US Dollar Index Technical Forecast: USD Weekly Trade Levels (DXY)

- US Dollar plunges to multi-year technical support post-FOMC

- USD risk for downside exhaustion / price inflection- PCE on tap next week

- DXY resistance 101.41/70, 102.62/99 (key), 104.04/11– Support 100.61, 98.97-99.66 (key), 97.69

The US Dollar plunged into major technical support this week on the heels of the Fed rate decision and it’s make-or-break for the bears at fresh yearly lows. The DXY battle lines are drawn heading into key US inflation data next week. These are the updated targets and invalidation levels that matter on the DXY weekly technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this USD setup and more. Join live on Monday’s at 8:30am EST.

US Dollar Price Chart – USD Weekly (DXY)

Chart Prepared by Michael Boutros, Sr. Technical Strategist; DXY on TradingView

Technical Outlook: In my last US Dollar Technical Forecast we noted that DXY had, “halted its decline at confluent downtrend support around the December low with the September opening-range taking shape just above. From a trading standpoint, the threat remains weighted to the downside while below 102.99 with a break of the monthly lows needed to fuel a test of longer-term slope support.” The rally halted at initial weekly resistance with a three-week test failing before plunging back into trend support- the focus is on a possible exhaustion / price inflection into this threshold over the next few weeks.

The index has been trading within the confines of a descending pitchfork (blue) extending off the June highs with the lower parallel catching the yearly lows for the past month. Note that the 2011 original slope converges on the lower parallel over the next few weeks- this slope has been instrumental in major US Dollar turns for the past decade and a close below is needed to fuel the next leg lower in price.

Initial weekly resistance remains with the objective yearly open / 23.6% retracement of the yearly range at 101.41/70 and is backed by 102.62/99- a region defined by the 38.2% retracement, the 2016 high-close (HC) and the January low-week close (LWC). A breach / weekly close above this threshold would be needed to suggest a more significant low is in place with key resistance eyed with the 52-week moving average / 61.8% retracement at 104.04/11.

A break/ close below this major slope (~100.30/61) would threaten a drop towards a critical pivot zone at 98.97-99.66- a region defined by the 61.8% Fibonacci retracement off the 2021 advance, the 2023 swing low and the 2019 swing high. Look for a larger reaction there IF reached. (Note that losses below this threshold would threaten a much steeper decline with initial support objectives eyed at the 2018 swing high near 97.69.)

Bottom line: The US Dollar index has plunged into technical confluence zone at multi-year upslope / multi-month downtrend support – risk for downside exhaustion / price inflection into this zone. From at trading standpoint, a good zone to reduce portions of short-exposure / lower protective stops – rallies should be limited to 101.70 IF price is heading for a break on this stretch with a close below this week’s low needed to fuel the next leg lower.

Note that weekly momentum is currently marking bullish divergence with the September opening-range still intact post-Fed. Keep an eye out for major US inflation data next week with the Core Personal Consumption Expenditure (PCE) slated for Friday - watch the weekly closes here for guidance. Review my latest US Dollar Short-term Outlook for a closer look at the near-term DXY technical trade levels.

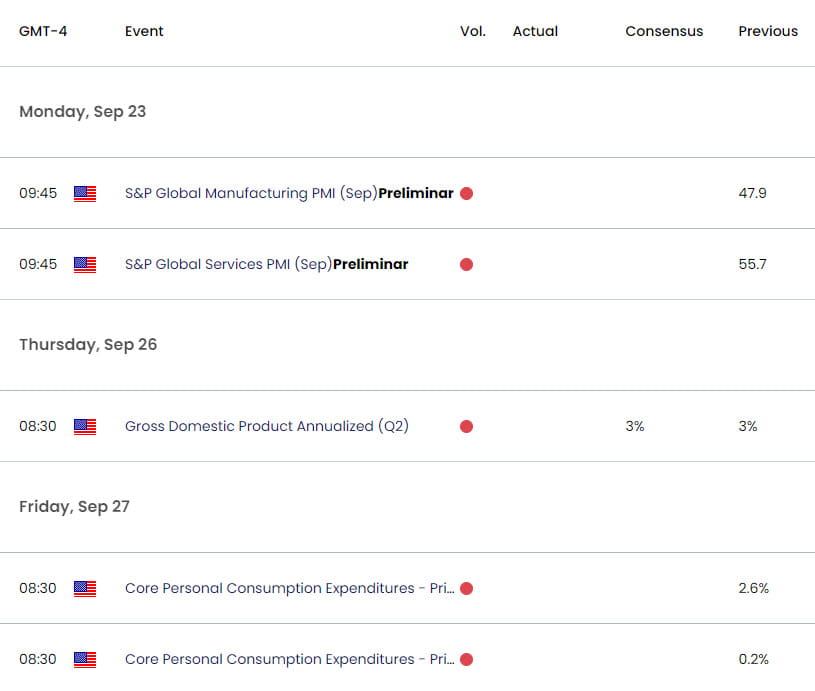

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Euro (EUR/USD)

- British Pound (GBP/USD)

- Australian Dollar (AUD/USD)

- Gold (XAU/USD)

- Japanese Yen (USD/JPY)

- Crude Oil (WTI)

- Canadian Dollar (USD/CAD)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex