US Dollar Talking Points:

- The US Dollar continues to show strength, setting a fresh two-month high today.

- EUR/USD is testing support around 1.0750 and GBP/USD is trading at a fresh monthly low. The big question around both markets is continuation potential.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

The US Dollar continues to show strength and earlier today, the currency pushed up to a fresh two-month-high via the DXY basket.

There has been effort from bears, however, as there were pullbacks on Monday and Tuesday, each of which have held higher-low support. The 103.00 level came into play shortly after this week’s open, and the 103.45 level was in-play earlier this morning as bulls showed yet another reaction to higher-low support. Each of those levels has some historical relevance, as 103.00 was the swing-high from March of 2020 as the pandemic was getting priced-in, and 103.45 was the swing-low that held support into the end of 2022 trade for DXY.

US Dollar - DXY Four-Hour Price Chart (indicative only, not available on Forex.com platforms)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Taking a step back to the daily chart, we can see where USD price action has largely remained in a range so far for 2023 trade. That level at 103.45 was key as this was support on a couple of different occasions but the bigger focal point is on range resistance, which begins to show around the 105.00 area in DXY.

This zone was in-play in the first week of the year, just before the Dollar turned-lower to set a fresh yearly low, and then again in March, just before the banking crisis showed up and drove a pattern of weakness to both US yields and the US Dollar.

Monday showed a higher-low in DXY around the 103.00 handle and that can be a key point for bullish continuation scenarios.

US Dollar - DXY Daily Price Chart (indicative only, not available on Forex.com platforms)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD

EUR/USD has started to show tendencies of a turn over the past couple of weeks. That move started from a stall at a key spot of resistance around the 1.1000 psychological level, which lasted for about a month before sellers started to push fresh lower-lows into the matter.

I had looked into the move on Monday, highlighting a spot of longer-term support that had started to constrain the bearish trend.

At this point a couple of days later, there’s been continued tests below that level at 1.0787, but the move hasn’t been able to break fresh ground below the 1.0750 level yet, which has come into play twice this morning to help set support. While such continued support can give a bullish appearance, it must also be considered that bears have continued to react to resistance, with this morning showing short-term resistance at the 1.0800 level.

That 1.0800 level can remain as resistance potential, and there’s more around the swing-low turned swing-high around 1.0845. As I had stated on Monday, given how quickly this move had built-in, there could even be an argument for lower-high resistance around the 1.0943 Fibonacci level that was setting support ahead of last week’s breakdown.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

GBP/USD

GBP/USD ran into a major trendline two weeks ago just before the Bank of England’s Super Thursday rate decision. After that meeting, the British Pound showed weakness against the US Dollar, initially re-testing the 1.2444 level that had twice set resistance in December and January. This week has seen sellers produce some drive below that level which keeps the door open for bigger picture bearish themes.

GBP/USD Weekly Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

On a shorter-term basis, GBP/USD has appeared to hold up a bit better than EUR/USD, as EUR/USD has erased all of its April gains while GBP/USD is still holding above April’s support.

I’m tracking that level at 1.2344 and if sellers can pose a breach below that, bearish continuation scenarios could look more attractive in the pair. The 1.2444 level could potentially function as resistance again as this morning’s high tested above that, and a show of resistance right around 1.2444 could constitute a lower-high, which would similarly keep the door open for bearish trend scenarios in the pair.

GBP/USD Daily Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

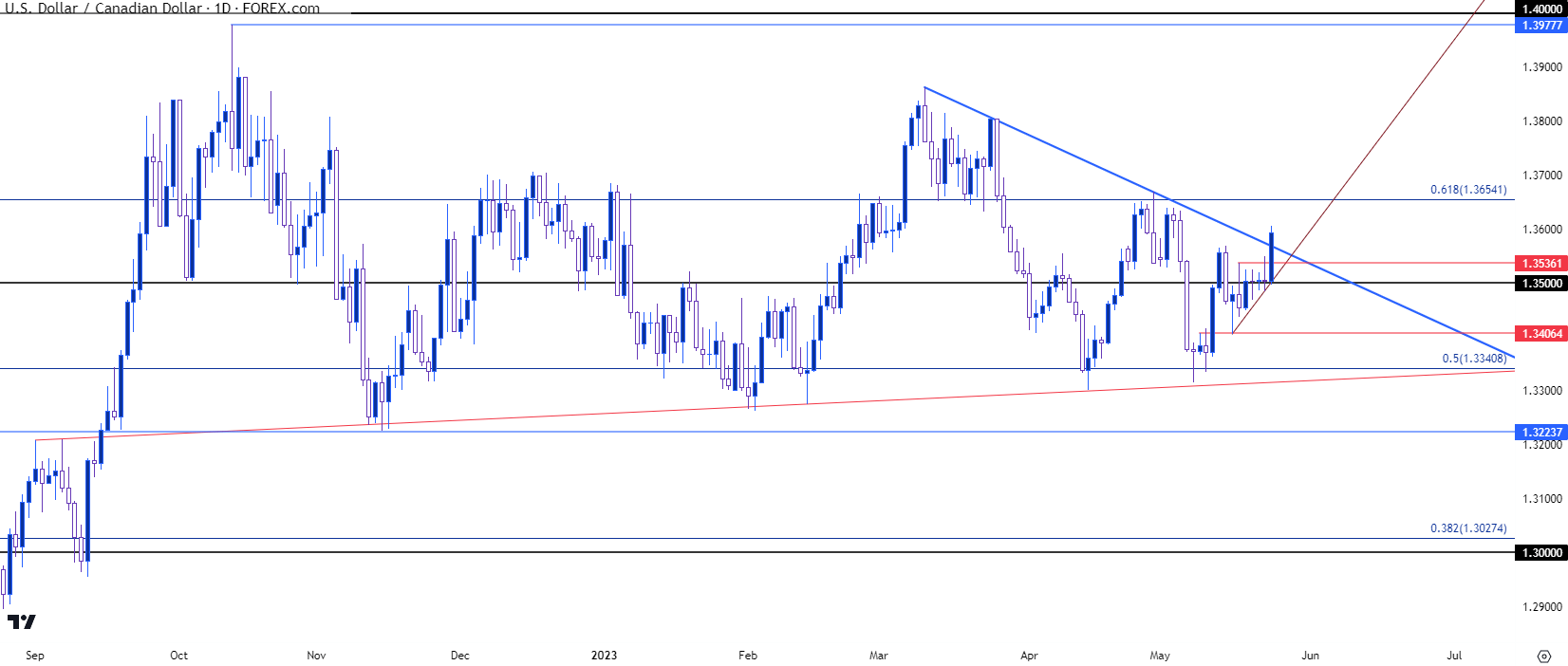

USD/CAD Breakout

USD/CAD appears to be working on resolving consolidation as the pair had seen price action coil over the past five trading days, right around the 1.3500 psychological level. That has so far led to a breakout this morning, which exposes the next spot of resistance potential around 1.3652. This is not a new level as this price was in-play as support in March and then resistance in April.

USD/CAD Daily Price Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

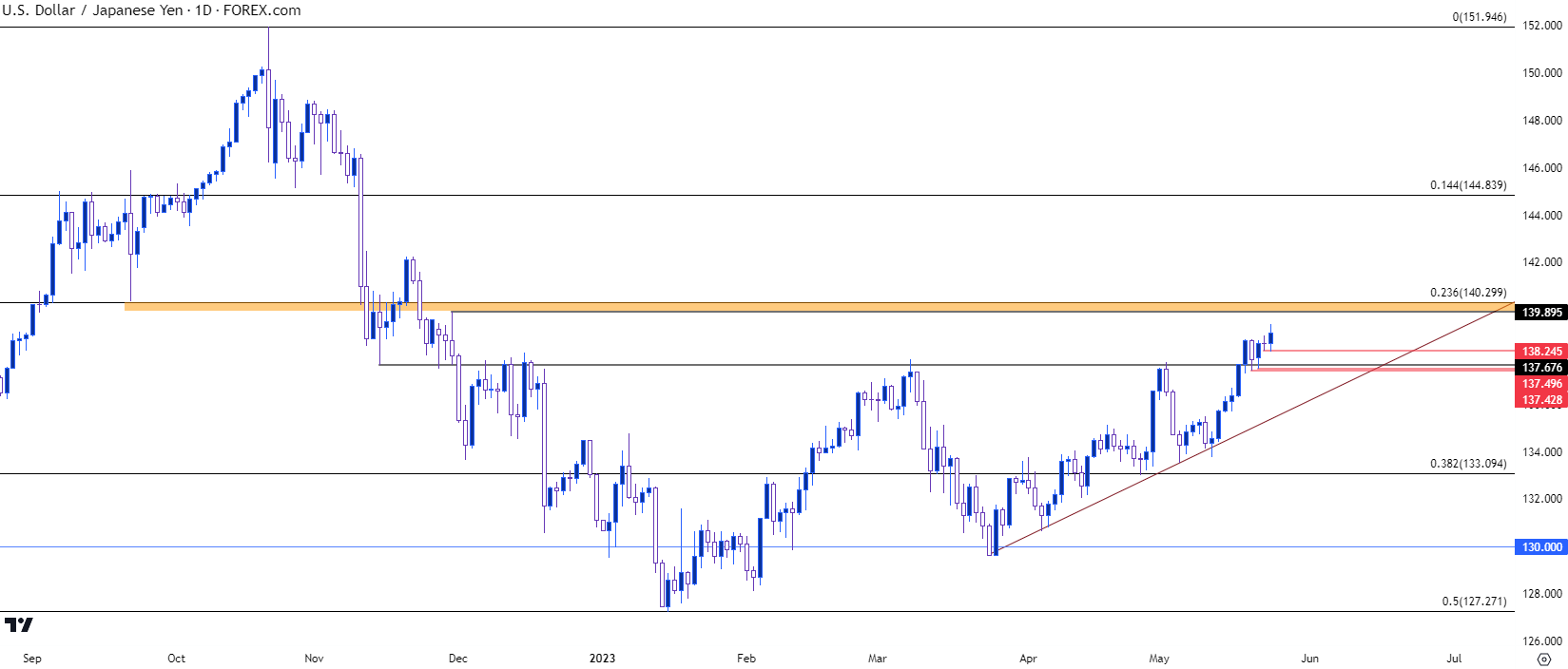

USD/JPY Breakout

USD/JPY has broken out to a fresh 2023 high this morning. The pair was previously in an ascending triangle formation that started to give way last week. Prior resistance at 137.67 was key spot of reference for that move as prior resistance, which was then tested as support last Friday as it helped to hold the lows into the end of the week.

This week started with another test of that level before bulls took over, helping to drive to that fresh 2023 high. The next spot of resistance is a little higher, from around 139.90 up to the Fibonacci level at 140.30. The 140 psychological level is also in that zone, so there’s a few different reasons for sellers to take note if price reaches up to this area. The bigger question is whether that resistance inflection will provide enough motivation to tilt the trend, and at this stage there’s a dearth of evidence to suggest that this will happen, but it should be considered as prices in USD/JPY haven’t yet seen a 140 print in 2023, and that first instance may lead-in to some profit taking.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist