US Dollar Index Technical Outlook: USD Short-term Trade Levels

- US Dollar declines 11 of the past 14 days- breaks multi-month uptrend / lows

- USD technical support hurdle now in view- threat for price inflection in the days ahead

- Resistance 104.08, ~104.40, 104.90s (key)- Support 103.49/60, 102.74/99 (key), 102.35

The US Dollar Index has plunged for 11 of the past 14 days (today would complete 12) with a third weekly decline taking DXY towards initial technical support. While the medium-term outlook remains weighted to the downside, we are on the lookout for possible price inflection into trend support just lower in the days ahead for guidance. Battles lines drawn on the DXY short-term technical charts into the close of the month.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this US Dollar technical setup and more. Join live on Monday’s at 8:30am EST.

US Dollar Index Price Chart – USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; DXY on TradingView

Technical Outlook: In last month’s USD Short-term Outlook, we noted that USD was approaching resistance at multi-week highs and that, “losses be limited to the 200-DMA IF price is heading higher on this stretch with a close above 105.71 needed to fuel the next leg in price. Note that losses below 104.15 could see things fall apart rather quickly- tread lightly on a test of this support IF reached.” The index rallied another 0.8% in the following days with DXY reversing off the 2023 high-week close (HWC) at 106.10 into the close of June (intraday high registered at 106.13).

A decline of nearly 3.3% off the high broke below the March uptrend / 200-day moving average with the sell-off now approaching confluent support at the 2023 yearly open / 100% extension of the April decline at 103.49/60- the immediate focus is on a reaction off this threshold IF reached with the medium-term risk still weighted to the downside while within this formation.

US Dollar Index Price Chart – USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; DXY on TradingView

Notes: A closer look at USD price action shows DXY trading within the confines of a descending pitchfork (blue) with an embedded channel (red) guiding the July decline. Weekly open resistance stands at 104.08 and is backed closely by the 200DMA (currently ~104.40). A break of the weekly opening-range highs would expose a possible rally towards the highlighted trendline confluence near 104.90s – rallies should be limited by this slope IF price is heading lower on this stretch. Broader bearish invalidation now set to the 61.8% retracement of the recent decline.

A break / close below this pivot zone would expose the next major technical confluence at 102.74/99- a region defined by the March low-day close (LDC), the 61.8% Fibonacci retracement of the December rally, the 2016 high-close (HC) and the 2020 high. Note that slope support also converges on this threshold over the next few weeks- look for a larger reaction there IF reached. Losses below this threshold could fuel another bout of accelerated declines towards the March low at 102.35 and the objective yearly open near 101.41.

Bottom line: The US Dollar sell-off is approaching confluent support and the focus is on possible downside exhaustion / price inflection into 103.49/60. From a trading standpoint, a good zone to reduce portions of short-exposure / lower protective stops- rallies should be limited to 105 IF price is heading lower on this stretch with a close below this pivot zone exposing more significant support near the March lows.

Keep in mind we get the release of key US inflation data next week – stay nimble into the release and watch the weekly closes here for guidance. Review my latest US Dollar Weekly Forecast for a look at the longer-term DXY technical trade levels.

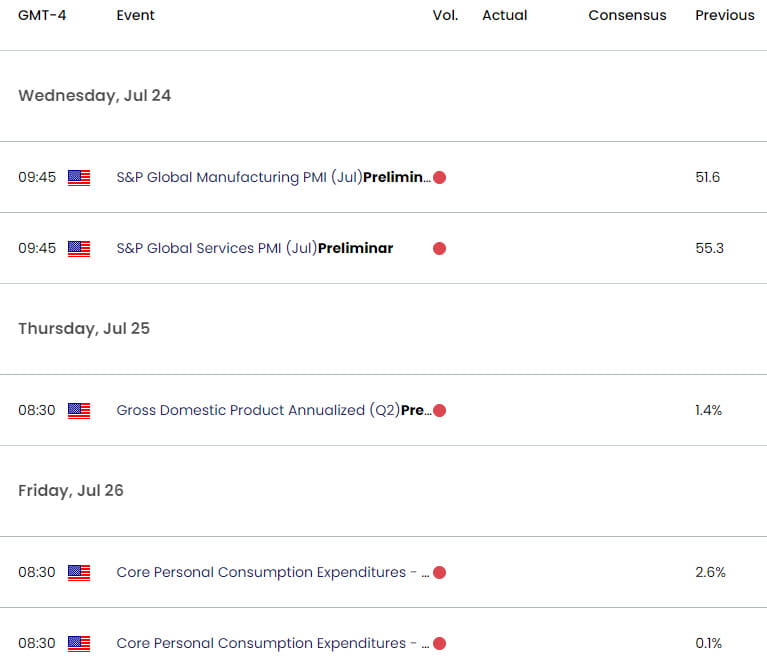

Key US Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Australian Dollar Short-term Outlook: AUD/USD Key Support Test

- British Pound Short-term Outlook: GBP/USD Bulls Go for the Break

- Euro Short-term Technical Outlook: EUR/USD Bulls Eye Range Resistance

- Gold Short-term Outlook: XAU/USD Coils into July- Breakout Ahead

- Canadian Dollar Short-term Outlook: USD/CAD Bulls Keep 2024 Uptrend

Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex