U.S. Dollar Talking Points:

- The U.S. Dollar has pulled back for a test of lower-high resistance after this morning’s CPI release.

- Once again, Core CPI printed very closely to the 4% marker as it came in at 3.8% v/s the expectation of 3.7%. This makes for a complicated argument behind rate cuts out of the Fed given that inflation is showing entrenchment per that data point. This stands in contrast to the Core PCE report from a couple of weeks ago, which has continued to fall in a faster fashion. Given the Fed’s recent dovish lean along with commentary around these data points, the USD bias over the past month has been bearish. This morning’s CPI report has driven a bullish move and there’s a test of resistance showing at prior support. The big question now is whether bears will respond, and in a related matter, whether bulls respond to higher-low support in EUR/USD.

- This is an archived webinar, if you'd like to join next week you're welcome to join. It’s free for all to register: Click here to register.

Core CPI remains very close to the 4% marker and as we looked at last month, this is something that suggests the possibility of inflation entrenchment. That was something the Fed had talked about last year when discussing when and how to slow rate hikes, with one of the fears or risks being that while there was some softness showing in inflation data, it could get entrenched at a higher level than what the Fed would want. And given that there’s now been six months at which Core CPI has printed within a 0.3% band of the 4% mark, that would seem to be a fear worth investigating before cutting rates.

But – that’s not the only data point to gauge inflation in the U.S. and the Fed’s ‘preferred inflation gauge’ of Core PCE has shown considerably more progress as it pushes closer and closer to the Fed’s 2% target. When this printed below-expectations last month, it excited Dollar bears and eventually led to a breakdown below the 200-day moving average.

So, we have one data point suggesting inflation entrenchment and another highlighting what the Fed wants, and it should come as no surprise as to which has driven the FX market over the past month as the dovish Fed-speak has helped to keep Dollar bulls at bay, while negative data points have finally given bears some motivation to push to fresh lows.

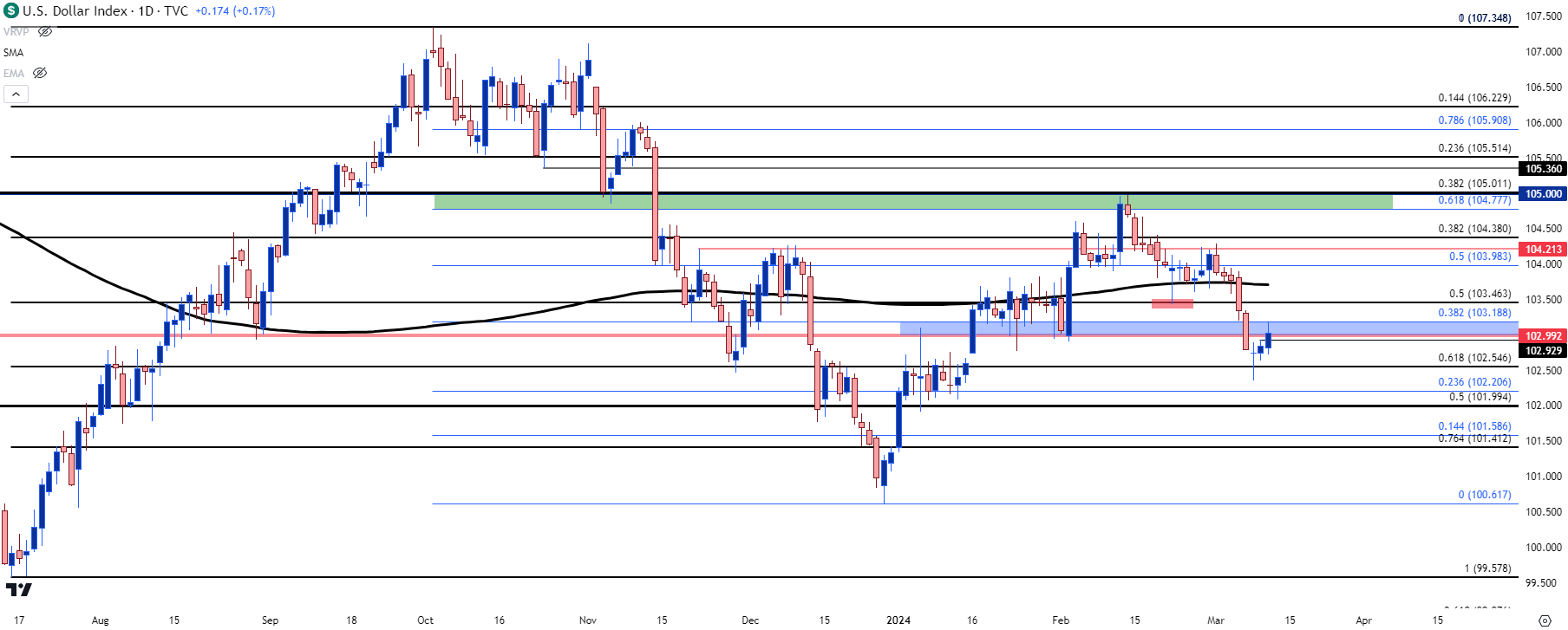

In the U.S. Dollar, price remains below the 200-day moving average and price has pulled back for a test of support at prior resistance. If bears can hold resistance in the current zone, this would keep the door open for sellers to continue the push and there’s deeper support potential around 102.55, 102.20, 102.00 and then the zone from 101.41-101.59.

Above current price and the 103.19 Fibonacci level there are a few areas of note for possible resistance. The level at 103.46 stands out as this is a Fibonacci level as well as a prior price swing. Above that, we have the 200-day moving average which has made regular appearances in USD price action so far this year: That currently plots at 103.72. And above that, another Fibonacci level around 104.00; and if bulls can force a daily close above the 200-dma, that would indicate strength similar to what showed at the last 200-dma breakout in early-February, which could start to put bulls back in the driver’s seat.

U.S. Dollar Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD

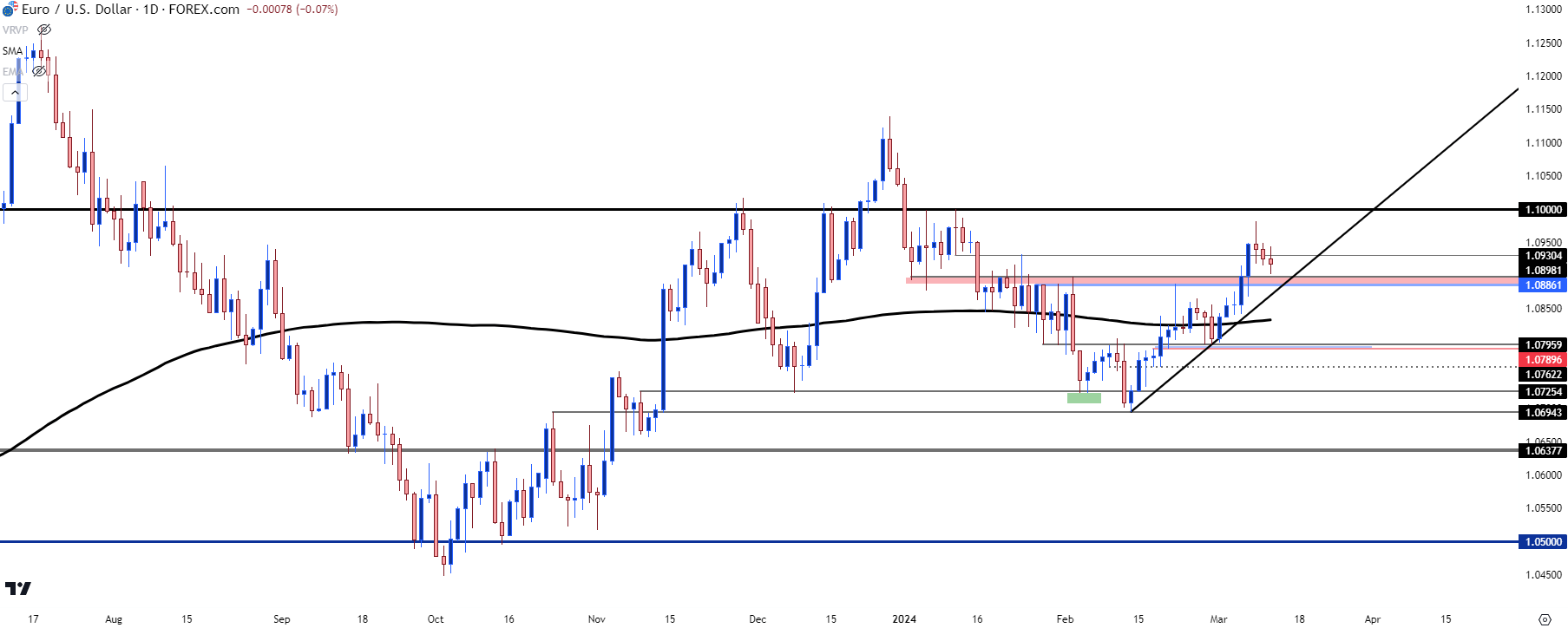

Key for that directional scenario in the USD is EUR/USD, as the Euro makes up 57.6% of the DXY quote. When the U.S. Dollar began to sell-off last month after the comment from Austan Goolsbee of the Chicago Fed, EUR/USD began to rally and in the month since, the pair has tacked on 200+ pips. As I had shared in the webinar, longer-term, this remains a range, and I’m dubious of the Euro’s ability to push trends significantly beyond range resistance of 1.1000/1.1100.

That said, price action from the daily is showing as bullish given that month-long trend of higher-highs and lows, along with price holding above the 200-dma.

From the daily chart below we can see a support zone around prior resistance of 1.0886-1.0900 and bulls holding higher-lows in that zone keeps the door open for continuation. On the chart below, you’ll probably also notice a zone around 1.0795, and I had talked about this in the webinar a few weeks ago. That was a very similar setup to what’s showing now albeit a more developed trend a few weeks later.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

GBP/USD

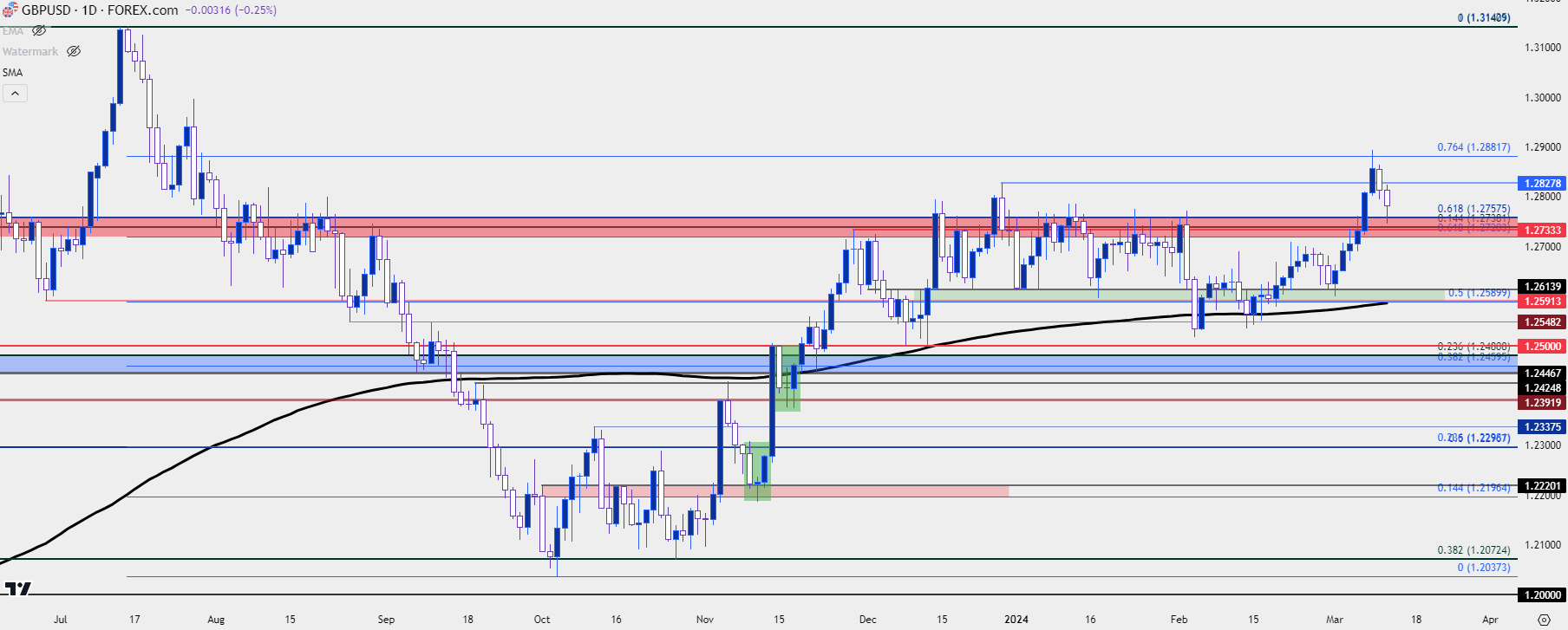

While EUR/USD has been range-bound over the past 15 months, GBP/USD appears to hold more trending potential at this point from the daily chart.

I had talked about the confluent zone of Fibonacci resistance running from 1.2720-1.2758 numerous times over the three months that it was in-play. In February, bears got a legitimate chance to push on a fresh trend, but they failed to do so as the 200-day moving average helped to produce a higher-low that led into an eventual breakout of that resistance zone. I had talked about this at-length in the webinar a month ago and since, bulls have returned to push in a fresh seven-month high.

Now – price is testing that prior resistance as support. And if the USD does hold lower-high resistance and begin to sell-off and push towards lows, this can retain bullish potential in GBP/USD with the 1.3000 level as a legitimate prospect.

GBP/USD Daily Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

USD/JPY

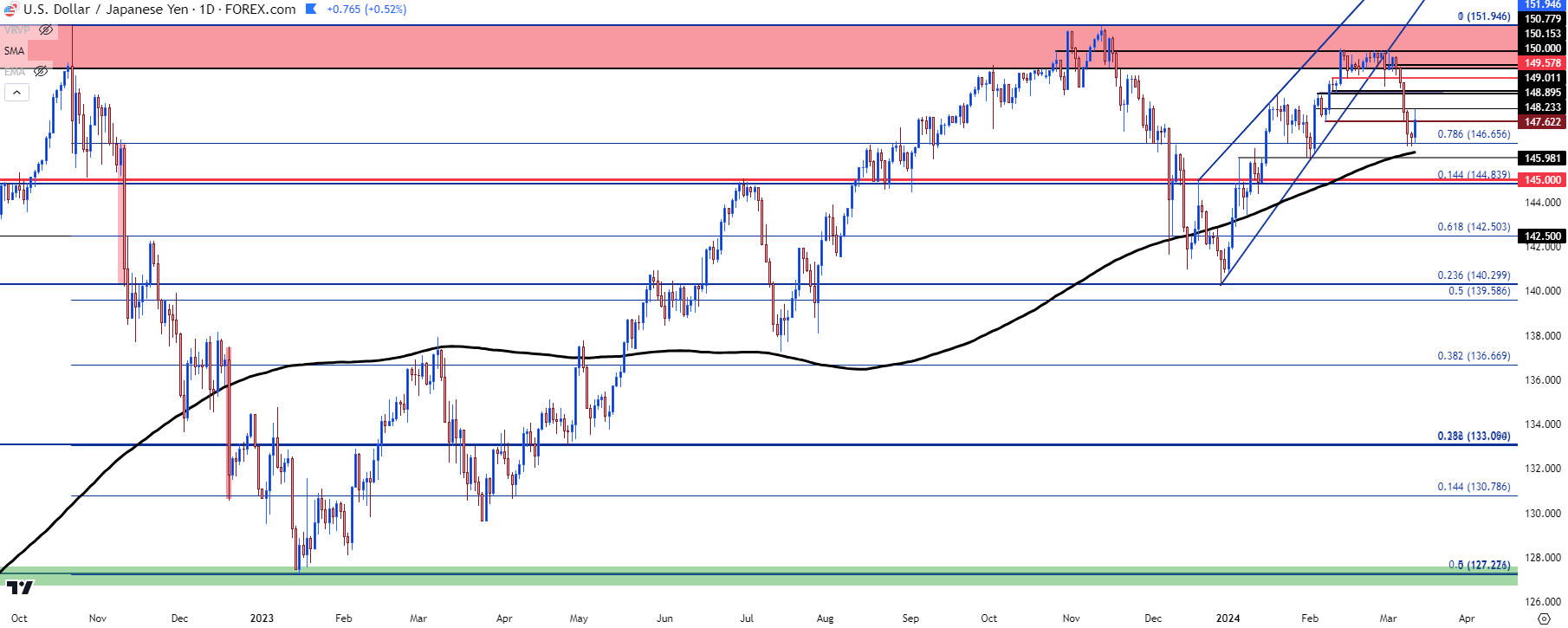

If we are on the cusp of a larger move of USD-weakness, USD/JPY could be a very interesting candidate to work with that theme.

As we saw USD weakness drive last week, USD/JPY fell further through the bottom of a rising wedge formation, the initial break of which began after the Core PCE report towards the end of last month. That move helped to produce a 400+ pip pullback in the pair and price ran all the way until a Fibonacci level came into play at 146.66, which has since held the lows.

Given that price is now somewhat removed from the 150.00 area that’s seemed to elicit ire from the Japanese Finance Ministry, this can retain some bullish potential if the Dollar remains support. The carry is still positive in the pair and if there isn’t the overriding fear of USD breaking down, there could be less motive for carry traders to bail.

But – if the Fed does get their way and if data continues to sour in the U.S. to the degree that rate cuts become a more legitimate prospect, then that motivation for carry traders to bail on the trend could grow very loudly.

For traders that are looking to work with continued Yen-weakness, there may be brighter pastures elsewhere, such as GBP/JPY or EUR/JPY as I had discussed a few weeks ago.

USD/JPY Daily Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

Gold (XAU/USD)

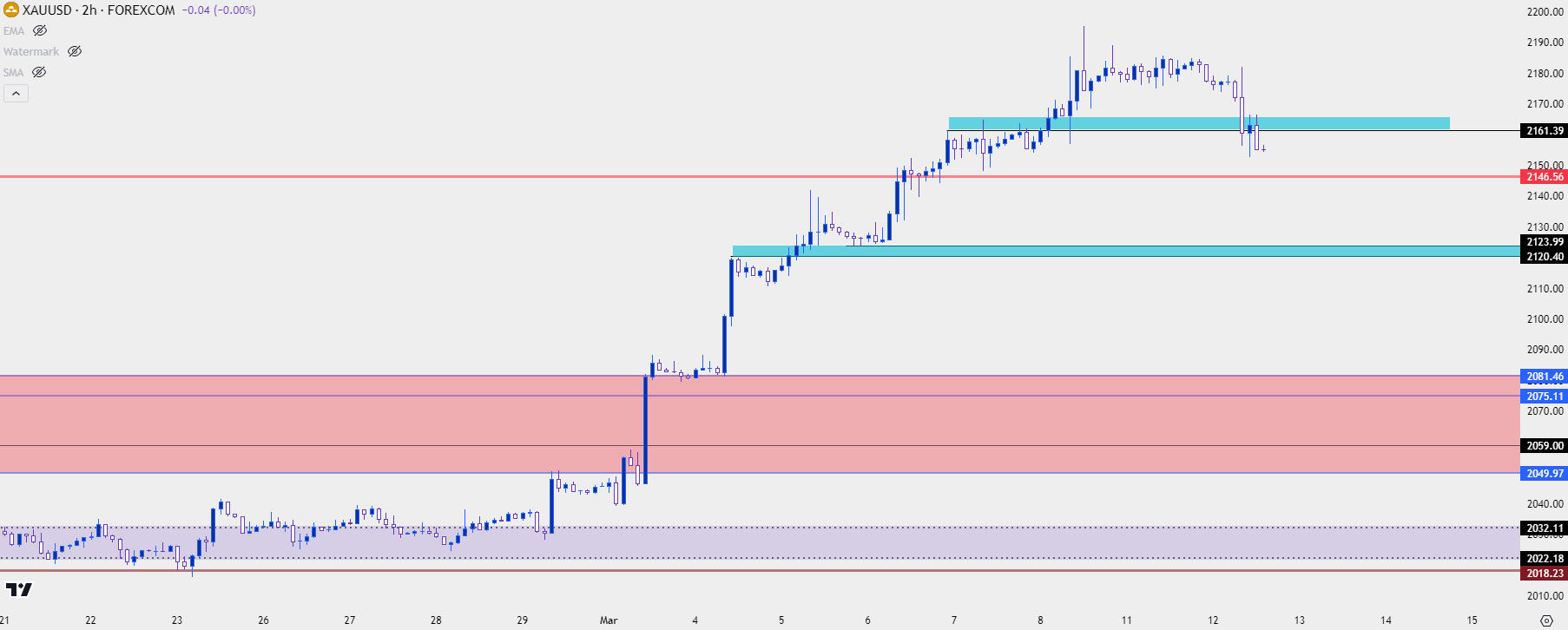

Gold put in a massive breakout last week and at this point there’s been nine consecutive bullish daily closes for spot gold.

The way in which this has priced-in remains of interest, as the Core CPI report last month helped to produce the first test below the $2,000 psychological level in gold so far this year. But – that didn’t remain for long as it was just a day later that Austan Goolsbee said that markets should avoid getting ‘flipped out’ about the inflation report and slowly, strength started to return.

I remain of the mind that the trending potential for gold above $2k shows when the Fed has formally flipped. And perhaps we are a step closer to that given how Fed members have seemingly shrugged off the data that hasn’t went their way while they’ve focused on the data that has. But – this can imply a relationship where strong U.S. data or items that don’t coalesce with that dovish Fed-speak could produce strong reversion scenarios.

We saw a smaller case of that this morning, when prices pulled back quickly on the back of the higher-than-expected CPI print. Given that this was one of the first pullbacks to show over the past two weeks, this was also one of the first opportunities that bulls had to try to bid a higher-low, that had initially showed at an aggressive spot of $2161. If that doesn’t end up helping to hold the daily lows, there’s deeper support potential around 2146 and then again around 2120-2124. If bears can push below that zone then the prospect of bullish trend continuation would like a bit more sour, and this could start to open the door for larger reversal scenarios in spot Gold (XAU/USD).

Gold Two-Hour Price Chart

Chart prepared by James Stanley, Gold on Tradingview

Chart prepared by James Stanley, Gold on Tradingview

--- written by James Stanley, Senior Strategist