US Dollar Index Technical Outlook: DXY Short-term Trade Levels

- US Dollar Index five-day rally approaching initial resistance hurdles

- USD recovery may be vulnerable heading into major event-risk this week (Fed/PCE)

- DXY resistance 101.65, ~102, 102.75- support 101.08, 100.82, 99.96

The US Dollar Index ripped more than 2% off fresh yearly lows with a five-day rally now approaching initial resistance hurdles ahead of major event risk this week. The rally threatens to invalidate a break of the yearly opening-range lows and the battle-lines are drawn as we head into the FOMC rate decision and US PCE on Friday. These are the updated targets and invalidation levels that matter on the DXY short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this US Dollar technical setup and more. Join live on Monday’s at 8:30am EST.

US Dollar Index Price Chart – DXY Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; DXY on TradingView

Technical Outlook: In last month’s US Dollar Short-term Outlook, we noted that a rebound in DXY was testing resistance into the 103-handle; “a good zone to reduce portions of long-exposure / raise protective stops – losses should be limited to the 102-handle IF price is heading higher on this stretch with a breach above 103.63 needed to fuel the next leg higher in price…” The index registered a high at 103.57 into the start of July before plunging more than 3.8% with the decline rebounding off confluent support last week around the 2019 high at 99.67. A six-day rally is now probing initial resistance with the FOMC and ECB interest rate decisions on tap- buckle-up!

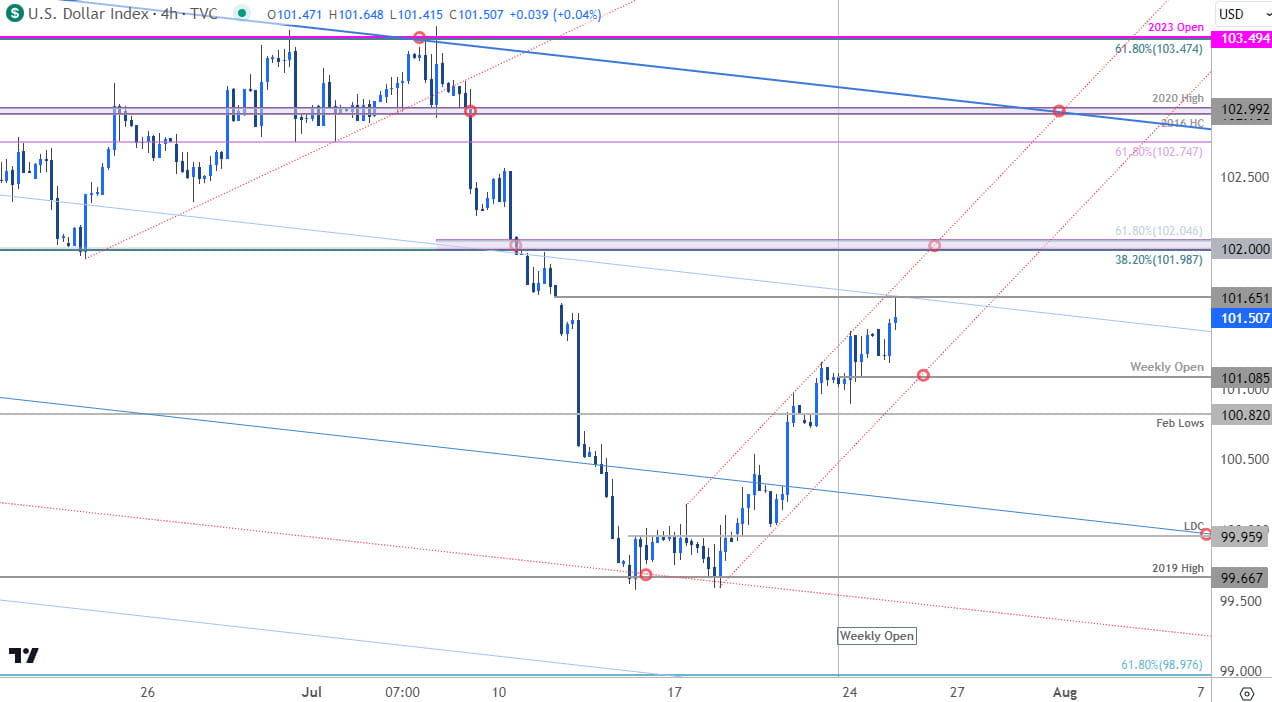

US Dollar Index Price Chart – DXY 240min

Chart Prepared b/y Michael Boutros, Sr. Technical Strategist; DXY on TradingView

Notes: A closer look at USD price action shows DXY rebounding off a sliding parallel extending off the March lows (red) with recovery trading within the confines of a tight ascending channel formation. Initial resistance is being tested today at the uncovered gap / 75% parallel (blue) at 101.65 with more significant resistance into the 102-handle- a breach / close above this threshold would be needed to keep the immediate advance viable towards 102.75 and 103.

Broader bearish invalidation now lowered to the objective yearly open / 61.8% retracement of the yearly range at 103.47/49- a close above this threshold would suggest a more significant low was registered this month and shift the medium-term focus back to the topside in the US Dollar

Weekly-open support rests at 101.08 backed by the February low at 100.82- a break / close below this threshold would threaten resumption towards the low-day close at 99.96, 99.66 and the 61.8% Fibonacci retracement of the 2021 advance at 98.98- look for a larger reaction there IF reached.

Bottom line: The US Dollar rally may be vulnerable here on the back of a six-day rally into confluent resistance with major event risk on tap into the close of the week. From at trading standpoint, a good zone to reduce portions of long-exposure / raise protective stops- losses should be limited to 100.82 IF price is heading higher on this stretch. Stay nimble heading into the close of the week with the FOMC / ECB rate decisions and US core inflation data likely to fuel some volatility here- watch the Friday close for guidance. Review my latest US Dollar Weekly Technical Forecast for a longer-term look at the DXY trade levels.

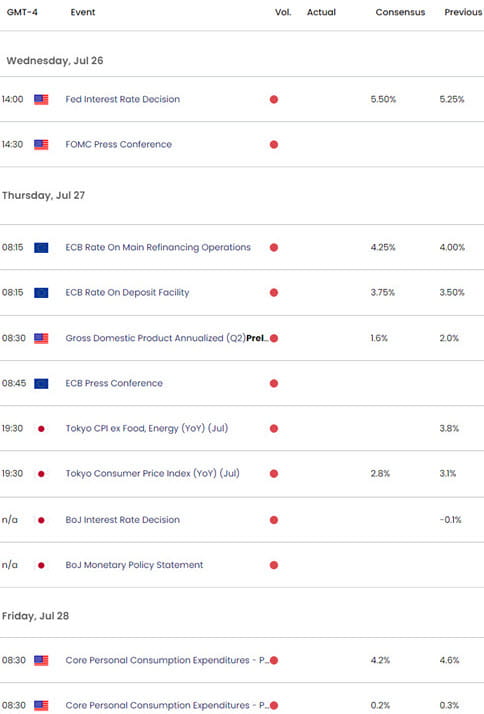

Key USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Australian Dollar Short-term Outlook: AUD/USD Snap Back

- Euro Short-term Outlook: EUR/USD Eight-day Rally at Resistance

- Japanese Yen Short-Term Technical Outlook: USD/JPY Free-Falling

- Gold Short-term Price Outlook: XAU/USD Moment of Truth at Key Support

- Canadian Dollar Short-term Outlook: USD/CAD Grinds at Resistance into Q3

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex