US Dollar Talking Points:

- The US Dollar is limping into the close of 2023 much like it limped into the close of 2022.

- While the USD was digesting for much of the first half of the year, DXY began to shake in 2H as a false breakdown in July led to a strong pattern of 11 consecutive weekly gains. After spending much of October mean reverting, the Dollar snapped back in November and has continued to push lower as markets have begun to gear up for rate cuts from the Fed in 2024.

- Questions abound around recessionary potential in Europe and one of the larger items on the FX-front for 2024 is the Japanese Yen, both items are addressed below.

With a week left in 2023 trade markets are continuing to push the US Dollar lower. This extends the reversal that began in early-November, on the back of the FOMC rate meeting that day, which stands in stark contrast to the bullish trend that had drove into October trade. And really, this resembles last year in a few key ways: There was a strong trend that held through September, with the USD beginning to congest in October with a bias towards bears, which then broke down aggressively in Q4 after a massive push following the release of CPI reports in November.

I had talked about this ahead of the inflation release a couple of months ago and there were parallels that could be drawn to both EUR/USD and Gold. And in the wake of that release, both markets broke out and continue to show continuation potential.

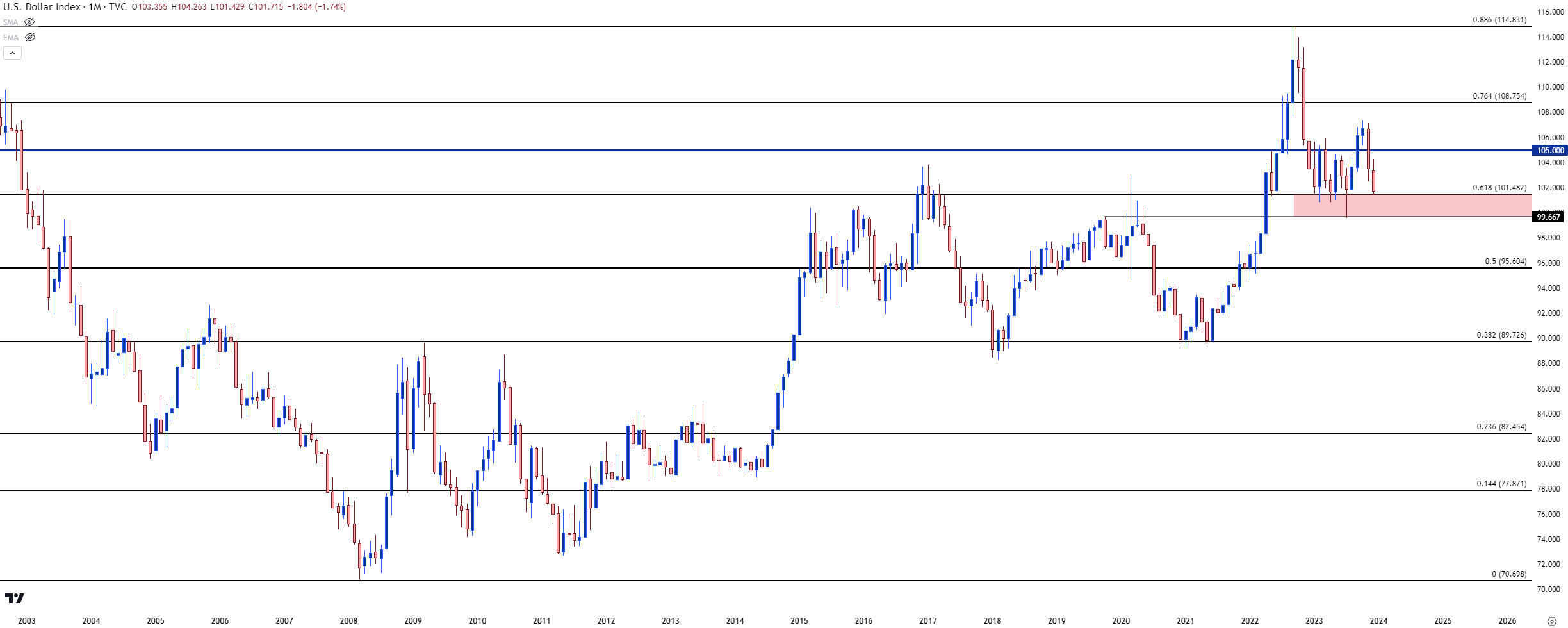

From the monthly chart of USD below, we can see price making a fast push down to a key level, the 61.8% retracement of the 20-year move in the DXY. The level at 101.48 was in-play practically all year, coming into the picture in January of 2023 and holding support for numerous months before the false breakout in July. But now we’re back down there…

US Dollar Monthly Price Chart (indicative)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

USD Rally Extinguished in Q4

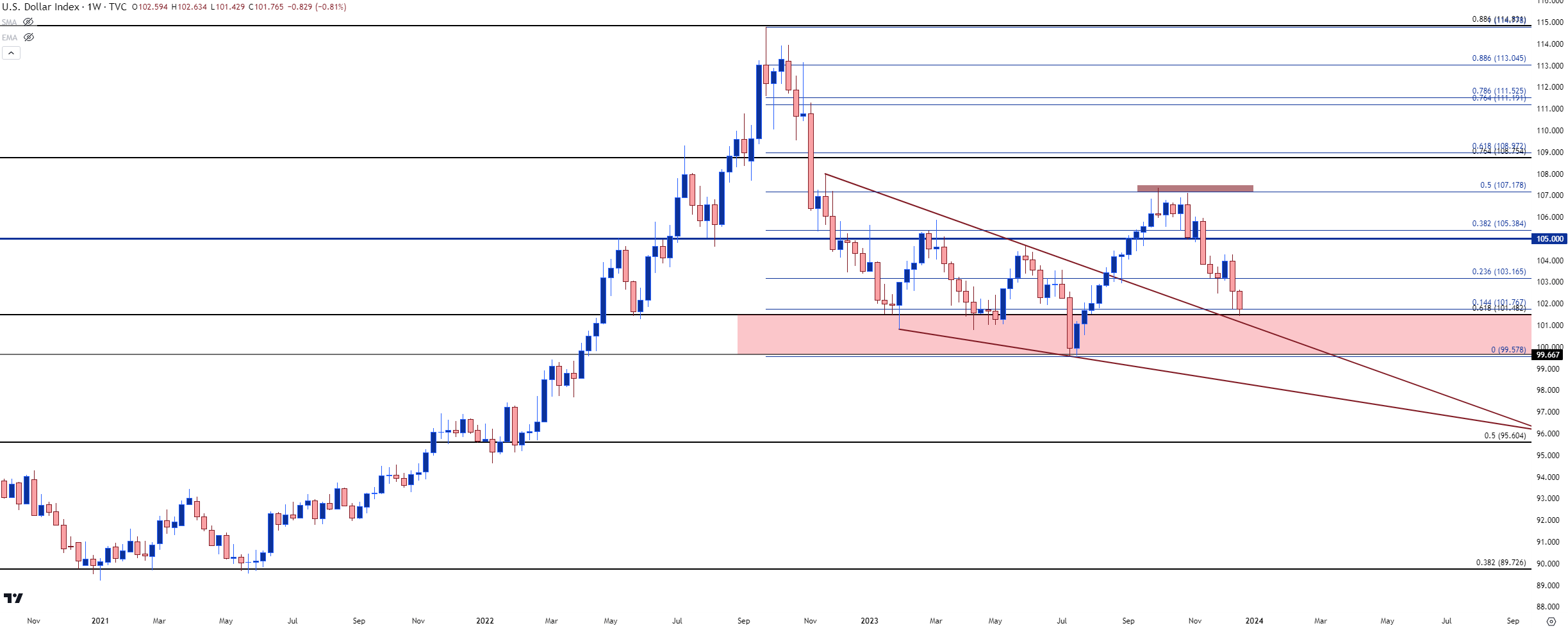

The attempted bearish breakdown in July was quickly faded, and that pushed into that 11-week pattern of gains until, eventually, the USD found resistance at the 50% mark of the pullback move that started last year. And bulls continued to try to push the move through October, but they could never get over that hump at the 50% mark; and then sellers went to work shortly after the November open.

From the weekly below, the trend has been clear, and bears are pushing into 2024 with control of near-term price action in the USD. But their path ahead is not without challenge as we saw from the continued build of support throughout the year at that 61.8% Fibonacci retracement, which remains an issue until sellers can force a decisive push below the 100 psychological level on DXY.

But, perhaps a more pertinent question when discussing longer-term technical trajectories is the implication of fundamentals. One of the major driving factors in this bearish move in the USD has been the possibility of rate cuts in the US; and after the ECB said that they’re not yet discussing cuts and the BoE saying that they’re expecting to hold rates at a ‘sufficiently restrictive’ level, there’s been a clear dichotomy in rate expectations of recent. But – can that last? The European economy moves into 2024 with a number of question marks and if we do find ourselves in an environment where the Fed is forced to cut in March, would the ECB be left unscathed while retaining a relatively-hawkish stance?

US Dollar Weekly Price Chart (indicative)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD

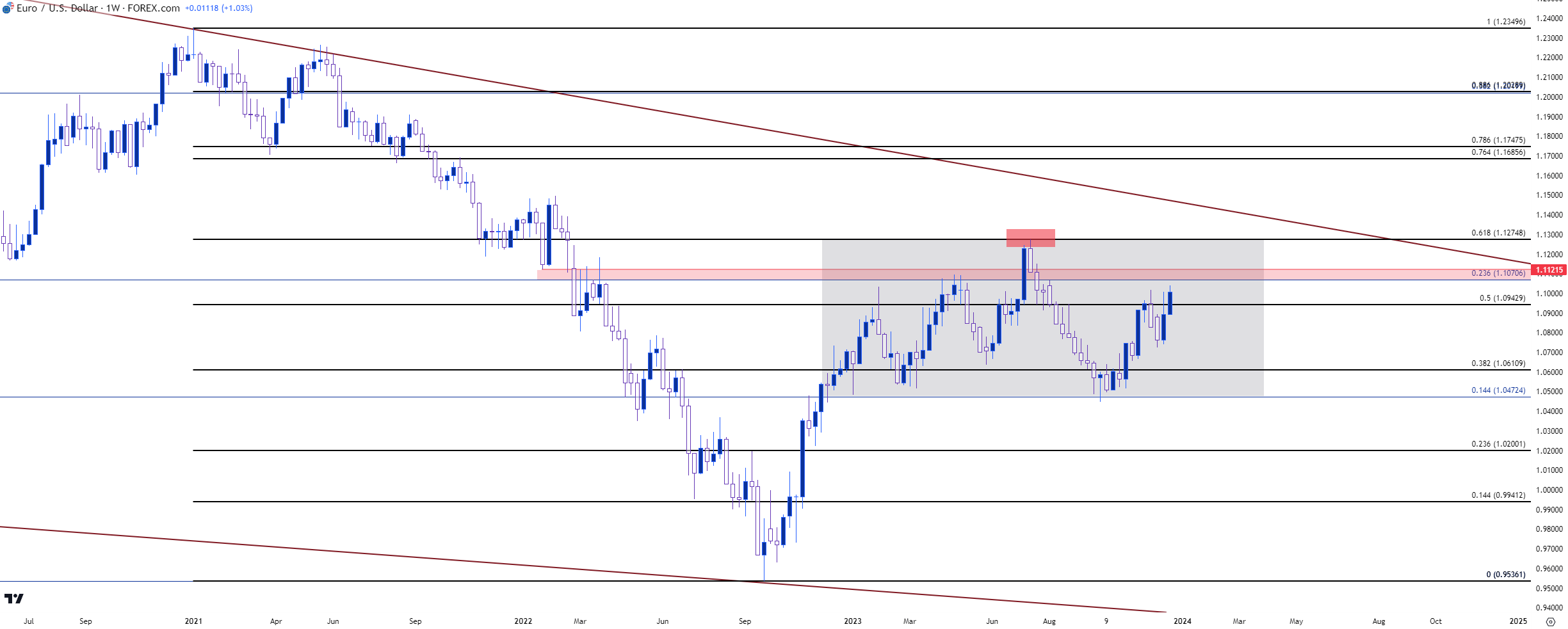

It’s been a range-bound year for EUR/USD, and the below monthly chart illustrates that well. I’ve drawn a grey box around 2023 trade; grey to indicate the lack of directional impulse, and this further highlights the similar theme discussed above in the USD.

The Euro is 57.6% of the US Dollar composition in the DXY basket, so it’s rare for a trend to develop in one without at least some participation from the other, and that was somewhat of the case for 2023. There was a support bounce in early-October that held the lows, allowing for a doji to build on that monthly bar. That was followed by profuse strength in November, which completed a morning star formation. And much like bears have potential in the USD as we move into next year given the pace of the trend, bulls are showing potential in EUR/USD given the persistent push to the 1.1000 handle that had shown throughout this year.

EUR/USD Monthly Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

On the weekly chart below, I’ve added another Fibonacci retracement and this one is applied to the 2021-2022 major move. The 61.8% retracement from that study is what held the high in 2023 trade before sellers were ultimately able to push back-below the 1.1000 handle.

That becomes a major waypoint at 1.1275 if bulls can stretch the move, but before we get there, they’ll have to encounter resistance in a 51-pip zone running from 1.1071-1.1122.

One challenge for bulls for next year will be the same thing that was exciting bears into Q4, and that’s the prospect of recessionary potential in Europe. Former ECB President Mario Draghi had said that he would be surprised if the economy hadn’t moved into recession by the end of the year, which would become evident in data in the first half of 2024. If this happens that could drive the ECB to rate cuts, and perhaps even sooner than the FOMC. In that scenario there could be a very valid case for weakness in the Euro.

EUR/USD Weekly Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

USD/JPY

This seems like a loaded situation for 2024. To date the BoJ hasn’t adjusted policy since before the pandemic. This was a hot button coming into 2023 as there was an expected leadership change atop the BoJ and the fear was that Kuroda’s successor wouldn’t be quite as dovish. Kazuo Ueda took over in April and, to date, he has posed zero changes outside of a policy review that was initiated shortly after he took over the top post at the bank.

Inflation remained consistent through much of the year but as we saw Yen-strength show up in Q4 against the USD, there’s the prospect of currency strength helping to temper inflation and this may remove the need for the BoJ to do anything, near-term. Now, with all of that said, this remains a highly fluid scenario as the Bank of Japan has risk on either side and as we saw from the past year, it does not seem that they want to take on that risk unless they need to. This doesn’t mean that market participants will be satisfied to sit around and wait.

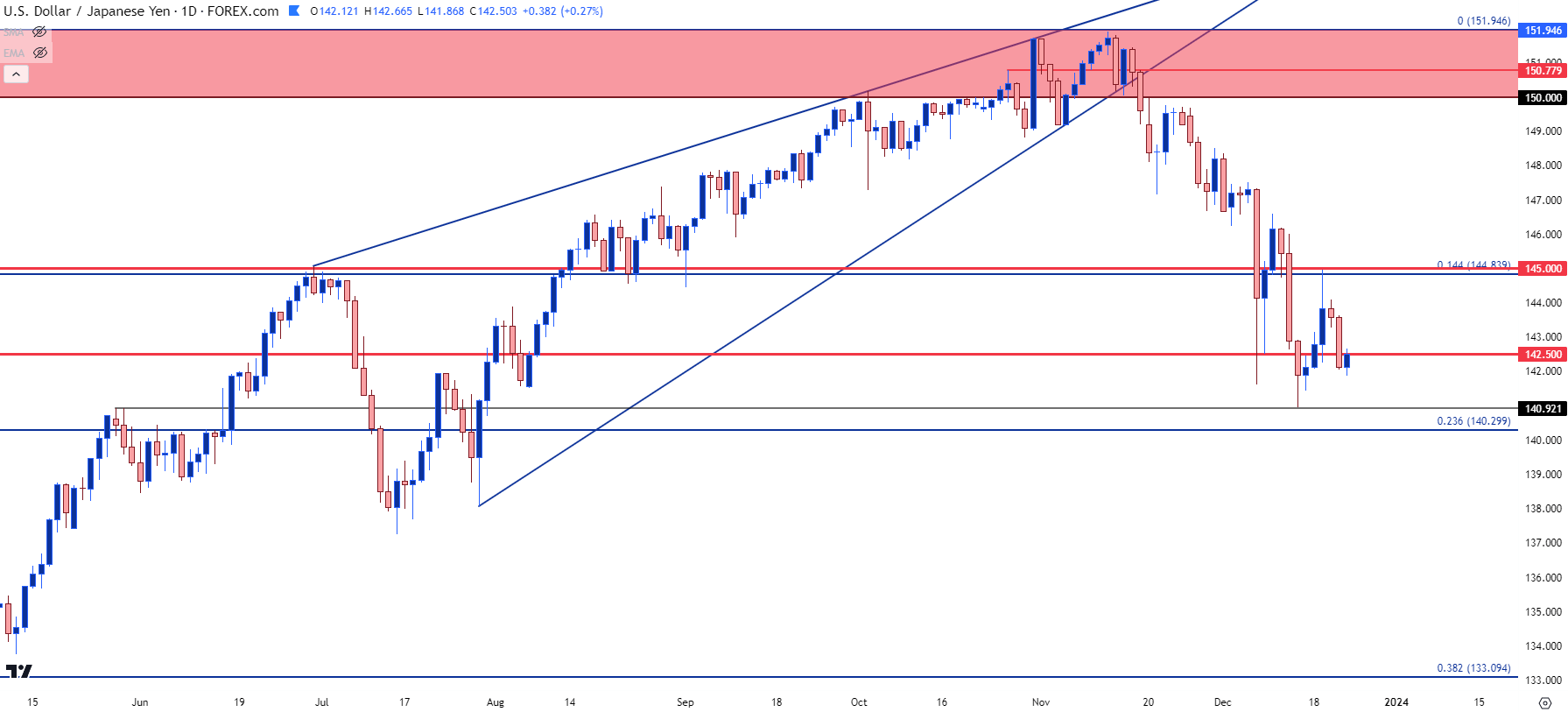

Last year we saw USD/JPY reverse aggressively after the November CPI report. The pair broke below 145 and kept going, until support eventually showed up at the 50% mark of the prior bullish move in mid-January. The pair then trended-higher for much of the next 10 months, until finding resistance at the same 152 area that helped to mark the high the year before.

From the below weekly chart, the push from bears is clear and this has been in-place since the November CPI report pushed a breach of the rising wedge formation.

USD/JPY Weekly Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

USD/JPY Shorter-Term

As I’ve been discussing in webinars, there is difference in the way that this move is showing against what happened last year. This has seemed especially painful for breakout traders as there’s been a propensity for large and sizable pullbacks to appear after another impulsive move lower. This means a couple of different things, the most obvious of which is the potential for short-term counter-trend scenarios. But, perhaps more pressing, for trend traders looking to push bearish continuation themes, waiting for a lower-high resistance test could be a more operable way forward rather than chasing a fresh break.

We saw something similar at the December BoJ rate decision, when USD/JPY reversed after the BoJ made no changes and resistance showed up at a familiar area of 145.00. A ‘sell the rips’ type of scenario could remain in-place until some sort of shift shows on the fundamental front.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist