US Dollar Talking Points:

- The US Dollar is putting in its largest bearish move on the daily chart since last November, right around the time that USD bears began to take-over.

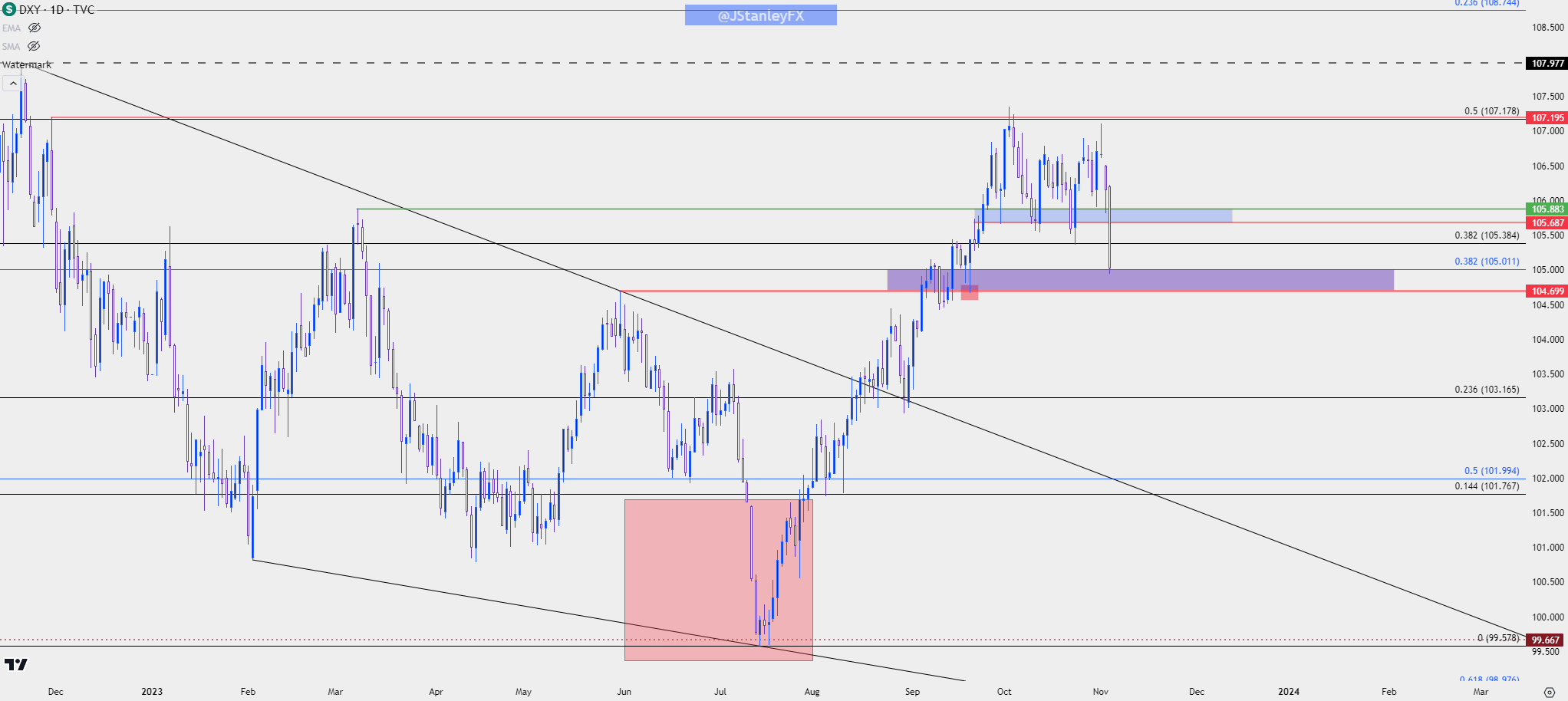

- There’s been a strong response across the FX-spectrum after the Wednesday FOMC meeting. DXY was holding a gain going into that daily bar but the FOMC meeting helped to build a gravestone doji as bulls fled, and that weakness continued to take-hold through the remainder of the week.

- USD is now re-testing support at a major spot on the chart around the 105.00 handle in DXY. The natural question here is whether the DXY has topped and the answer to that will likely have some relation to whether or not EUR/USD bulls can start to exhibit a bit more control of the trend.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

The US Dollar came into the month of October with a full head of steam, riding a trend that amounted to 11 consecutive weekly gains. This is rare, as it’s only happened once in the past decade. The USD hit resistance at the 50% retracement of last year’s pullback in early-October and then spent the rest of the month grinding back-and-forth, with bulls continually failing to push up for a re-test of that resistance level.

And it’s taken awhile, but USD bears have finally been able to get some run after a really big week with the FOMC rate decision on Wednesday and NFP on Friday. The natural question after a move of this nature, following a couple of major drivers, is whether it’s the start of a fresh trend. And if we draw back to last year this would resemble the way that USD had pulled back then, with price initially stalling before a piece of data helped to bring bears back into the mix. In the USD that happened last year on November 10th with a CPI print.

There’s still a significant amount of support below current price action that bears will need to work through if they want to that to come to fruition. At this point the USD has already pulled back for a test of support at the 105.00 level, which is the 38.2% retracement of the 2021-2022 major move. I have that spanned down to 104.70 to mark a support zone.

US Dollar Daily Chart (indicative only)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

USD Longer-Term

Taking a step back to the weekly highlights that stall that took over in October, and it also puts some relative scope behind the pullback that we’re seeing right now.

The breach of support and the test of fresh lows looked at on the daily chart above could be opening the door for bears, but they will still have to push to further take control of the matter. The 38.2% Fibonacci retracement of the recent rally plots at 104.38 and if bears can push below that, reversal themes can begin to take on more attraction, with the 50% level from that same Fibonacci study as the next spot of longer-term support.

But – on the other side of the matter the USD has seen strong showings to support over the past month while that stall was pricing-in and with another big zone coming into play after NFP today, there’s still a valid case for bullish reversal potential of the short-term theme, focusing on the bigger picture and the possibility of bullish continuation in the USD.

The weekly bar is currently working on a bearish outside week which, if complete, puts bears in the driver’s seat for next week.

US Dollar Weekly Price Chart (indicative only)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD

Can Euro bulls finally put in some lift?

The answer to this question likely has some relation to the above question in the USD, and as I’ve been talking about over the past month, I’m of the opinion that one of the reasons that the US Dollar hasn’t been able to muster a deeper pullback is the fact that Euro bulls seemed disinterested in re-taking control of the trend.

This remains a tenuous manner as each bullish breakout over the past month has been aggressively faded and it remains to be seen as to whether the current break will meet the same fate. There is a bit of hope, however, as price is pushing out of the bullish channel that’s built since the 1.0500 support test came into the picture a month ago.

There’s a major resistance test on the way at 1.0766, which is a prior swing-low-turned-swing-high that is confluent with the 50% mark of the recent sell-off. This is a big spot for next week and if bulls can punch through then the door opens for a test of the 50% retracement that plots at 1.0862.

That’s a spot to investigate for invalidation of the broader bearish trend if/when that scenario comes into the picture.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

GBP/USD

Cable is putting in a strong topside move to go along with this push of USD-weakness. I had written about this on Wednesday just after the FOMC, highlighting a higher-low that had showed around a Fibonacci level. We then had BoE with a Super Thursday rate decision the day after, and the pair has put in an explosive bullish move after the release of this morning’s NFP report.

With a move of this nature there was likely a lot of short covering taking place after the dominant trend stalled for more than a month. And given proximity to the 1.2000 big figure, it made sense as to why sellers may have lost motivation.

At this point price is nearing re-test of another key spot of resistance on the weekly chart, which begins around 1.2467 and runs up to a Fibonacci level at 1.2482. There’s a spot of interest for support potential around prior resistance, drawn from prior swings at 1.2308-1.2338. If bulls can hold that in the early-portion of next week, this can function as a higher-low for scenarios of bullish continuation.

GBP/USD Weekly Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

USD/CAD

USD/CAD has had an interesting week. The pair put in a strong bullish breakout in the prior week and ran up to a fresh yearly high on Monday to test the 1.3900 level. I had looked into this on Monday, and as I had warned bulls had a tough road ahead for continuation. But there were also a number of possible supports that could’ve come into play if bulls did want to continue that trend. And the two supports nearby were shredded through, with the third spot coming into play in late-Friday trade.

That’s a major spot at 1.3652, which is a Fibonacci level that’s had considerable interest as both support and resistance throughout this year.

While near-term momentum is difficult to ignore, this is a major spot and as you can see from the weekly chart below, there was some considerable resistance that had priced-in here previously. So if bulls can hold the lows in the early-portion of this week there could remain bullish trending tendencies. But, if the fail to hold support around that 1.3652 spot, 1.3500 becomes the next major spot of interest for the pair.

USD/CAD Weekly Price Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

USD/JPY

I think the Bank of Japan is probably pretty happy as they go into the weekend. The BoJ had a rate decision earlier in the week and when the bank did not address rates or make any veiled threats of intervention, and the pair hurriedly jumped back above the 150 mark.

The USD weakness that took over after FOMC and NFP, however, made a noticeable dent in the matter as the pair was slammed back-below the big figure. And this is somewhat of the scenario that showed last Q4.

Last year the BoJ intervened to defend the 150.00 spot on USD/JPY. The pair pulled back after that but what’s important here is that the bulk of the reversal priced-in almost a full month after the intervention. With hindsight it looks like the reversal was entirely intervention-driven but the timelines don’t seem to fit that explanation.

Instead, it’s the prospect of carry unwind that I think is the brightest theme for bears at the moment; because as long as monetary policy remains tilted in the direction that it is, there can remain a bullish bias on the pair (in the direction of the carry). But if there’s the prospect of principal losses, such as there was last year when the USD was reversing on the back of lower CPI prints, then that carry can unwind very quickly.

From the weekly chart below, we can see USD/JPY working on a bearish engulfing formation which points to the possibility of a larger bearish reversal move, but there will be the need for follow-through from sellers next week.

USD/JPY Weekly Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

As noted above the carry remains tilted to the long side of the pair and that certainly remains a factor. This becomes less important in an environment of falling US Dollars, however, as the prospect of principal losses can not only dissuade fresh longs, it can also motivate current longs to close, which can create more supply which can lead to falling prices.

This is similar to the way USD/JPY reacted after November 10th of last year. And that bearish theme hung around until mid-January, when bulls finally returned to the matter to show support at the 50% mark of the 2021-2022 major move.

So, the question around USD/JPY for next week is whether the USD pullback hastens; and if it does USD/JPY may turn out to be one of the more attractive setups for bearish USD as carry trades unwind for fear of deeper principal losses.

But bears will have to drive through some supports that have been important of recent. From the below daily chart we can see that structure, with price maintaining a bullish trendline that’s currently confluent with an 88.6% Fibonacci retracement at 149.13. Below that, 148.42 remains of interest, and this is followed by the current monthly low at 147.32.

If sellers can take out that level, that would be a show of greater control which can then open the door for supports at 146.66. 145.90 and then the 145.00 big figure.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist