US Dollar Talking Points:

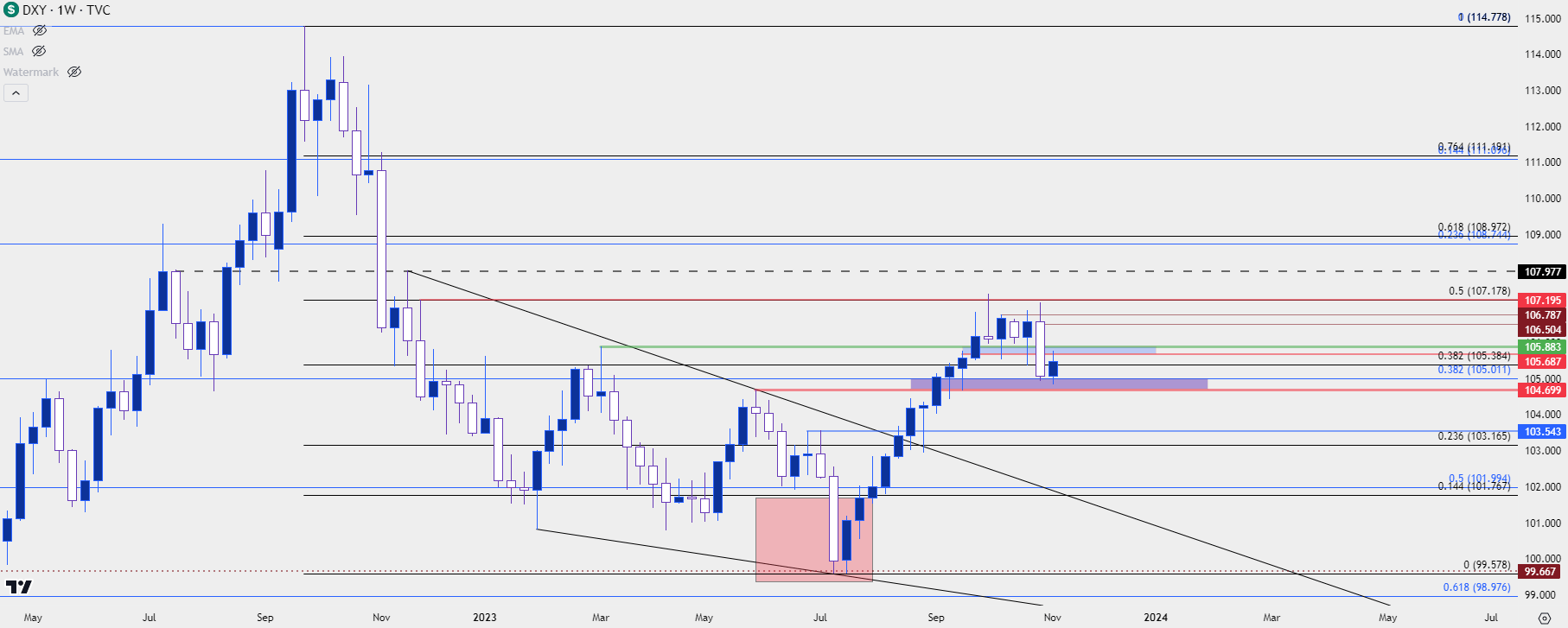

- The US Dollar is bouncing from support at the 105.00 handle, and is currently testing short-term resistance at prior support. This begs the question as to whether a deeper pullback in the USD can develop.

- Yields and equities remain with a volatile backdrop, and I spent some time towards the end of this webinar talking about my views there, along with my expectations around both near and long-term FOMC policy.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

The US Dollar continues to see volatility after last week’s push to a fresh monthly low. At this point price has held support at a big spot on the chart around the 105.00 handle, which is the 38.2% Fibonacci retracement of the 2021-2022 major move. But the bounce from that support has so far held lower-high resistance and a continued build of lower-lows and lower-highs can keep the door open for a deeper pullback move.

US Dollar Daily Price Chart (indicative)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Taking a step back to the weekly chart highlights the challenge with pullback scenarios, as the bullish trend has been stalled for almost the entirety of October; with bears finally taking a step forward around the November open, helped along by the FOMC rate decision.

But given how tenuous bears have been to take control over the past month, this can produce some challenges for continuation.

One of the factors that’s played into this has been the Euro. EUR/USD has seen the bearish trend stall at 1.0500 over the past month but as yet, bulls haven’t been able to do much there as price remains within a bear flag formation.

US Dollar Weekly Price Chart (indicative)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

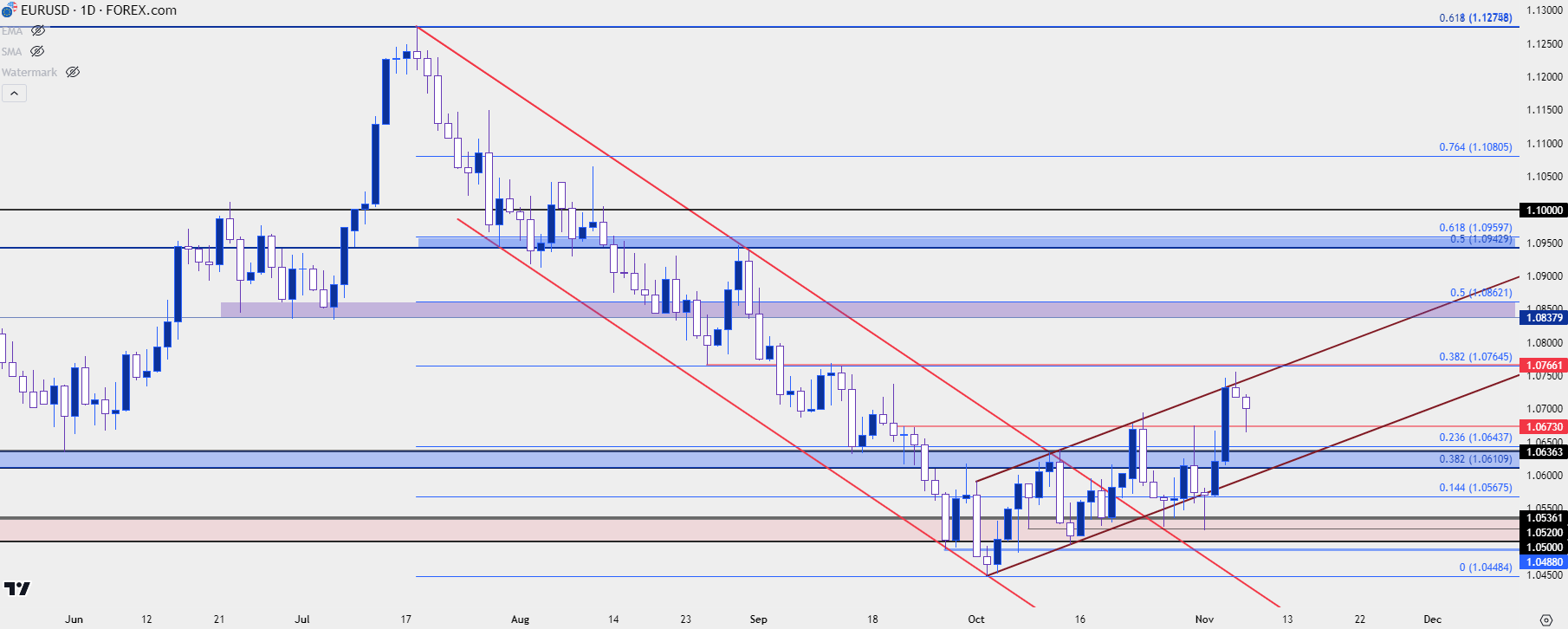

EUR/USD

I started warning of the 1.0500 level in EUR/USD in late-September in these webinars. The pair was starting to feel oversold after a three-month sell-off drove prices by more than 700 pips; and once the big figure came back into the picture, sellers started to let the trend slip.

The month of October produced numerous tests around, below and then just above the 1.0500 level. Along the way, prices worked into a bullish channel which, when taken with the prior bearish trend, presents a bear flag scenario.

There was a false breakdown from that formation last Wednesday, around the FOMC rate decision, and since then bulls have shown renewed vigor. Perhaps this is something that can produce a scenario that seemingly could not come to fruition just a week ago.

As of this writing we’re seeing a support response to a key level at 1.0673, and there remains a large zone of support potential below that, spanning from the familiar area between 1.0611-1.0644. Bulls holding lows above that level can keep the door open for topside scenarios. For upcoming resistance, there’s spots at 1.0766, 1.0838-1.0862 and then 1.0943-1.0960.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

GBP/USD

Cable presents a similar, albeit less emphatic picture as the above in EUR/USD. While EUR/USD was churning a series of higher highs in October, there wasn’t much of that in GBP/USD as the pair continued to hold below a bearish trendline.

There was, however, a build of support above the 1.2000 big figure, with a higher low support hold of the Fibonacci level at 1.2072 in late-October. There was a Bank of England Super Thursday rate decision the day after FOMC last week, and that helped to bring a breakout to the pair with the print of a fresh monthly high.

At this stage the pullback move appears to have some greater development than EUR/USD, simply given the contrasting price action over the past month, and a similar scenario of bullish potential remains here if buyers can hold support at a higher-low. In GBP/USD, we’re seeing on of those levels tested intra-day around the 1.2300 handle; and below that is another big spot ranging from 1.2196-1.2220.

GBP/USD Daily Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

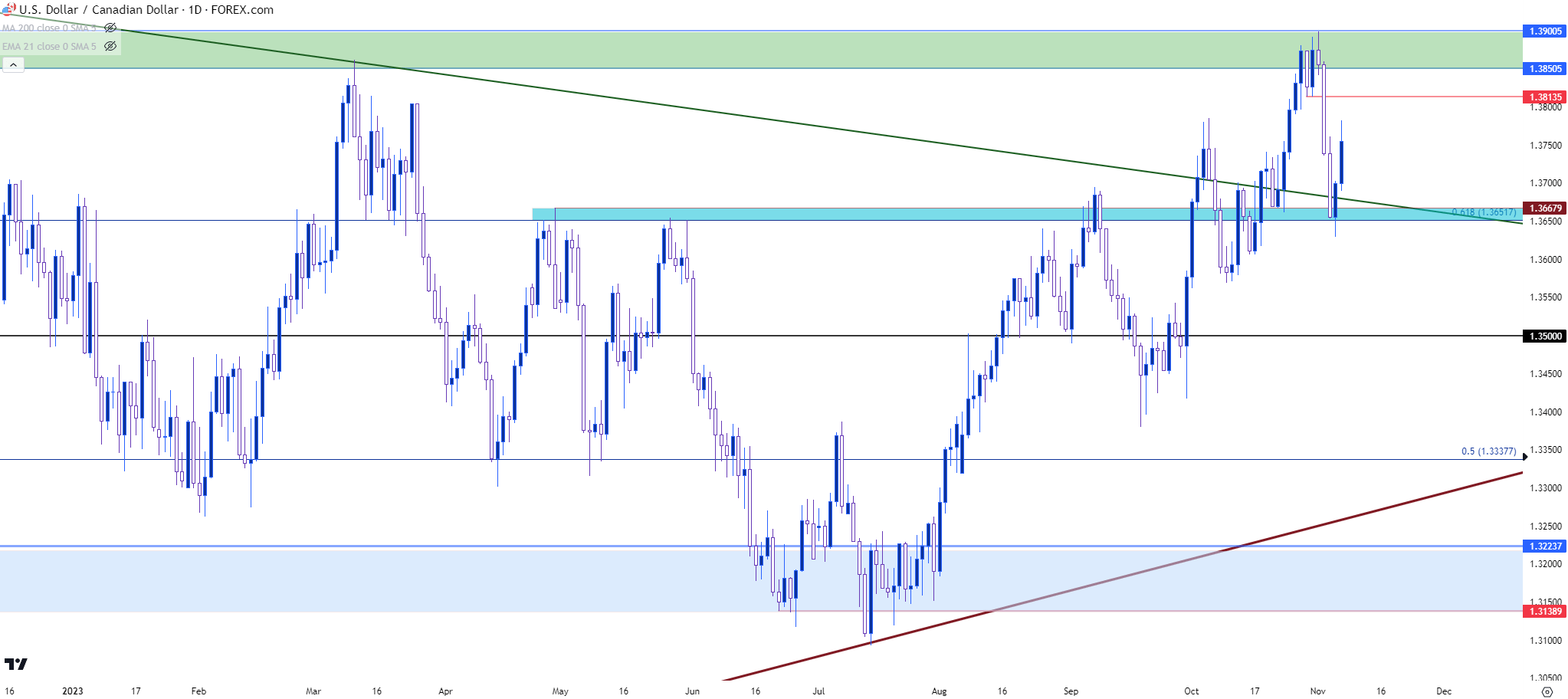

USD/CAD

USD/CAD has shown some interest on the technical front of late.

Going back a couple of weeks ago, and USD/CAD was setting up for a bullish breakout test as price had started to venture above a symmetrical wedge formation.

And then last week that breakout ventured up to the top of a resistance zone that ran from 1.3850-1.3900, with the latter level helping to establish the current high.

The US Dollar sell-off around the FOMC rate decision drove a strong pullback from that breakout, with USD/CAD prices returning to a key spot on the chart at the 1.3652 Fibonacci level, which helped to hold the low into the end of last week.

That support has since led to another swing, this time with bulls pushing higher. The question now is whether bulls can force a different outcome at 1.3850-1.3900 from what happened last week. As shared on the webinar, the 1.4000 level lurks above that so even if bulls can get above 1.3900, the question remains for how long that might run.

Shorter-term, there’s some possible lower-high resistance setting up on the candles that built around that breakout from last week.

USD/CAD Daily Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

Chart prepared by James Stanley, USD/CAD on Tradingview

USD/JPY

USD/JPY remains a challenge. The pair is currently trading above the 150.00 handle but this does not preclude an intervention type of scenario from the Bank of Japan, particularly in the case of bullish continuation in the US Dollar and in-turn, USD/JPY.

What could be more interesting, however, is if we do end up seeing a larger USD pullback. This is what really seemed to help the BoJ last year because the bank intervened in October, but that merely pulled USD/JPY back to support at 145.00.

The big move in the pair was Thursday, November 10th, which was the date of a CPI release that brought USD-bears out in droves. The carry trade is a contributing factor to this bullish incline and that’s remained positive this year as the pair has gained more than 2,000 pips to go back above the 150.00 big figure.

But – that carry isn’t as attractive if there’s a legitimate fear of principal loss, which can compel other carry traders to hurriedly close positions. This is one of the reasons why such trends will often take the ‘up the stairs, down the elevator’ type of format, and that’s what explains the backdrop in USD/JPY after last year saw a 50% retracement in about three months – for a move that took 21 months to build.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

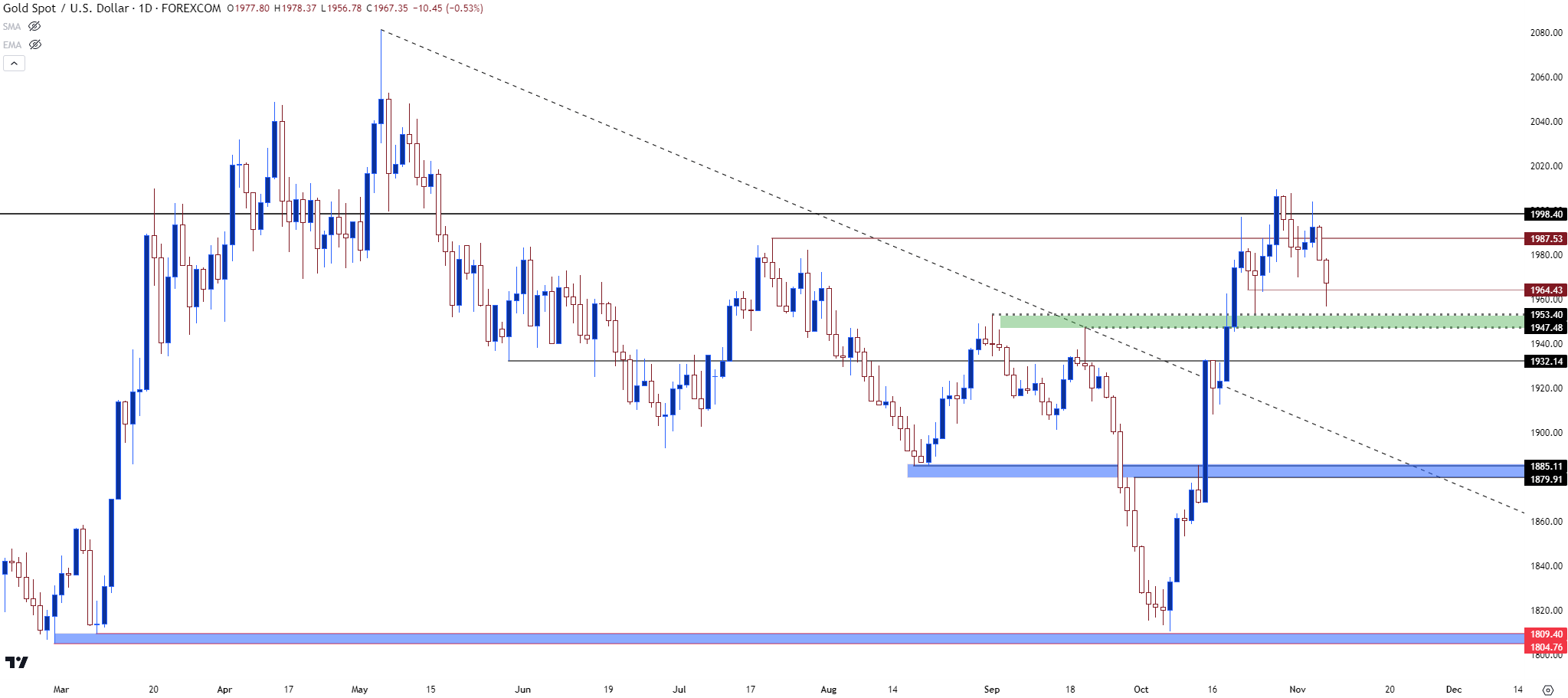

Gold

Gold finally saw the bullish breakout calm after being unable to drive above the $2k psychological level. The big question now is whether the topside trend is done or whether bulls go for another test above the big figure.

As shared in the webinar, I’m of the opinion that gold can leave $2k behind, although I think that happens after the Fed pivots. And as I shared the Fed formally announcing an end to rate cuts and an openness to rate cuts can create a number of moves in other markets, such as Treasuries and then, in-turn, equities.

Bears haven’t entirely taken over just yet, so there could remain another test of $2k. At this point there’s a big zone of potential support as taken from prior resistance, spanning from around 1947-1953. If sellers can begin to test below that then that’ll be a greater show of force, which could allow for a deeper pullback scenario with focus shifting towards 1880-1885.

Gold (XAU/USD) Daily Price Chart

Chart prepared by James Stanley, Gold on Tradingview

Chart prepared by James Stanley, Gold on Tradingview

--- written by James Stanley, Senior Strategist