US Dollar Index Technical Forecast: USD Weekly Trade Levels (DXY)

- US Dollar plunges more than 4.2% off June high– threatens break of multi-year trend support

- USD poised for fifth consecutive weekly decline- support in view

- DXY resistance 104.82-105.18, 106.10/11 (key), 107.18– Support 103.60, 102.87/99 (key), 101.33

The US Dollar is off more than 0.7% since the Sunday open with now poised to mark a fifth consecutive weekly decline- a feat not seen since the April 2023 multi-month low was registered. The focus is on the weekly close with price now approaching support at the objective 2024 yearly open. Battle lines drawn on the on the DXY weekly technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this USD setup and more. Join live on Monday’s at 8:30am EST.

US Dollar Price Chart – USD Weekly (DXY)

Chart Prepared by Michael Boutros, Sr. Technical Strategist; DXY on TradingView

Technical Outlook: In my last US Dollar Technical Forecast we noted that DXY was trading, “just above confluent support with the August opening-range taking shape within well-defined technical barriers. From at trading standpoint, the immediate focus is on a breakout of the 103.60-105.18 range for guidance…” The range broke & secured a weekly close below days later with the index plunging nearly 2.7% off the August highs.

A fifth consecutive weekly decline is now probing below a slope parallel extending off the 2023 lows with the next support levels eyed at the 2023 December low-week close (LWC) / 2024 yearly open at 101.33/41 and the 2011 original slope, currently near ~100.20s- both areas of interest for possible downside exhaustion / price inflection IF reached. A critical technical confluence rests just lower at 98.97-99.67- a region defined by the 61.8% Fibonacci retracement of the 2021 rally, the 2023 swing low, and the 2019 swing high. A close below this threshold would suggest a more significant trend reversal is underway.

Initial resistance now eyed at 102.87/91 and is backed by the 100% extension at 103.60. Ultimately, a breach / close above the July high-week reversal close at 104.87 would be needed to suggest a more significant low is in place / shift the focus back towards the 2023 consolidation resistance (red).

Bottom line: The US Dollar index threatening a break below multi-year trend support. From a trading standpoint, look to reduce short-exposure / lower protective stops on a drop towards the yearly open- rallies should be limited to 102.91 IF price is heading lower on this stretch with a close below 101.33 needed to fuel the next major leg. Review my latest US Dollar Short-term Outlook for a closer look at the near-term DXY technical trade levels.

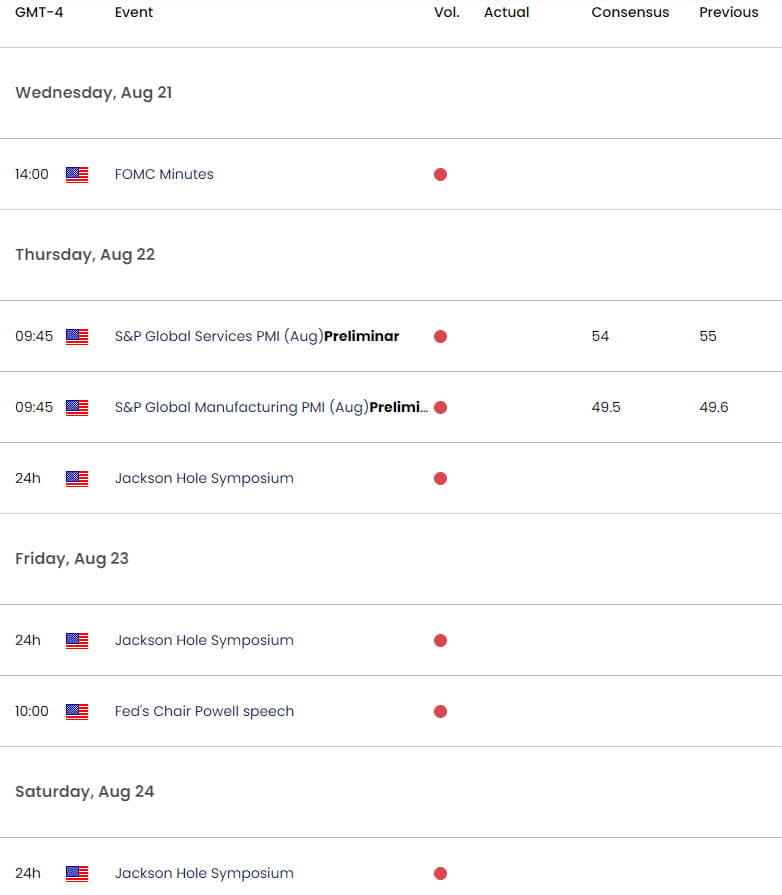

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- British Pound (GBP/USD)

- Japanese Yen (USD/JPY)

- Crude Oil (WTI)

- Euro (EUR/USD)

- Gold (XAU/USD)

- Australian Dollar (AUD/USD)

- Canadian Dollar (USD/CAD)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex