tune of ~63%. If CPI comes out strong, this could question those rate cut bets for March and the rest of the year and, in-turn, support the bid in USD/DXY.

Risk markets ended last year on a very high note and given that sentiment, it’s difficult to find many bears in sight when it comes to stocks. This has come along with a softening in long-term US rates and that’s also shown weakness in the USD, which has been particularly noticeable since the FOMC rate decision on November 1st. If we dial back to early-October it seems like almost a completely different picture when rates were surging and stocks were on their back foot, but at the source of that shift has been the prospect of earlier and more rate cuts in 2024 from the FOMC. The big question now is whether inflation will cooperate enough for the Fed to begin that softening.

At this point there’s a 63.8% probability of at least one rate cut by the end of the March rate decision. And then going out to the end of the year, there’s a greater than 55% probability of at least six 25 bp rate cuts by the end of 2024. That’s a lot by many measures, especially in a market where stocks trade very near their all-time-highs and Core CPI remains almost double the Fed’s target.

The CPI release on Thursday will be closely watched for continued signs of the Fed’s fight with inflation. If this comes out above the expectation of 3.2% for headline CPI or 3.8% for Core CPI, rate cut bets could get priced-down and that can lead to reversion in related themes, such as the USD-weakness that’s been prominent since the November open, or the equity rally that’s taken on a life of its own over the past two months.

Large Expectations for a Very Dovish 2024 from the FOMC

Chart prepared by James Stanley; data derived from CME Fedwatch

Chart prepared by James Stanley; data derived from CME Fedwatch

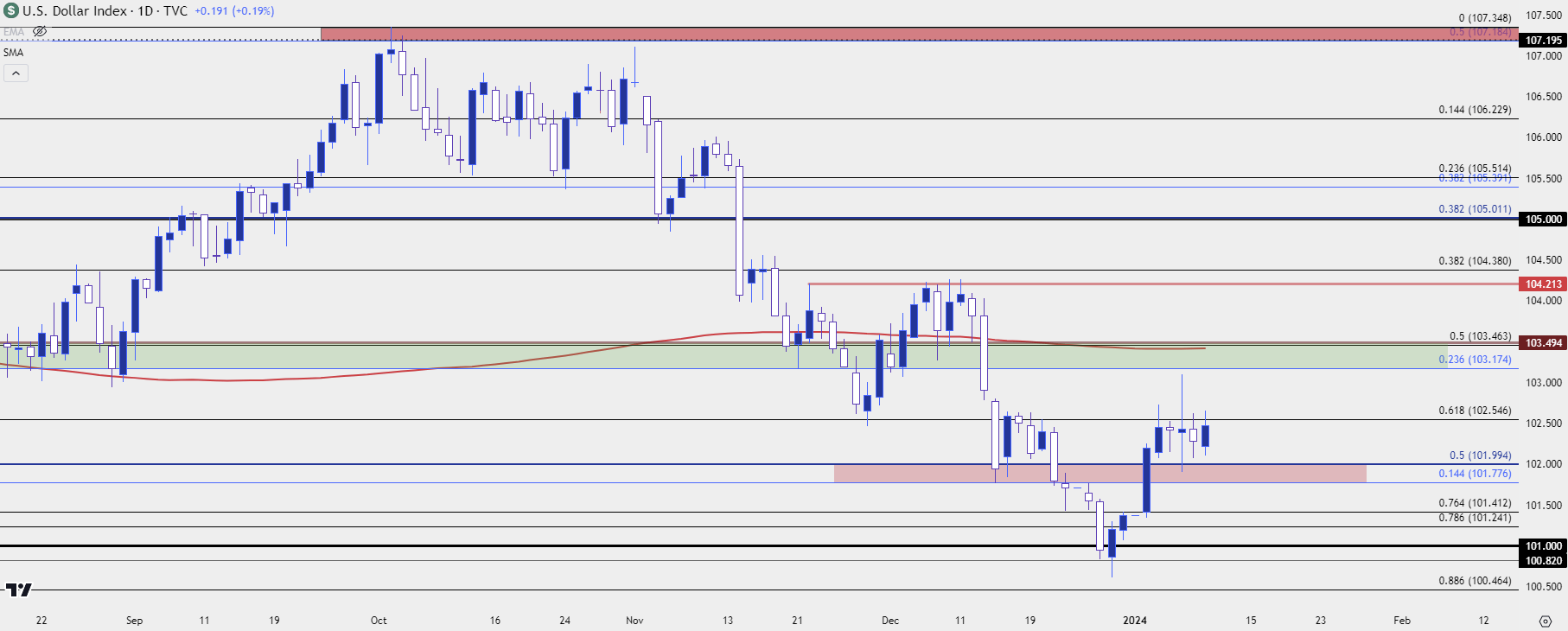

US Dollar

The US Dollar was holding a strong bullish trend as we went into the November FOMC rate decision. Prices in DXY had even made an approach at the highs ahead of that meeting, but by the end of the day buyers had evacuated and sellers started to take-over.

There was an attempted bounce in early-November from the 105.00 handle, and that was soundly faded after the November 14th CPI release, giving bears another reason to extend the trend. That led to a push down to support at the Fibonacci level around 102.50, after which another bounce developed.

That bounce was aggressively faded around the FOMC rate decision on December 13th, again, helped along as bears got another shot-in-the-arm, this time from a very dovish sounding Jerome Powell at that meeting. That trend largely continued into the final few days of the year, with support eventually showing up at the 100.82 level and leading into a bounce to begin the new year.

At this point, the past few weeks of price action in DXY look like a V-shaped reversal, and price is resisting at the same 102.55 level that had come in as support in late-November. Sitting overhead is a major zone around the 103.50 level, which is also near the 200-day moving average. If bulls can press through tomorrow’s CPI release, that becomes the next area of resistance to track.

US Dollar Daily Price Chart (via DXY, indicative)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

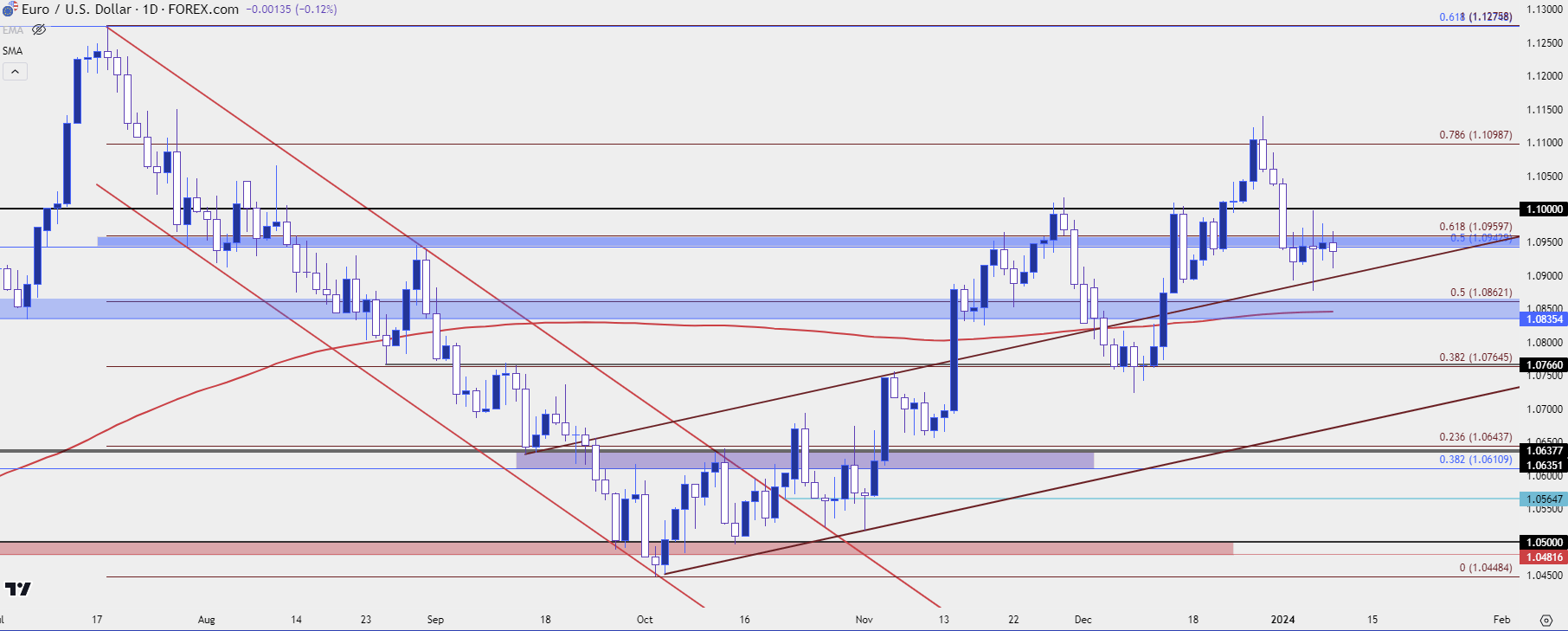

EUR/USD

Is the Fed really going to cut before the ECB?

This will probably remain as an operable question for a good portion of 1H, 2024, but when the US Dollar bullish trend was pricing in from July into October, a major push point was weakness in the Euro. The Euro is 57.6% of the DXY, after all, so in many cases it’s difficult to forecast a trend in one without at least some participation from the other. And one of the major factors that seemed to flip in Q4 was the pricing-in of more rate cuts and a faster softening path out of the US. The question now is whether that theme was over-done and whether there’s some reversion on the horizon?

EUR/USD put in another 1.1000 test on Friday after the ISM release but sellers showed up soon after to hold the highs below that level. The Friday bar is a long-legged doji that continues to define the range in the pair, and as I shared in the webinar there remains a bullish bias as taken from the daily chart as we’ve seen a continued progression of higher-highs and lows.

But this could shift quickly: There’s another support zone a little lower, around 1.0835-1.0862, and if price pushes down there and is met with buying support, the bullish trend retains potential. But if buyers cannot hold that zone – and price pushes below the 200-day moving average, then the next support is the 1.0766 area that was last in-play in early-December, and this would open the door to lower-high resistance at prior support, in the same 1.0832-1.0865 zone that’s potential support.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

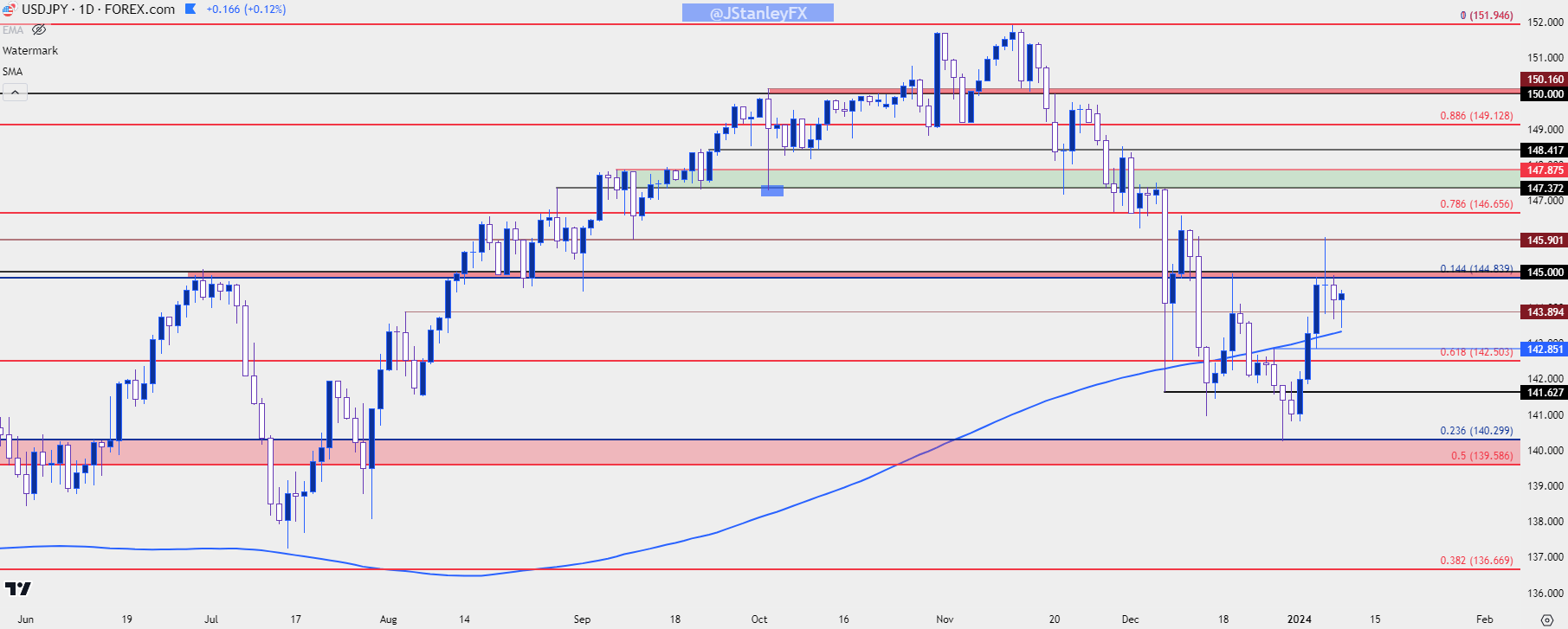

USD/JPY

While the Euro is 57.6% of the US Dollar via the DXY basket, the Japanese Yen plays a fairly large role, as well, with a 13.6% allocation. But what’s interesting here is the juxtaposition of the pair given the stance at the BoJ, where no changes have been made since the onset of the Covid pandemic. While many other central banks lifted rates to ward off inflation, Japan has welcomed the inflation and they’ve seemed almost reticent to endanger that; and given the decades of struggle with deflation and disinflation, that caution can be understandable.

But – if the US Dollar has topped and if we are going to see all those expected rate hikes come in this year, the short side of USD/JPY could remain as an interesting venue.

The propellant for the bullish trend was carry: As the US was lifting rates and the BoJ was standing pat, the amount of rollover or swap for holding long positions in the pair continued to increase. And then as more and more people started following the carry, demand outstripped supply and this led to a bullish trend.

At that point traders could profit from both the increased rollover payment and the continuation of the bullish trend. When it works, it can work very well as it’s a symbiotic market theme. This also explains the ramp in the pair from 2021-2022; but as we saw in Q4 of 2022 it can fast become a game of cat and mouse when matters begin to move in the other direction.

If the prospect of reversal becomes more prominent, traders riding that trend aren’t likely to wait around. And it’s like the old saying about smoke in a movie theater, the exit door is only so wide so would you really want to wait?

When this happened in November of 2022 there was little waiting as bulls hurriedly bailed on the trade, leading to a 50% retracement of a trend that took 21 months to build – in three months. In 2023, a similar backdrop appeared where the USD began to congest in October followed by pullback in November, pushed along by a lower-than-expected CPI report.

The difference between the two scenarios is the USD, as the US Dollar plummeted in November of 2022 and that was very much helped along by rising rate bets in Europe or the UK. That hasn’t happened here and going back to the first question in the EUR/USD section, the ECB may be cutting before the Fed this year and that has likely restrained USD bears from going for a heavier move and, in-turn, this has helped USD/JPY to avoid plummeting the way that it did in Q4 of 2022.

So, if we do end up with a continuation of USD-weakness there could be more room to go with the bearish theme, similar to what played out in late-2022 price action. Or, alternatively, if we see rate cut bets out of the US getting priced-out again, similar to what was showing as we came into October, then those reasons for USD/JPY bears to jump on the short side could whittle down, and like we’ve seen so far in 2024 trade, the snap back move can similarly be aggressive.

As I had said in the webinar, it seems that USD/JPY is like an amplification of USD themes at the moment and this could remain a viable way to impose strategy on USD or DXY.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist