US Dollar Talking Points:

- The US Dollar has pulled back after a very strong retail sales report this morning, similar to what showed earlier in the month in response to Non-farm Payrolls.

- The big question at this point is whether the dominant theme of USD-strength is ready for continuation or whether it’s still showing symptoms of overbought behavior. Selling off or pulling back on the back of strong data would indicate a still-crowded backdrop but the other side of the question is whether any other currencies are able to onboard strength, as bears have remained vigilant in EUR/USD and GBP/USD.

- This is an archived webinar that’s free for all to join. If you would like to join the weekly webinar on Tuesdays at 1PM ET, the following link will allow for registration: Click here to register.

Trends usually don’t show in a linear fashion. Ideally, a trend takes on the two steps forward, one step back type of approach that governs many other changes or adaptations that we’ll see in our day to day lives, but that’s not always the case.

Sometimes the trend is so strong that even a minor pullback is met with intense buying pressure. And in that event, even the slightest hint of ‘bad’ news can compel that pullback, which can then bring bulls into the mix to advance that topside trend. But, at some point, most anyone that wants to buy already has, and the question then becomes how price might be able to continue that advance.

Supply and demand pushes market prices, not data. The conduit between data and market prices are market participants, and even in a ‘good story’ scenario, if anyone that wants to buy is already long, even a strong report could lead to a pullback or sell-off. This is very similar to how I’ve been explaining the US Dollar of late after the currency spent 11 consecutive weeks trending higher. Two weeks ago was the first break in that sequence when price built in a gravestone doji, and that weakness even had some run through the first few days of last week.

But the CPI report on Thursday brought out a strong response from bulls, even though it was a largely in-line release. That bullish bounce fueled by the CPI report ran a bit too far, too fast, and soon price was finding lower-high resistance at 106.76.

This morning showed another strong report with US retail sales coming in at 0.7% for the month against an expectation of 0.3%. Initially, the USD showed a rally, very similar to the NFP report earlier in the month. But, also like that NFP report, USD strength didn’t stick around for long and prices quickly began to reverse.

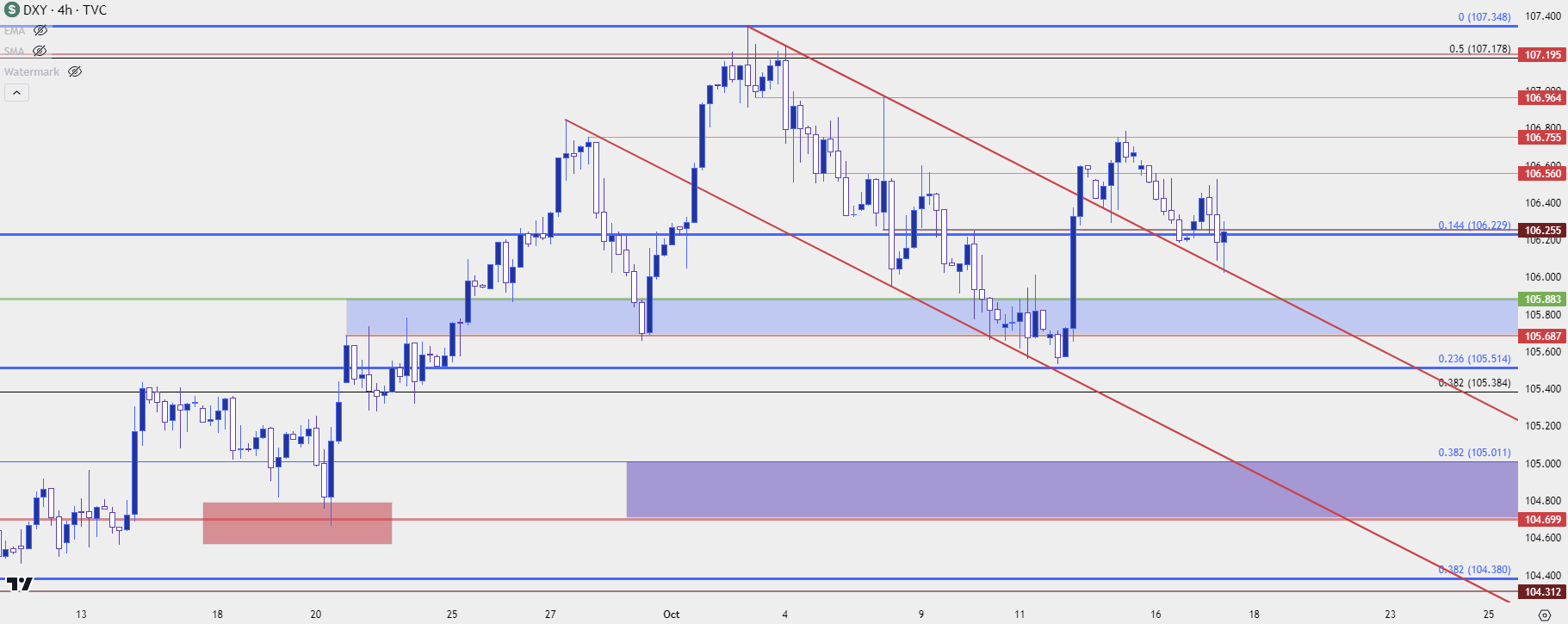

At this point, the US Dollar has held support from the topside of a bearish channel, but the lows from last week appear vulnerable given the lack of response from bulls to another strong piece of US data. There remains support potential at the 105.69-105.88 area on the chart that had come into play last week, and below that is another significant zone spanning from 104.70-105.00. Between the two, there’s a Fibonacci level at 105.38 that remains of interest.

US Dollar Four-Hour Price Chart (indicative only, not available on Forex.com platforms)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

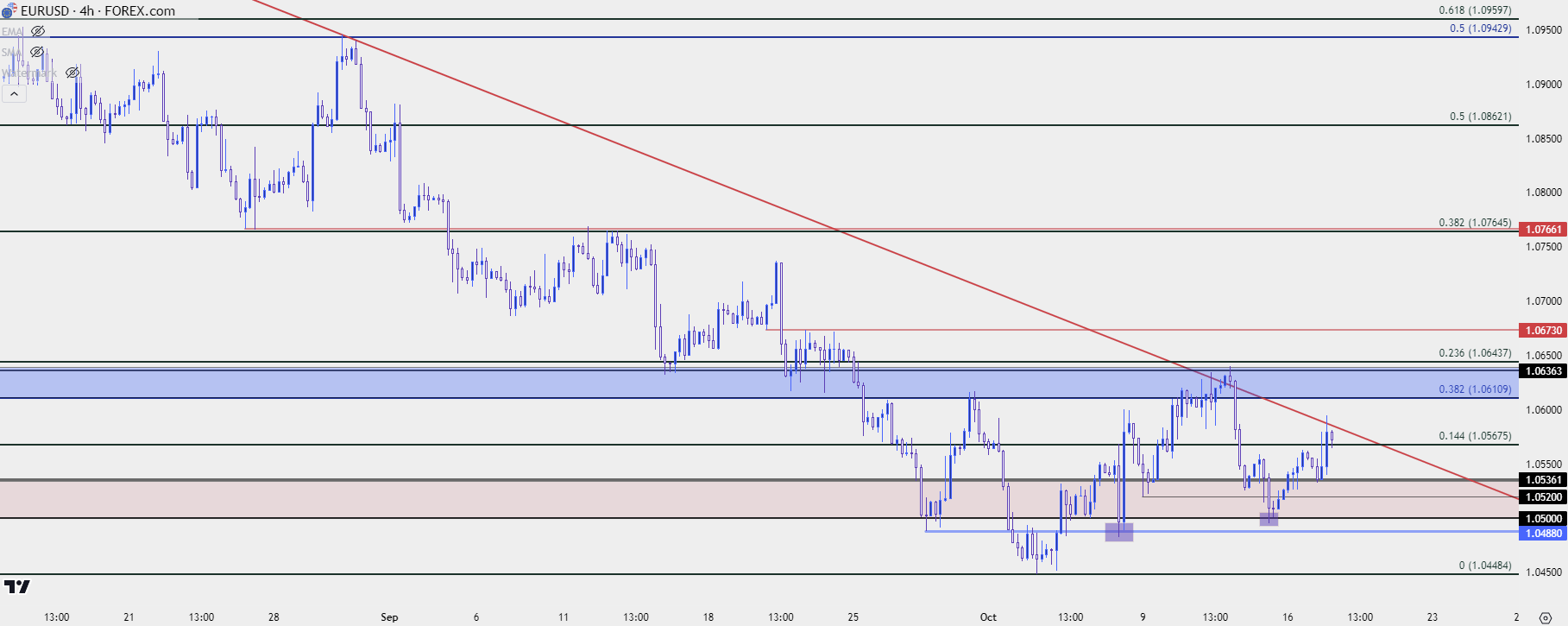

EUR/USD 1.0500

I’ve been talking about the 1.0500 level in EUR/USD for the past few webinars and it remains an issue today. Psychological levels of this nature can take some time to leave behind and as I discussed a couple of weeks ago, the 1.0500 level could prove as a hindrance to bears.

So far, this has led to a higher-low during NFP and then another higher-low last Friday, with support showing right at the 1.0500 handle. The other side of the issue, however, is that bulls don’t appear that enthusiastic: The rally last week ran all the way up to confluent resistance at 1.0636 before prices tilted-lower for that next re-test of 1.0500. The sequencing of higher-lows remains intact and we may have another higher-low for that sequence with a hold at 1.0536.

But at some point bulls are going to need to stretch up to test resistance if they’re going to take control of the trend, even if only for the short-term. There remains resistance potential at both 1.0611 and 1.0636. That latter price likely has some stops sitting above it after last week’s inflection, and if those stops are triggered that can draw some additional demand into the market, which could lead to a test of a higher-high. In that scenario, I’m tracking resistance potential at 1.0673 and then 1.0766.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

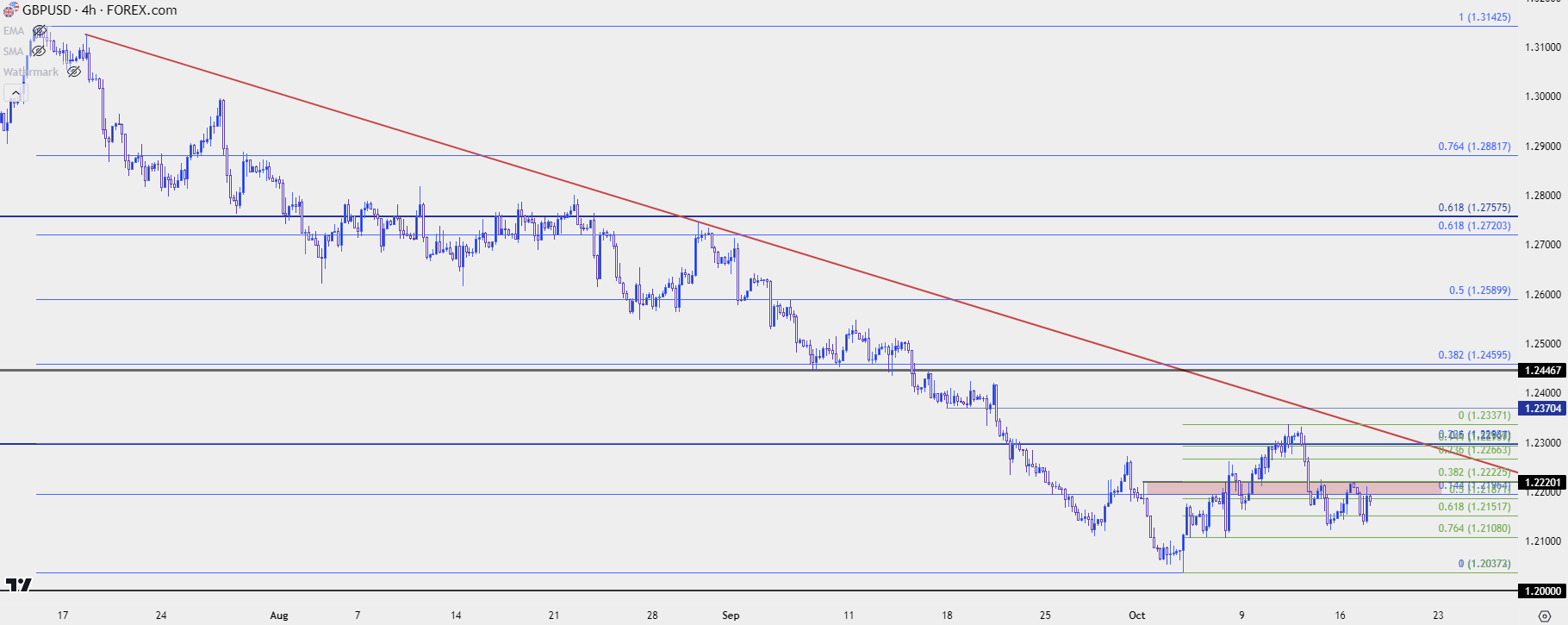

GBP/USD 1.2300

From the webinar, I highlighted a couple of similarities between EUR/USD and GBP/USD; but also one key difference in that during the USD bullish run, the sell-off in GBP/USD actually outpaced that of EUR/USD. This could keep the pair as possibly more attractive for themes of USD-strength, when or if that dominant trend comes back.

From the four-hour chart below, we can see a similar element of stall in the bearish trend of GBP/USD. Price is currently testing a resistance zone around the 1.2200 handle, but it’s the level around 1.2300 that remains of interest, and if bulls can force a breakout that spot comes into the picture as a possible lower-high for the pair.

GBP/USD Four-Hour Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

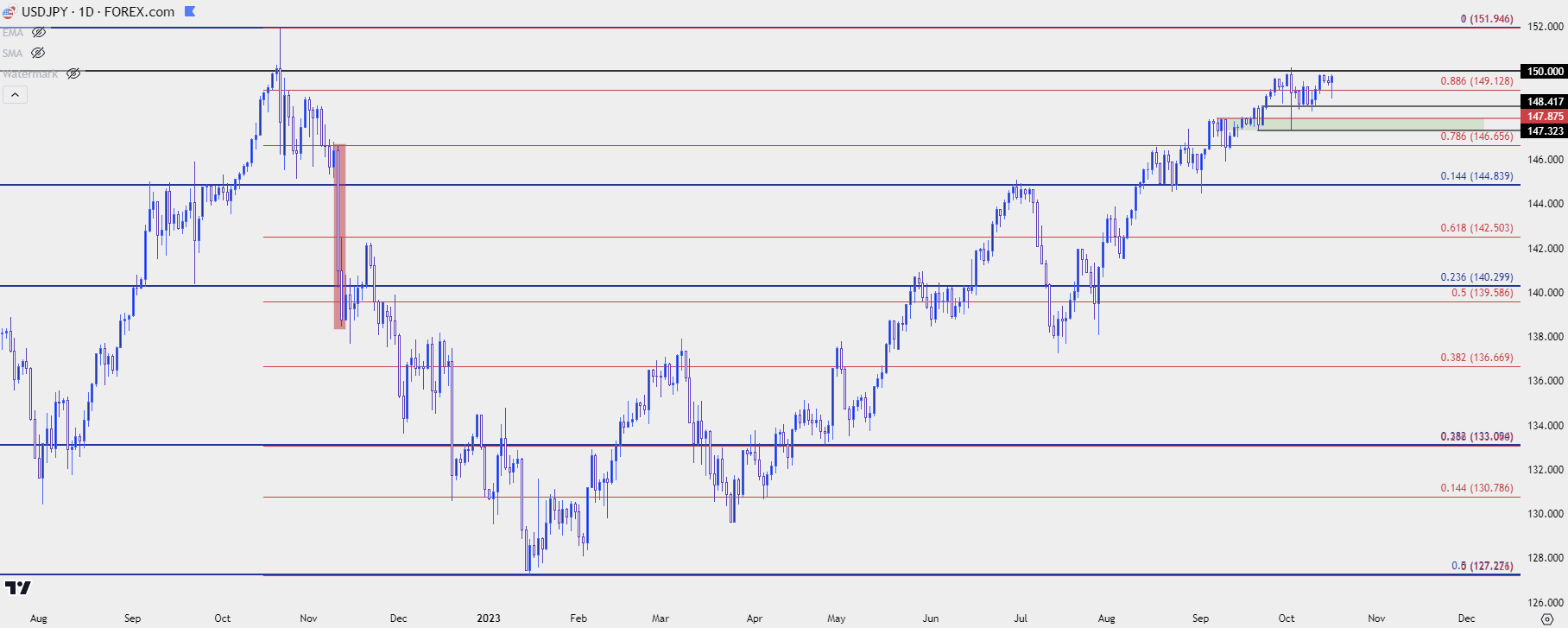

USD/JPY 150.00

USD/JPY is very near the same 150 level that brought about a strong reversal just a couple weeks ago. Reuters reported after-the-fact that money market data indicated that the sell-off may not have been an intervention move, and that may have played a role in what’s happened since.

Bulls seem somewhat undeterred as prices is edging closer and closer for a re-test. The carry remains decisively tilted to the long side of the pair and it seems that there’s little expectation for change around the BoJ.

The big question is what happens on another test above the 150.00 handle. There’s been only one daily close above that price in the past 33 years, and it led into a strong intervention response from the BoJ. Notably, what made that intervention look so successful was the USD trend reversing last November, but the intervention announcement stalled bulls long enough for market sentiment to take over a month later.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

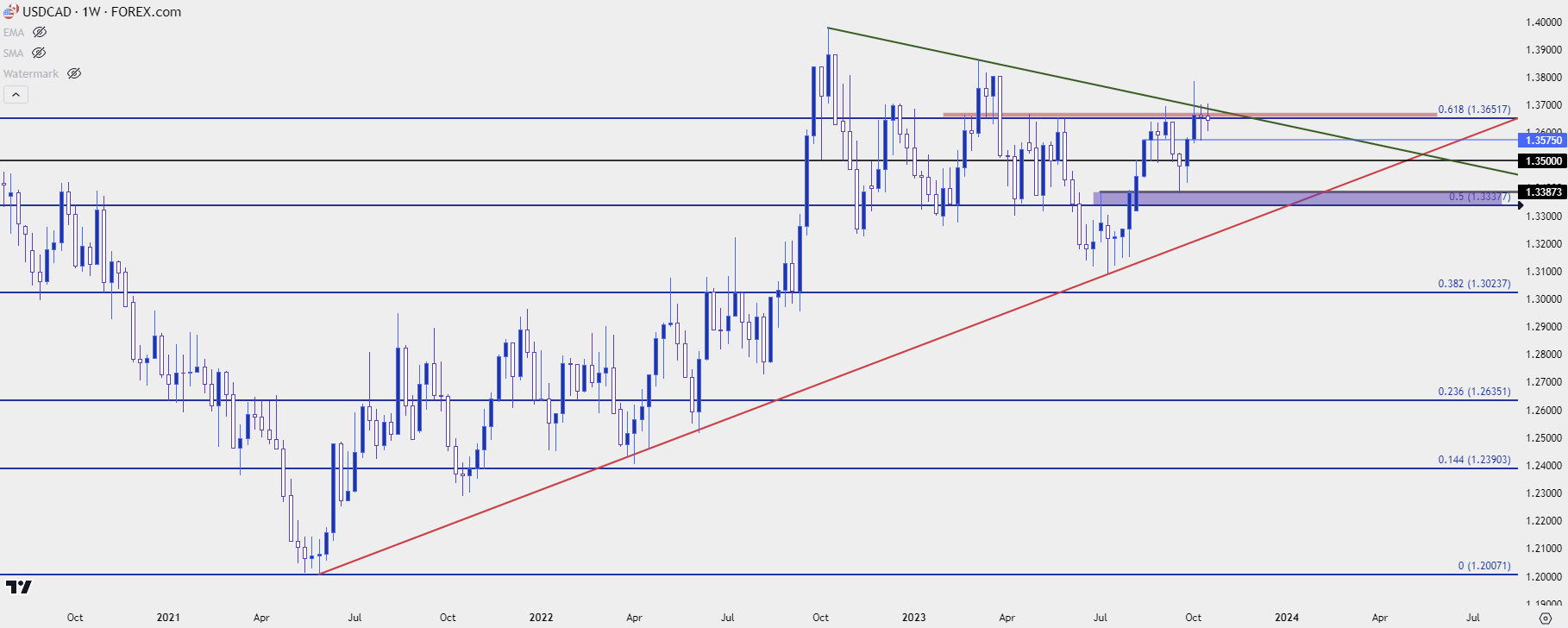

USD/CAD 1.3652

Tomorrow brings a Bank of Canada rate decision and USD/CAD is at a major level ahead of that announcement. The price of 1.3652 is a level that’s been in-play for much of the year on the pair. This is the 61.8% Fibonacci retracement of the 2020-2021 major move and it helped to build a doji on the weekly chart of USD/CAD last week.

Last week’s low was at 1.3575, and below that is another spot of support potential at the 1.3500 psychological level.

USD/CAD Weekly Price Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

Chart prepared by James Stanley, USD/CAD on Tradingview

--- written by James Stanley, Senior Strategist