US Dollar Talking Points:

- Large moves have priced-in with a concerted push after the release of CPI data this morning. I had highlighted similarities around the US Dollar and related markets in yesterday’s article, and so far, those themes are playing out in a very similar manner.

- The question now, of course, is continuation potential. In November of last year, it was a CPI print released on November 10th that brought bears into USD and they controlled the trend for much of the next three months.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

Has the US Dollar topped for 2023?

That’s a question that well likely hear more about in the coming weeks and given this morning’s sell-off, the answer is looking at least a little clearer at this point.

To recap, the US Dollar showed a false bearish breakdown in July, and that was followed by immense strength that lasted for 11 consecutive weeks. Such a run is rare, as there’s only been one other instance of this in the US Dollar over the past 20 years; and USD remained strong coming into October trade.

After finding resistance at the 50% mark of the pullback move that started last year on October the 3rd, the USD began to stall and spent the entirety of last month building a mean-reverting range. But there was a bearish tinge as there were a series of lower-lows that had priced-in. This kept bulls on their back foot and started to get bears more and more anticipatory of an eventual pullback move.

Yesterday, DXY was holding a lower high after a recent lower low; and given the CPI report on the calendar for this morning an analog appeared. Because the US Dollar followed a similar script last year, with exuberant strength through September trade, only to congest in October; and then a knock-out punch from a CPI report that allowed bears to finally push for a fresh downside trend.

Well, this morning continued that theme as CPI came out at 3.2% against a 3.3% expectation, and that’s brought USD bears into the mix as the currency has dropped to a fresh two-month-low. The move is somewhat stretched on a short-term basis, and there’s a possible support level around 104.03. Below that, a major zone exists at the 103.50 area as this is the 50% mark of the bullish trend that started in July.

US Dollar Daily Chart (indicative only)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

USD Strategy

At this point there’s a fresh lower-low and the move has already been sizable for today, so chasing could produce challenges. The big question here for bearish continuation scenarios is how aggressive sellers might remain to be, and in a related matter, how aggressive EUR/USD bulls might be, as that’s been somewhat of an issue over the past month.

For the US Dollar, there’s nearby resistance potential at the Fibonacci level of 104.38, and then it’s that major zone that runs from 104.70-105.00.

On the underside of price action, 103.50 remains a major spot for DXY. This is the 50% mark of the recent rally, and it’s also confluent with a prior double top formation that led into that July breakdown attempt.

US Dollar Eight-Hour Price Chart (indicative only)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD There’s the Pullback Move

In September that price was coming into the picture after a very consistent run from bears. Around that time the RSI indicator had went into oversold territory for the first time since before the pair had bottomed a year earlier.

In early-October trade there was the continued build of pullback potential, as there were a series of higher-lows that posted, with 1.0482 coming into play on NFP Friday, which led to a 1.0500 support hold a week later. For the week of FOMC, bears couldn’t even get down to 1.0500, which led to another higher-low.

The problem along the way was that bulls seemed reticent to hold the bid for long. Each topside breakout would soon stall, and price remained within the bullish channel without buyers able to stretch.

Until this morning, that is, and prices in the pair have now broken out to fresh two-month highs.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

Just like USD above, there’s a fresh break and the big question now is continuation potential. In EUR/USD, there’s an obvious level of higher-low support potential that can be taken from prior resistance. This plots around the 1.0750-1.0765 area on the chart. For more aggressive stances, there’s a possible support level as taken from prior resistance, around 1.0809.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

Cable Crush

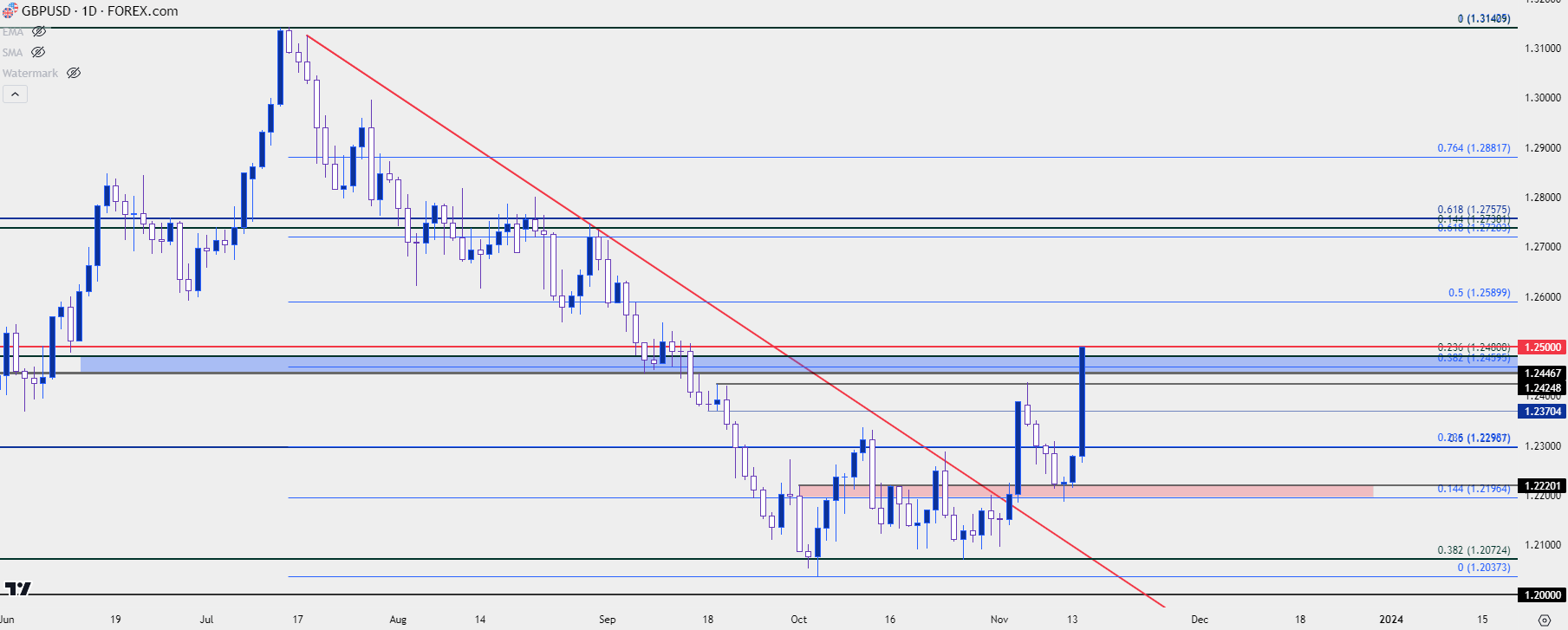

While EUR/USD was showing more signs of life in October, that wasn’t the same case in GBP/USD. Cable spent much of last month with price action narrowing deeper and deeper into a longer-term digestion pattern.

The pair finally started to wake up after the Fed on November the 1st, with a boost from the Bank of England Super Thursday rate decision. This finally led to a fresh higher-high and as of last Friday, price was holding a higher-low at a prior zone of resistance.

Yesterday saw the completion of a morning star formation and today has seen a strong run off that. This has catapulted price into the 1.2500 handle and this could be a big spot of resistance for the pair.

For bulls, this could be a difficult area to chase price. There is support potential at 1.2447, 1.2428 and then 1.2370. If none of those hold the lows, then there’s a confluent spot around the 1.2300 handle that remains of interest.

GBP/USD Daily Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

USD/CAD

USD/CAD broke out of a multi-year symmetrical wedge a few weeks ago. Price ran up to a fresh yearly high but couldn’t make much ground beyond the 1.3850-1.3900 area on the chart. That held the highs and pulled price back towards the formation and then another major level came into play, as the Fibonacci level at 1.3652 came into hold the lows yet again.

That’s a big price and it’s been in-play on USD/CAD in numerous ways this year; first as resistance in February and then support in March, only to become resistance again in April, and May and then again in September.

At this point, it’s the recent higher-low so if bears can penetrate below that level there could be deeper mean-reversion potential. Below that, there remains support potential at the 1.3575 and 1.3500 levels.

USD/CAD Weekly Price Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

Chart prepared by James Stanley, USD/CAD on Tradingview

USD/JPY

If the US Dollar has topped – and that’s still an ‘if’ at this point – there could be some items of interest in USD/JPY.

That was a big assist last year for the Bank of Japan. The BoJ had intervened in October of last year when USD/JPY made a fast run at the 152.00 level. But – that intervention could merely pause bulls, it couldn’t bring the reversal. The reversal didn’t begin until November 10th – the morning of that CPI release. And then for the next three months USD/JPY went on to continue the pullback, wiping away 50% of the move that took 21 months to build – in three short months.

The carry is still tilted to the long side on the pair. But if there’s a realistic expectation of principal losses, well that carry might not matter so much, and this could lead to a fast unwind scenario as those that bought in anticipation of carry hurriedly close positions for fear of losing principal.

So this remains an item of interest around USD themes, particularly if we see USD-weakness taking on more of a role into the end of the year.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

Gold

In the webinar I again cautioned against correlations, as the often-expected inverse correlation between gold and the US Dollar can oscillate.

But with this recent pullback in rate hike odds we’ve seen gold prices put in a strong bounce from support at the 1932 level. And given dynamics around the FOMC of late, it’s become obvious that this is at least a factor of importance to gold markets.

The 1947-1953 zone remains key in spot XAU/USD. This was generated from swing highs in September and has more recently come back into the picture as support last week and then resistance yesterday. If bulls can hold higher-lows above that zone, the door remains open for topside potential.

Gold (XAU/USD) Eight-Hour Price Chart

Chart prepared by James Stanley, Gold on Tradingview

Chart prepared by James Stanley, Gold on Tradingview

SPX

A few weeks ago when equities were still mired in a sell-off, I shared my opinion that I thought a Santa Rally would still remain as a possibility. Behind this idea was the fact that despite the Fed’s rate hike trajectory over the past couple of years, we haven’t really seen anything ‘break.’ Sure, we had crypto concerns a year ago when the FTX fiasco came into the news. And then in March, there was the trembling around regional banks but, similarly, it looks as though that’s been addressed to a degree.

So, whether the Fed hikes another 25 bps or not, is there a significant amount of difference on the horizon?

More to the point, however, is when the Fed does signal that rate hikes are done and rate cuts are on the way, that could trigger a bull run in bonds. And that’s something that could show as a hindrance for equities, but that seems to be more of a 2024 problem for now, as it did to me a few weeks ago.

The issue now is that stocks have run so aggressively over the past couple of weeks that there’s been hardly an opening for longs to jump on board. The S&P 500 is trading above 4500 at the moment and that’s 9.7% above the low from just three weeks ago.

There’s support potential around prior swings in the 4462-4469 area, and then another around 4403-4417.

S&P 500 Weekly Price Chart (indicative)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist